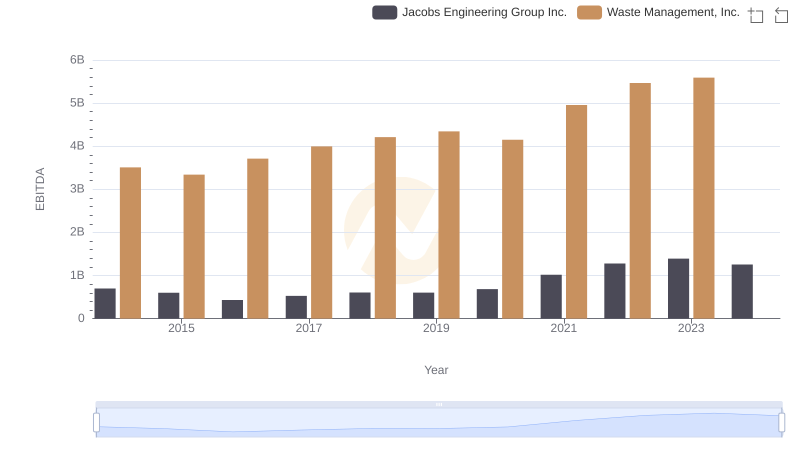

| __timestamp | Pentair plc | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1109300000 | 3509000000 |

| Thursday, January 1, 2015 | 842400000 | 3342000000 |

| Friday, January 1, 2016 | 890400000 | 3713000000 |

| Sunday, January 1, 2017 | 488600000 | 3996000000 |

| Monday, January 1, 2018 | 552800000 | 4212000000 |

| Tuesday, January 1, 2019 | 513200000 | 4344000000 |

| Wednesday, January 1, 2020 | 527600000 | 4149000000 |

| Friday, January 1, 2021 | 714400000 | 4956000000 |

| Saturday, January 1, 2022 | 830400000 | 5466000000 |

| Sunday, January 1, 2023 | 852000000 | 5592000000 |

| Monday, January 1, 2024 | 803800000 | 5128000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Waste Management, Inc. has consistently outperformed Pentair plc in terms of EBITDA, showcasing its robust business model. From 2014 to 2023, Waste Management's EBITDA grew by approximately 60%, peaking at $5.6 billion in 2023. In contrast, Pentair plc experienced a more volatile journey, with its EBITDA fluctuating and ultimately declining by around 23% from its 2014 high of $1.1 billion.

This comparison highlights Waste Management's resilience and strategic prowess in maintaining steady growth, even amidst economic uncertainties. Meanwhile, Pentair's journey underscores the challenges faced by companies in adapting to market dynamics. As we look to the future, these insights offer valuable lessons in financial strategy and operational efficiency.

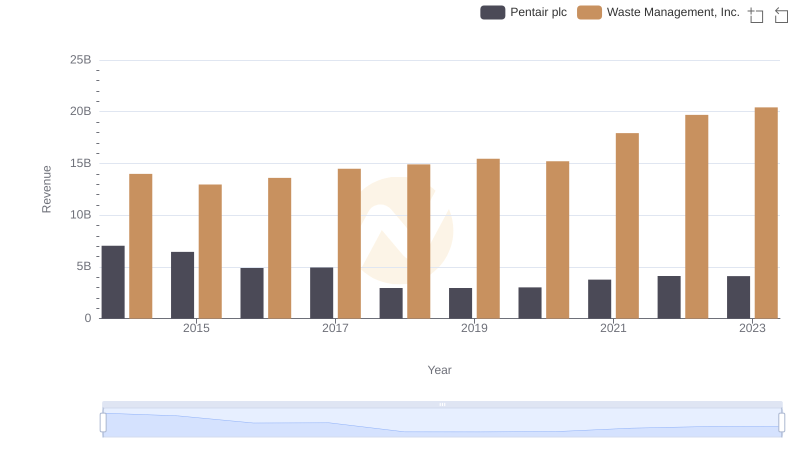

Annual Revenue Comparison: Waste Management, Inc. vs Pentair plc

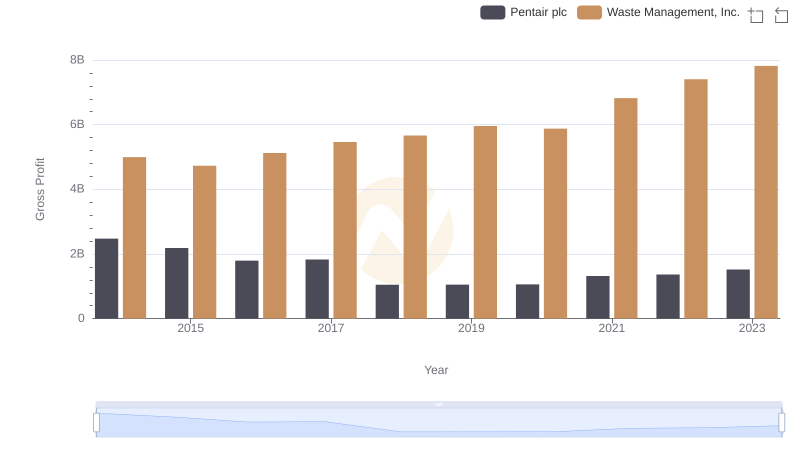

Who Generates Higher Gross Profit? Waste Management, Inc. or Pentair plc

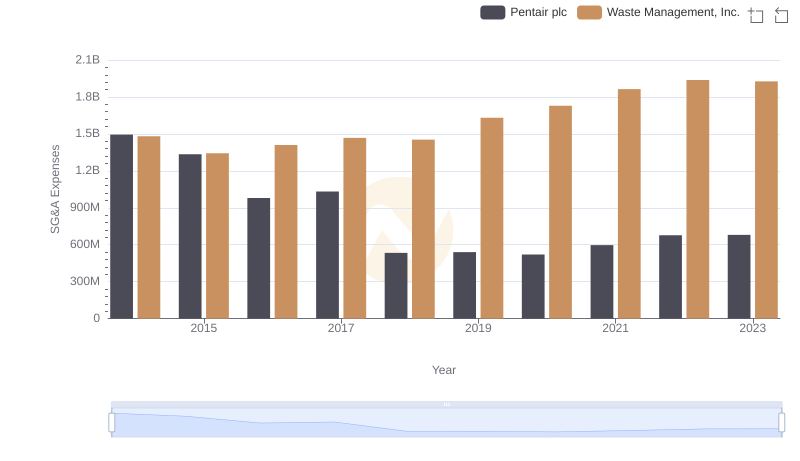

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Pentair plc

Comparative EBITDA Analysis: Waste Management, Inc. vs Jacobs Engineering Group Inc.

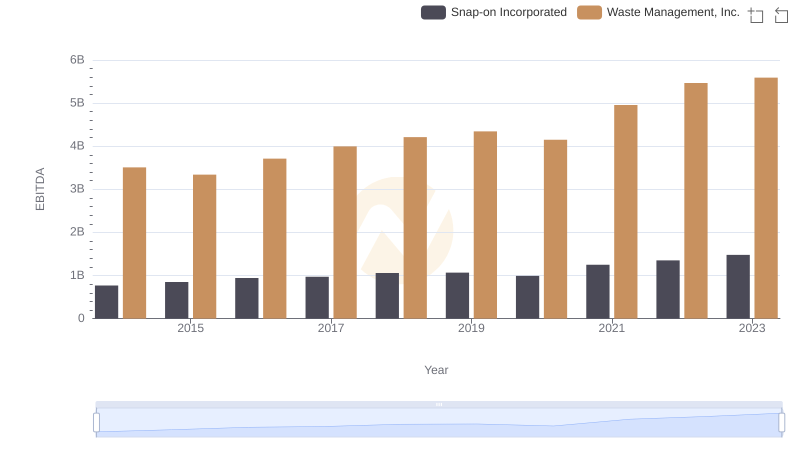

Professional EBITDA Benchmarking: Waste Management, Inc. vs Snap-on Incorporated

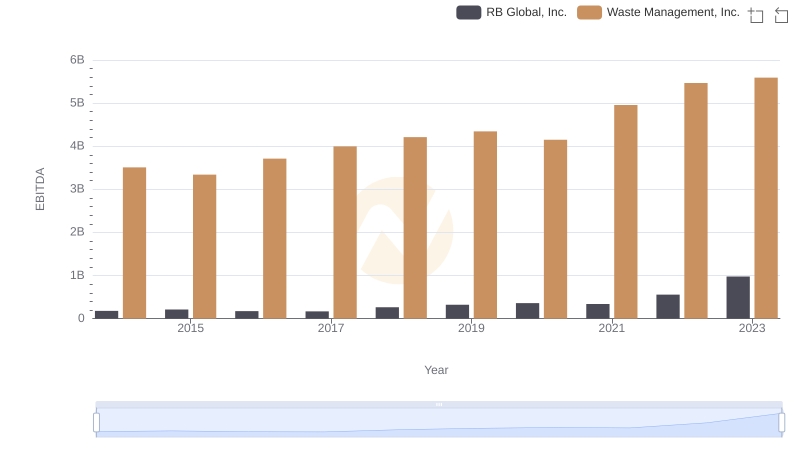

Waste Management, Inc. vs RB Global, Inc.: In-Depth EBITDA Performance Comparison

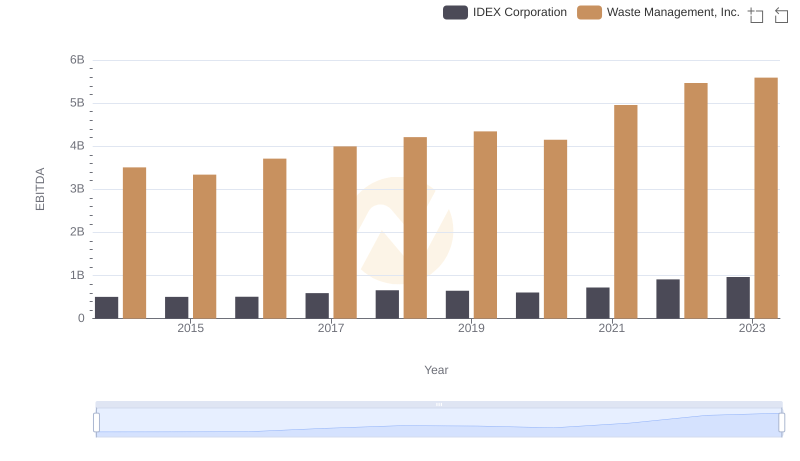

Professional EBITDA Benchmarking: Waste Management, Inc. vs IDEX Corporation

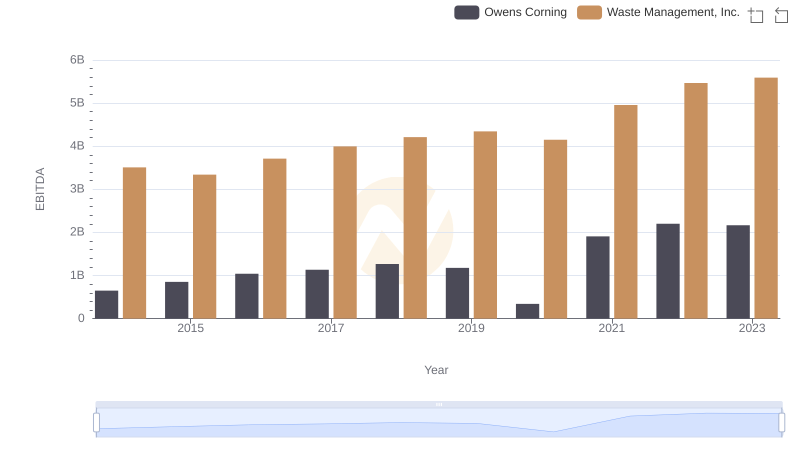

A Side-by-Side Analysis of EBITDA: Waste Management, Inc. and Owens Corning

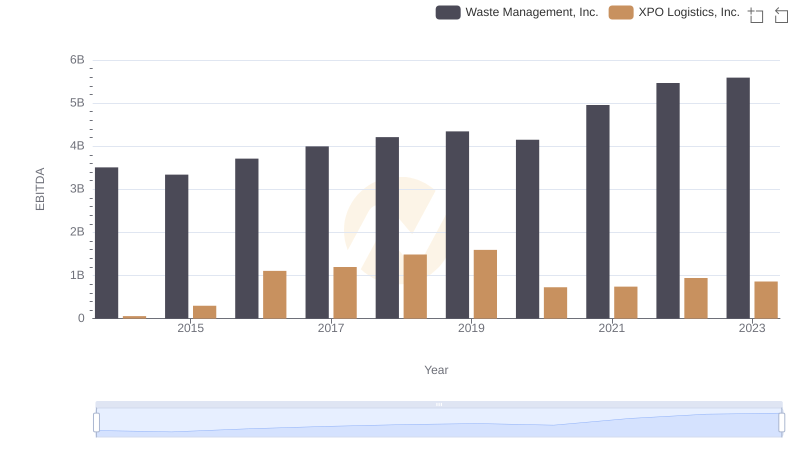

EBITDA Analysis: Evaluating Waste Management, Inc. Against XPO Logistics, Inc.

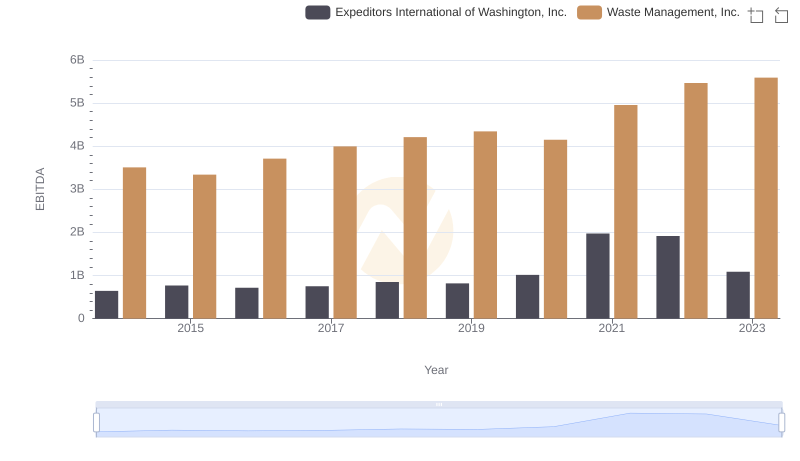

A Professional Review of EBITDA: Waste Management, Inc. Compared to Expeditors International of Washington, Inc.