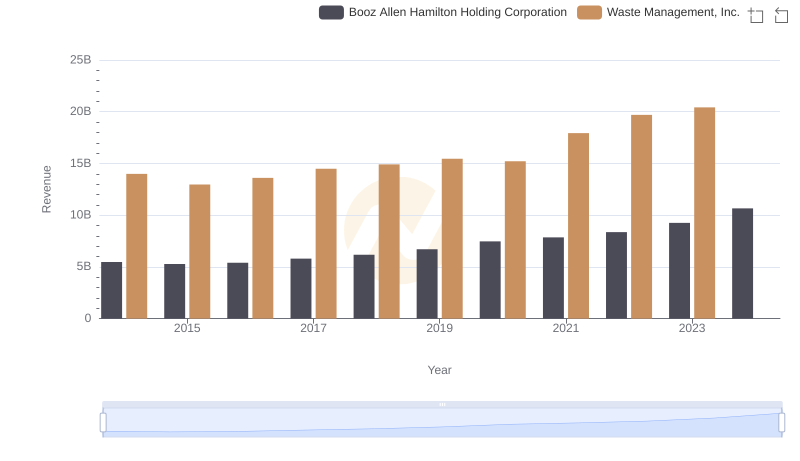

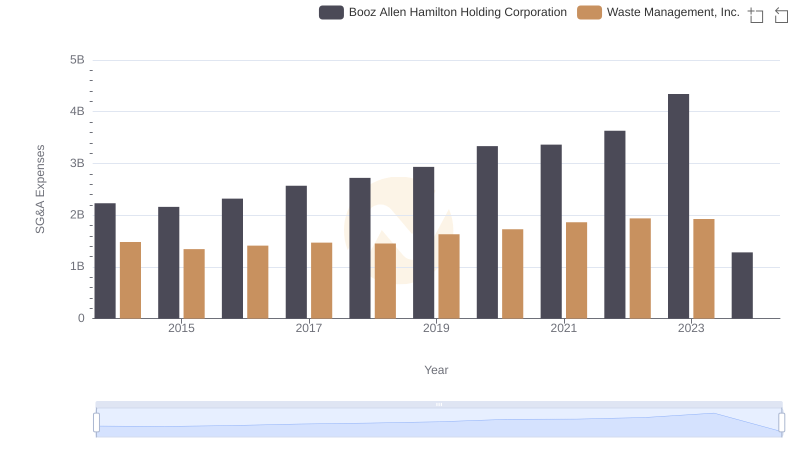

| __timestamp | Booz Allen Hamilton Holding Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762580000 | 4994000000 |

| Thursday, January 1, 2015 | 2680921000 | 4730000000 |

| Friday, January 1, 2016 | 2825712000 | 5123000000 |

| Sunday, January 1, 2017 | 3112302000 | 5464000000 |

| Monday, January 1, 2018 | 3304750000 | 5665000000 |

| Tuesday, January 1, 2019 | 3603571000 | 5959000000 |

| Wednesday, January 1, 2020 | 4084661000 | 5877000000 |

| Friday, January 1, 2021 | 4201408000 | 6820000000 |

| Saturday, January 1, 2022 | 4464078000 | 7404000000 |

| Sunday, January 1, 2023 | 4954101000 | 7820000000 |

| Monday, January 1, 2024 | 2459049000 | 8680000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial for investors and stakeholders. Waste Management, Inc. and Booz Allen Hamilton Holding Corporation, two giants in their respective industries, have shown distinct trajectories over the past decade. From 2014 to 2023, Waste Management, Inc. consistently outperformed Booz Allen Hamilton in terms of gross profit, with a peak in 2023 reaching approximately 7.82 billion USD. This represents a growth of nearly 57% from 2014. In contrast, Booz Allen Hamilton's gross profit grew by about 79% over the same period, peaking at around 4.95 billion USD in 2023. However, the data for 2024 shows a significant drop for Booz Allen Hamilton, indicating potential challenges ahead. This analysis highlights the importance of strategic financial planning and market adaptability in maintaining profitability.

Breaking Down Revenue Trends: Waste Management, Inc. vs Booz Allen Hamilton Holding Corporation

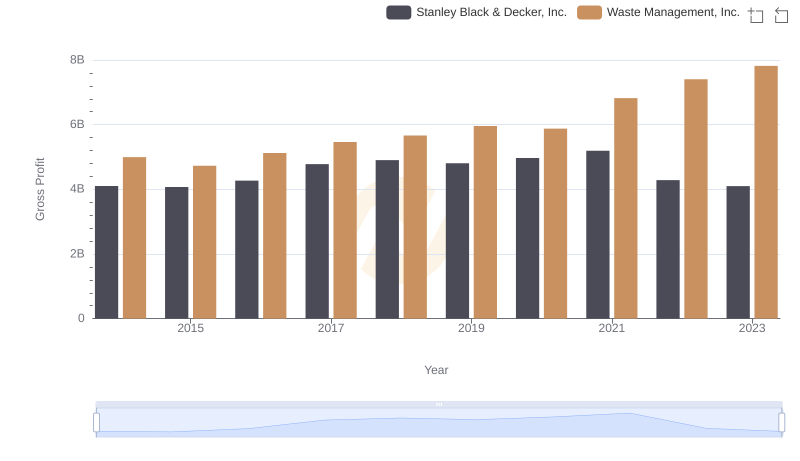

Gross Profit Comparison: Waste Management, Inc. and Stanley Black & Decker, Inc. Trends

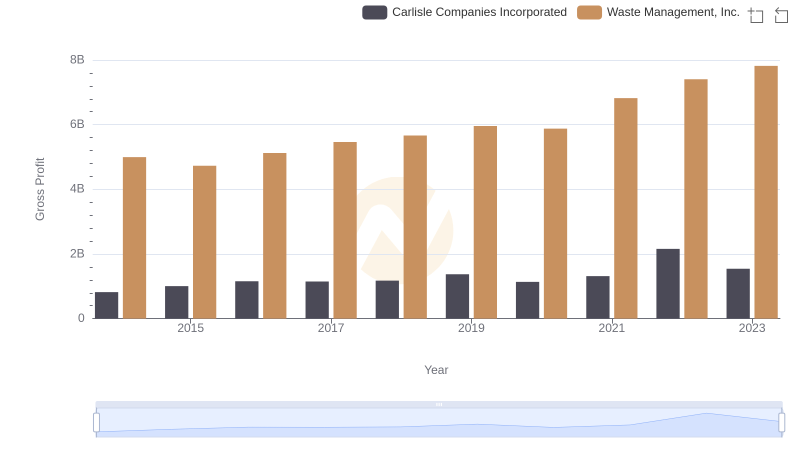

Gross Profit Analysis: Comparing Waste Management, Inc. and Carlisle Companies Incorporated

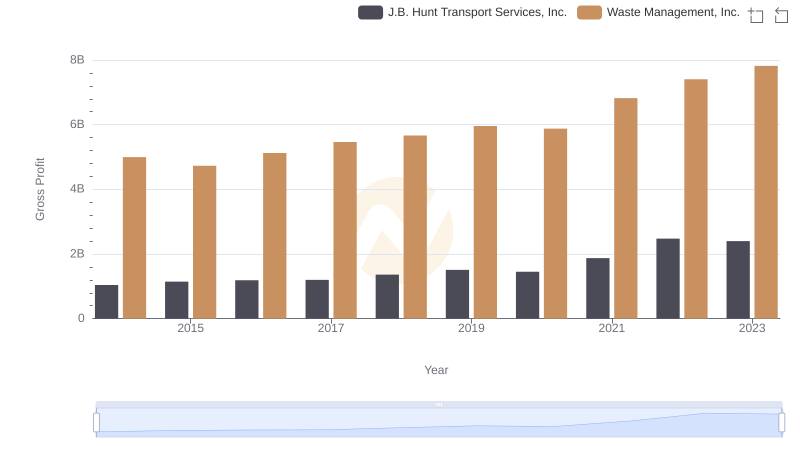

Gross Profit Analysis: Comparing Waste Management, Inc. and J.B. Hunt Transport Services, Inc.

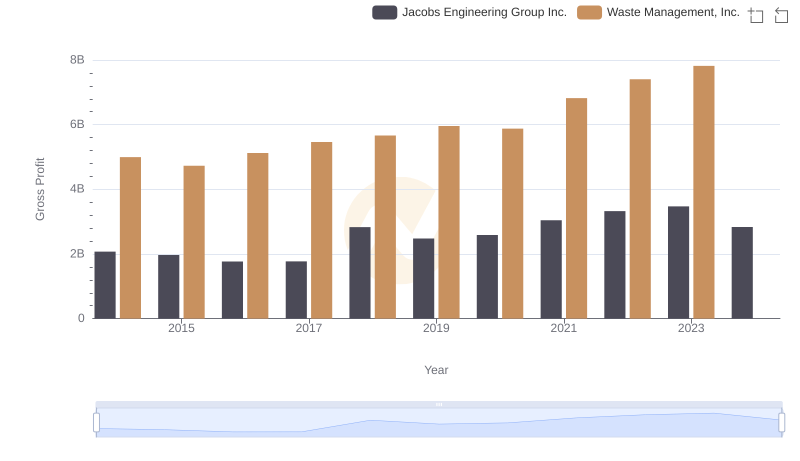

Waste Management, Inc. and Jacobs Engineering Group Inc.: A Detailed Gross Profit Analysis

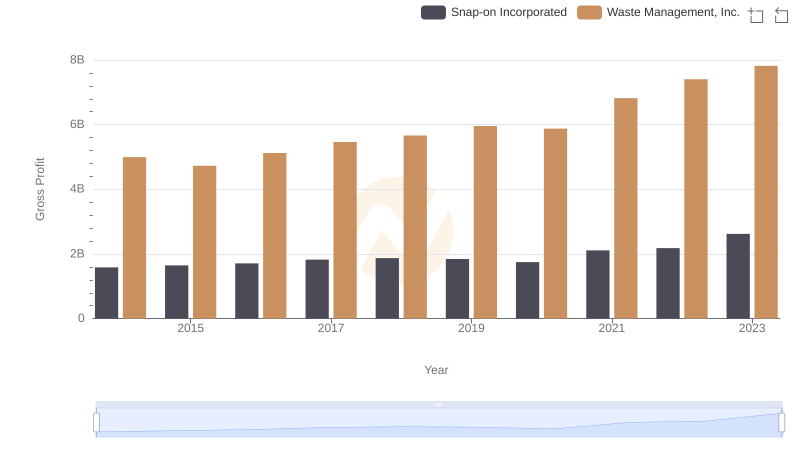

Waste Management, Inc. and Snap-on Incorporated: A Detailed Gross Profit Analysis

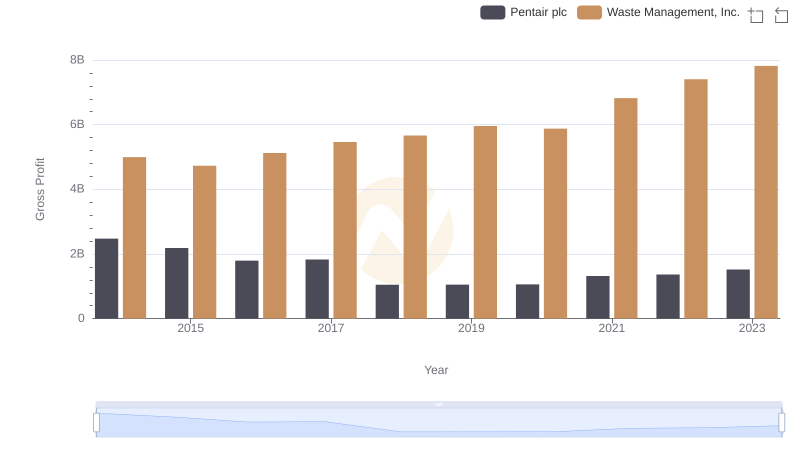

Who Generates Higher Gross Profit? Waste Management, Inc. or Pentair plc

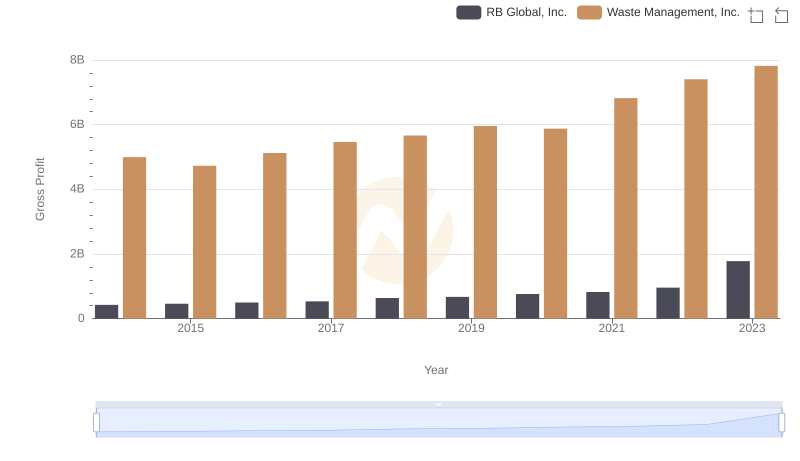

Gross Profit Comparison: Waste Management, Inc. and RB Global, Inc. Trends

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Booz Allen Hamilton Holding Corporation