| __timestamp | Curtiss-Wright Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 192800000 |

| Thursday, January 1, 2015 | 411801000 | 233900000 |

| Friday, January 1, 2016 | 383793000 | 292700000 |

| Sunday, January 1, 2017 | 418544000 | 322300000 |

| Monday, January 1, 2018 | 433110000 | 410400000 |

| Tuesday, January 1, 2019 | 422272000 | 547300000 |

| Wednesday, January 1, 2020 | 412825000 | 578800000 |

| Friday, January 1, 2021 | 443096000 | 201500000 |

| Saturday, January 1, 2022 | 445679000 | 411300000 |

| Sunday, January 1, 2023 | 496812000 | 674400000 |

| Monday, January 1, 2024 | 518857000 | 757200000 |

Igniting the spark of knowledge

In the competitive world of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. This analysis compares Ryanair Holdings plc and Curtiss-Wright Corporation from 2014 to 2023. Over this period, Ryanair's SG&A expenses surged by approximately 250%, peaking in 2023. In contrast, Curtiss-Wright's expenses grew by about 17%, reflecting a more stable trajectory.

Ryanair's fluctuating SG&A expenses, with a notable dip in 2021, suggest strategic shifts or market challenges. Meanwhile, Curtiss-Wright's consistent expense management highlights its operational stability. The absence of data for Curtiss-Wright in 2024 suggests a need for further investigation. This comparison underscores the importance of efficient SG&A management in maintaining competitive advantage and profitability.

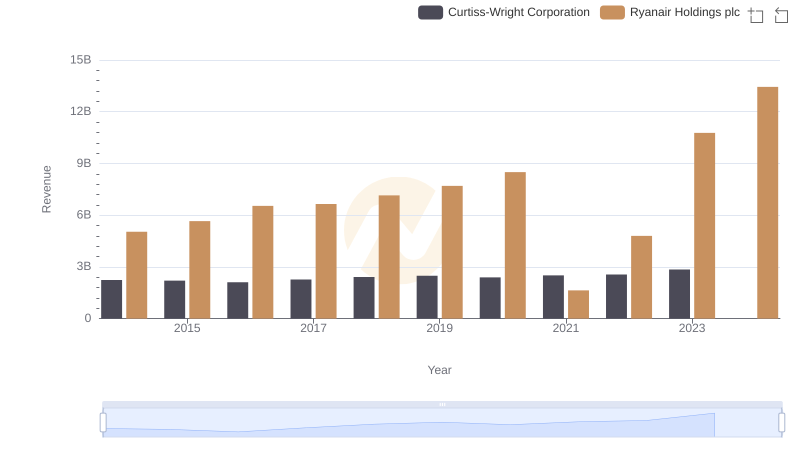

Ryanair Holdings plc vs Curtiss-Wright Corporation: Examining Key Revenue Metrics

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

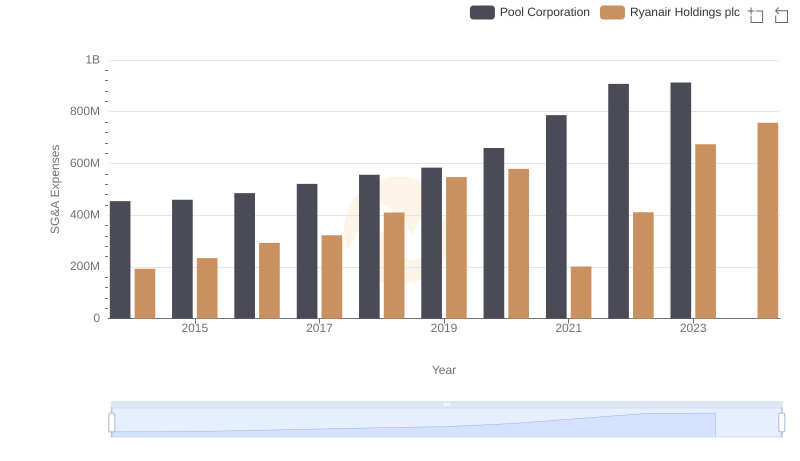

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Pool Corporation

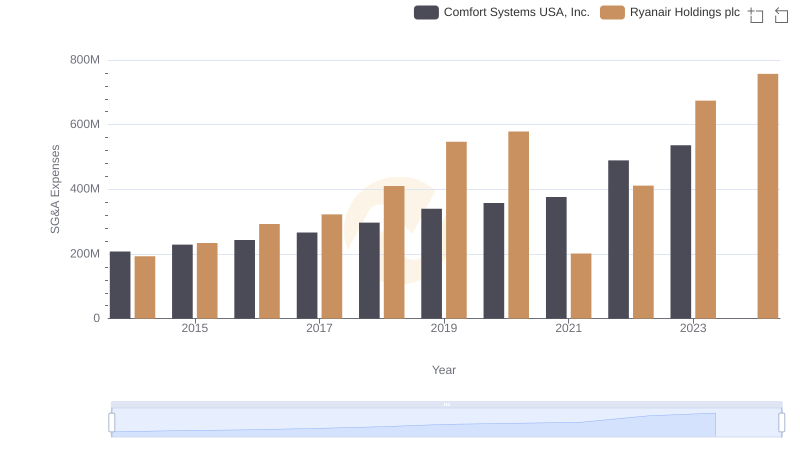

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Comfort Systems USA, Inc.

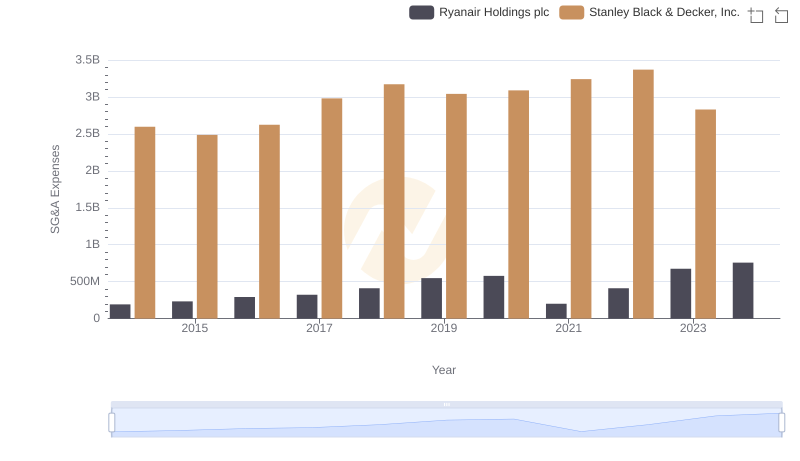

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.

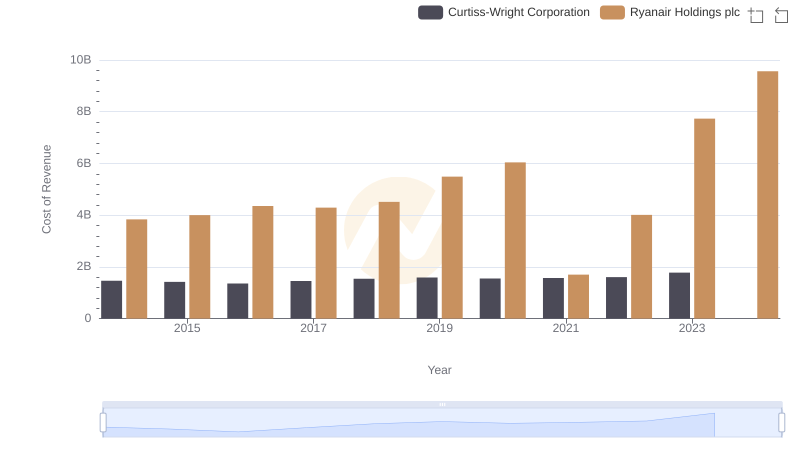

Cost of Revenue Trends: Ryanair Holdings plc vs Curtiss-Wright Corporation

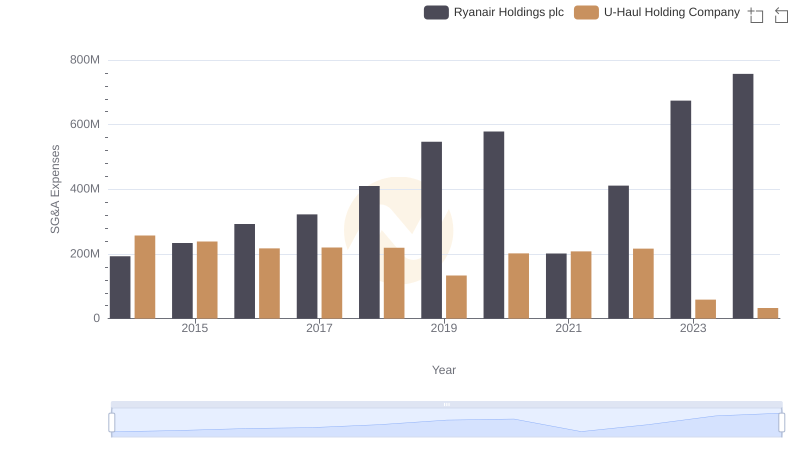

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

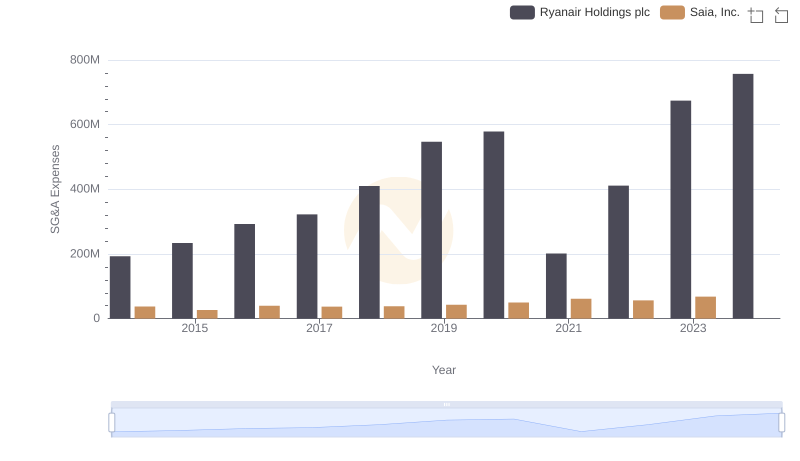

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends

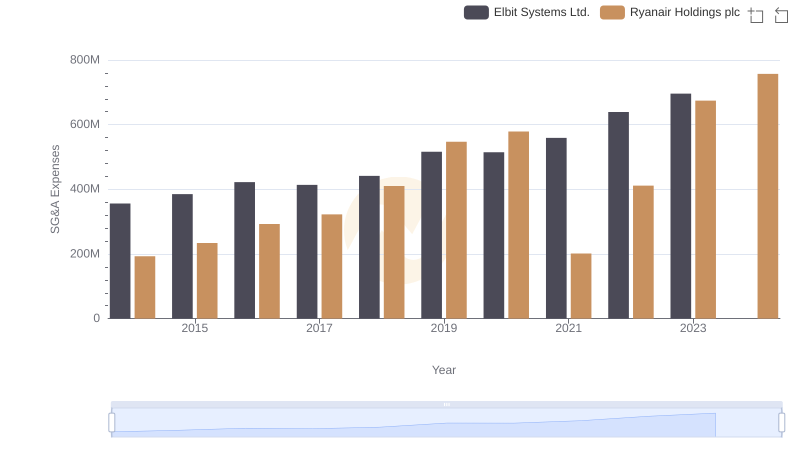

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Elbit Systems Ltd.

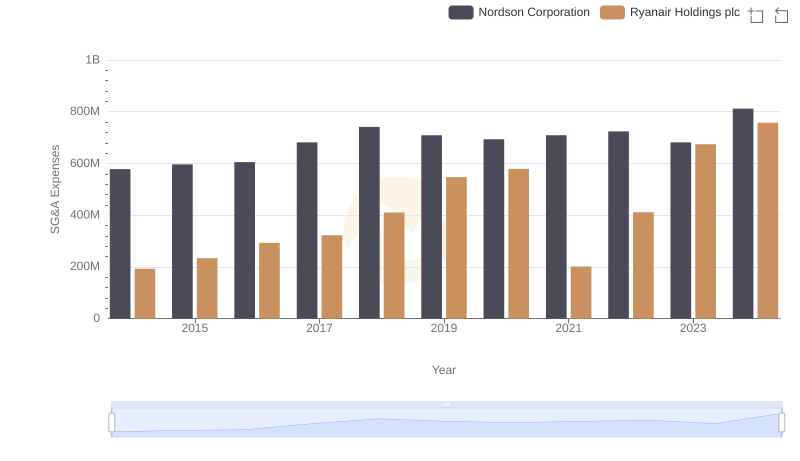

Ryanair Holdings plc and Nordson Corporation: SG&A Spending Patterns Compared

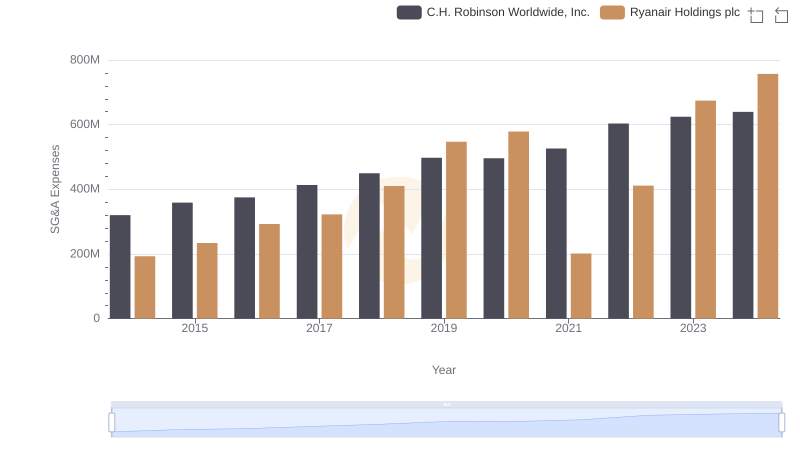

Ryanair Holdings plc vs C.H. Robinson Worldwide, Inc.: SG&A Expense Trends