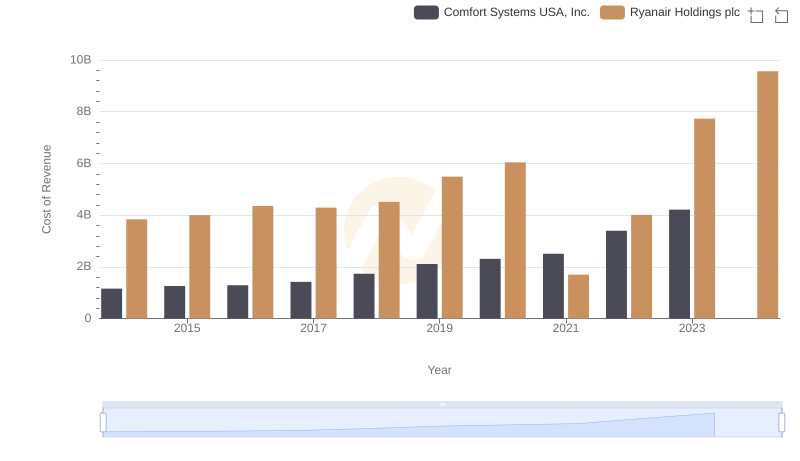

| __timestamp | Comfort Systems USA, Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 207652000 | 192800000 |

| Thursday, January 1, 2015 | 228965000 | 233900000 |

| Friday, January 1, 2016 | 243201000 | 292700000 |

| Sunday, January 1, 2017 | 266586000 | 322300000 |

| Monday, January 1, 2018 | 296986000 | 410400000 |

| Tuesday, January 1, 2019 | 340005000 | 547300000 |

| Wednesday, January 1, 2020 | 357777000 | 578800000 |

| Friday, January 1, 2021 | 376309000 | 201500000 |

| Saturday, January 1, 2022 | 489344000 | 411300000 |

| Sunday, January 1, 2023 | 536188999 | 674400000 |

| Monday, January 1, 2024 | 757200000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Ryanair Holdings plc and Comfort Systems USA, Inc. have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Comfort Systems USA, Inc. saw a steady increase in SG&A expenses, rising by approximately 158%, reflecting their strategic expansion and operational scaling. In contrast, Ryanair Holdings plc experienced a more volatile pattern, with a notable dip in 2021, likely due to pandemic-related disruptions, before rebounding by 235% in 2023.

This analysis highlights the dynamic nature of SG&A management across industries, offering insights into how companies adapt to economic challenges and opportunities. As we look to the future, monitoring these trends will be key to understanding corporate resilience and strategic agility.

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

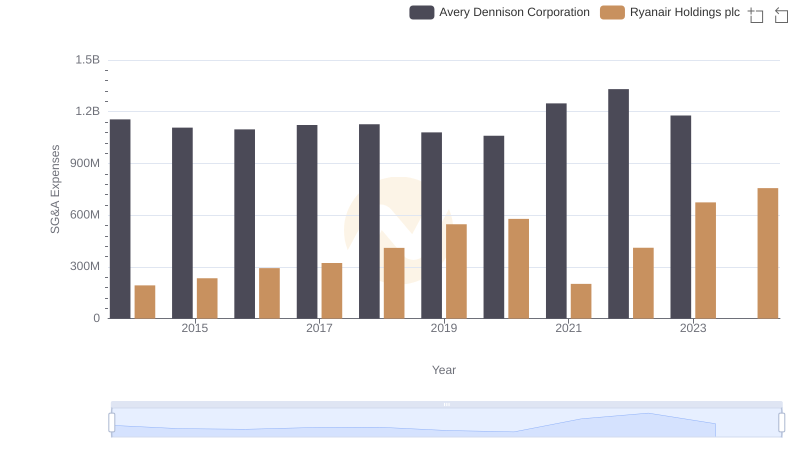

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Avery Dennison Corporation

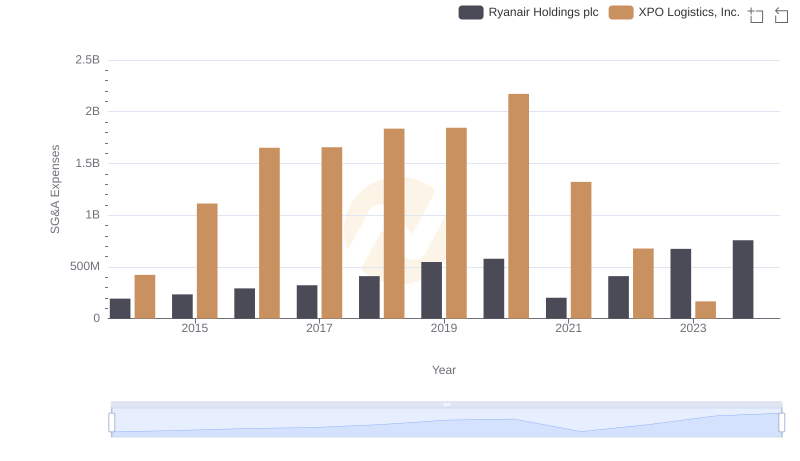

Breaking Down SG&A Expenses: Ryanair Holdings plc vs XPO Logistics, Inc.

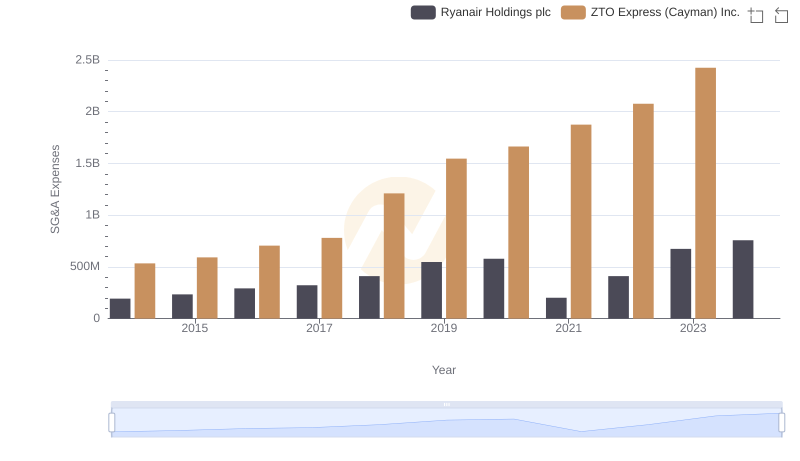

Breaking Down SG&A Expenses: Ryanair Holdings plc vs ZTO Express (Cayman) Inc.

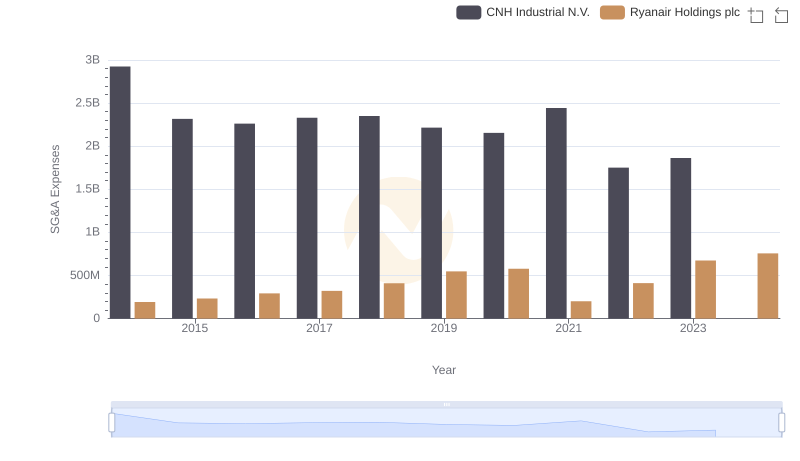

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.

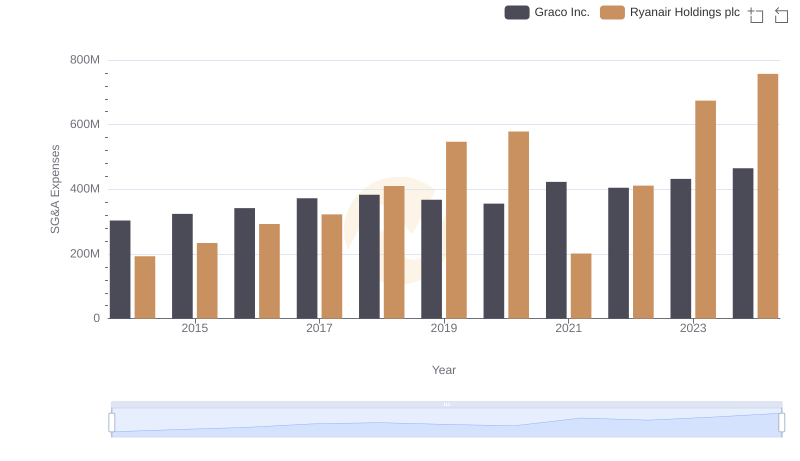

Ryanair Holdings plc and Graco Inc.: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

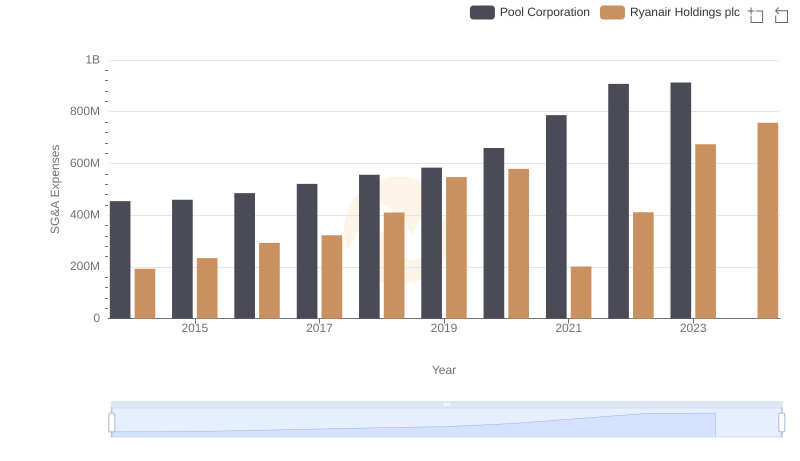

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Pool Corporation

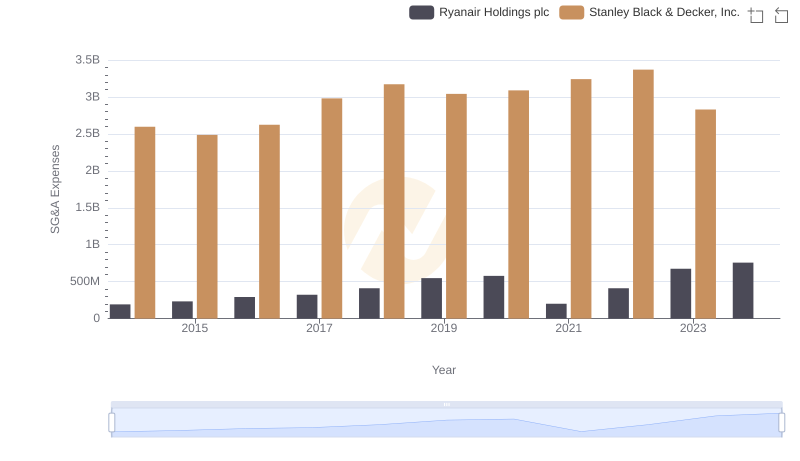

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.

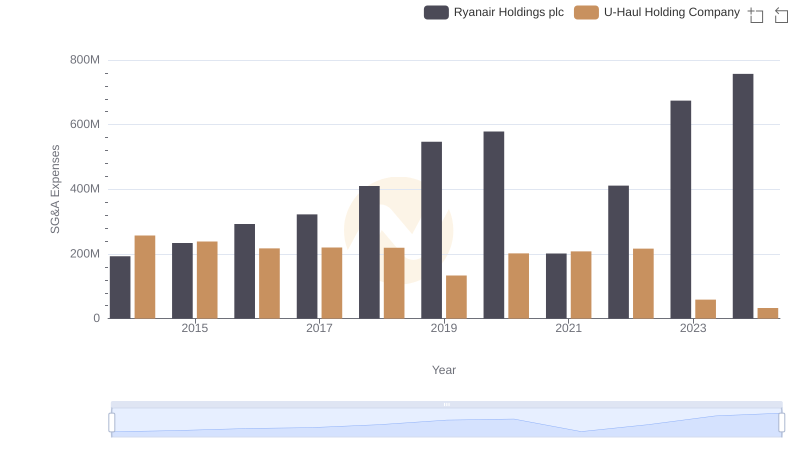

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

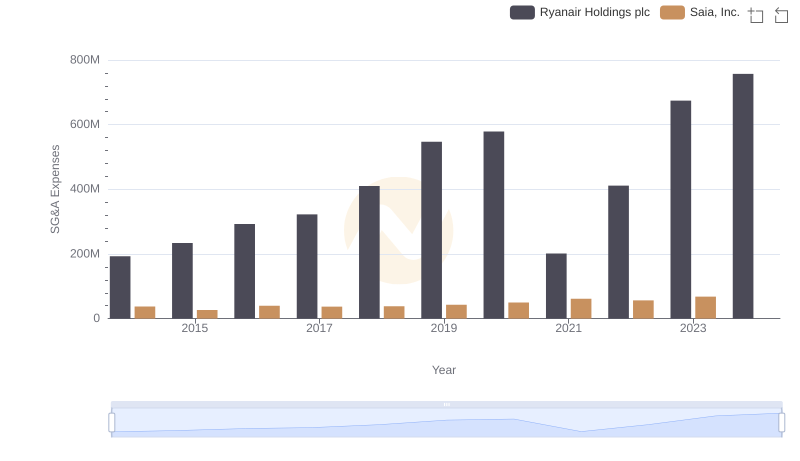

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends