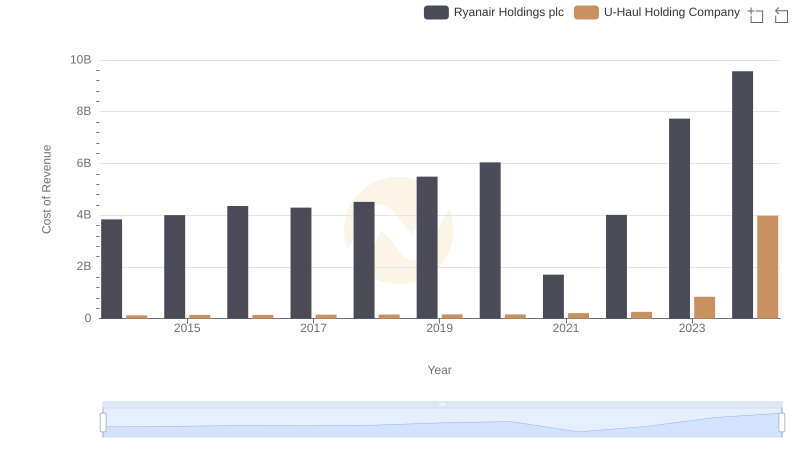

| __timestamp | Ryanair Holdings plc | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 192800000 | 257168000 |

| Thursday, January 1, 2015 | 233900000 | 238558000 |

| Friday, January 1, 2016 | 292700000 | 217216000 |

| Sunday, January 1, 2017 | 322300000 | 220053000 |

| Monday, January 1, 2018 | 410400000 | 219271000 |

| Tuesday, January 1, 2019 | 547300000 | 133435000 |

| Wednesday, January 1, 2020 | 578800000 | 201718000 |

| Friday, January 1, 2021 | 201500000 | 207982000 |

| Saturday, January 1, 2022 | 411300000 | 216557000 |

| Sunday, January 1, 2023 | 674400000 | 58753000 |

| Monday, January 1, 2024 | 757200000 | 32654000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. Over the past decade, Ryanair Holdings plc and U-Haul Holding Company have showcased contrasting trajectories in their SG&A expenses.

From 2014 to 2024, Ryanair's SG&A expenses surged by nearly 293%, reflecting its aggressive expansion strategy across Europe. In contrast, U-Haul's expenses saw a decline of approximately 87%, indicating a strategic shift towards cost optimization in the North American market.

The year 2023 marked a pivotal point, with Ryanair's expenses peaking at 674 million, while U-Haul's plummeted to just 59 million. This divergence highlights the distinct paths these companies have taken in response to market demands and economic conditions. As we look to the future, these trends offer valuable insights into the strategic priorities of these industry giants.

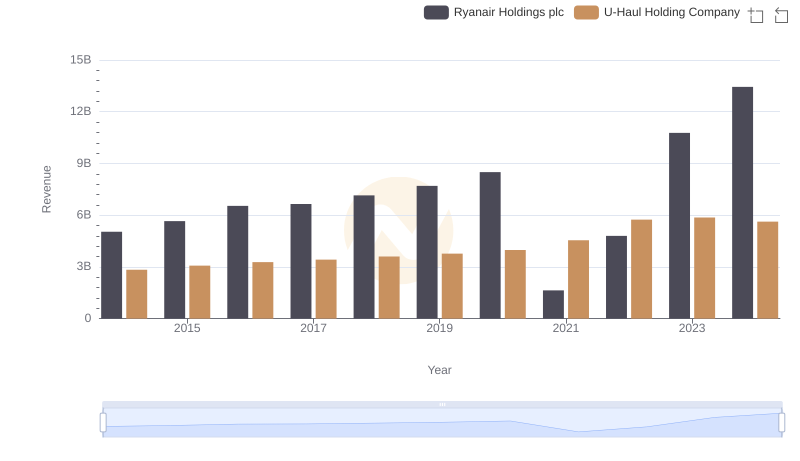

Breaking Down Revenue Trends: Ryanair Holdings plc vs U-Haul Holding Company

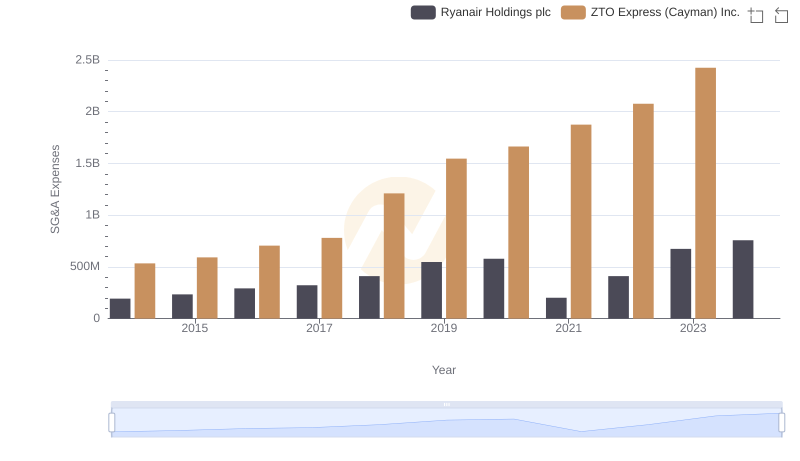

Breaking Down SG&A Expenses: Ryanair Holdings plc vs ZTO Express (Cayman) Inc.

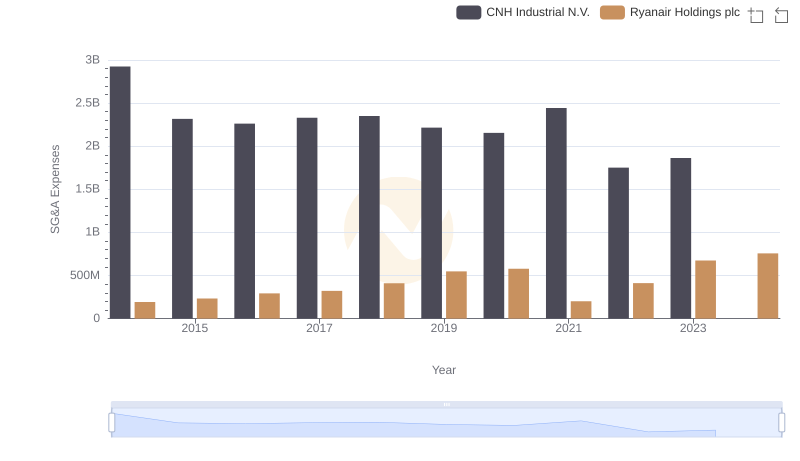

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.

Ryanair Holdings plc vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

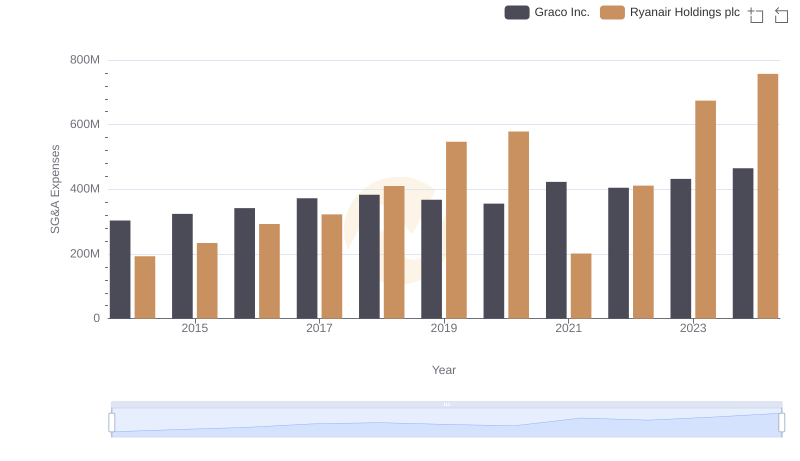

Ryanair Holdings plc and Graco Inc.: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

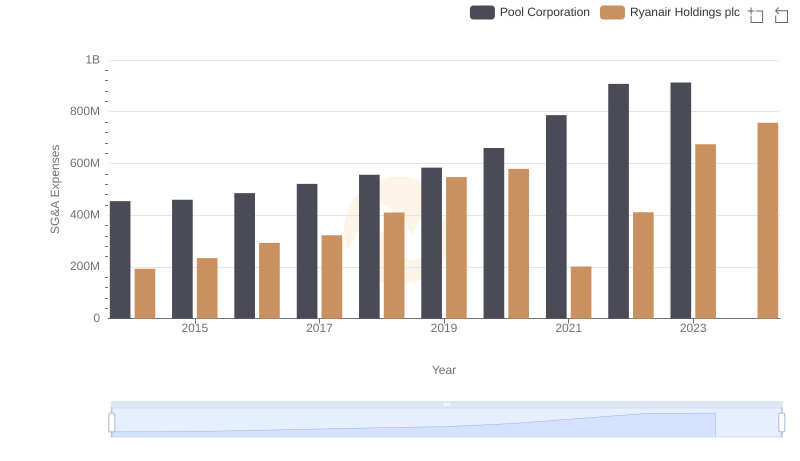

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Pool Corporation

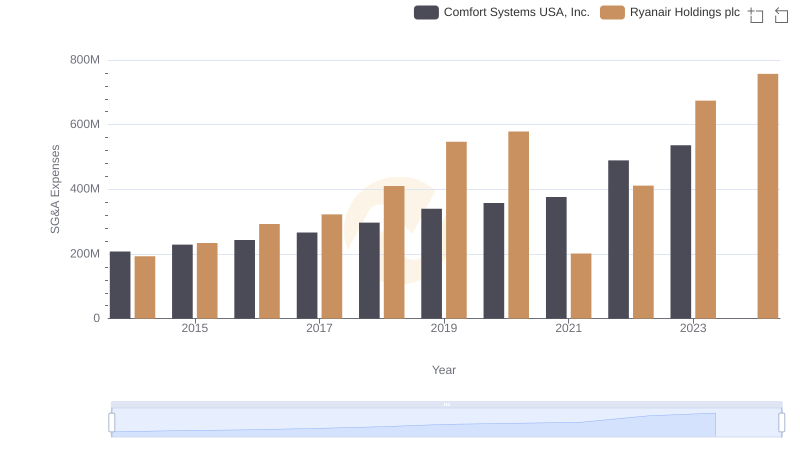

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Comfort Systems USA, Inc.

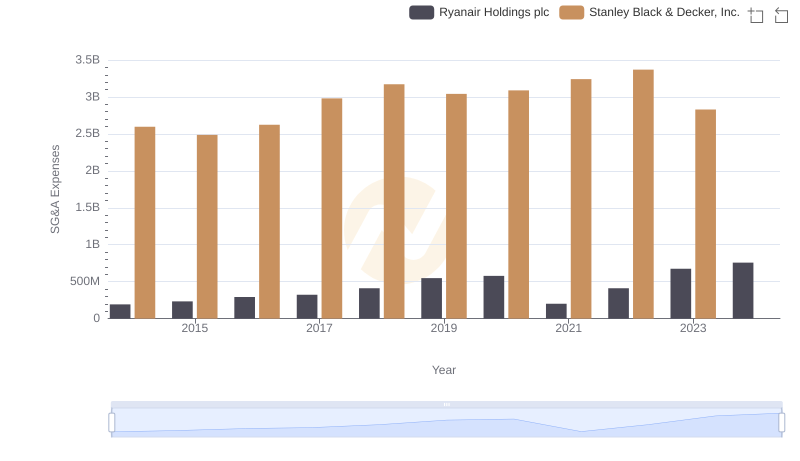

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.

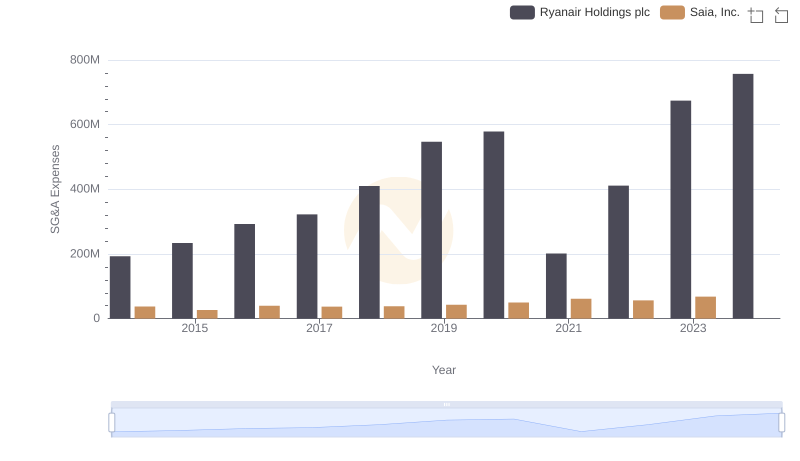

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends

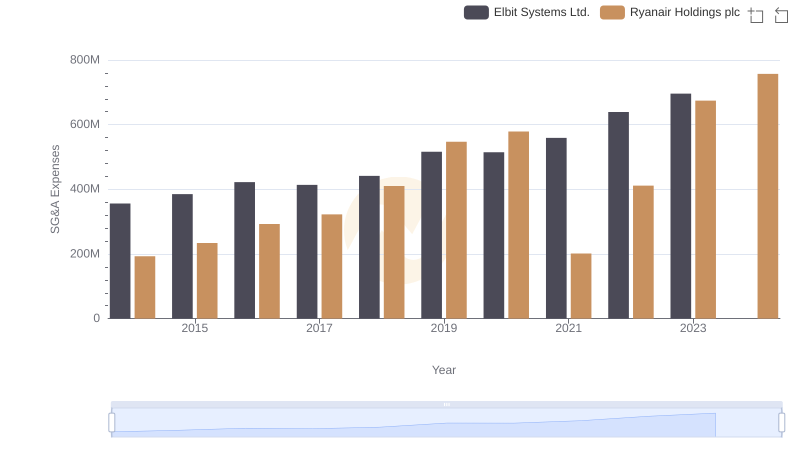

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Elbit Systems Ltd.

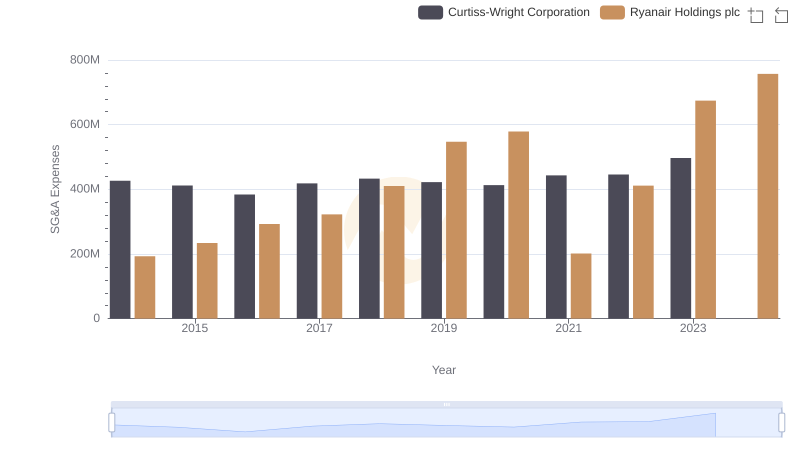

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Curtiss-Wright Corporation