| __timestamp | Elbit Systems Ltd. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 192800000 |

| Thursday, January 1, 2015 | 385059000 | 233900000 |

| Friday, January 1, 2016 | 422390000 | 292700000 |

| Sunday, January 1, 2017 | 413560000 | 322300000 |

| Monday, January 1, 2018 | 441362000 | 410400000 |

| Tuesday, January 1, 2019 | 516149000 | 547300000 |

| Wednesday, January 1, 2020 | 514638000 | 578800000 |

| Friday, January 1, 2021 | 559113000 | 201500000 |

| Saturday, January 1, 2022 | 639067000 | 411300000 |

| Sunday, January 1, 2023 | 696022000 | 674400000 |

| Monday, January 1, 2024 | 757200000 |

Unleashing the power of data

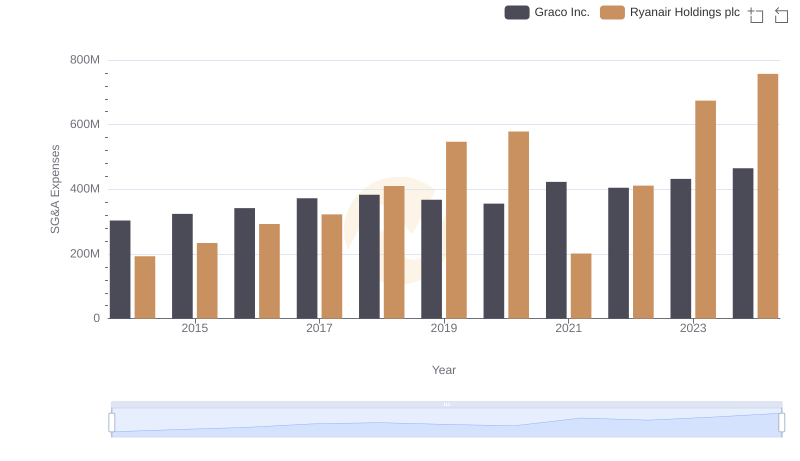

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. This chart offers a fascinating glimpse into the Selling, General, and Administrative (SG&A) expenses of Ryanair Holdings plc and Elbit Systems Ltd. from 2014 to 2023. Over this decade, Elbit Systems Ltd. has seen a steady increase in SG&A costs, peaking at approximately 696 million in 2023, a 95% rise from 2014. Meanwhile, Ryanair Holdings plc experienced more volatility, with expenses fluctuating significantly, notably dropping in 2021 before rebounding to 674 million in 2023. This data highlights the contrasting financial strategies of a leading airline and a defense electronics company, reflecting their unique market challenges and operational priorities. Notably, data for Elbit Systems Ltd. in 2024 is missing, indicating potential reporting delays or strategic shifts.

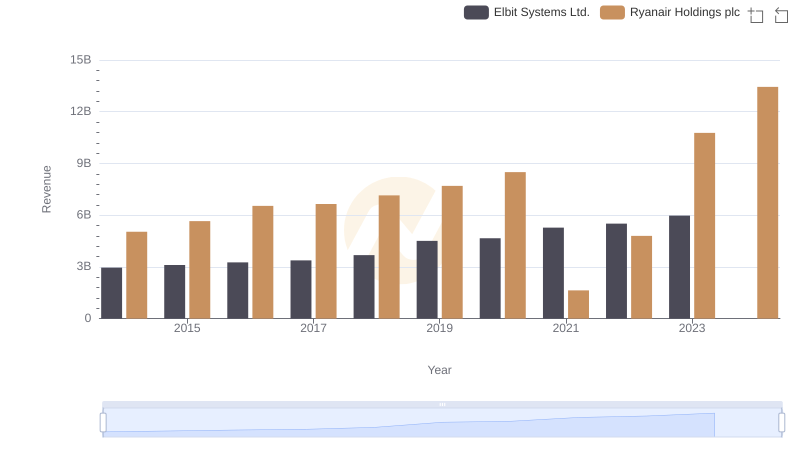

Who Generates More Revenue? Ryanair Holdings plc or Elbit Systems Ltd.

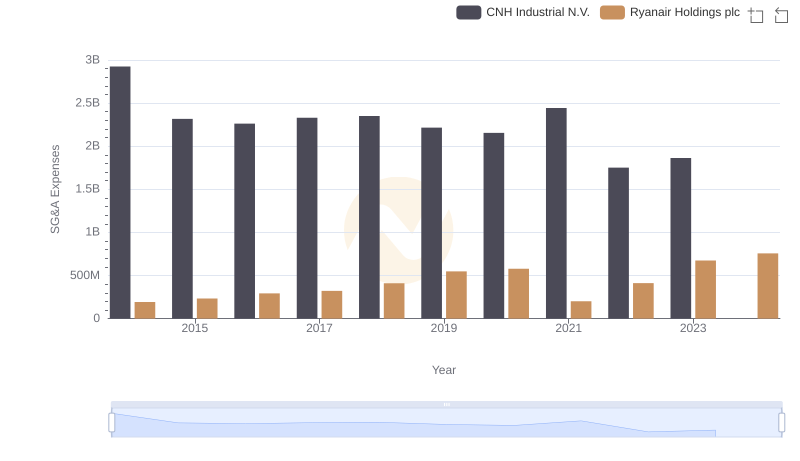

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.

Ryanair Holdings plc and Graco Inc.: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

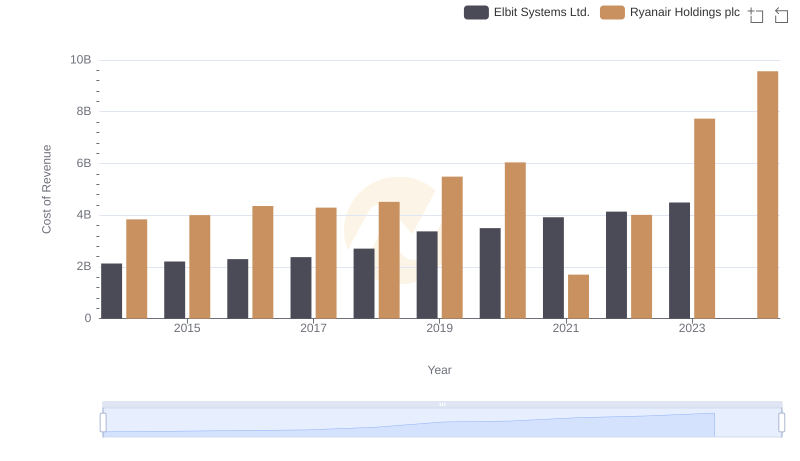

Analyzing Cost of Revenue: Ryanair Holdings plc and Elbit Systems Ltd.

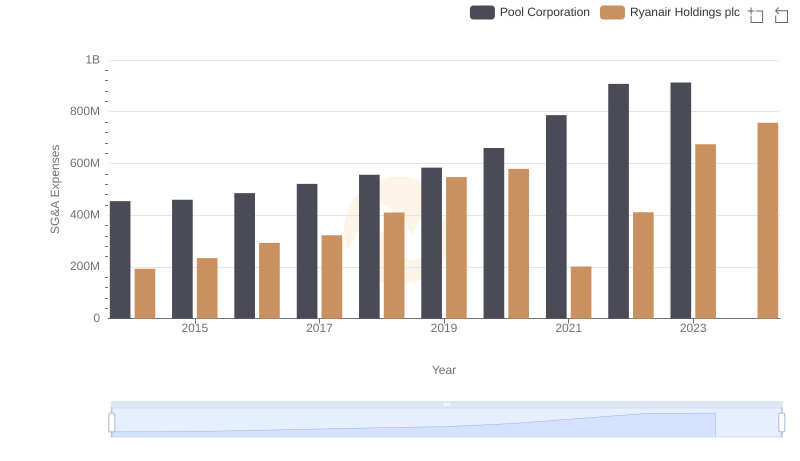

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Pool Corporation

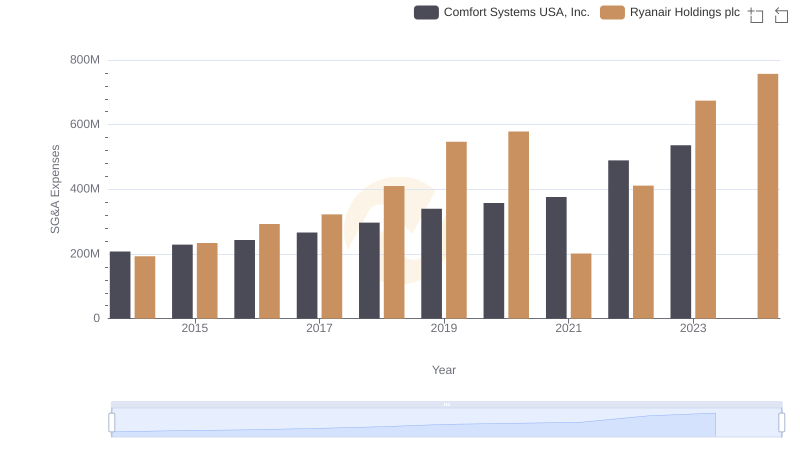

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Comfort Systems USA, Inc.

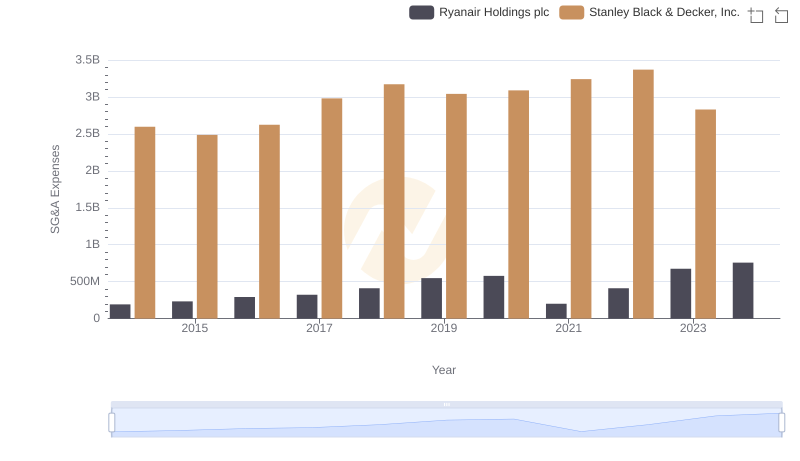

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.

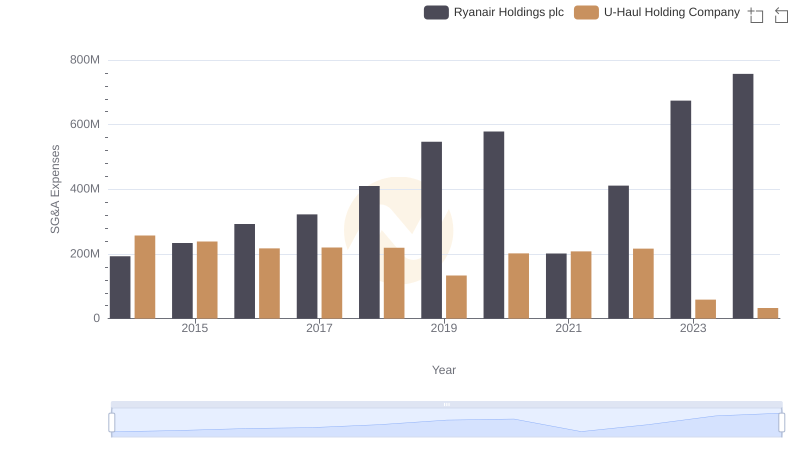

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

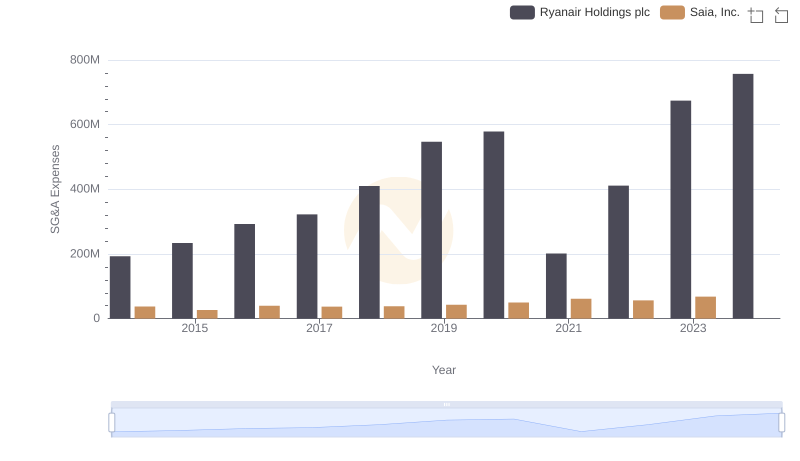

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends

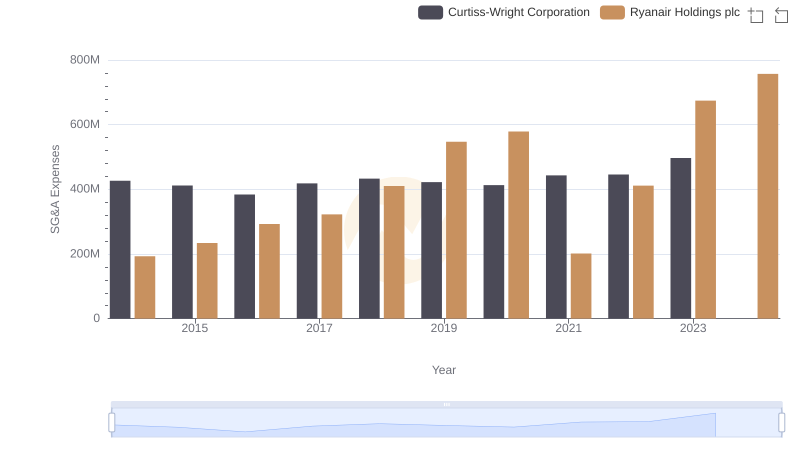

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Curtiss-Wright Corporation