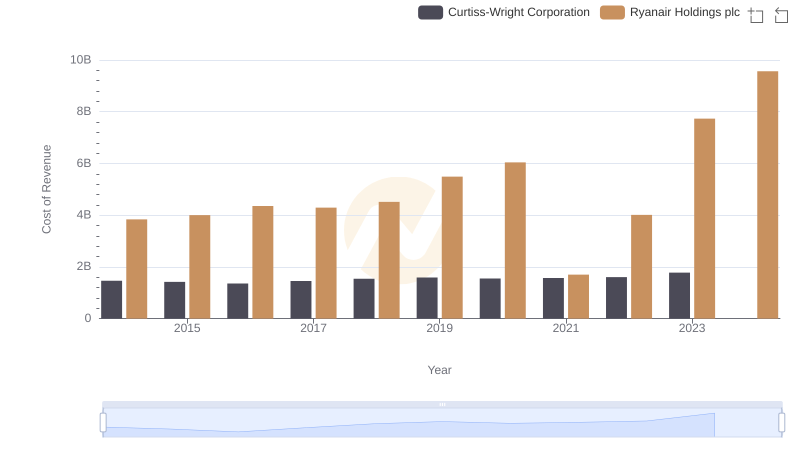

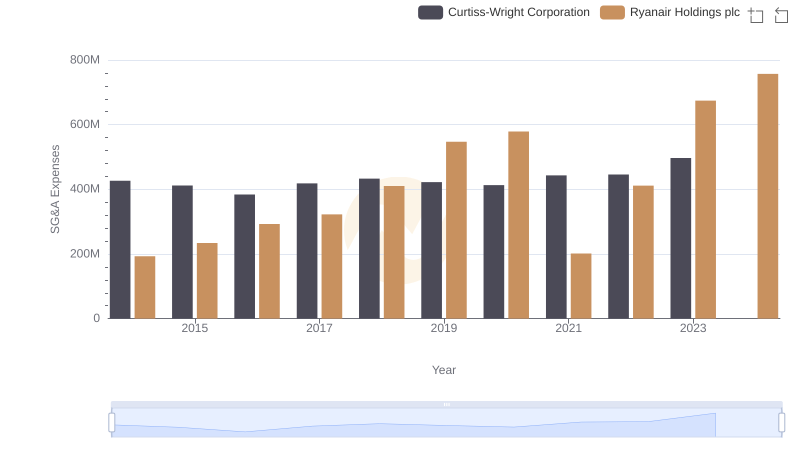

| __timestamp | Curtiss-Wright Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2243126000 | 5036700000 |

| Thursday, January 1, 2015 | 2205683000 | 5654000000 |

| Friday, January 1, 2016 | 2108931000 | 6535800000 |

| Sunday, January 1, 2017 | 2271026000 | 6647800000 |

| Monday, January 1, 2018 | 2411835000 | 7151000000 |

| Tuesday, January 1, 2019 | 2487961000 | 7697400000 |

| Wednesday, January 1, 2020 | 2391336000 | 8494799999 |

| Friday, January 1, 2021 | 2505931000 | 1635800000 |

| Saturday, January 1, 2022 | 2557025000 | 4800900000 |

| Sunday, January 1, 2023 | 2845373000 | 10775200000 |

| Monday, January 1, 2024 | 3121189000 | 13443800000 |

Igniting the spark of knowledge

In the world of aviation and engineering, Ryanair Holdings plc and Curtiss-Wright Corporation stand as titans, each dominating their respective sectors. Over the past decade, Ryanair has soared with a remarkable 90% increase in revenue, peaking at over €10 billion in 2023. This growth trajectory highlights Ryanair's resilience and strategic prowess, especially considering the aviation industry's volatility.

Conversely, Curtiss-Wright Corporation, a stalwart in engineering, has maintained steady growth, with revenues increasing by approximately 27% since 2014. Their peak revenue in 2023 reached nearly $2.85 billion, showcasing their consistent performance in a competitive market.

While Ryanair's revenue dipped significantly in 2021, reflecting the global pandemic's impact, it rebounded impressively by 2023. Curtiss-Wright's steady climb underscores its robust business model. This comparison offers a fascinating glimpse into how two industry leaders navigate challenges and capitalize on opportunities.

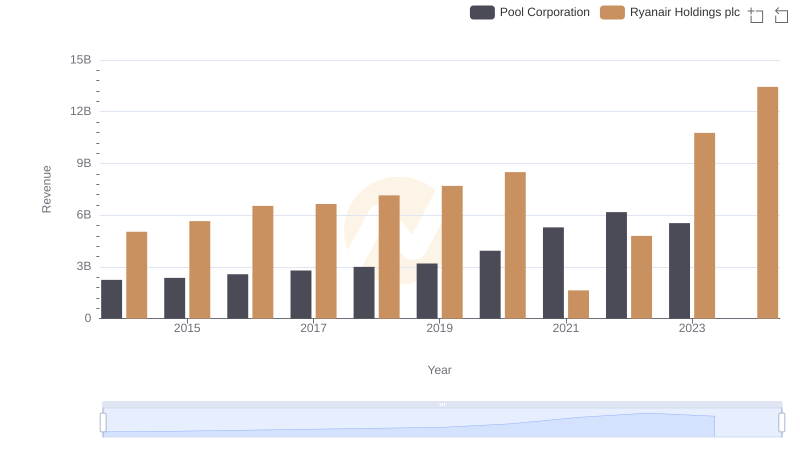

Breaking Down Revenue Trends: Ryanair Holdings plc vs Pool Corporation

Ryanair Holdings plc or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

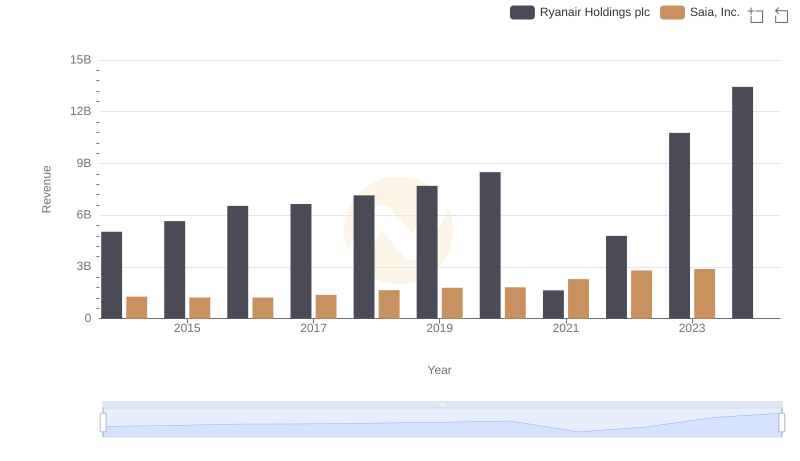

Comparing Revenue Performance: Ryanair Holdings plc or Saia, Inc.?

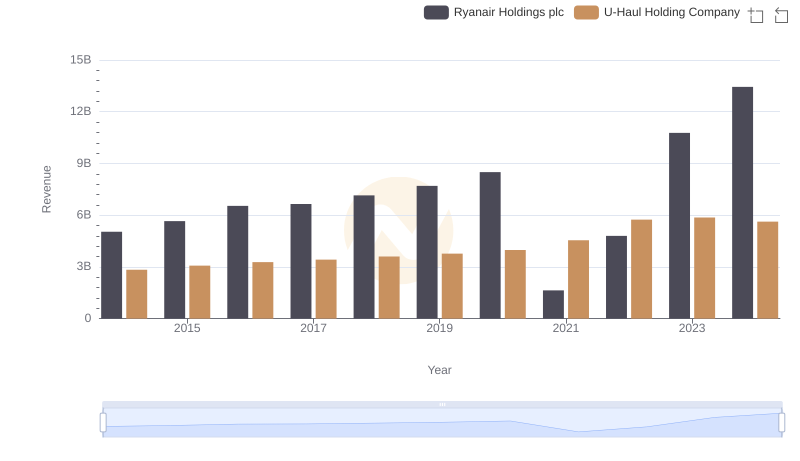

Breaking Down Revenue Trends: Ryanair Holdings plc vs U-Haul Holding Company

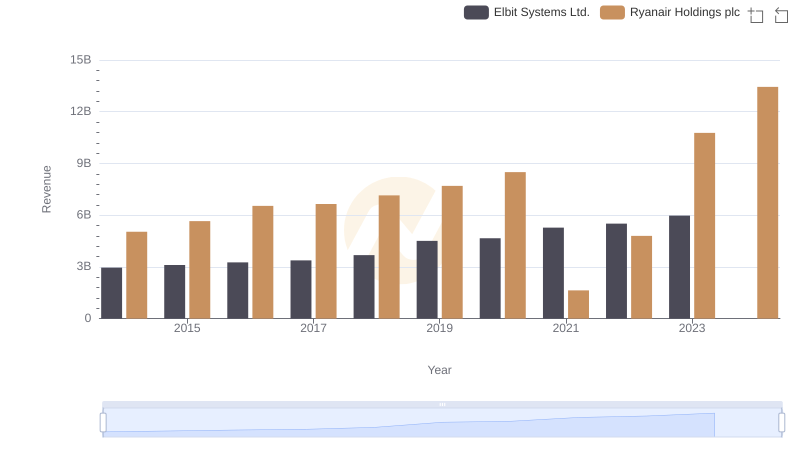

Who Generates More Revenue? Ryanair Holdings plc or Elbit Systems Ltd.

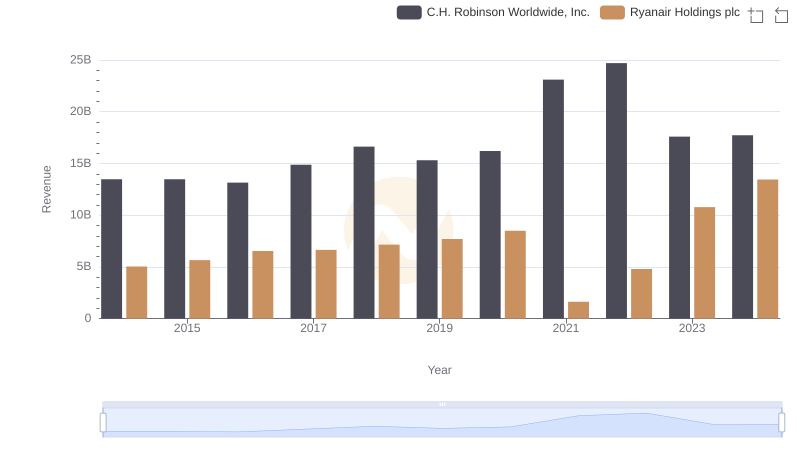

Ryanair Holdings plc vs C.H. Robinson Worldwide, Inc.: Examining Key Revenue Metrics

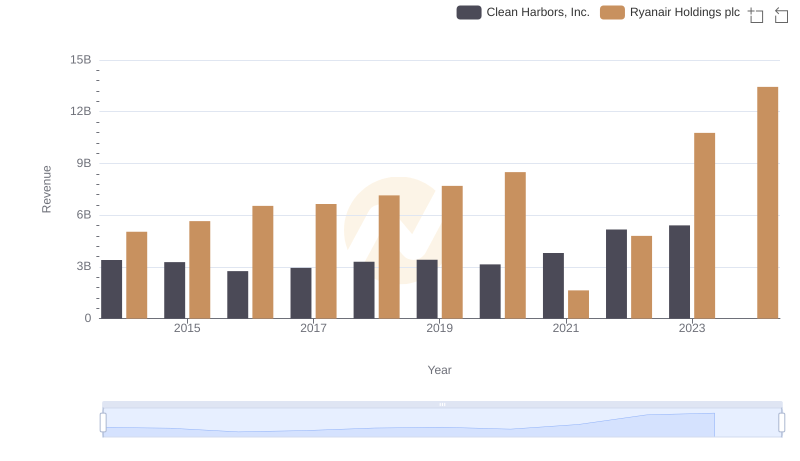

Revenue Showdown: Ryanair Holdings plc vs Clean Harbors, Inc.

Cost of Revenue Trends: Ryanair Holdings plc vs Curtiss-Wright Corporation

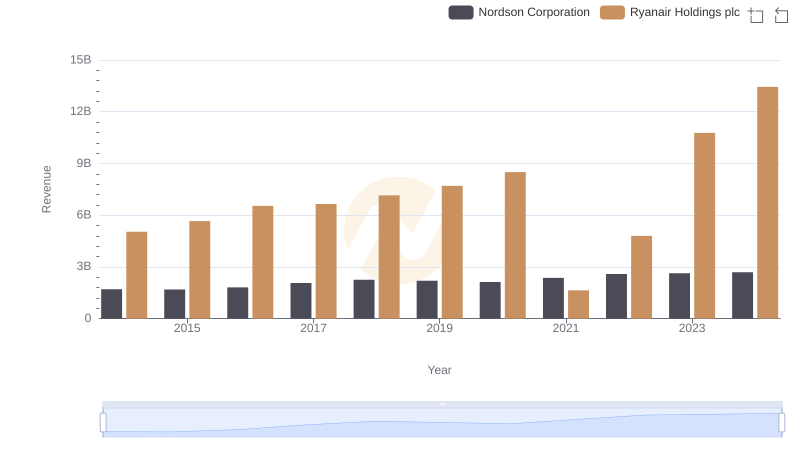

Annual Revenue Comparison: Ryanair Holdings plc vs Nordson Corporation

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Curtiss-Wright Corporation