| __timestamp | Pool Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 454470000 | 192800000 |

| Thursday, January 1, 2015 | 459422000 | 233900000 |

| Friday, January 1, 2016 | 485228000 | 292700000 |

| Sunday, January 1, 2017 | 520918000 | 322300000 |

| Monday, January 1, 2018 | 556284000 | 410400000 |

| Tuesday, January 1, 2019 | 583679000 | 547300000 |

| Wednesday, January 1, 2020 | 659931000 | 578800000 |

| Friday, January 1, 2021 | 786808000 | 201500000 |

| Saturday, January 1, 2022 | 907629000 | 411300000 |

| Sunday, January 1, 2023 | 912927000 | 674400000 |

| Monday, January 1, 2024 | 757200000 |

Unlocking the unknown

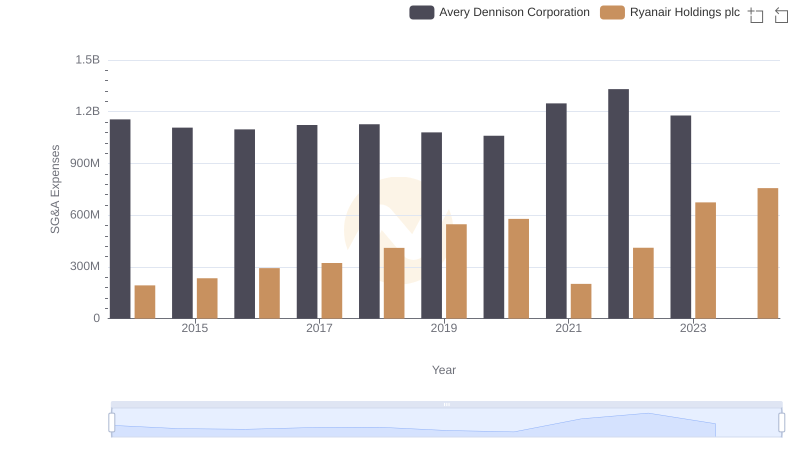

In the ever-evolving landscape of global business, understanding the financial dynamics of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two prominent companies: Ryanair Holdings plc and Pool Corporation, from 2014 to 2023.

Ryanair, a titan in the aviation sector, has seen its SG&A expenses grow by approximately 250% over the decade, reflecting its strategic expansions and operational adjustments. Notably, 2023 marked a significant increase, with expenses reaching their peak, indicating a robust post-pandemic recovery.

Conversely, Pool Corporation, a leader in the distribution of swimming pool supplies, has consistently maintained higher SG&A expenses, peaking in 2023 with a 100% increase since 2014. This steady rise underscores its market dominance and strategic investments.

While both companies exhibit growth, the data highlights distinct financial strategies, offering valuable insights into their operational priorities.

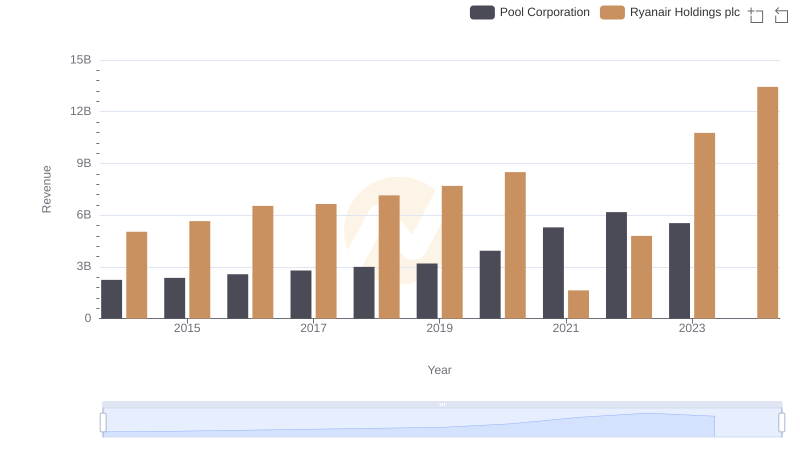

Breaking Down Revenue Trends: Ryanair Holdings plc vs Pool Corporation

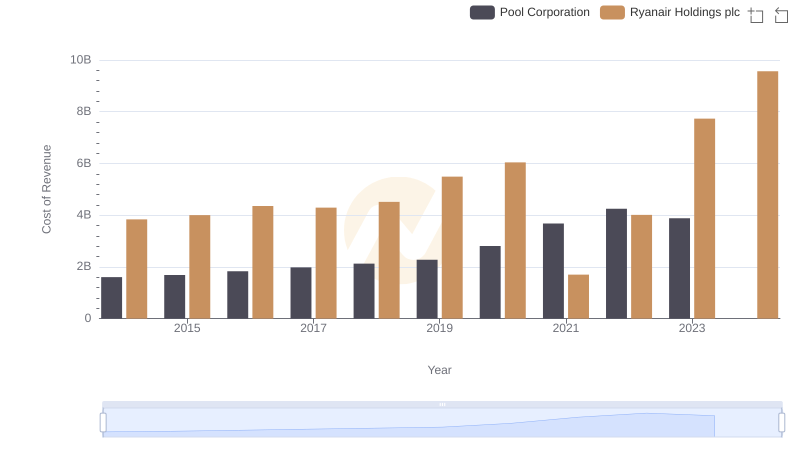

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Avery Dennison Corporation

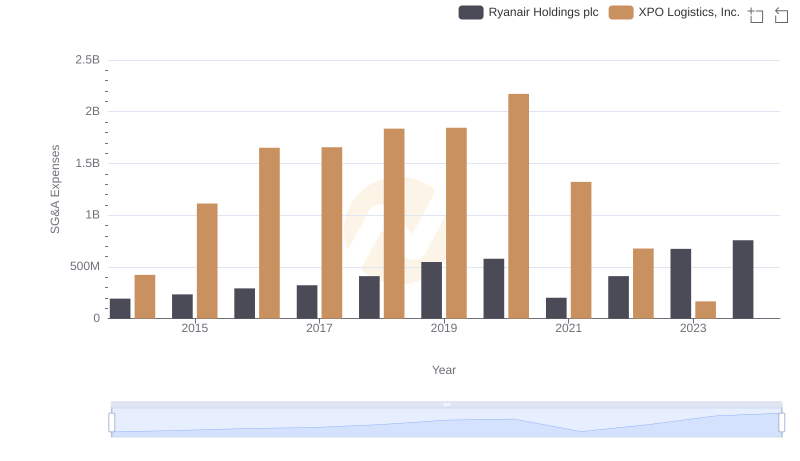

Breaking Down SG&A Expenses: Ryanair Holdings plc vs XPO Logistics, Inc.

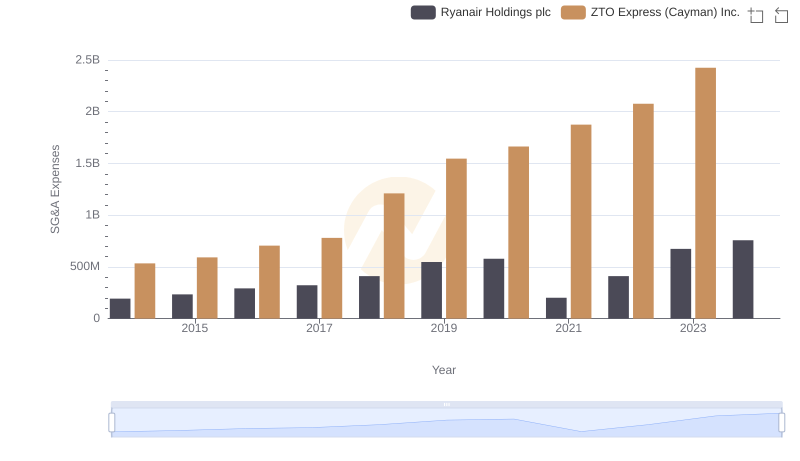

Breaking Down SG&A Expenses: Ryanair Holdings plc vs ZTO Express (Cayman) Inc.

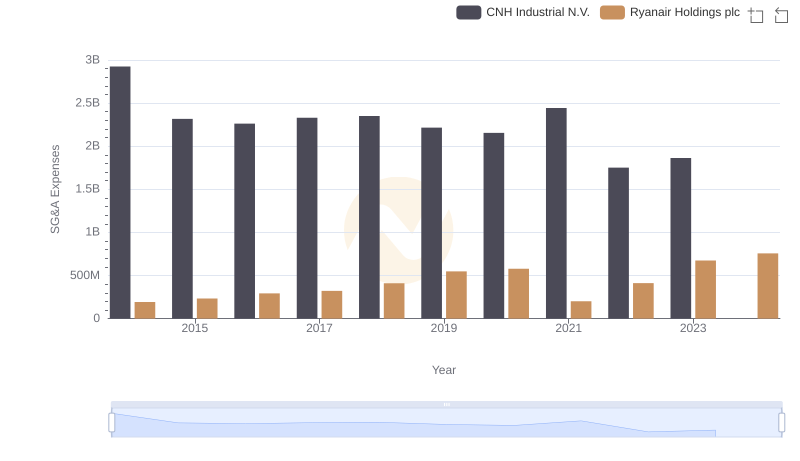

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.

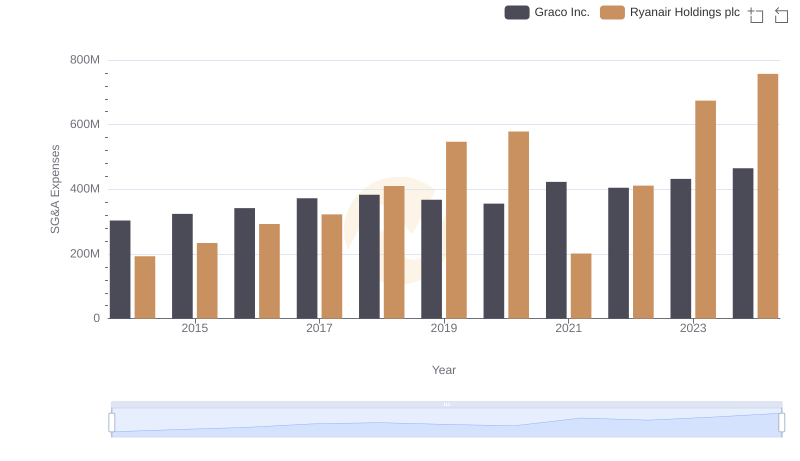

Ryanair Holdings plc and Graco Inc.: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

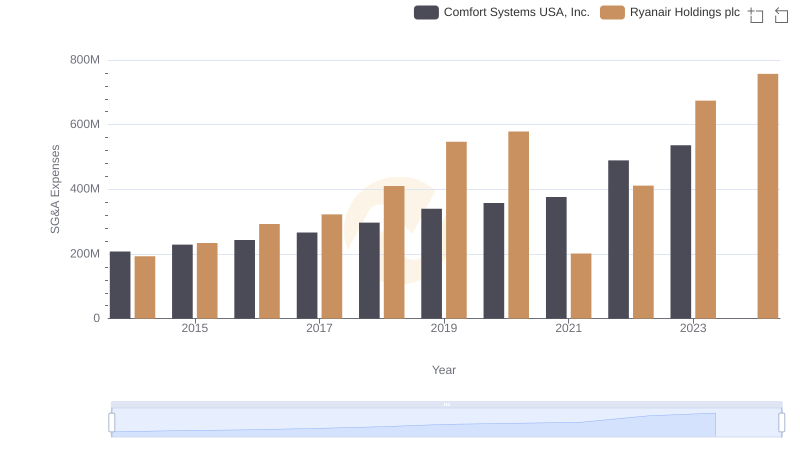

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Comfort Systems USA, Inc.

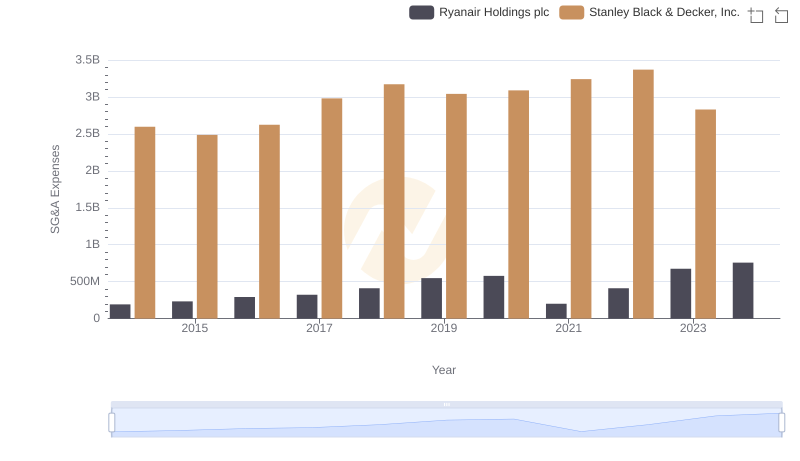

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.

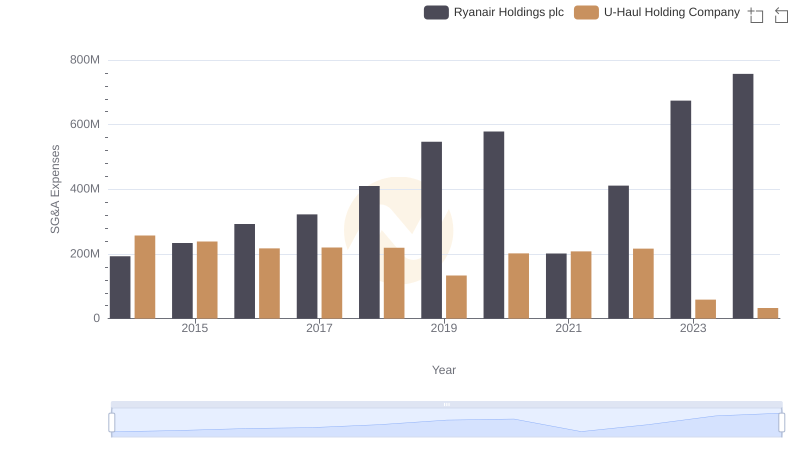

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

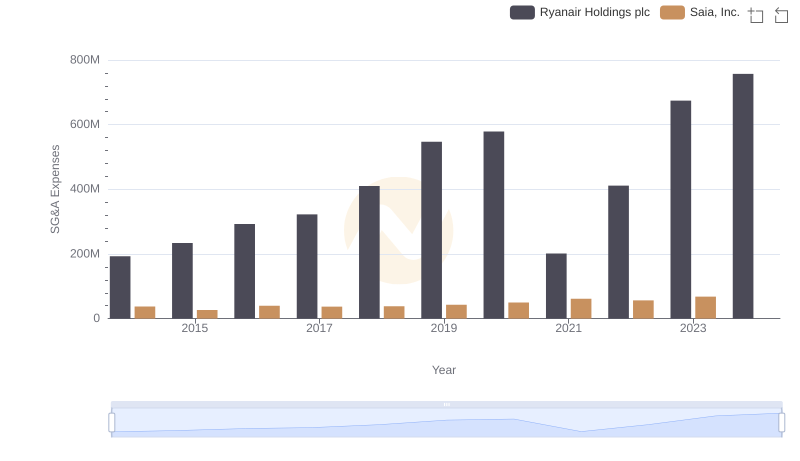

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends