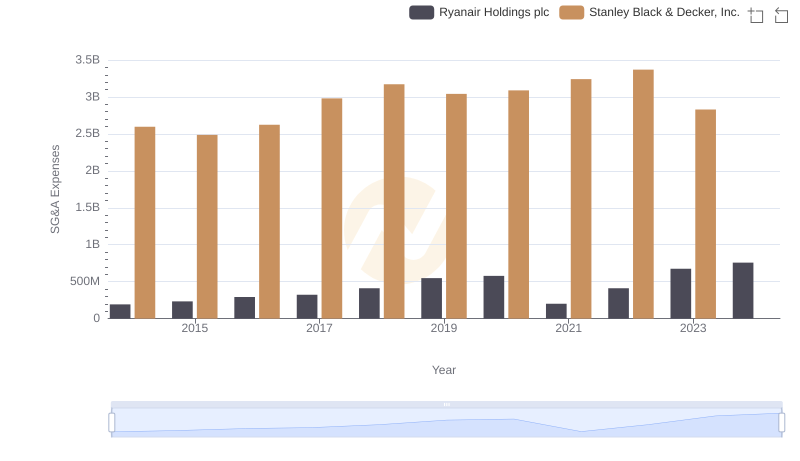

| __timestamp | Ryanair Holdings plc | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 192800000 | 2595900000 |

| Thursday, January 1, 2015 | 233900000 | 2486400000 |

| Friday, January 1, 2016 | 292700000 | 2623900000 |

| Sunday, January 1, 2017 | 322300000 | 2980100000 |

| Monday, January 1, 2018 | 410400000 | 3171700000 |

| Tuesday, January 1, 2019 | 547300000 | 3041000000 |

| Wednesday, January 1, 2020 | 578800000 | 3089600000 |

| Friday, January 1, 2021 | 201500000 | 3240400000 |

| Saturday, January 1, 2022 | 411300000 | 3370000000 |

| Sunday, January 1, 2023 | 674400000 | 2829300000 |

| Monday, January 1, 2024 | 757200000 | 3310500000 |

Cracking the code

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. This analysis compares Ryanair Holdings plc and Stanley Black & Decker, Inc. over a decade, from 2014 to 2023. Ryanair, a leader in low-cost aviation, has seen its SG&A expenses grow by approximately 293% from 2014 to 2023, reflecting strategic expansions and market adaptations. In contrast, Stanley Black & Decker, a stalwart in the tools and storage industry, maintained a relatively stable SG&A expense profile, peaking in 2022. Notably, Ryanair's expenses surged in 2023, while Stanley Black & Decker's data for 2024 remains unavailable, highlighting potential shifts in their financial strategies. This comparison underscores the dynamic nature of SG&A management across industries, offering insights into how these companies navigate economic landscapes.

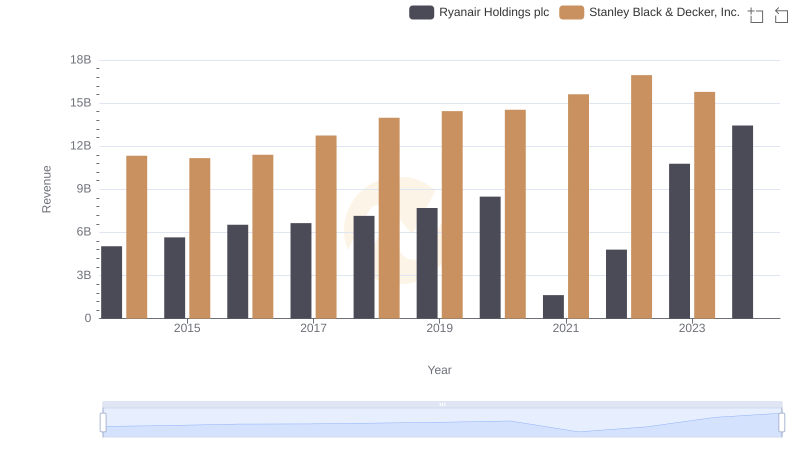

Annual Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

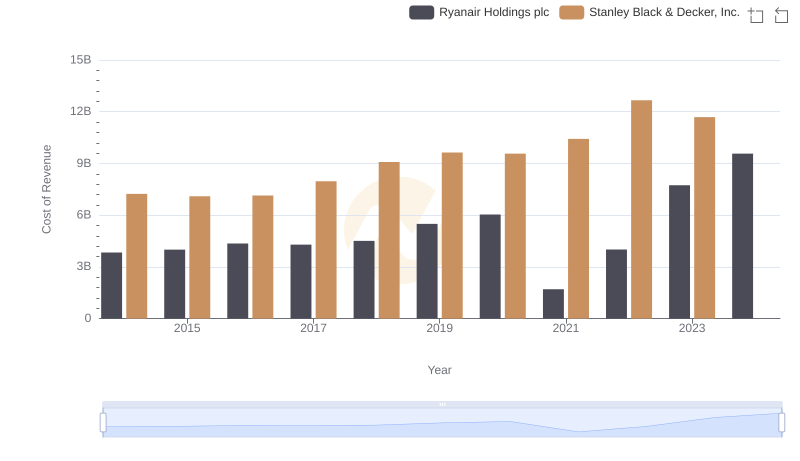

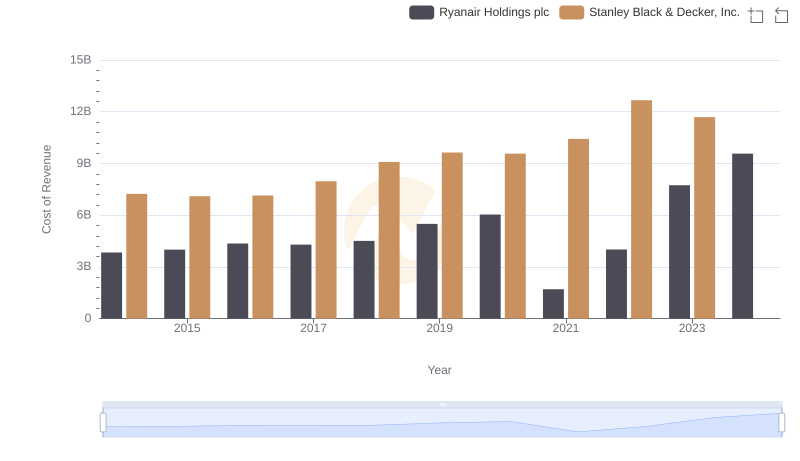

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

Operational Costs Compared: SG&A Analysis of Ryanair Holdings plc and Stanley Black & Decker, Inc.

Ryanair Holdings plc or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

Cost of Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

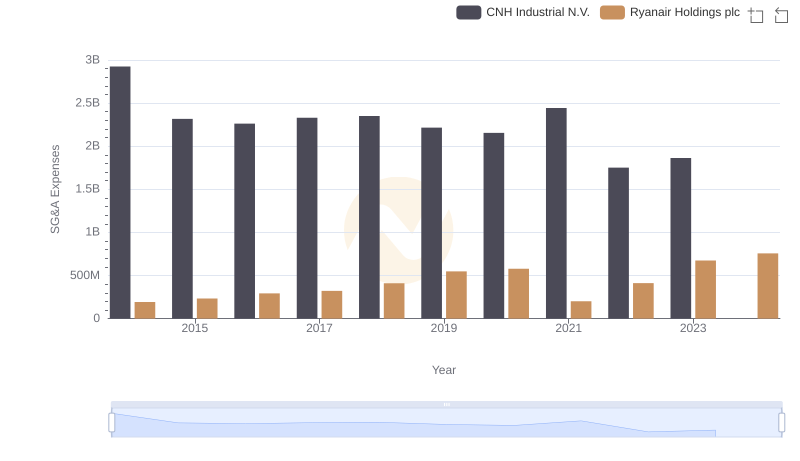

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.

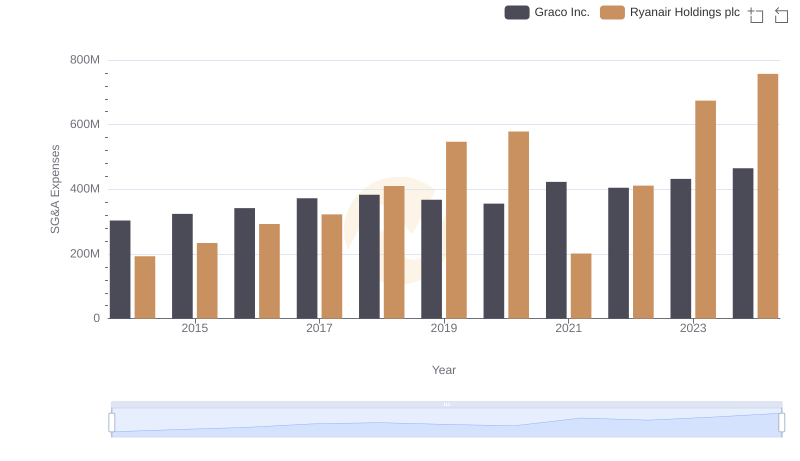

Ryanair Holdings plc and Graco Inc.: SG&A Spending Patterns Compared

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or AECOM

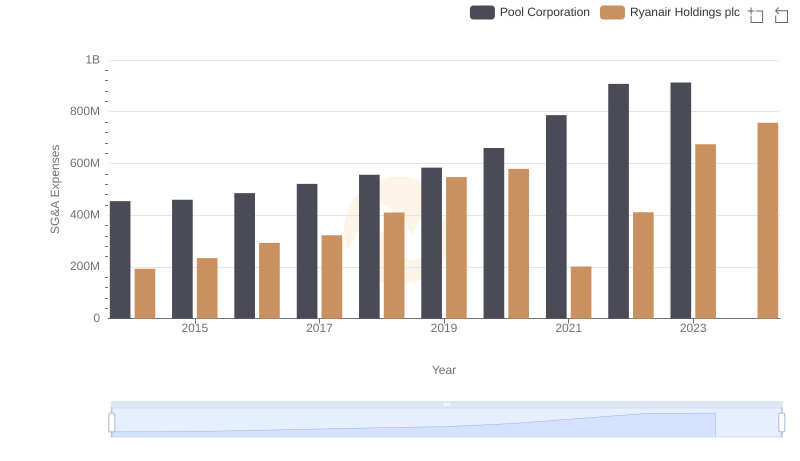

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Pool Corporation

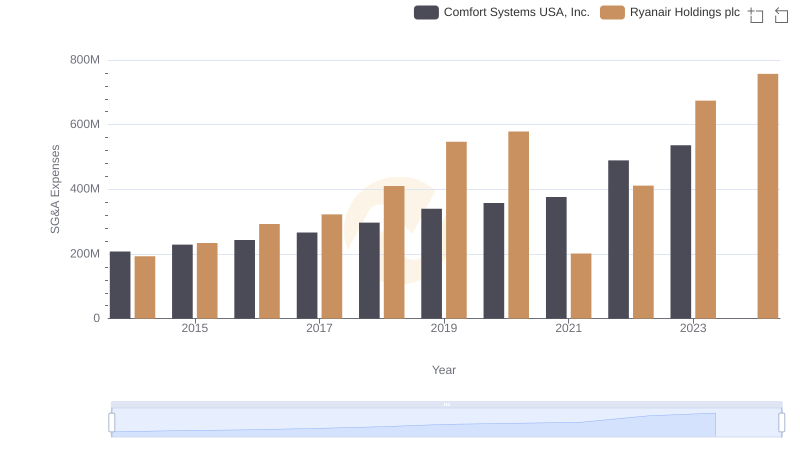

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Comfort Systems USA, Inc.

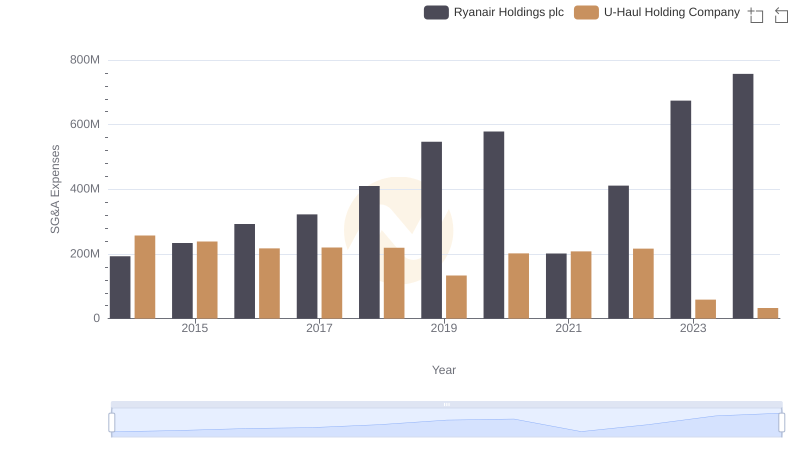

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

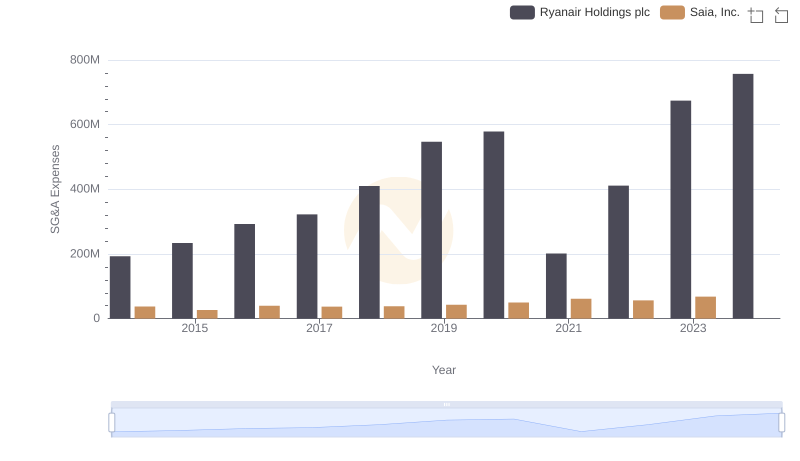

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends