| __timestamp | C.H. Robinson Worldwide, Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 192800000 |

| Thursday, January 1, 2015 | 358760000 | 233900000 |

| Friday, January 1, 2016 | 375061000 | 292700000 |

| Sunday, January 1, 2017 | 413404000 | 322300000 |

| Monday, January 1, 2018 | 449610000 | 410400000 |

| Tuesday, January 1, 2019 | 497806000 | 547300000 |

| Wednesday, January 1, 2020 | 496122000 | 578800000 |

| Friday, January 1, 2021 | 526371000 | 201500000 |

| Saturday, January 1, 2022 | 603415000 | 411300000 |

| Sunday, January 1, 2023 | 624266000 | 674400000 |

| Monday, January 1, 2024 | 639624000 | 757200000 |

Unleashing insights

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two prominent companies: Ryanair Holdings plc and C.H. Robinson Worldwide, Inc., from 2014 to 2024.

Over the past decade, Ryanair's SG&A expenses have shown a remarkable increase of nearly 293%, reflecting its aggressive expansion and marketing strategies. In contrast, C.H. Robinson's expenses grew by approximately 100%, indicating a more stable and consistent approach.

By 2024, Ryanair's SG&A expenses are projected to surpass C.H. Robinson's by 18%, highlighting its dynamic growth trajectory. This trend underscores the differing strategic priorities of these companies, with Ryanair focusing on rapid growth and C.H. Robinson maintaining steady operations.

Understanding these trends offers valuable insights into the financial health and strategic direction of these industry titans.

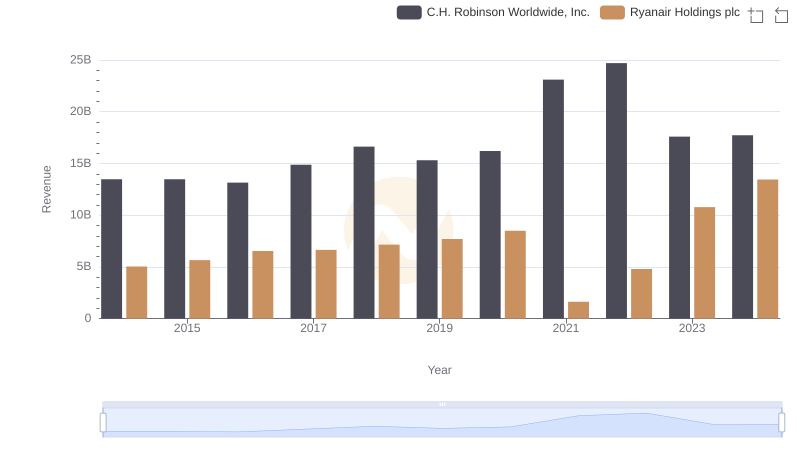

Ryanair Holdings plc vs C.H. Robinson Worldwide, Inc.: Examining Key Revenue Metrics

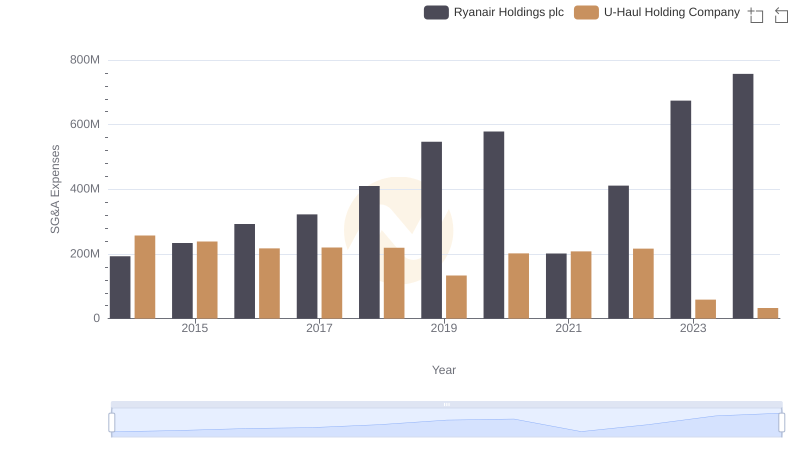

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

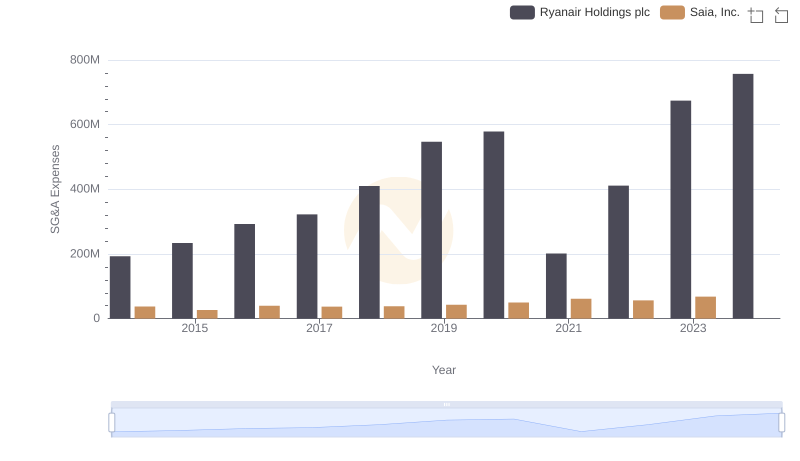

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends

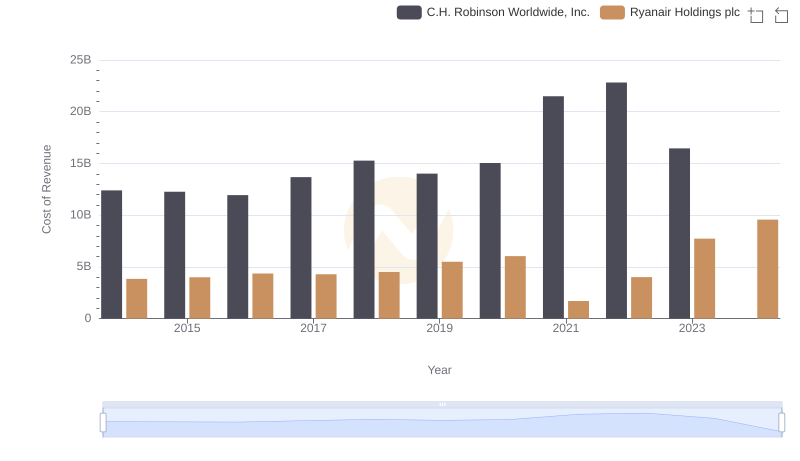

Cost Insights: Breaking Down Ryanair Holdings plc and C.H. Robinson Worldwide, Inc.'s Expenses

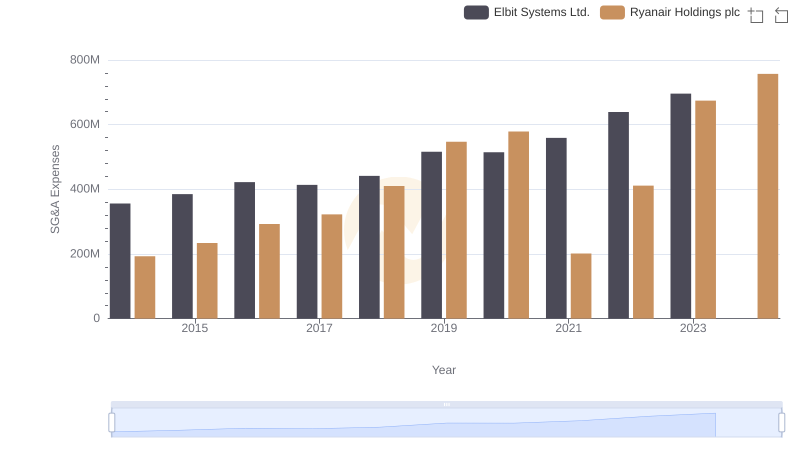

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Elbit Systems Ltd.

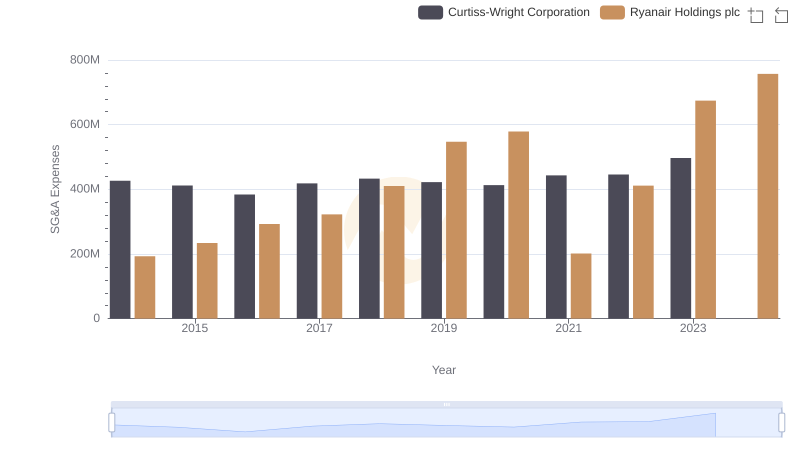

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Curtiss-Wright Corporation

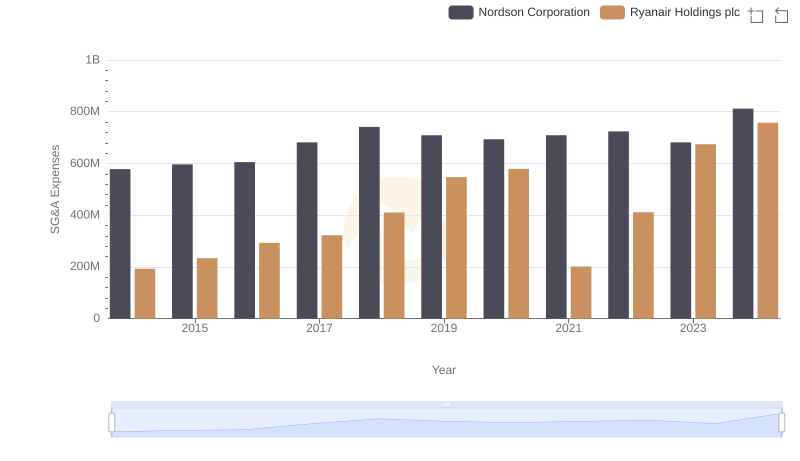

Ryanair Holdings plc and Nordson Corporation: SG&A Spending Patterns Compared

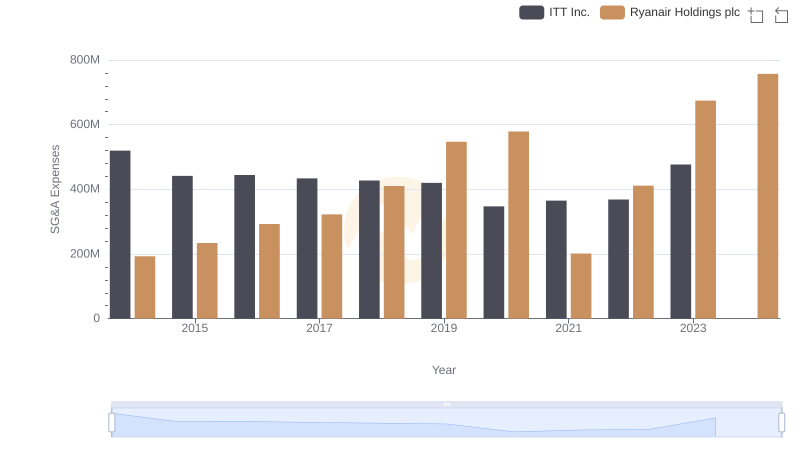

Ryanair Holdings plc and ITT Inc.: SG&A Spending Patterns Compared

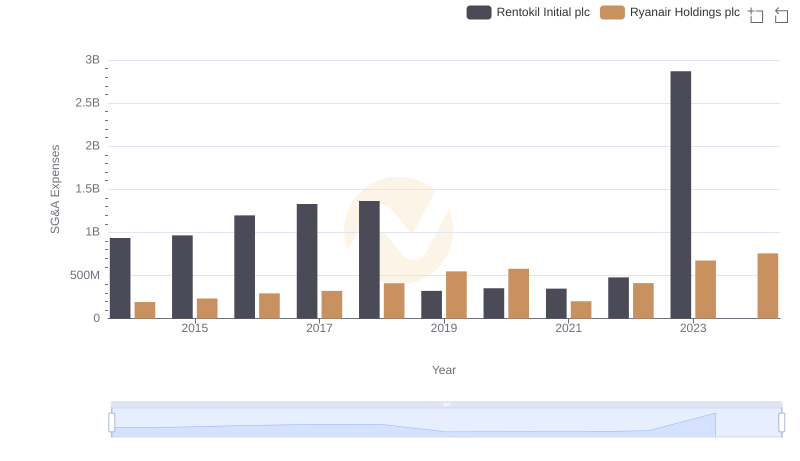

Ryanair Holdings plc vs Rentokil Initial plc: SG&A Expense Trends

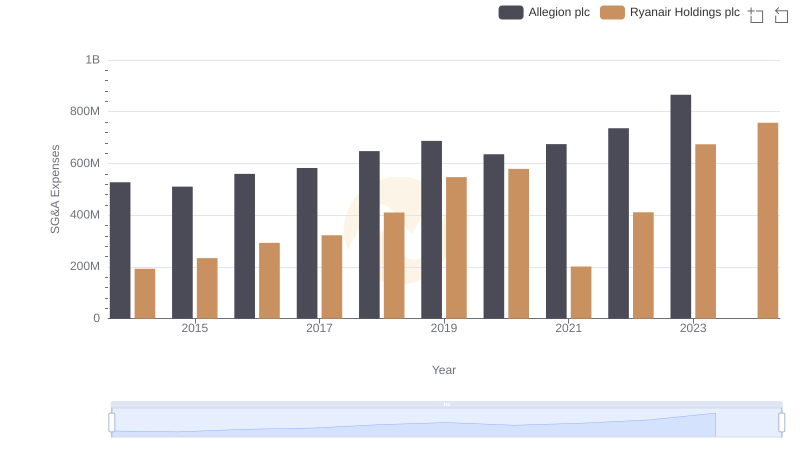

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Allegion plc

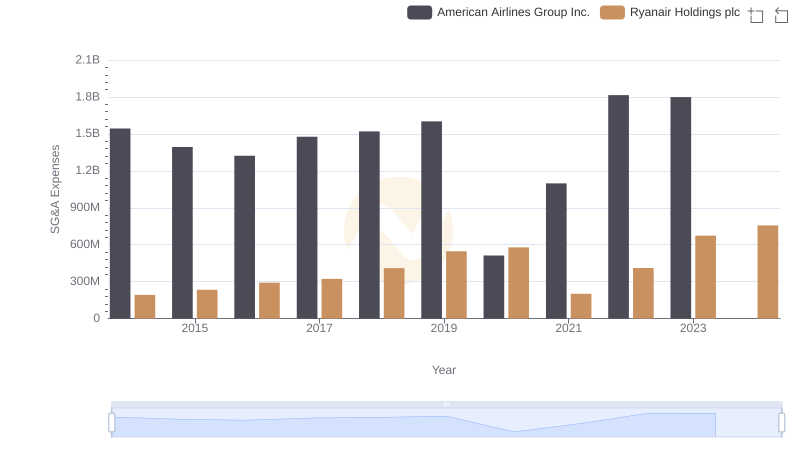

Breaking Down SG&A Expenses: Ryanair Holdings plc vs American Airlines Group Inc.