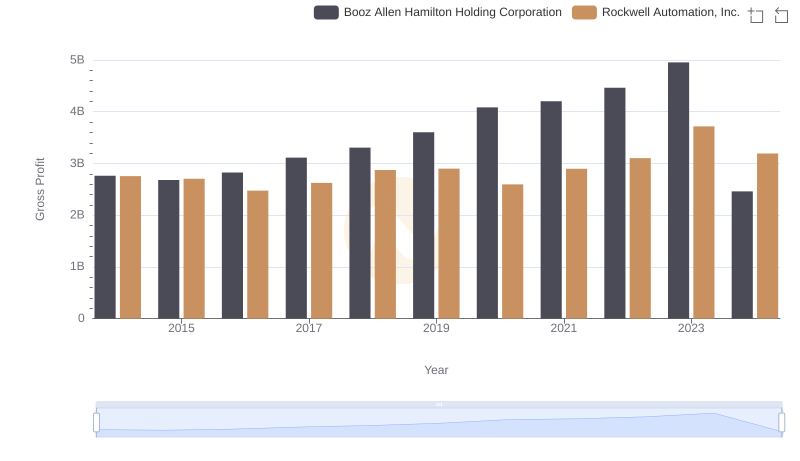

| __timestamp | Booz Allen Hamilton Holding Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 1570100000 |

| Thursday, January 1, 2015 | 2159439000 | 1506400000 |

| Friday, January 1, 2016 | 2319592000 | 1467400000 |

| Sunday, January 1, 2017 | 2568511000 | 1591500000 |

| Monday, January 1, 2018 | 2719909000 | 1599000000 |

| Tuesday, January 1, 2019 | 2932602000 | 1538500000 |

| Wednesday, January 1, 2020 | 3334378000 | 1479800000 |

| Friday, January 1, 2021 | 3362722000 | 1680000000 |

| Saturday, January 1, 2022 | 3633150000 | 1766700000 |

| Sunday, January 1, 2023 | 4341769000 | 2023700000 |

| Monday, January 1, 2024 | 1281443000 | 2002600000 |

In pursuit of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis compares the SG&A efficiency of Rockwell Automation, Inc. and Booz Allen Hamilton Holding Corporation from 2014 to 2024.

Over the past decade, Booz Allen Hamilton has seen a significant increase in SG&A expenses, peaking in 2023 with a 95% rise from 2014. In contrast, Rockwell Automation's SG&A expenses have grown more modestly, with a 29% increase over the same period. This suggests a more controlled approach to managing operational costs.

For investors and stakeholders, understanding these trends is vital. Booz Allen's aggressive expansion strategy may indicate a focus on growth, while Rockwell's steady increase suggests a balanced approach to cost management. As we move into 2024, these strategies will continue to shape their financial landscapes.

Breaking Down Revenue Trends: Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation

Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation

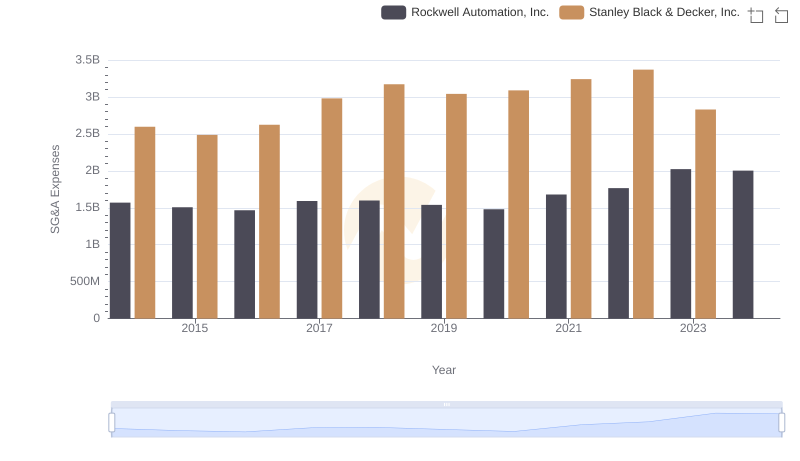

Selling, General, and Administrative Costs: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

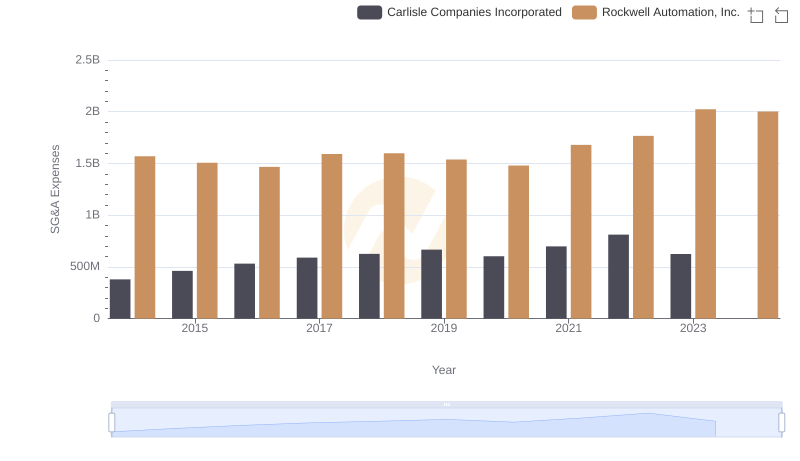

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and Carlisle Companies Incorporated

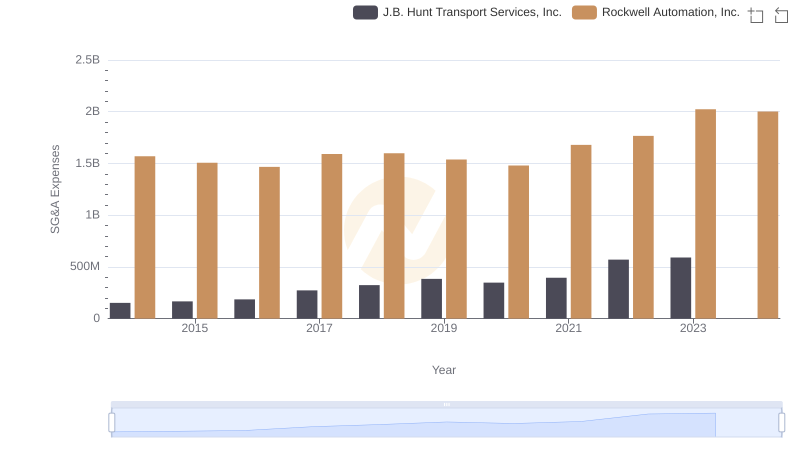

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.

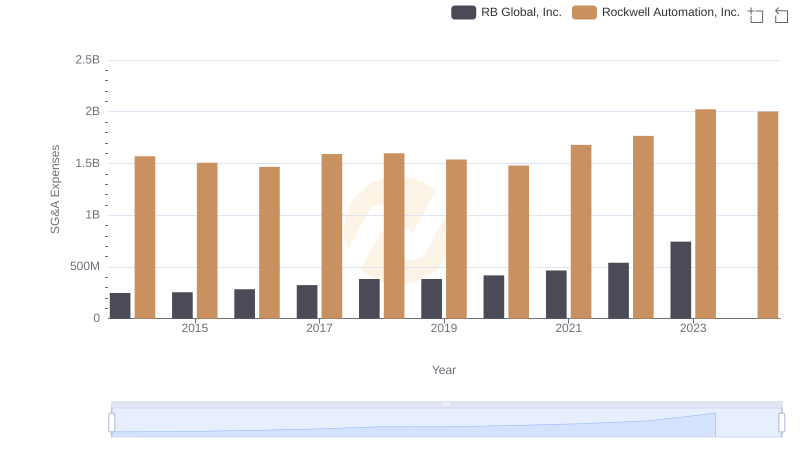

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and RB Global, Inc.

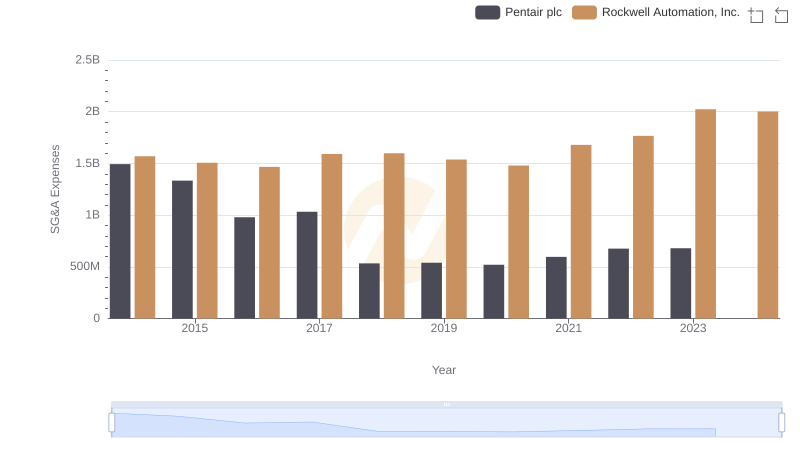

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

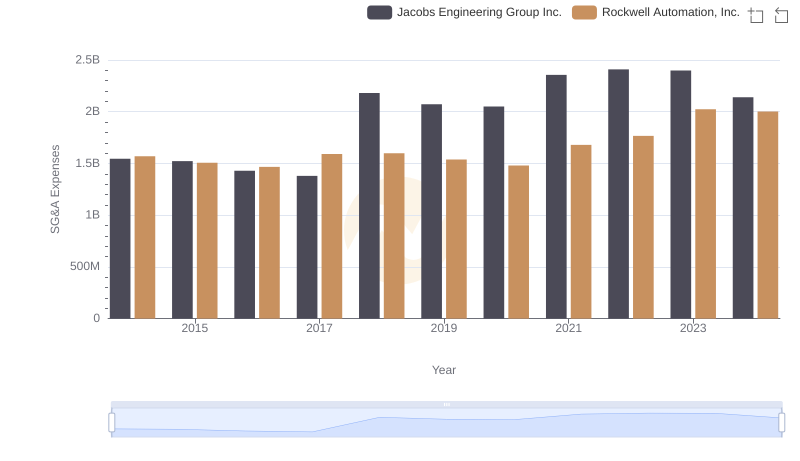

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: SG&A Expense Trends

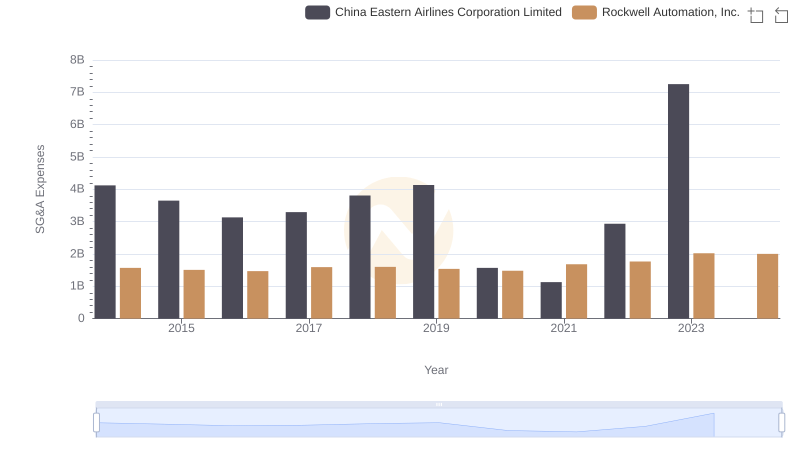

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs China Eastern Airlines Corporation Limited