| __timestamp | Carlisle Companies Incorporated | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 1570100000 |

| Thursday, January 1, 2015 | 461900000 | 1506400000 |

| Friday, January 1, 2016 | 532000000 | 1467400000 |

| Sunday, January 1, 2017 | 589400000 | 1591500000 |

| Monday, January 1, 2018 | 625400000 | 1599000000 |

| Tuesday, January 1, 2019 | 667100000 | 1538500000 |

| Wednesday, January 1, 2020 | 603200000 | 1479800000 |

| Friday, January 1, 2021 | 698200000 | 1680000000 |

| Saturday, January 1, 2022 | 811500000 | 1766700000 |

| Sunday, January 1, 2023 | 625200000 | 2023700000 |

| Monday, January 1, 2024 | 722800000 | 2002600000 |

Unleashing the power of data

In the competitive landscape of industrial automation and manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Rockwell Automation, Inc. and Carlisle Companies Incorporated, two industry titans, have shown distinct trends over the past decade.

From 2014 to 2023, Rockwell Automation's SG&A expenses have consistently increased, peaking at approximately $2 billion in 2023. This represents a growth of nearly 29% from their 2014 figures, indicating a strategic investment in administrative capabilities to support their expanding operations.

Conversely, Carlisle Companies experienced a more volatile trajectory. Their SG&A expenses surged by over 114% from 2014 to 2022, before a notable dip in 2023. This fluctuation suggests a dynamic approach to managing operational costs, possibly reflecting shifts in business strategy or market conditions.

While Rockwell Automation demonstrates a steady increase in SG&A expenses, Carlisle's variable pattern highlights different strategic priorities. These insights offer a window into how these companies navigate the complexities of their respective markets.

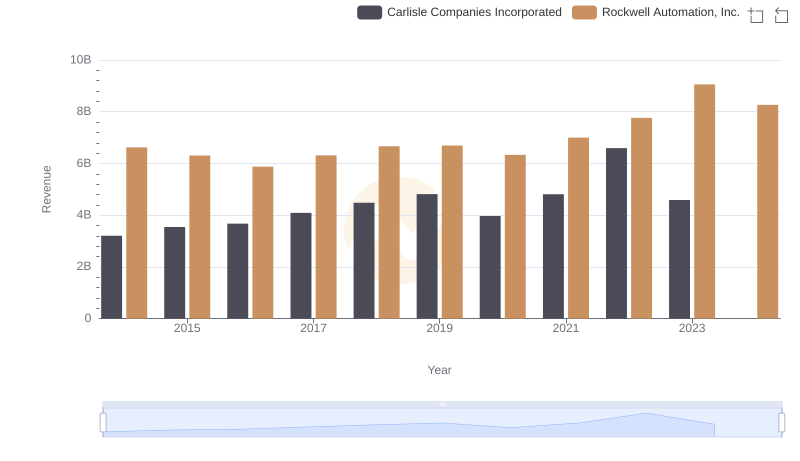

Rockwell Automation, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

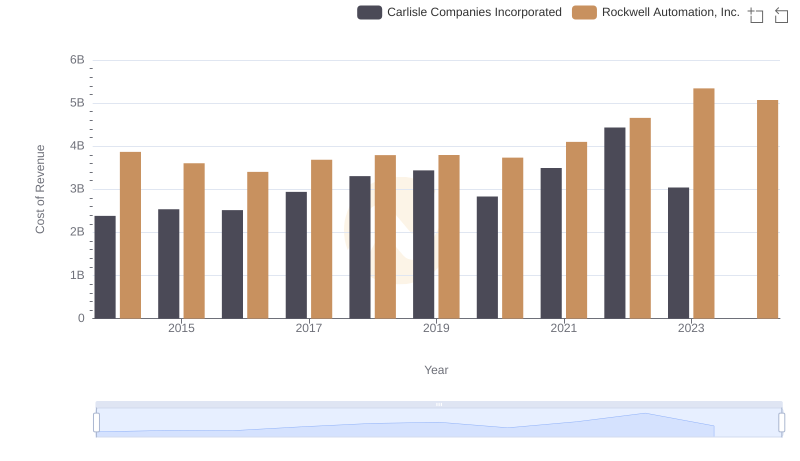

Cost of Revenue Trends: Rockwell Automation, Inc. vs Carlisle Companies Incorporated

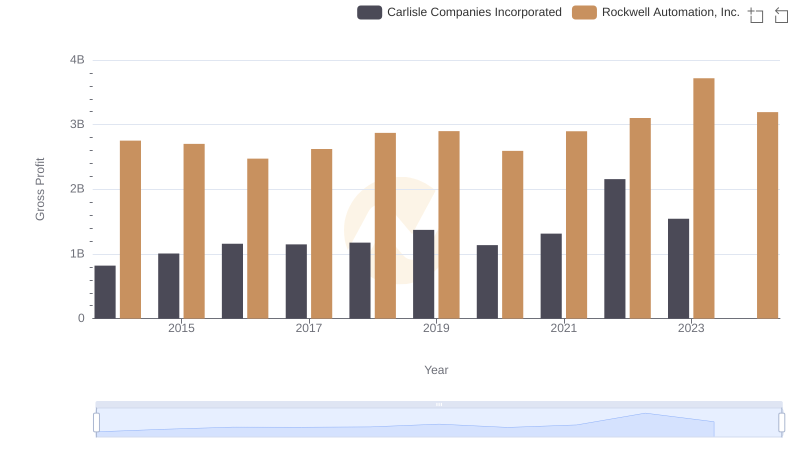

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and Carlisle Companies Incorporated

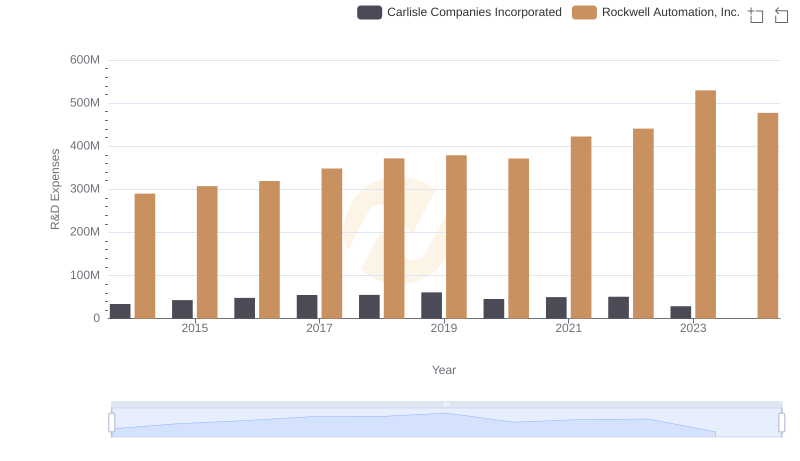

Rockwell Automation, Inc. or Carlisle Companies Incorporated: Who Invests More in Innovation?

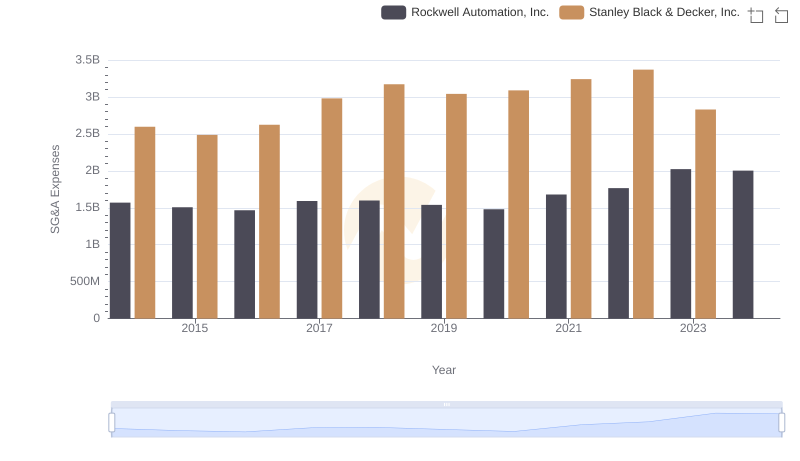

Selling, General, and Administrative Costs: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

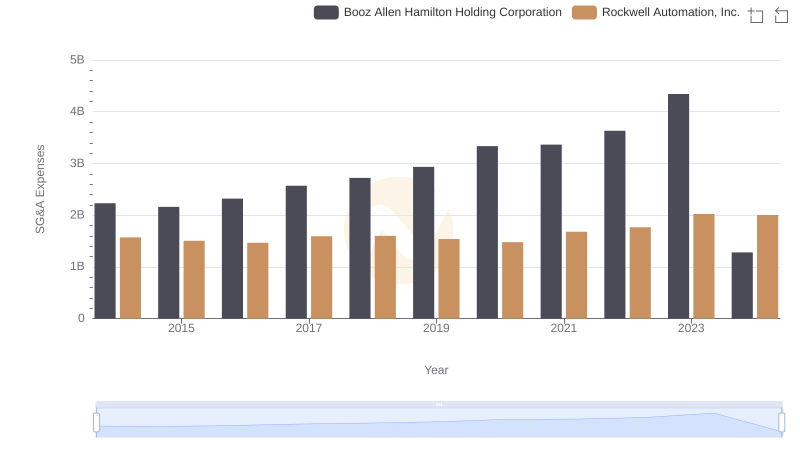

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and Booz Allen Hamilton Holding Corporation

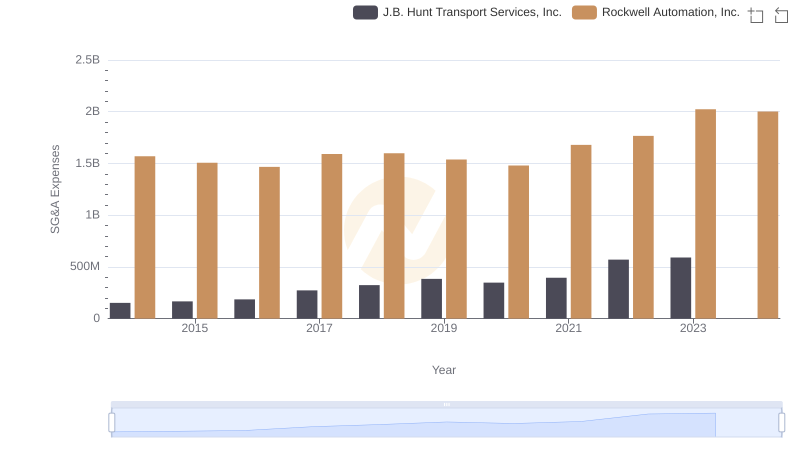

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.

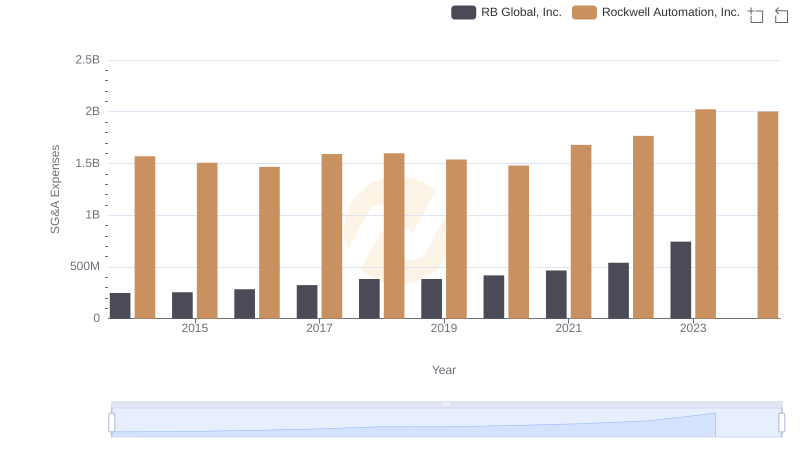

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and RB Global, Inc.

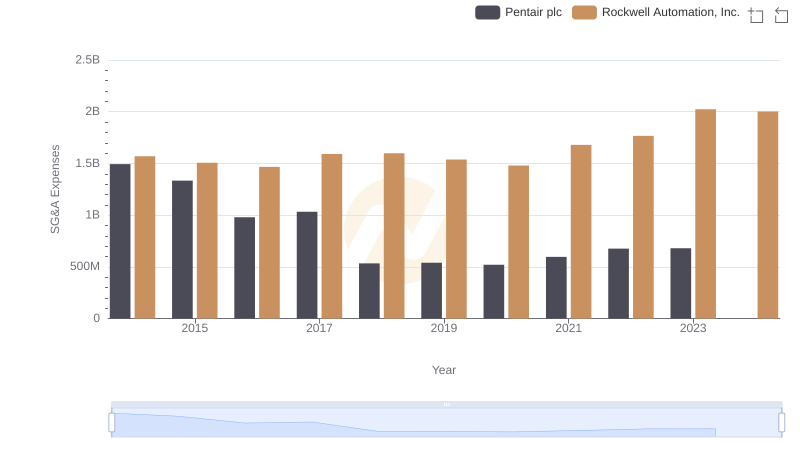

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: Rockwell Automation, Inc. and Carlisle Companies Incorporated