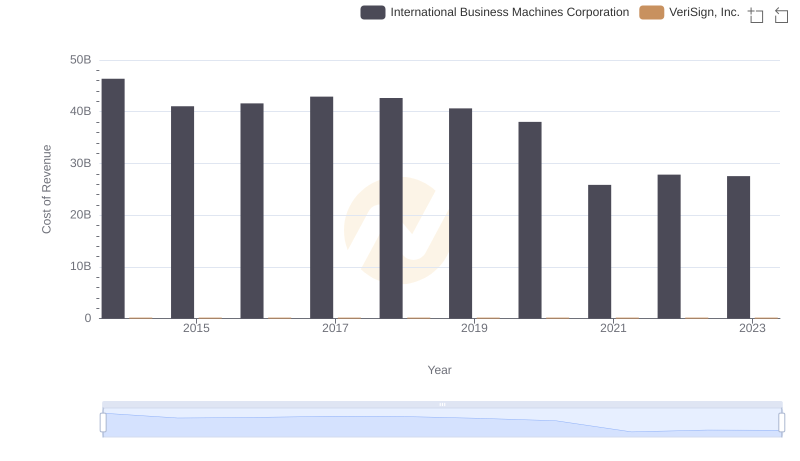

| __timestamp | International Business Machines Corporation | SS&C Technologies Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46386000000 | 410731000 |

| Thursday, January 1, 2015 | 41057000000 | 532350000 |

| Friday, January 1, 2016 | 41403000000 | 800489000 |

| Sunday, January 1, 2017 | 42196000000 | 886425000 |

| Monday, January 1, 2018 | 42655000000 | 2051100000 |

| Tuesday, January 1, 2019 | 26181000000 | 2611700000 |

| Wednesday, January 1, 2020 | 24314000000 | 2574100000 |

| Friday, January 1, 2021 | 25865000000 | 2641700000 |

| Saturday, January 1, 2022 | 27842000000 | 2767700000 |

| Sunday, January 1, 2023 | 27560000000 | 2851000000 |

| Monday, January 1, 2024 | 27202000000 | 3018400000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis delves into the cost of revenue trends for International Business Machines Corporation (IBM) and SS&C Technologies Holdings, Inc. from 2014 to 2023.

IBM, a stalwart in the tech industry, has seen its cost of revenue decrease by approximately 41% over the past decade, from a peak in 2014 to a notable dip in 2023. This trend reflects IBM's strategic shift towards more efficient operations and a focus on high-margin services.

Conversely, SS&C Technologies has experienced a remarkable growth in its cost of revenue, increasing nearly sevenfold from 2014 to 2023. This surge underscores SS&C's aggressive expansion and acquisition strategy, positioning itself as a formidable player in the financial services software sector.

While the data for 2024 is incomplete, the trends observed provide valuable insights into the strategic directions of these companies. IBM's cost-cutting measures contrast with SS&C's growth-driven approach, offering a fascinating glimpse into their respective market strategies.

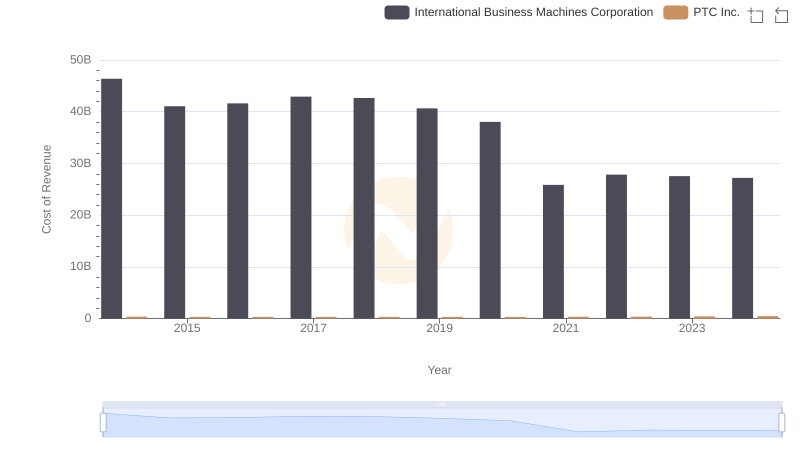

Cost Insights: Breaking Down International Business Machines Corporation and PTC Inc.'s Expenses

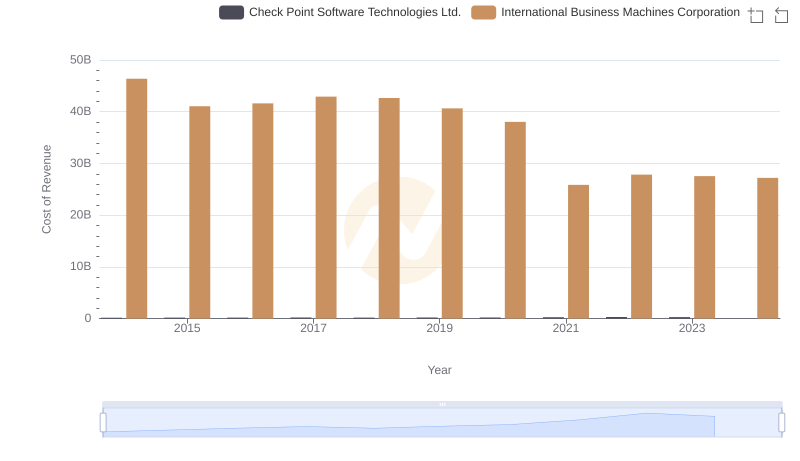

Cost of Revenue: Key Insights for International Business Machines Corporation and Check Point Software Technologies Ltd.

Cost Insights: Breaking Down International Business Machines Corporation and Pure Storage, Inc.'s Expenses

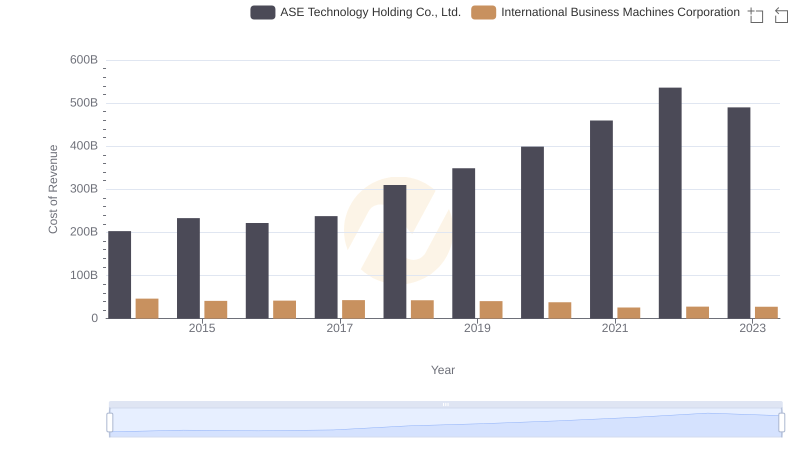

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: Efficiency in Cost of Revenue Explored

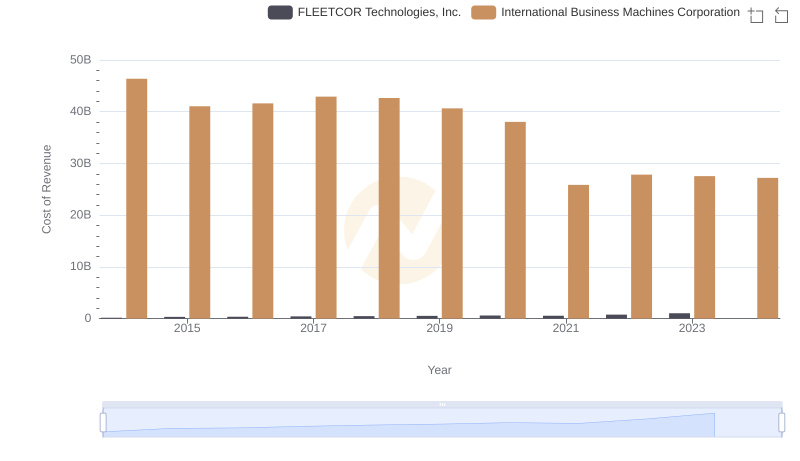

Analyzing Cost of Revenue: International Business Machines Corporation and FLEETCOR Technologies, Inc.

International Business Machines Corporation or SS&C Technologies Holdings, Inc.: Who Leads in Yearly Revenue?

Cost of Revenue Trends: International Business Machines Corporation vs Zebra Technologies Corporation

Cost of Revenue: Key Insights for International Business Machines Corporation and VeriSign, Inc.

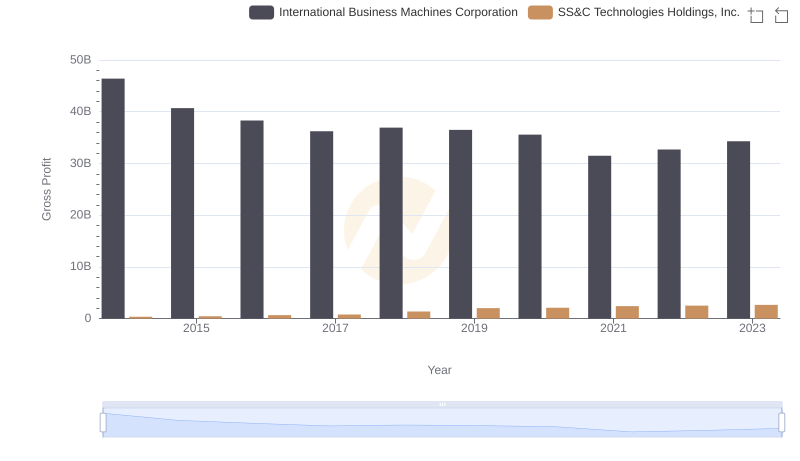

Who Generates Higher Gross Profit? International Business Machines Corporation or SS&C Technologies Holdings, Inc.

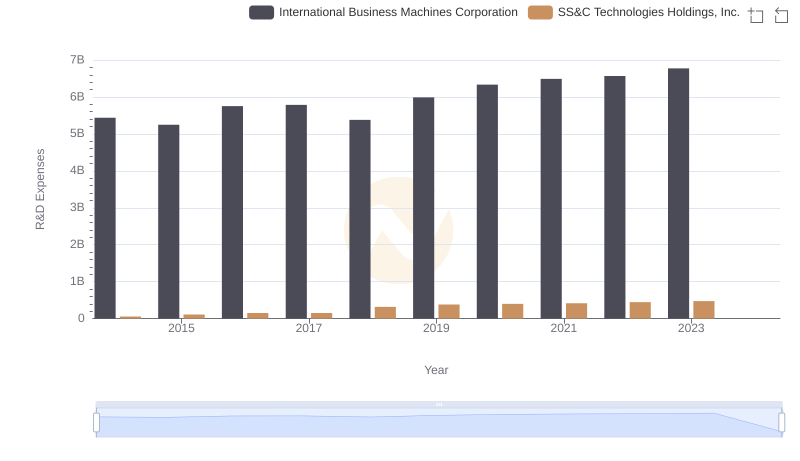

Comparing Innovation Spending: International Business Machines Corporation and SS&C Technologies Holdings, Inc.

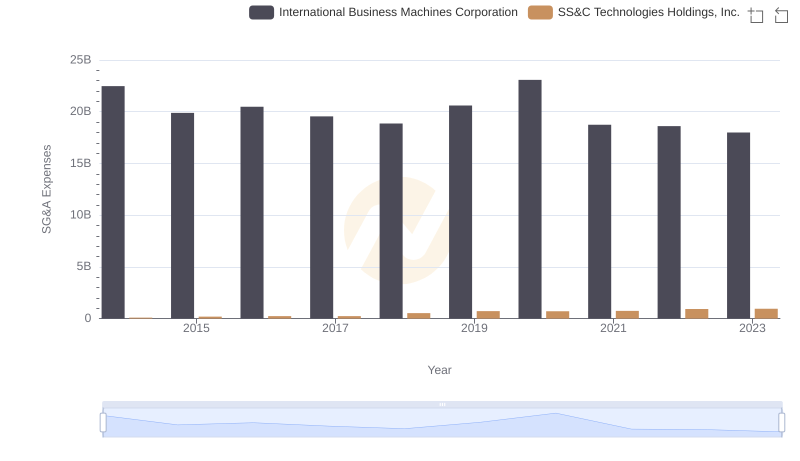

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and SS&C Technologies Holdings, Inc.

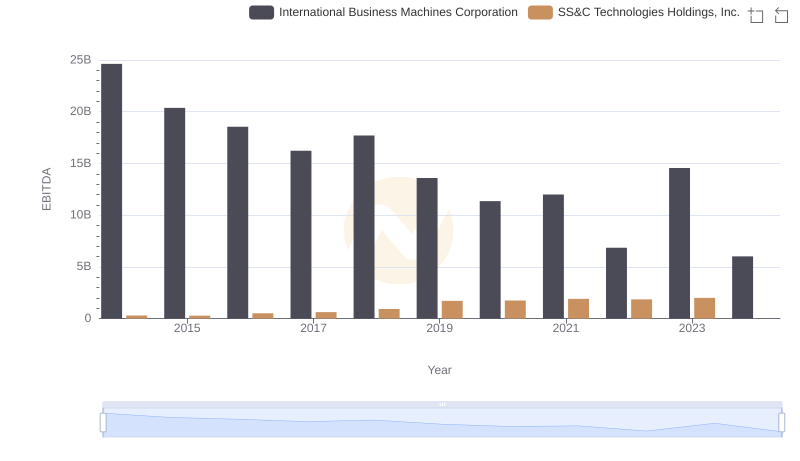

Comprehensive EBITDA Comparison: International Business Machines Corporation vs SS&C Technologies Holdings, Inc.