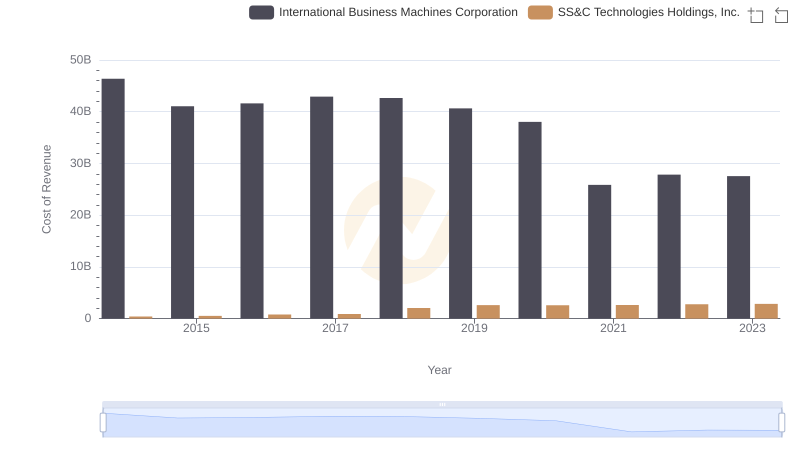

| __timestamp | International Business Machines Corporation | SS&C Technologies Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46407000000 | 357130000 |

| Thursday, January 1, 2015 | 40684000000 | 467935000 |

| Friday, January 1, 2016 | 38516000000 | 680947000 |

| Sunday, January 1, 2017 | 36943000000 | 788870000 |

| Monday, January 1, 2018 | 36936000000 | 1370000000 |

| Tuesday, January 1, 2019 | 31533000000 | 2021200000 |

| Wednesday, January 1, 2020 | 30865000000 | 2093800000 |

| Friday, January 1, 2021 | 31486000000 | 2409300000 |

| Saturday, January 1, 2022 | 32687000000 | 2515300000 |

| Sunday, January 1, 2023 | 34300000000 | 2651800000 |

| Monday, January 1, 2024 | 35551000000 | 2863600000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology, the battle for supremacy in gross profit generation is a captivating narrative. From 2014 to 2023, International Business Machines Corporation (IBM) consistently outperformed SS&C Technologies Holdings, Inc. in terms of gross profit. IBM's gross profit peaked in 2014, reaching nearly 46% higher than its 2023 figure, showcasing its historical strength. Meanwhile, SS&C Technologies, despite its smaller scale, demonstrated impressive growth, with its gross profit increasing by over 640% from 2014 to 2023.

This data highlights IBM's enduring dominance, yet SS&C's rapid growth trajectory cannot be ignored. As we look to the future, the absence of 2024 data for SS&C leaves room for speculation. Will SS&C continue its upward trend, or will IBM maintain its lead? This financial duel is a testament to the dynamic nature of the tech industry.

International Business Machines Corporation or SS&C Technologies Holdings, Inc.: Who Leads in Yearly Revenue?

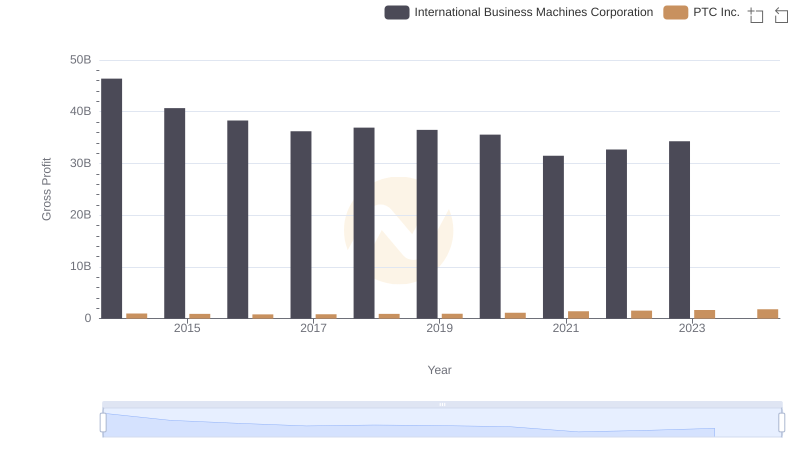

Gross Profit Analysis: Comparing International Business Machines Corporation and PTC Inc.

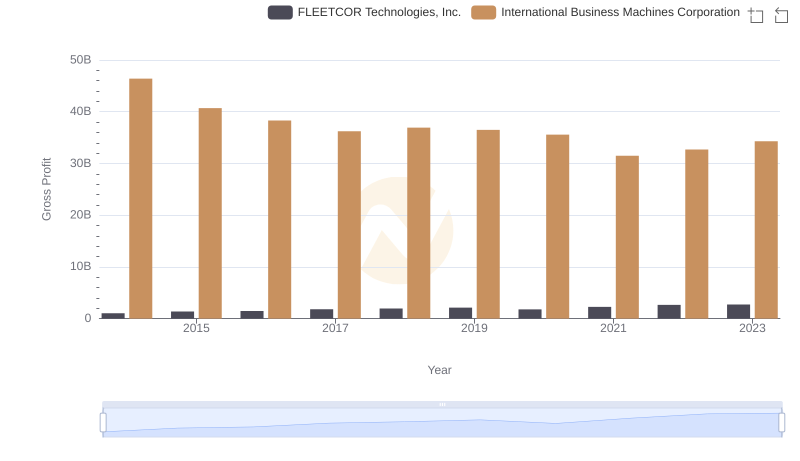

Gross Profit Comparison: International Business Machines Corporation and FLEETCOR Technologies, Inc. Trends

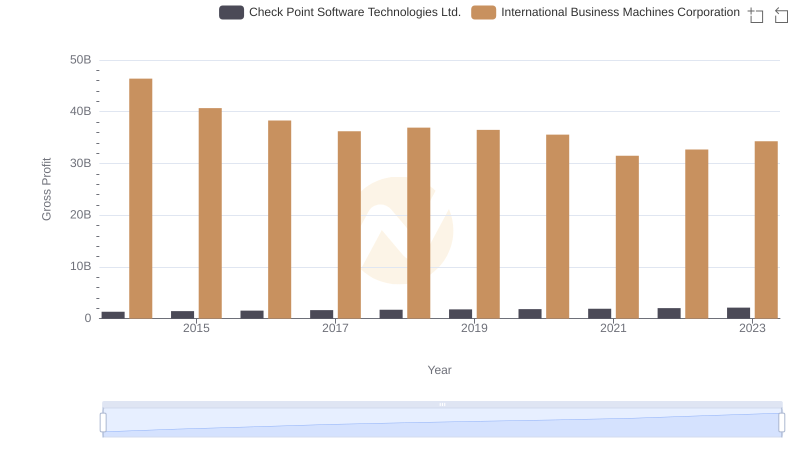

Key Insights on Gross Profit: International Business Machines Corporation vs Check Point Software Technologies Ltd.

Analyzing Cost of Revenue: International Business Machines Corporation and SS&C Technologies Holdings, Inc.

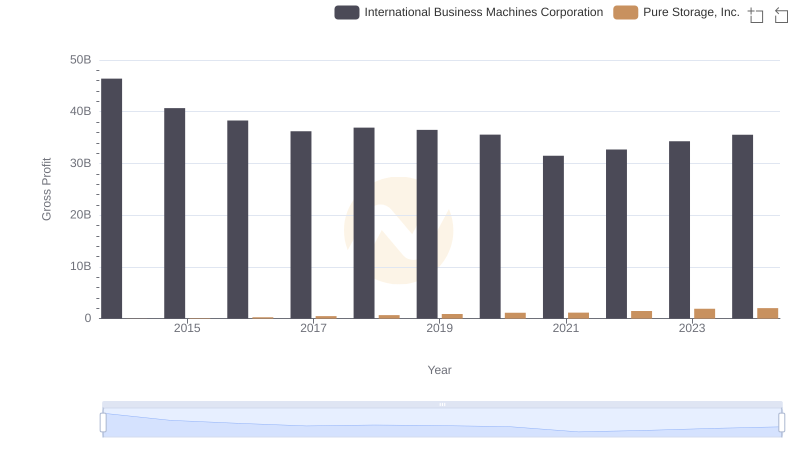

Gross Profit Trends Compared: International Business Machines Corporation vs Pure Storage, Inc.

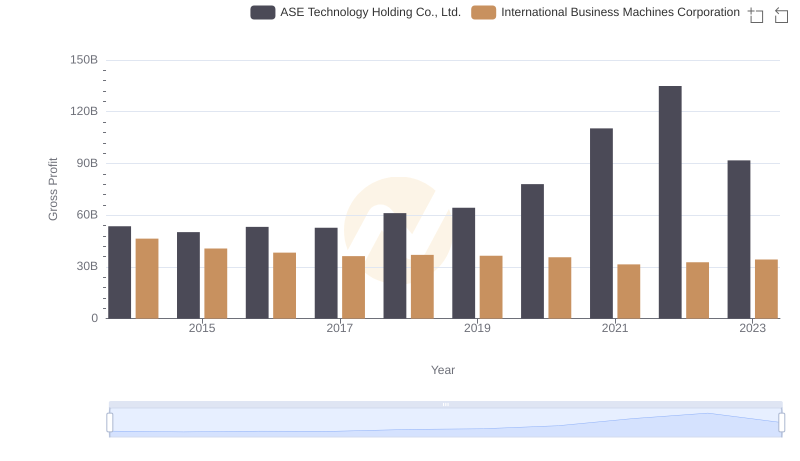

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

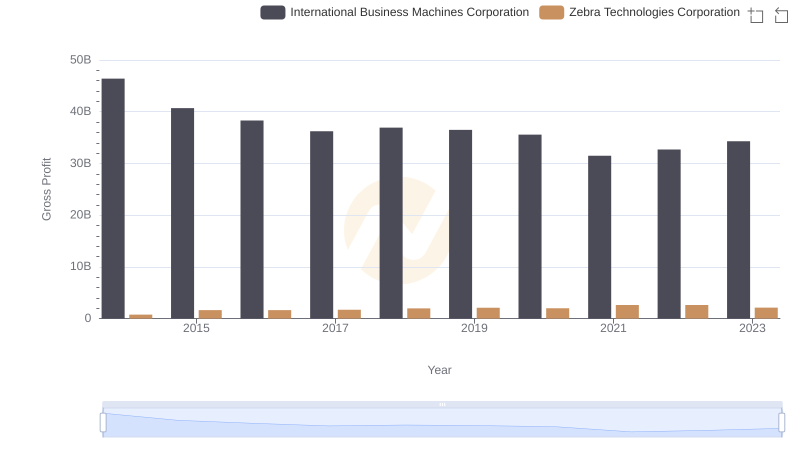

Gross Profit Trends Compared: International Business Machines Corporation vs Zebra Technologies Corporation

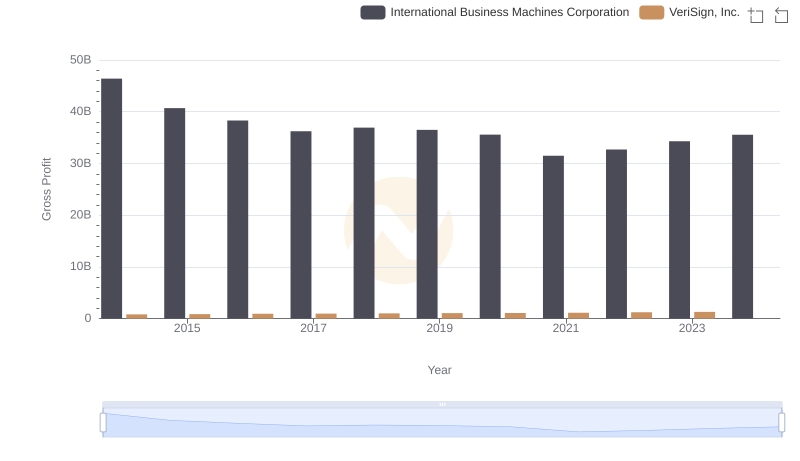

Gross Profit Analysis: Comparing International Business Machines Corporation and VeriSign, Inc.

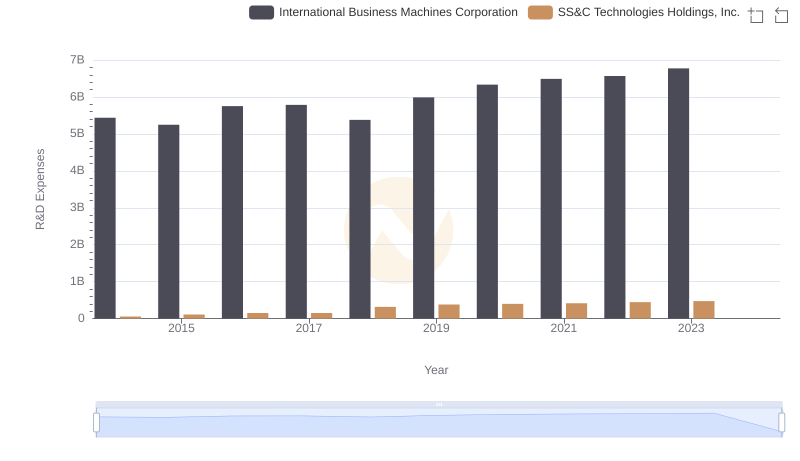

Comparing Innovation Spending: International Business Machines Corporation and SS&C Technologies Holdings, Inc.

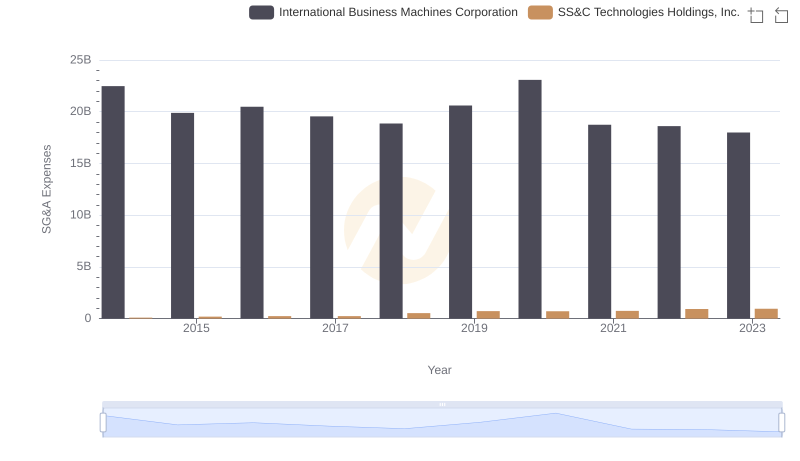

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and SS&C Technologies Holdings, Inc.

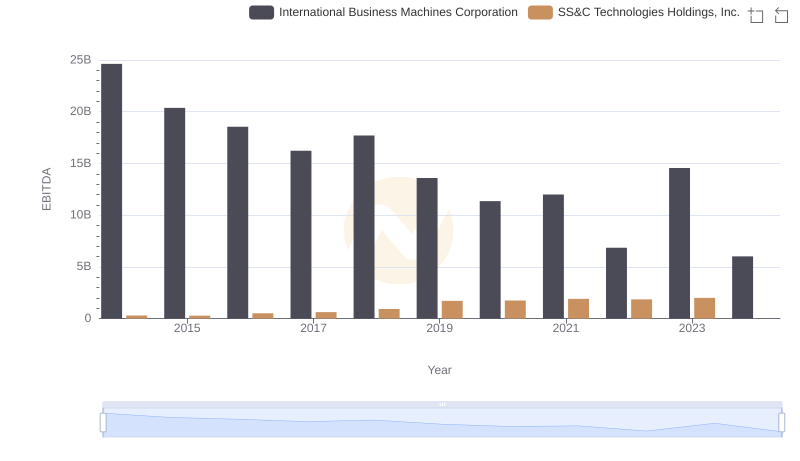

Comprehensive EBITDA Comparison: International Business Machines Corporation vs SS&C Technologies Holdings, Inc.