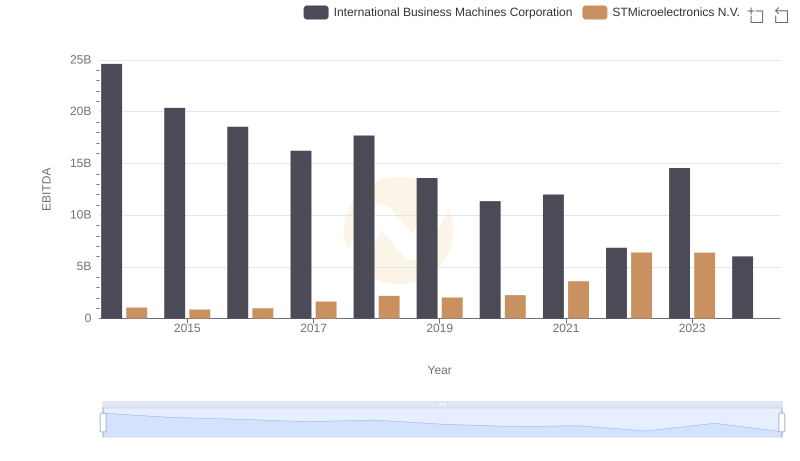

| __timestamp | International Business Machines Corporation | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 940000000 |

| Thursday, January 1, 2015 | 19894000000 | 891000000 |

| Friday, January 1, 2016 | 20279000000 | 933000000 |

| Sunday, January 1, 2017 | 19680000000 | 1001000000 |

| Monday, January 1, 2018 | 19366000000 | 1109000000 |

| Tuesday, January 1, 2019 | 18724000000 | 1093000000 |

| Wednesday, January 1, 2020 | 20561000000 | 1123000000 |

| Friday, January 1, 2021 | 18745000000 | 1319000000 |

| Saturday, January 1, 2022 | 17483000000 | 1428000000 |

| Sunday, January 1, 2023 | 17997000000 | 1650000000 |

| Monday, January 1, 2024 | 29536000000 |

Igniting the spark of knowledge

In the ever-evolving tech industry, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, International Business Machines Corporation (IBM) and STMicroelectronics N.V. (STM) have shown contrasting trends in their SG&A management. IBM, a giant in the tech world, saw its SG&A expenses decrease by approximately 20% over this period, from $22.47 billion in 2014 to $17.99 billion in 2023. In contrast, STM, a leading semiconductor company, experienced a 75% increase in SG&A expenses, rising from $940 million to $1.65 billion. This divergence highlights IBM's strategic cost-cutting measures, while STM's growth in expenses may reflect its expansion efforts. As the tech landscape continues to shift, these companies' approaches to managing SG&A costs will be pivotal in shaping their financial futures.

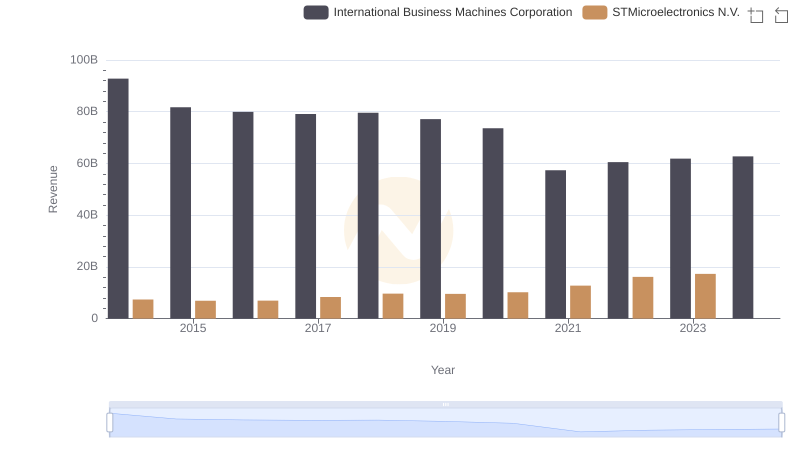

Who Generates More Revenue? International Business Machines Corporation or STMicroelectronics N.V.

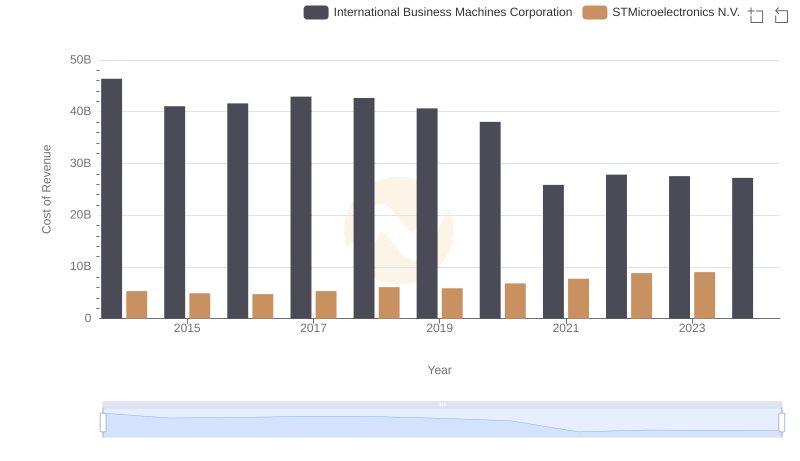

Cost of Revenue Comparison: International Business Machines Corporation vs STMicroelectronics N.V.

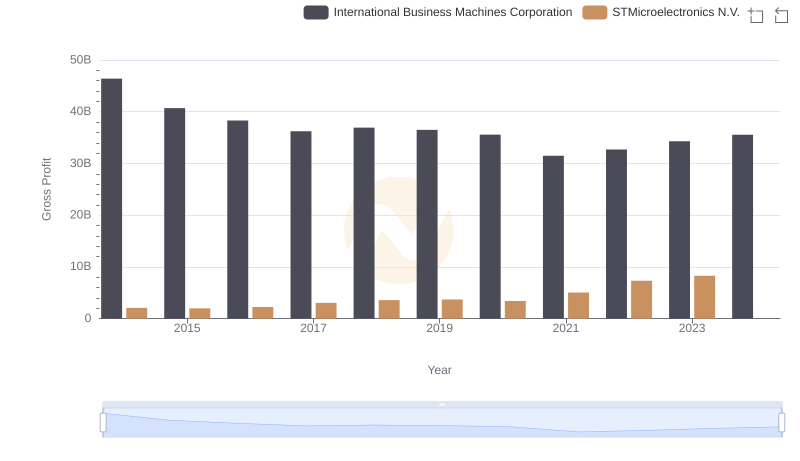

Who Generates Higher Gross Profit? International Business Machines Corporation or STMicroelectronics N.V.

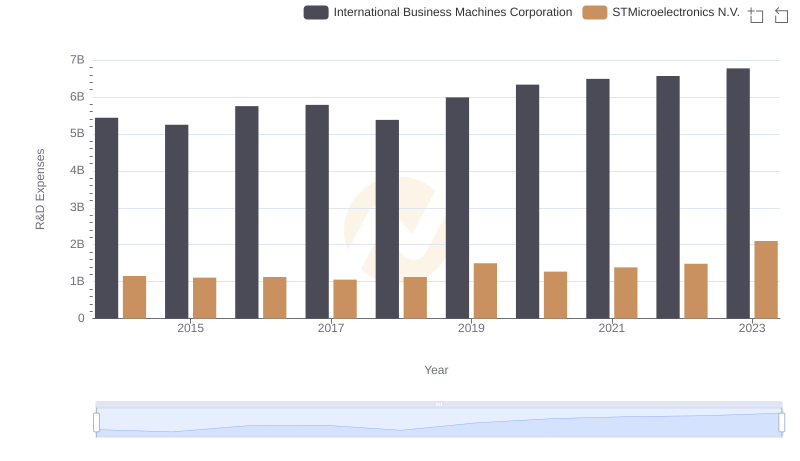

R&D Spending Showdown: International Business Machines Corporation vs STMicroelectronics N.V.

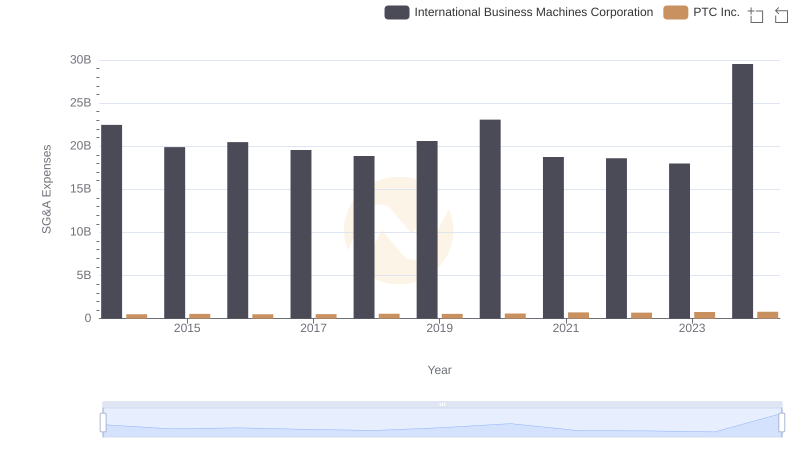

International Business Machines Corporation vs PTC Inc.: SG&A Expense Trends

Breaking Down SG&A Expenses: International Business Machines Corporation vs ON Semiconductor Corporation

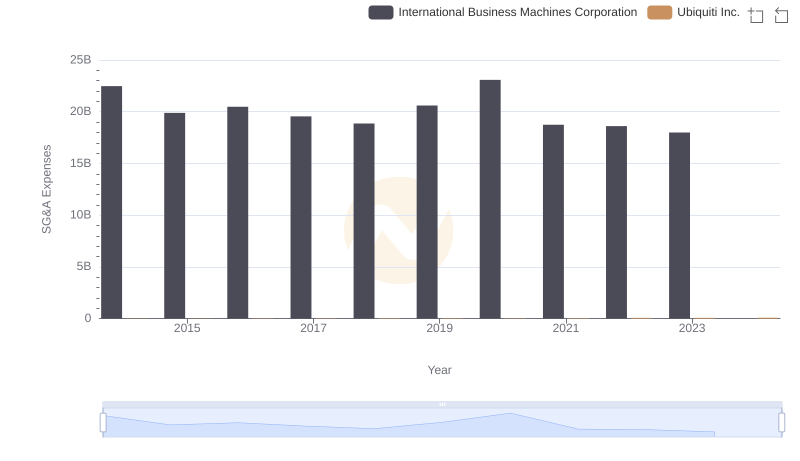

Breaking Down SG&A Expenses: International Business Machines Corporation vs Ubiquiti Inc.

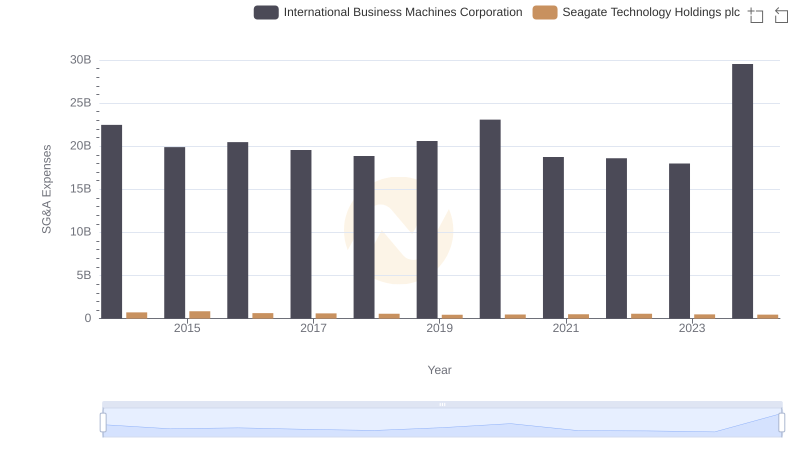

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Seagate Technology Holdings plc

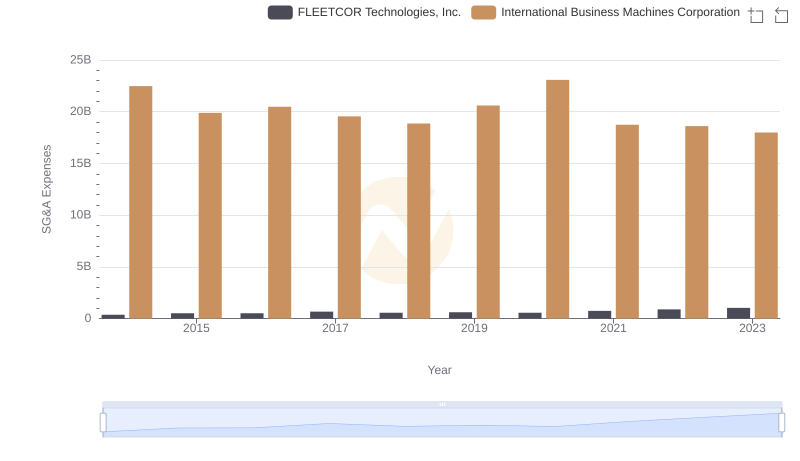

International Business Machines Corporation vs FLEETCOR Technologies, Inc.: SG&A Expense Trends

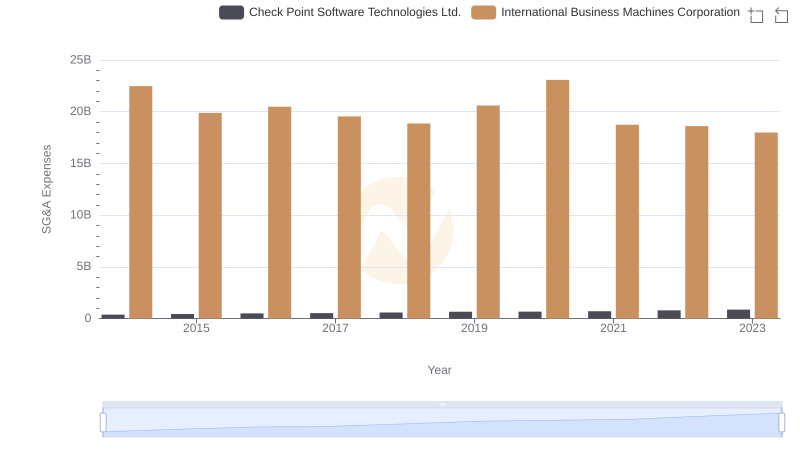

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Check Point Software Technologies Ltd.

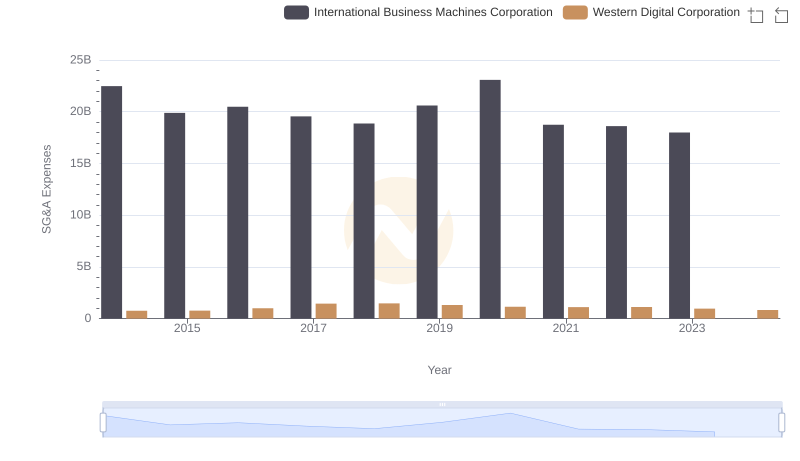

Selling, General, and Administrative Costs: International Business Machines Corporation vs Western Digital Corporation

Professional EBITDA Benchmarking: International Business Machines Corporation vs STMicroelectronics N.V.