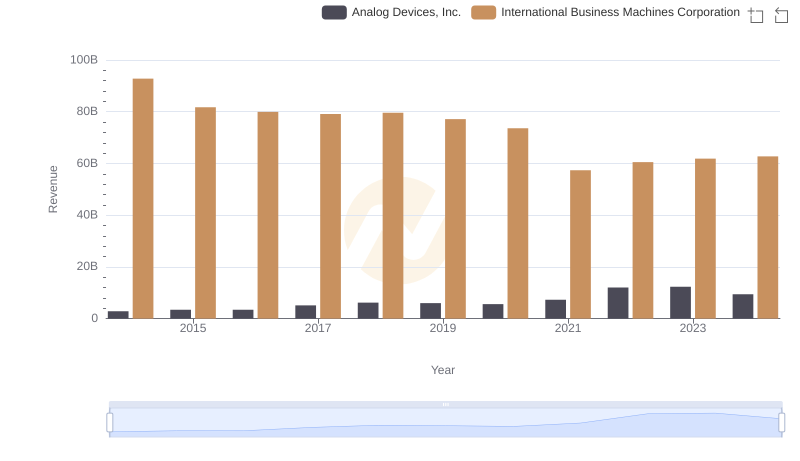

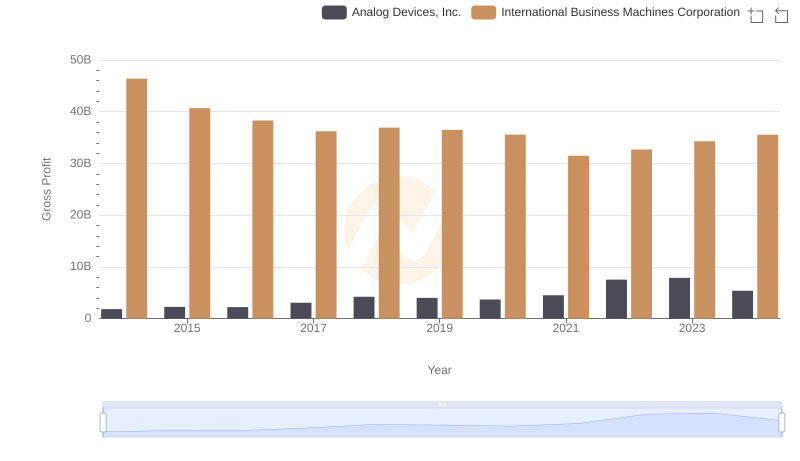

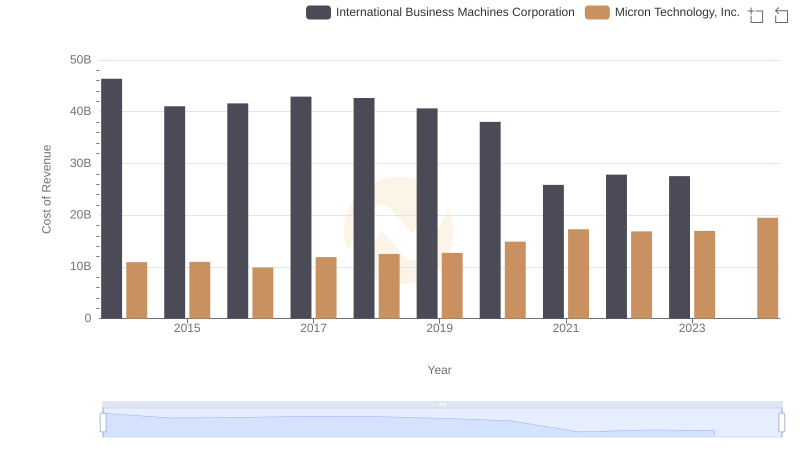

| __timestamp | Analog Devices, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1034585000 | 46386000000 |

| Thursday, January 1, 2015 | 1175830000 | 41057000000 |

| Friday, January 1, 2016 | 1194236000 | 41403000000 |

| Sunday, January 1, 2017 | 2045907000 | 42196000000 |

| Monday, January 1, 2018 | 1967640000 | 42655000000 |

| Tuesday, January 1, 2019 | 1977315000 | 26181000000 |

| Wednesday, January 1, 2020 | 1912578000 | 24314000000 |

| Friday, January 1, 2021 | 2793274000 | 25865000000 |

| Saturday, January 1, 2022 | 4481479000 | 27842000000 |

| Sunday, January 1, 2023 | 4428321000 | 27560000000 |

| Monday, January 1, 2024 | 4045814000 | 27202000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, cost efficiency remains a pivotal factor for success. Over the past decade, International Business Machines Corporation (IBM) and Analog Devices, Inc. have showcased contrasting trajectories in their cost of revenue. From 2014 to 2024, IBM's cost of revenue has seen a significant decline of approximately 41%, dropping from 46.4 billion to 27.2 billion. This trend reflects IBM's strategic shift towards more efficient operations and a focus on high-margin services.

Conversely, Analog Devices has experienced a remarkable increase of over 290% in its cost of revenue, rising from 1.03 billion to 4.05 billion. This surge is indicative of the company's aggressive expansion and investment in cutting-edge technologies. As we look to the future, these trends highlight the diverse strategies employed by tech giants to navigate the competitive landscape and drive growth.

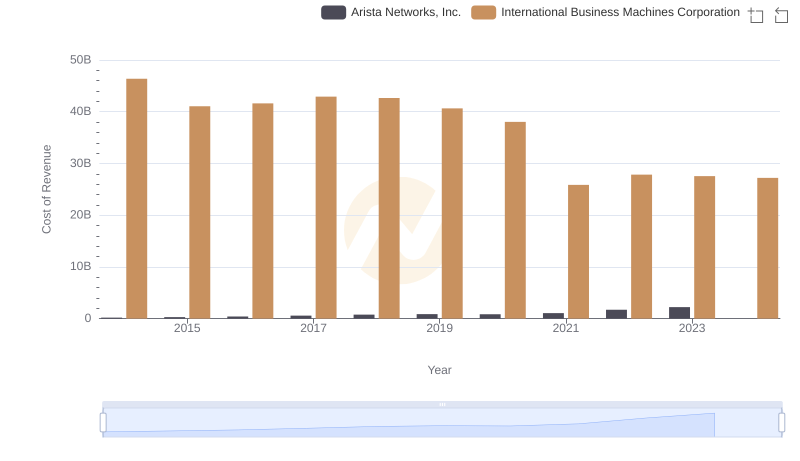

Analyzing Cost of Revenue: International Business Machines Corporation and Arista Networks, Inc.

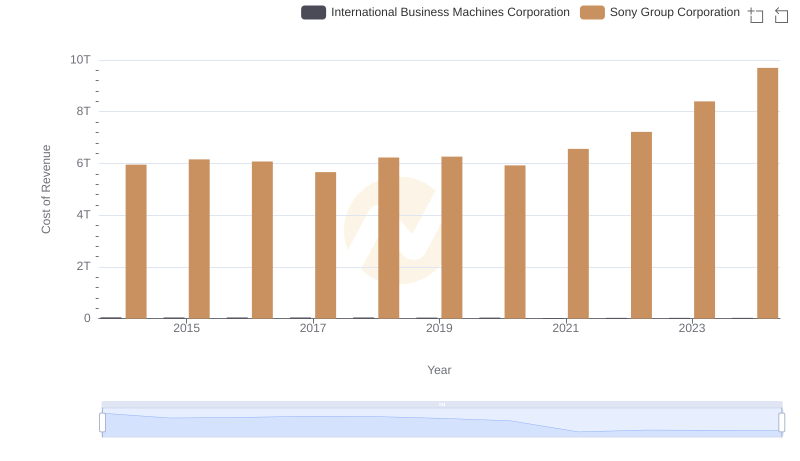

Cost of Revenue: Key Insights for International Business Machines Corporation and Sony Group Corporation

International Business Machines Corporation vs Analog Devices, Inc.: Examining Key Revenue Metrics

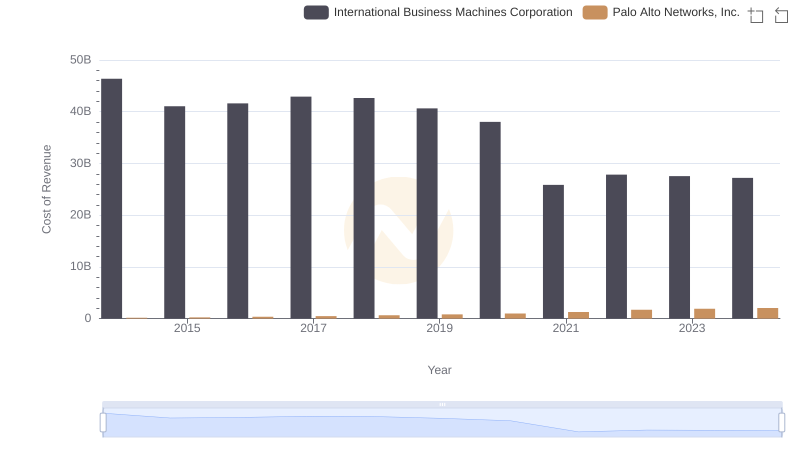

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Palo Alto Networks, Inc.

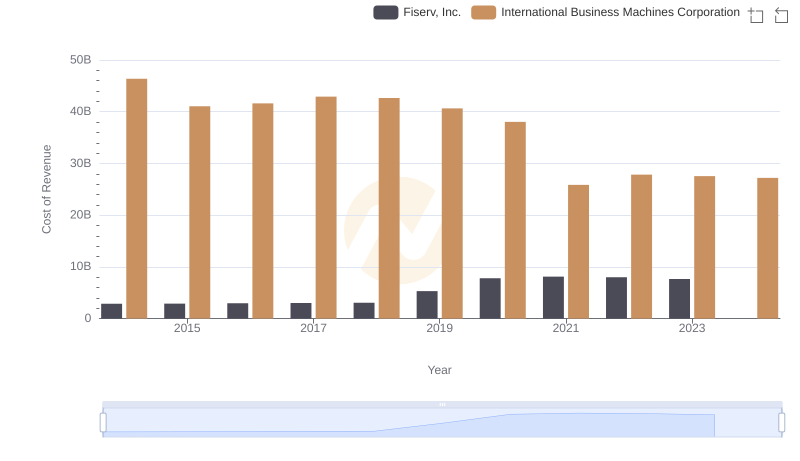

Analyzing Cost of Revenue: International Business Machines Corporation and Fiserv, Inc.

Who Generates Higher Gross Profit? International Business Machines Corporation or Analog Devices, Inc.

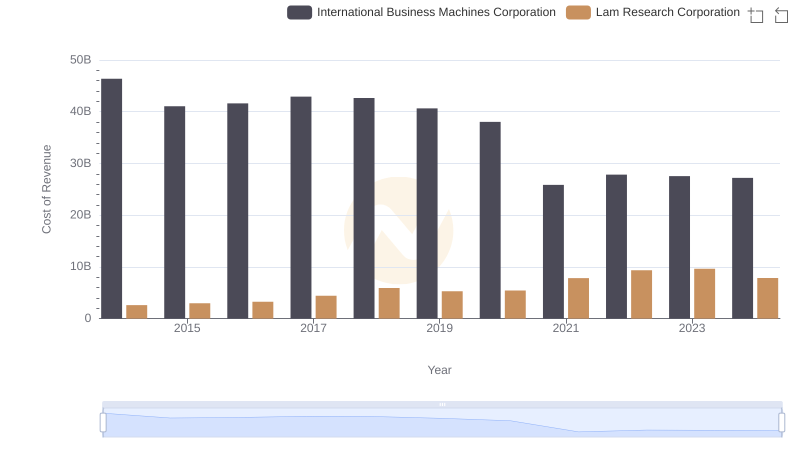

Analyzing Cost of Revenue: International Business Machines Corporation and Lam Research Corporation

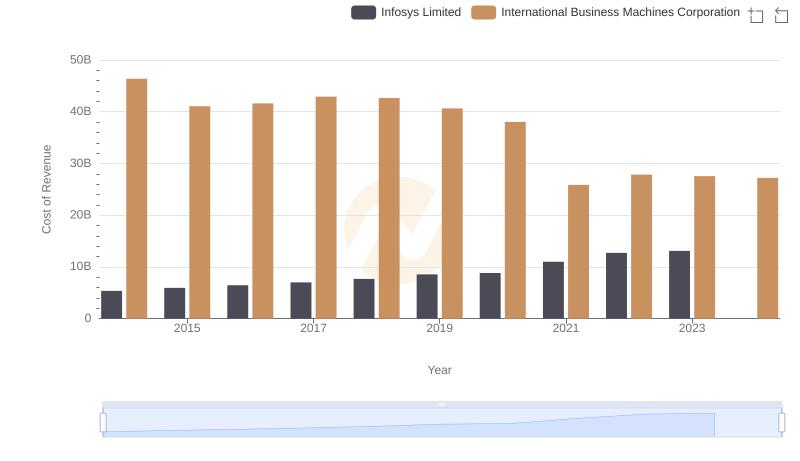

International Business Machines Corporation vs Infosys Limited: Efficiency in Cost of Revenue Explored

Cost of Revenue: Key Insights for International Business Machines Corporation and Micron Technology, Inc.

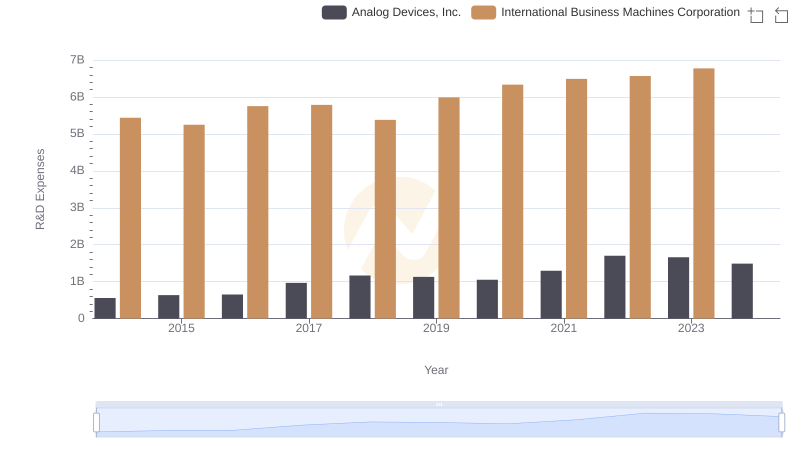

Research and Development Investment: International Business Machines Corporation vs Analog Devices, Inc.

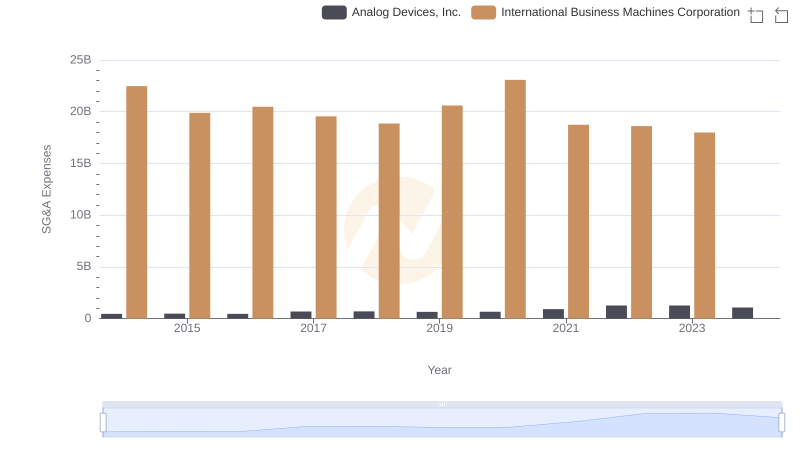

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

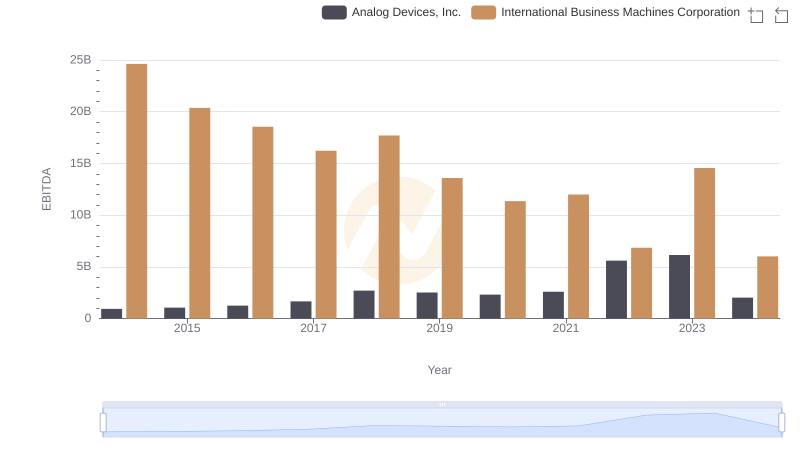

EBITDA Analysis: Evaluating International Business Machines Corporation Against Analog Devices, Inc.