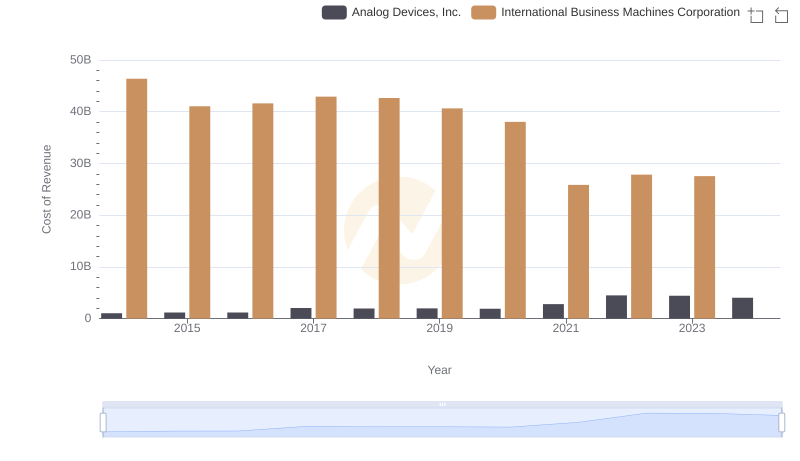

| __timestamp | Analog Devices, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2864773000 | 92793000000 |

| Thursday, January 1, 2015 | 3435092000 | 81742000000 |

| Friday, January 1, 2016 | 3421409000 | 79920000000 |

| Sunday, January 1, 2017 | 5107503000 | 79139000000 |

| Monday, January 1, 2018 | 6200942000 | 79591000000 |

| Tuesday, January 1, 2019 | 5991065000 | 57714000000 |

| Wednesday, January 1, 2020 | 5603056000 | 55179000000 |

| Friday, January 1, 2021 | 7318286000 | 57351000000 |

| Saturday, January 1, 2022 | 12013953000 | 60530000000 |

| Sunday, January 1, 2023 | 12305539000 | 61860000000 |

| Monday, January 1, 2024 | 9427157000 | 62753000000 |

Data in motion

In the ever-evolving landscape of technology, International Business Machines Corporation (IBM) and Analog Devices, Inc. (ADI) have carved distinct paths. From 2014 to 2024, IBM's revenue trajectory reveals a decline of approximately 32%, dropping from its peak in 2014. In contrast, ADI has experienced a remarkable growth of over 300% during the same period, showcasing its adaptability and innovation in the semiconductor industry.

IBM, a stalwart in the tech industry, saw its revenue peak in 2014, but faced challenges in maintaining its dominance. Meanwhile, ADI's strategic advancements have propelled its revenue to new heights, reaching its zenith in 2023. This divergence highlights the dynamic nature of the tech sector, where agility and innovation are key to sustained growth.

As we look to the future, the contrasting fortunes of these two companies offer valuable insights into the shifting paradigms of the technology industry.

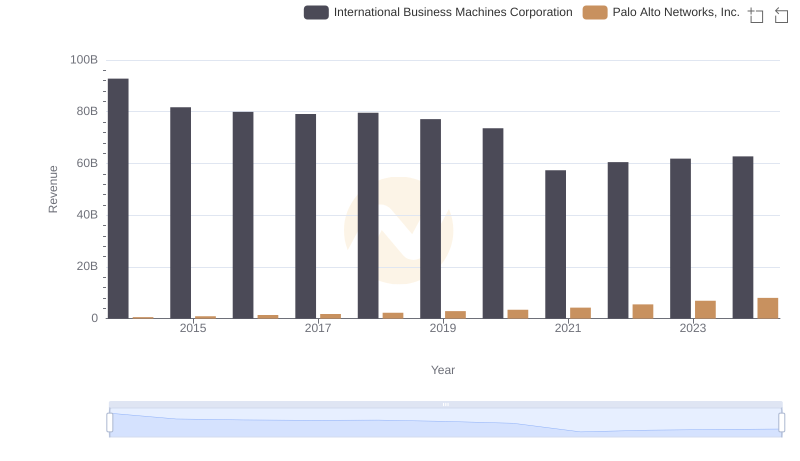

Revenue Insights: International Business Machines Corporation and Palo Alto Networks, Inc. Performance Compared

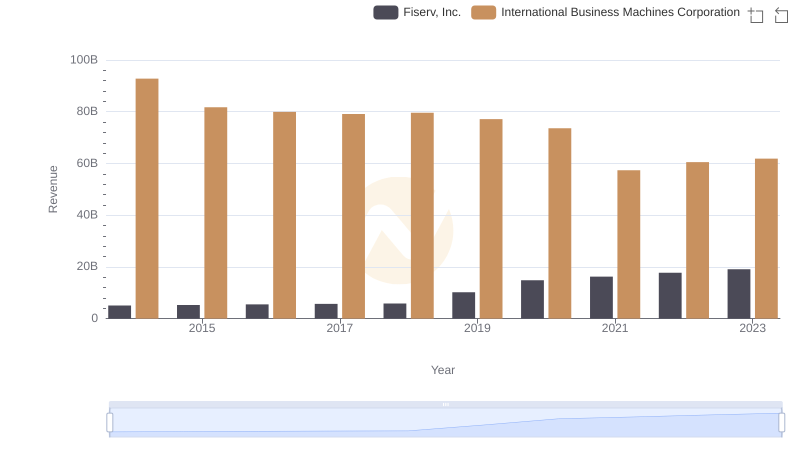

Breaking Down Revenue Trends: International Business Machines Corporation vs Fiserv, Inc.

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Analog Devices, Inc.

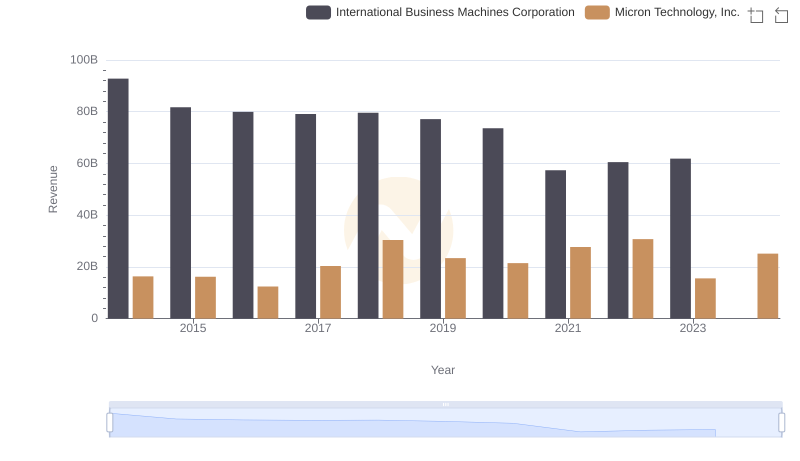

International Business Machines Corporation vs Micron Technology, Inc.: Examining Key Revenue Metrics

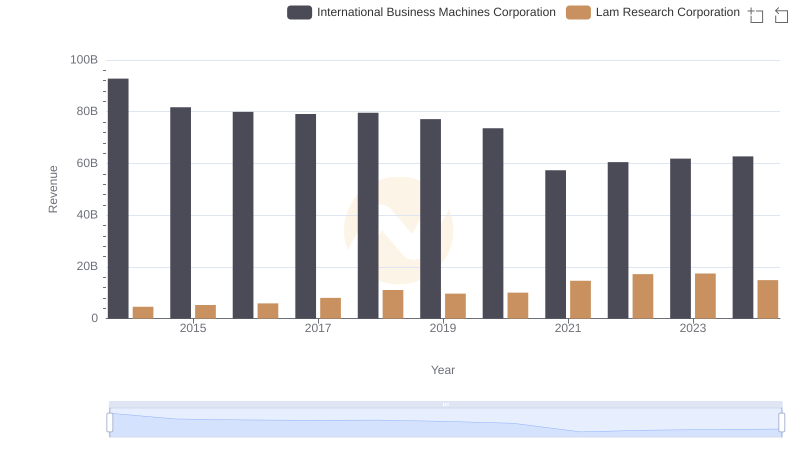

International Business Machines Corporation or Lam Research Corporation: Who Leads in Yearly Revenue?

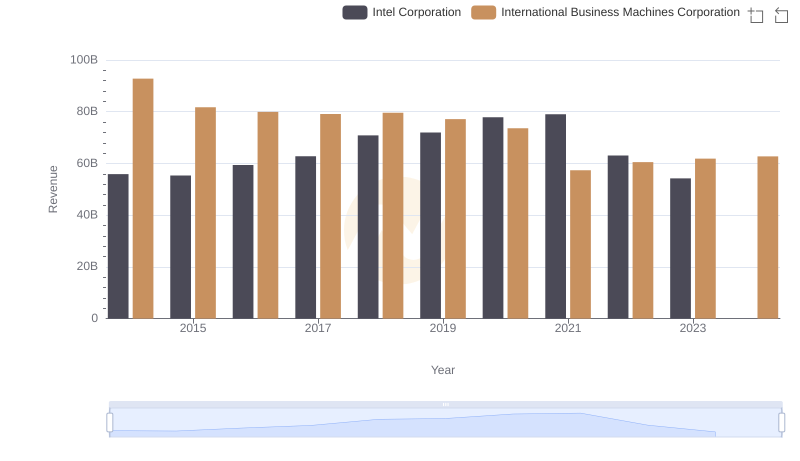

International Business Machines Corporation or Intel Corporation: Who Leads in Yearly Revenue?

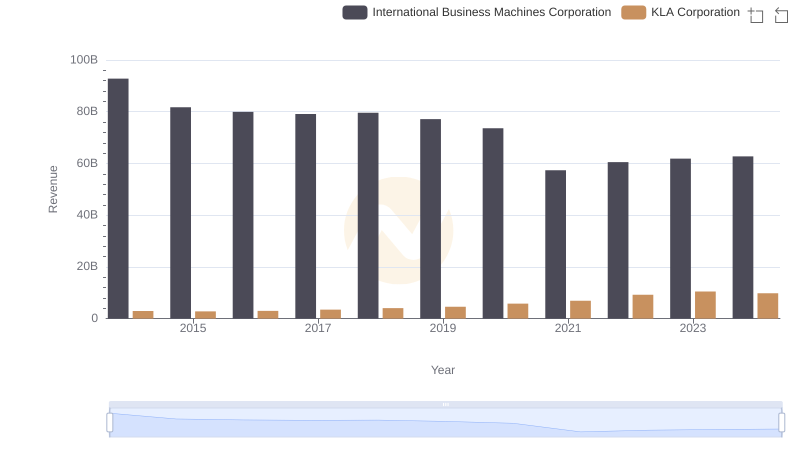

Breaking Down Revenue Trends: International Business Machines Corporation vs KLA Corporation

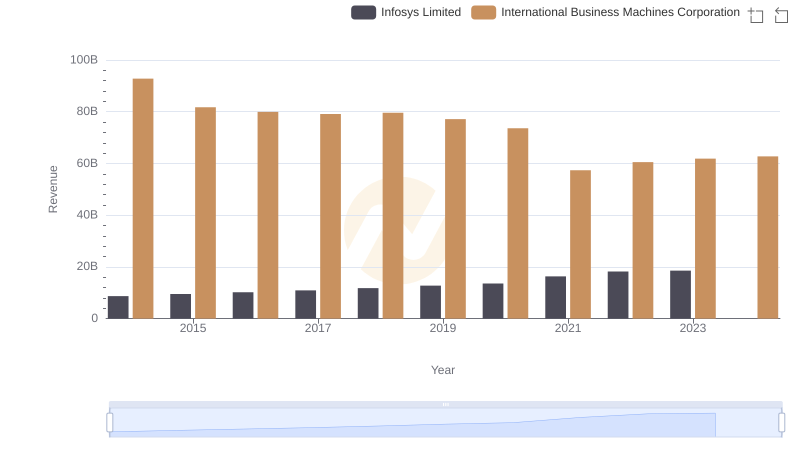

Revenue Insights: International Business Machines Corporation and Infosys Limited Performance Compared

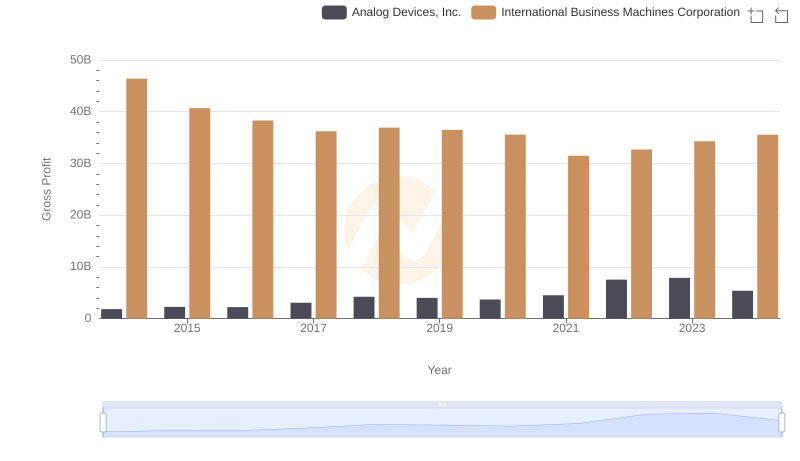

Who Generates Higher Gross Profit? International Business Machines Corporation or Analog Devices, Inc.

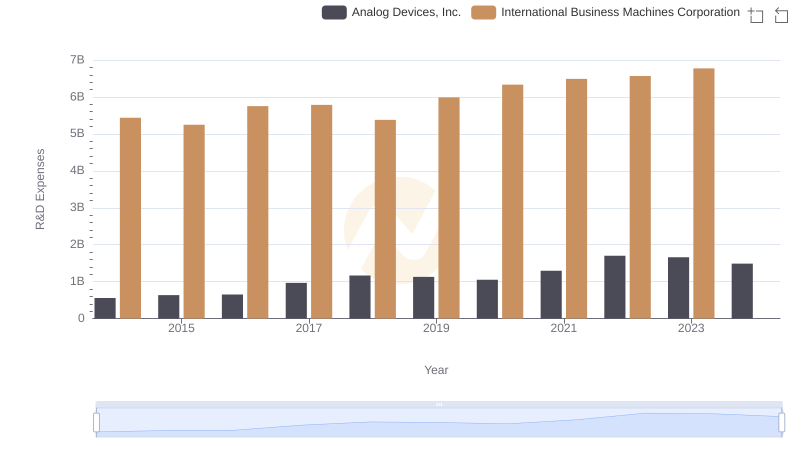

Research and Development Investment: International Business Machines Corporation vs Analog Devices, Inc.

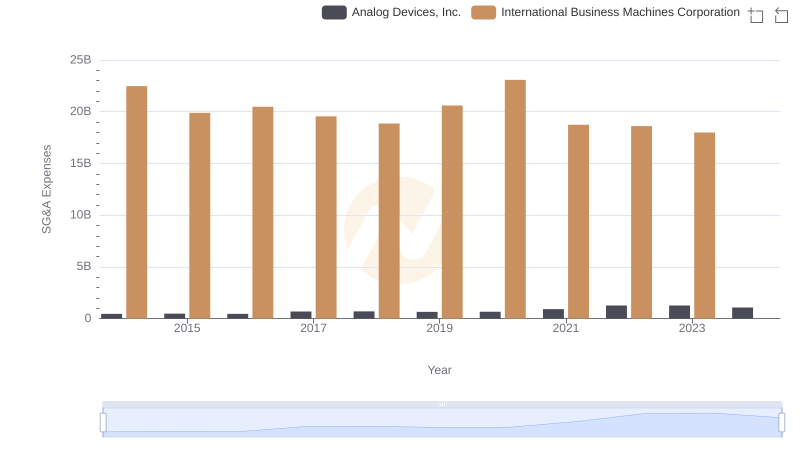

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.

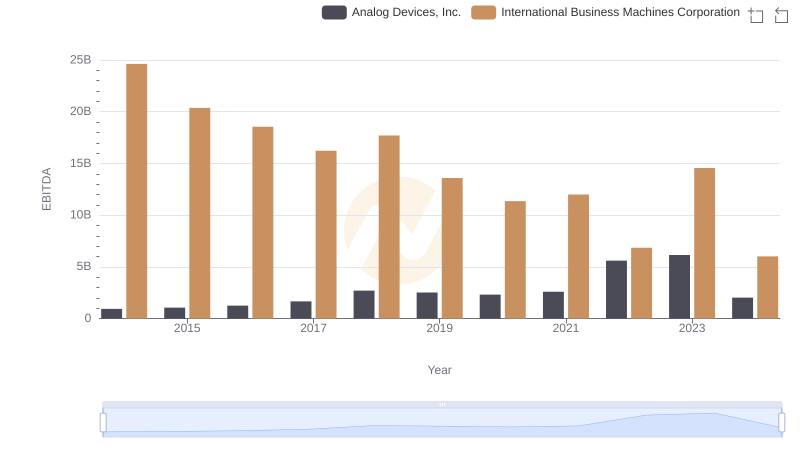

EBITDA Analysis: Evaluating International Business Machines Corporation Against Analog Devices, Inc.