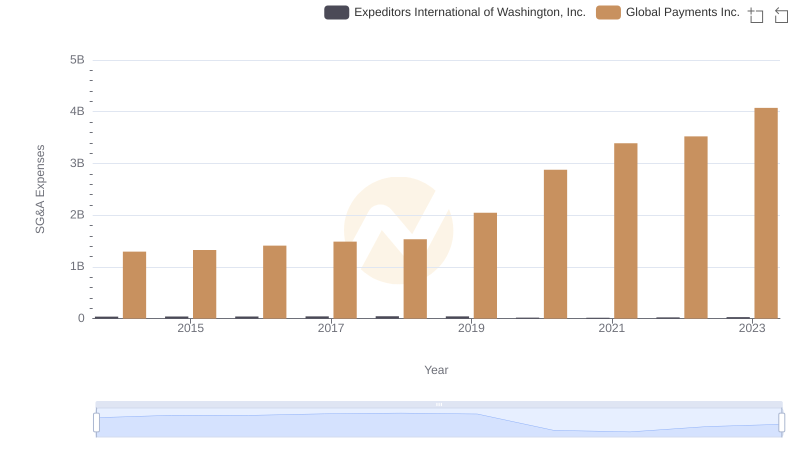

| __timestamp | Global Payments Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 422500000 |

| Thursday, January 1, 2015 | 1325567000 | 1113400000 |

| Friday, January 1, 2016 | 1411096000 | 1651200000 |

| Sunday, January 1, 2017 | 1488258000 | 1656500000 |

| Monday, January 1, 2018 | 1534297000 | 1837000000 |

| Tuesday, January 1, 2019 | 2046672000 | 1845000000 |

| Wednesday, January 1, 2020 | 2878878000 | 2172000000 |

| Friday, January 1, 2021 | 3391161000 | 1322000000 |

| Saturday, January 1, 2022 | 3524578000 | 678000000 |

| Sunday, January 1, 2023 | 4073768000 | 167000000 |

| Monday, January 1, 2024 | 4285307000 | 134000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding a company's efficiency in managing its Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Global Payments Inc. and XPO Logistics, Inc. have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Global Payments Inc. has seen a consistent rise in its SG&A expenses, peaking at approximately $4.1 billion in 2023. This represents a staggering 215% increase from its 2014 figures, reflecting the company's aggressive expansion and investment strategies.

Conversely, XPO Logistics, Inc. experienced a peak in 2020, with SG&A expenses reaching around $2.2 billion. However, by 2023, these expenses plummeted by over 90%, indicating a strategic shift towards cost optimization.

This analysis underscores the diverse strategies companies employ in managing operational costs, offering valuable insights for investors and stakeholders.

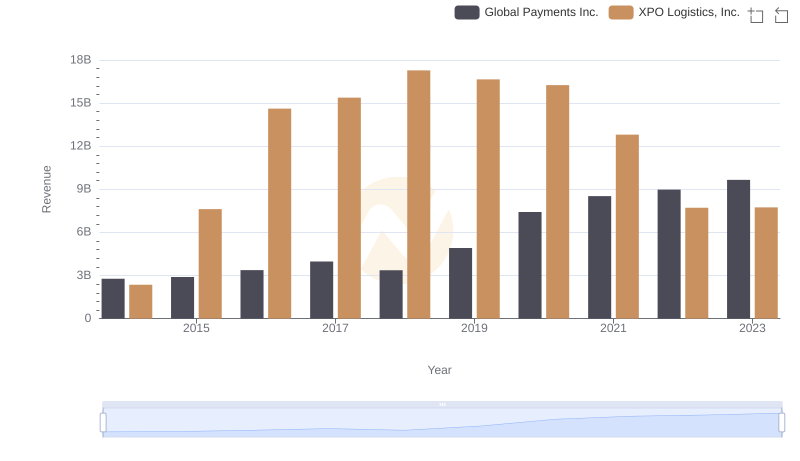

Breaking Down Revenue Trends: Global Payments Inc. vs XPO Logistics, Inc.

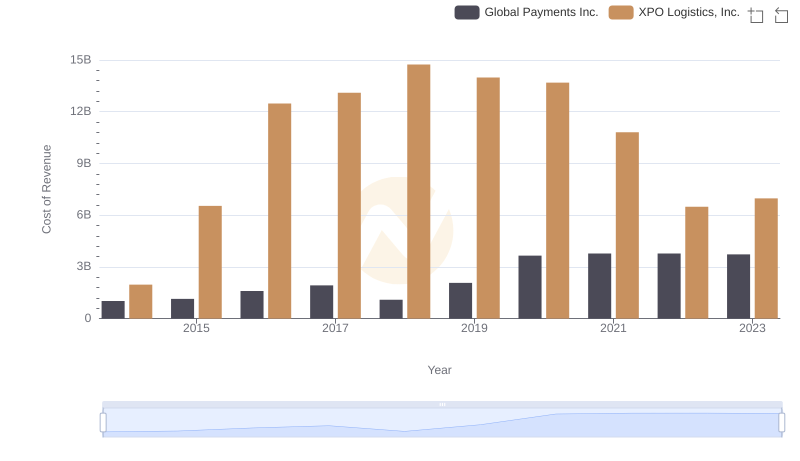

Cost of Revenue Comparison: Global Payments Inc. vs XPO Logistics, Inc.

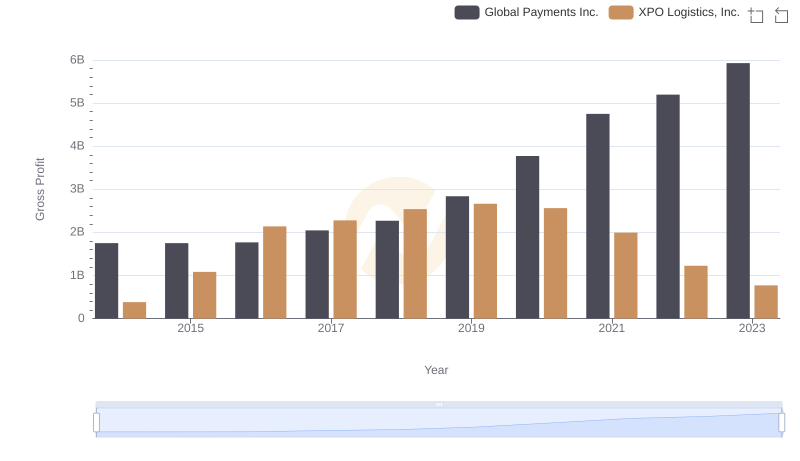

Gross Profit Analysis: Comparing Global Payments Inc. and XPO Logistics, Inc.

Breaking Down SG&A Expenses: Global Payments Inc. vs Expeditors International of Washington, Inc.

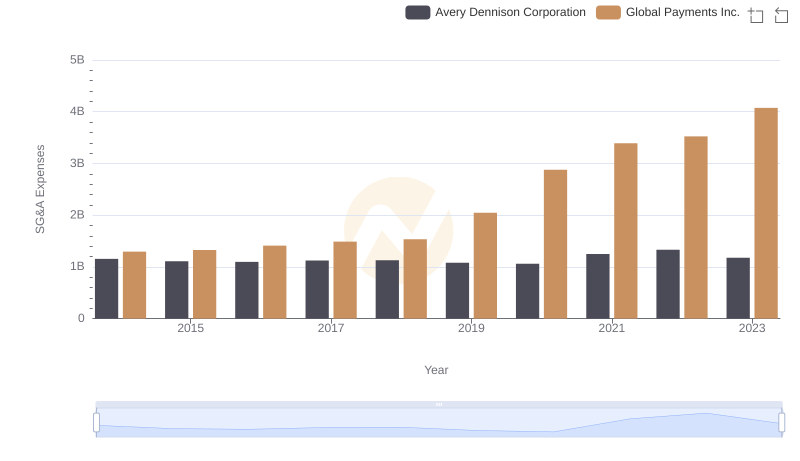

Comparing SG&A Expenses: Global Payments Inc. vs Avery Dennison Corporation Trends and Insights

Selling, General, and Administrative Costs: Global Payments Inc. vs ZTO Express (Cayman) Inc.

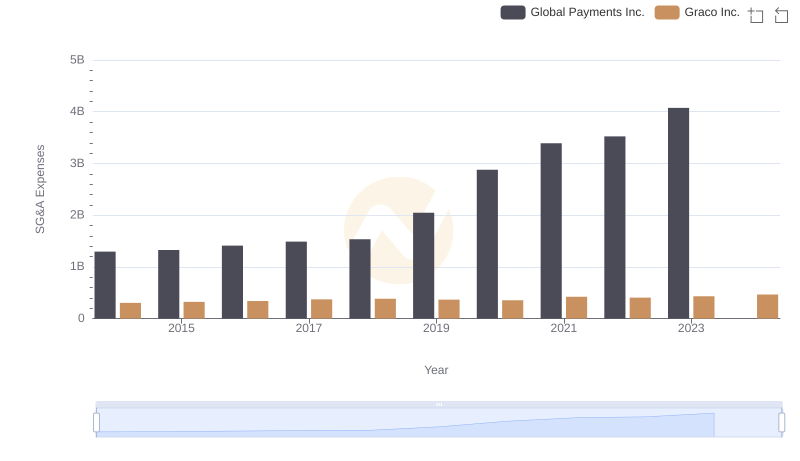

Global Payments Inc. vs Graco Inc.: SG&A Expense Trends

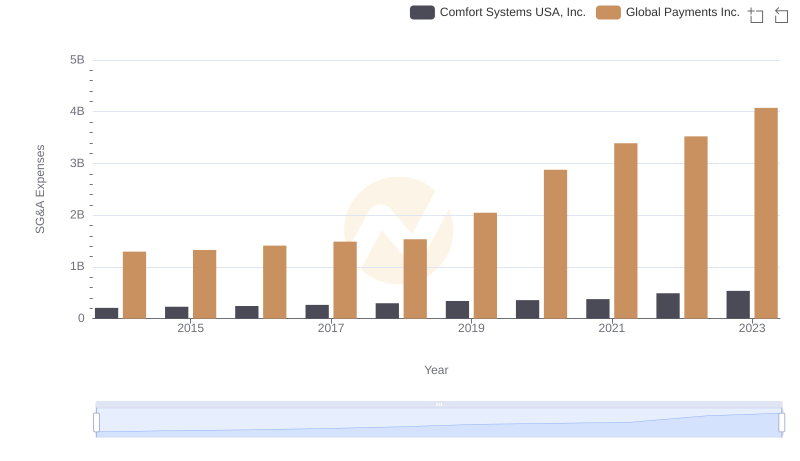

Selling, General, and Administrative Costs: Global Payments Inc. vs Comfort Systems USA, Inc.

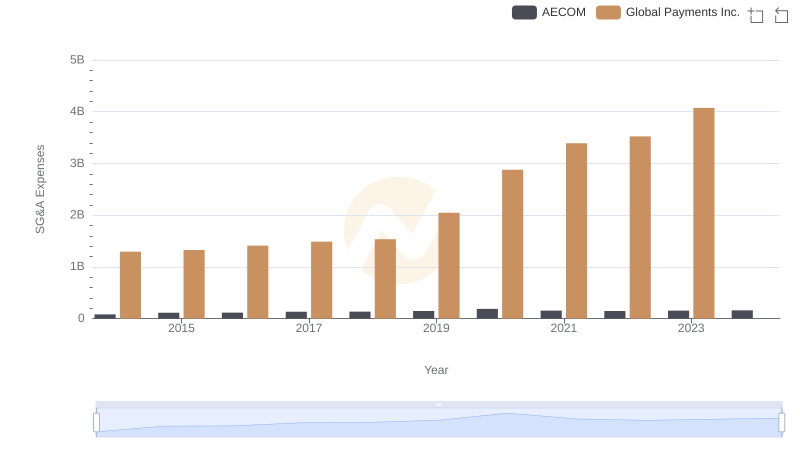

Global Payments Inc. and AECOM: SG&A Spending Patterns Compared

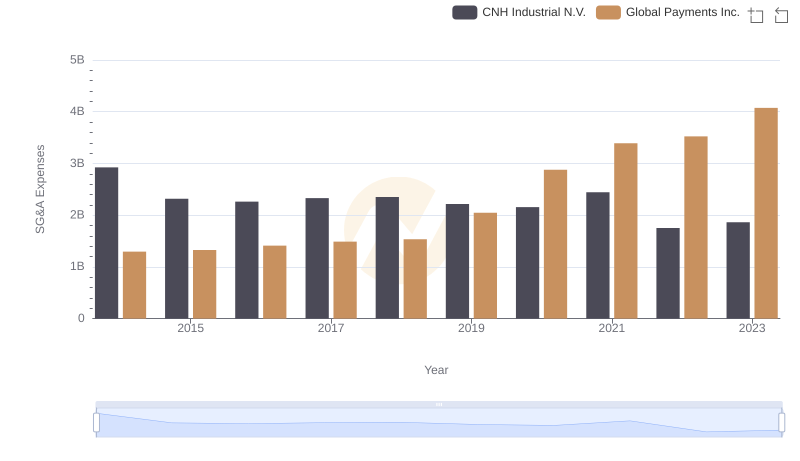

Global Payments Inc. or CNH Industrial N.V.: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Global Payments Inc. vs XPO Logistics, Inc.

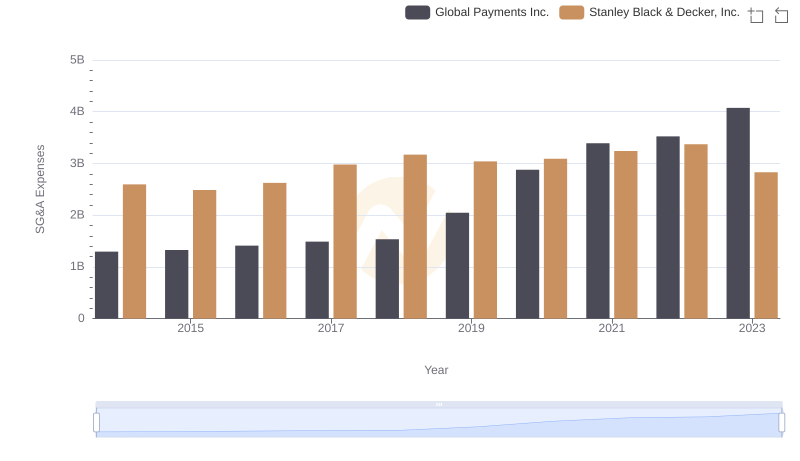

Breaking Down SG&A Expenses: Global Payments Inc. vs Stanley Black & Decker, Inc.