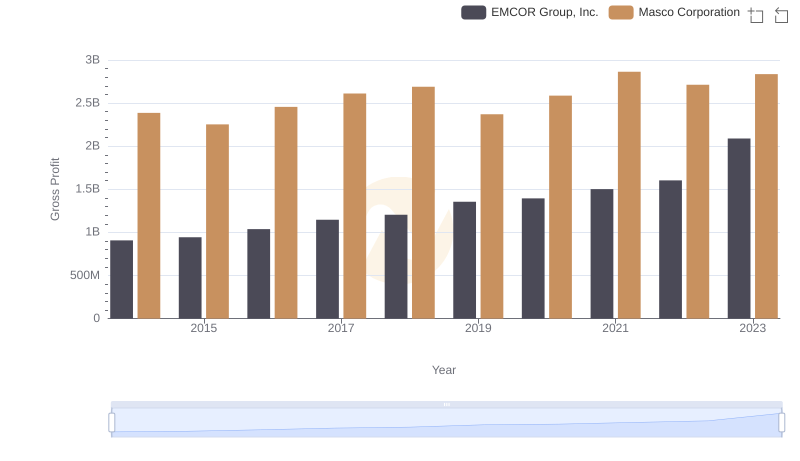

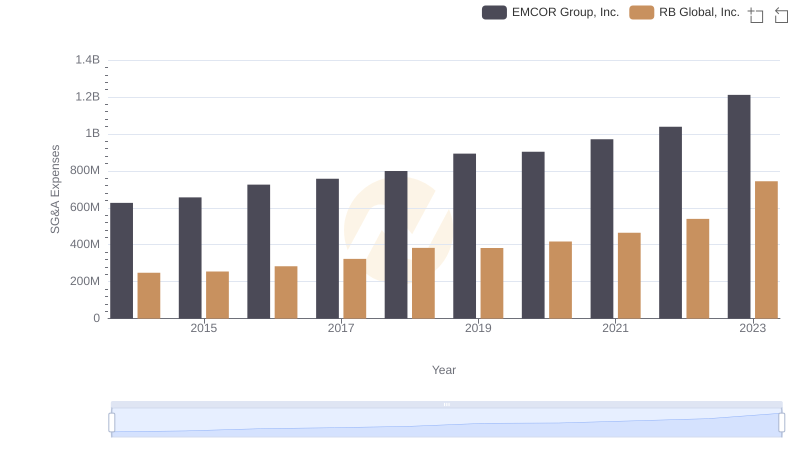

| __timestamp | EMCOR Group, Inc. | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 1607000000 |

| Thursday, January 1, 2015 | 656573000 | 1339000000 |

| Friday, January 1, 2016 | 725538000 | 1403000000 |

| Sunday, January 1, 2017 | 757062000 | 1442000000 |

| Monday, January 1, 2018 | 799157000 | 1478000000 |

| Tuesday, January 1, 2019 | 893453000 | 1274000000 |

| Wednesday, January 1, 2020 | 903584000 | 1292000000 |

| Friday, January 1, 2021 | 970937000 | 1413000000 |

| Saturday, January 1, 2022 | 1038717000 | 1390000000 |

| Sunday, January 1, 2023 | 1211233000 | 1481000000 |

| Monday, January 1, 2024 | 1468000000 |

Data in motion

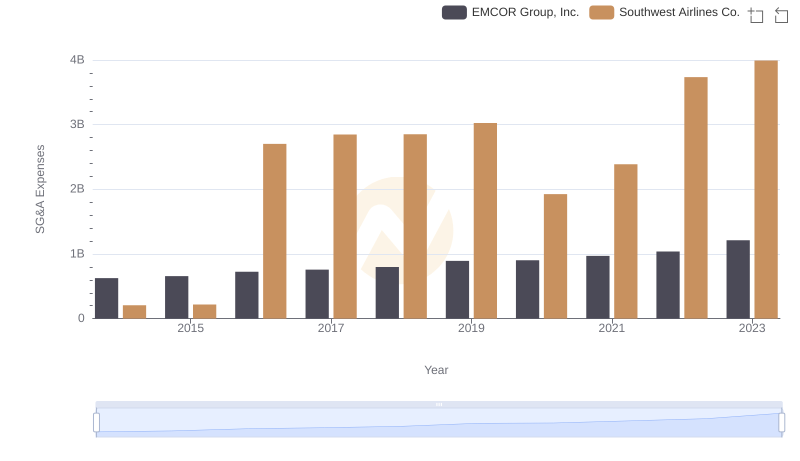

In the competitive landscape of corporate America, the efficiency of Selling, General, and Administrative (SG&A) expenses is a critical metric. Over the past decade, EMCOR Group, Inc. and Masco Corporation have demonstrated contrasting trends in their SG&A expenditures. From 2014 to 2023, EMCOR Group, Inc. has seen a steady increase in SG&A expenses, rising by approximately 93%, reflecting their strategic investments in operational growth. In contrast, Masco Corporation's SG&A expenses have fluctuated, peaking in 2014 and showing a modest decline thereafter, with a slight uptick in 2023. This divergence highlights EMCOR's aggressive expansion strategy compared to Masco's more conservative approach. As businesses navigate the post-pandemic economy, understanding these trends offers valuable insights into corporate strategies and financial health.

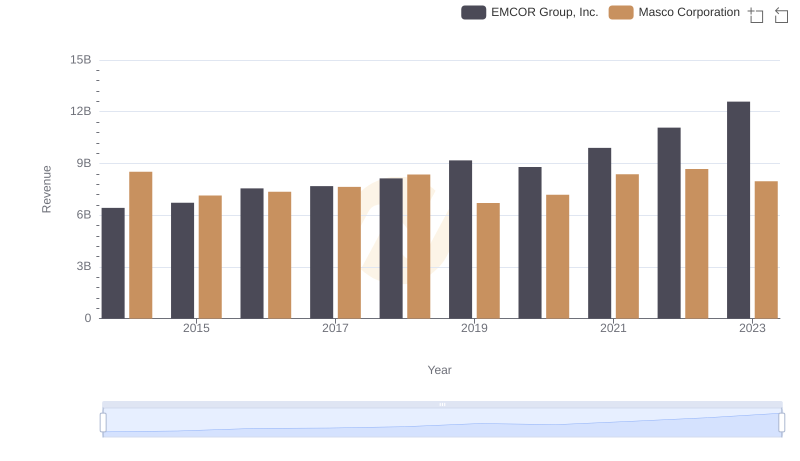

EMCOR Group, Inc. and Masco Corporation: A Comprehensive Revenue Analysis

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Southwest Airlines Co.

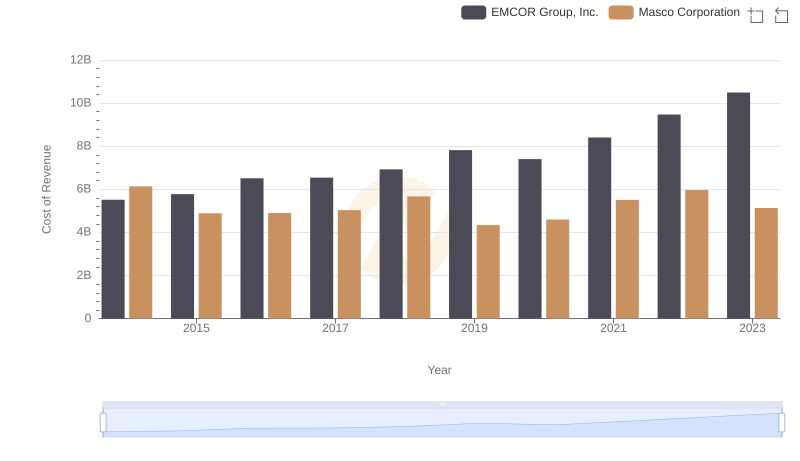

Cost of Revenue: Key Insights for EMCOR Group, Inc. and Masco Corporation

Gross Profit Trends Compared: EMCOR Group, Inc. vs Masco Corporation

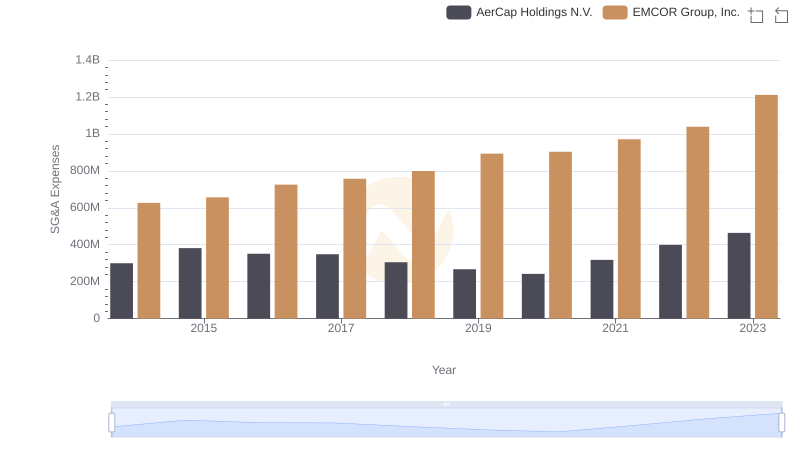

Comparing SG&A Expenses: EMCOR Group, Inc. vs AerCap Holdings N.V. Trends and Insights

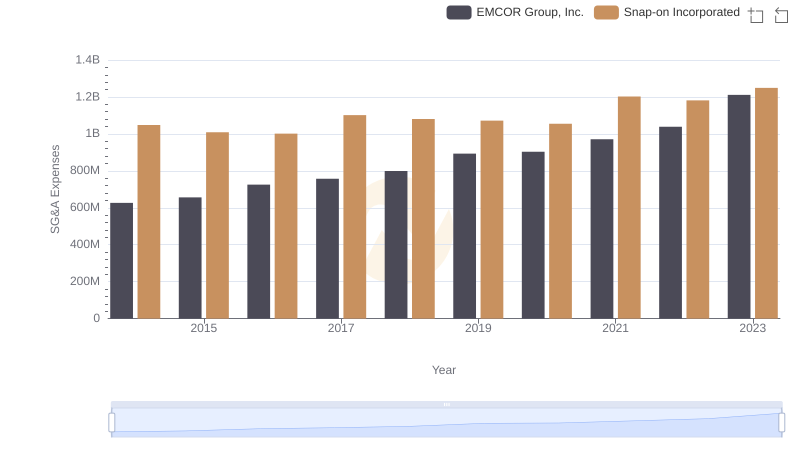

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Snap-on Incorporated

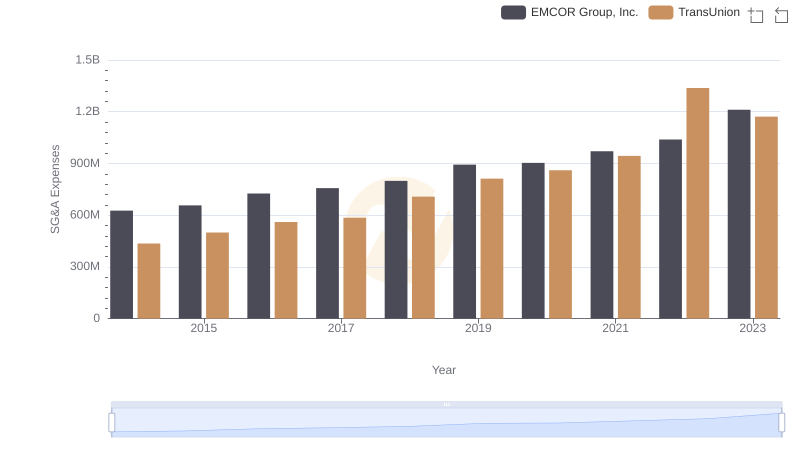

EMCOR Group, Inc. vs TransUnion: SG&A Expense Trends

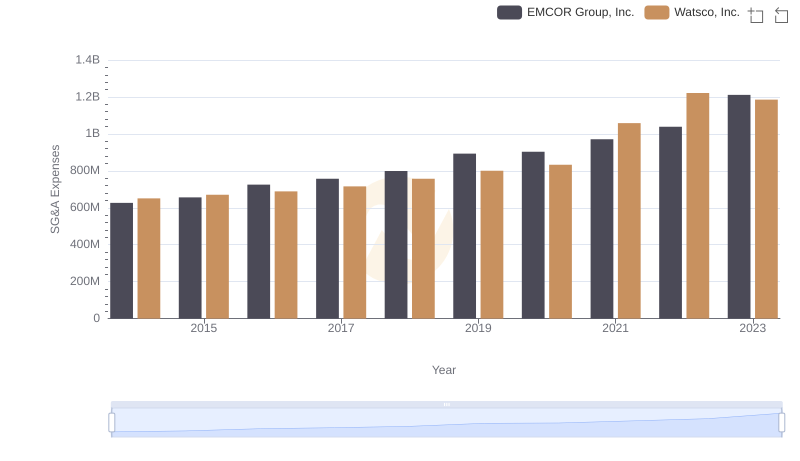

Cost Management Insights: SG&A Expenses for EMCOR Group, Inc. and Watsco, Inc.

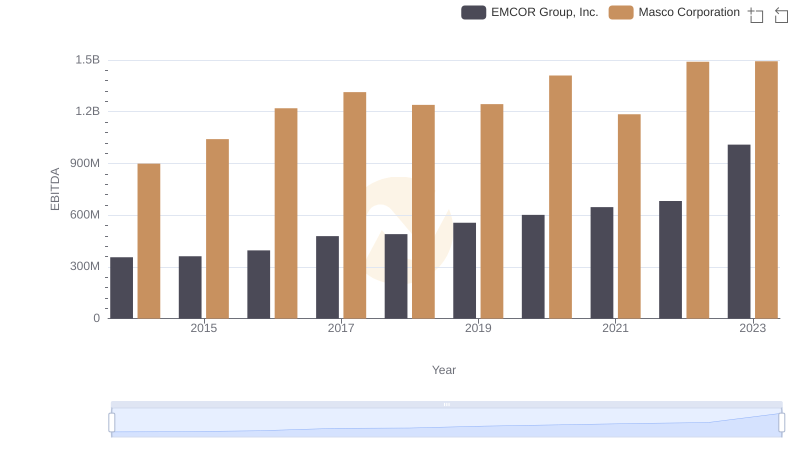

Professional EBITDA Benchmarking: EMCOR Group, Inc. vs Masco Corporation

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs J.B. Hunt Transport Services, Inc.

EMCOR Group, Inc. and RB Global, Inc.: SG&A Spending Patterns Compared