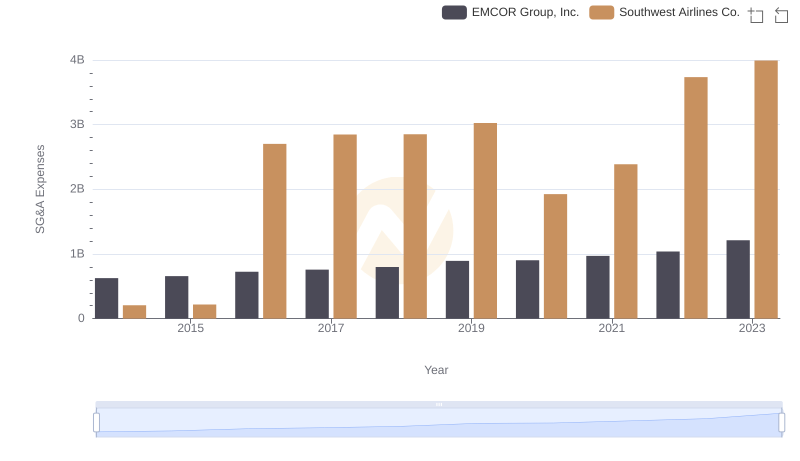

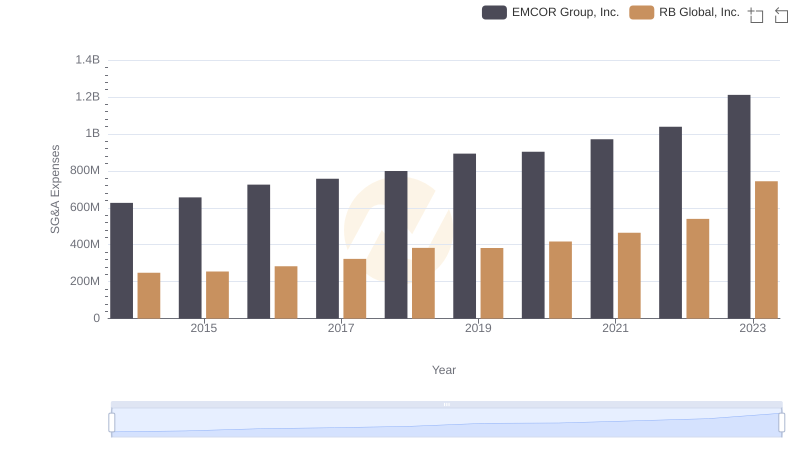

| __timestamp | EMCOR Group, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 1047900000 |

| Thursday, January 1, 2015 | 656573000 | 1009100000 |

| Friday, January 1, 2016 | 725538000 | 1001400000 |

| Sunday, January 1, 2017 | 757062000 | 1101300000 |

| Monday, January 1, 2018 | 799157000 | 1080700000 |

| Tuesday, January 1, 2019 | 893453000 | 1071500000 |

| Wednesday, January 1, 2020 | 903584000 | 1054800000 |

| Friday, January 1, 2021 | 970937000 | 1202300000 |

| Saturday, January 1, 2022 | 1038717000 | 1181200000 |

| Sunday, January 1, 2023 | 1211233000 | 1249000000 |

| Monday, January 1, 2024 | 0 |

Unleashing insights

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. Over the past decade, EMCOR Group, Inc. and Snap-on Incorporated have showcased distinct trajectories in managing these costs. From 2014 to 2023, EMCOR's SG&A expenses surged by approximately 93%, reflecting a strategic expansion and investment in operational capabilities. In contrast, Snap-on's expenses grew by about 19%, indicating a more conservative approach to cost management.

This comparative analysis highlights the diverse strategies employed by these industry giants in navigating the complexities of SG&A expenses.

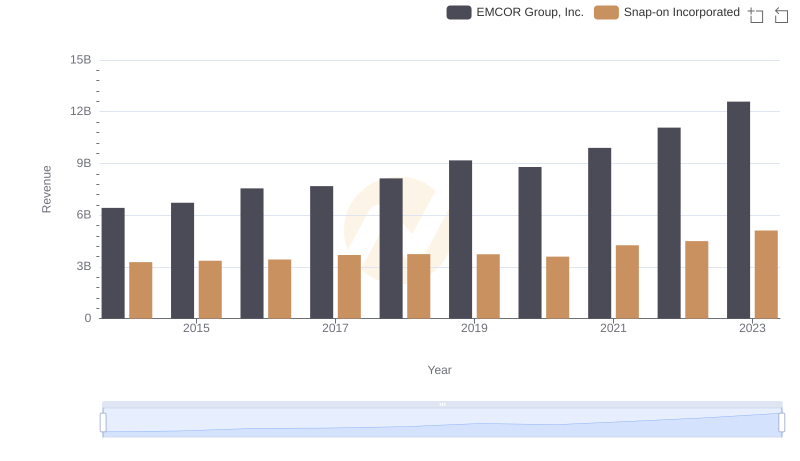

Annual Revenue Comparison: EMCOR Group, Inc. vs Snap-on Incorporated

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Southwest Airlines Co.

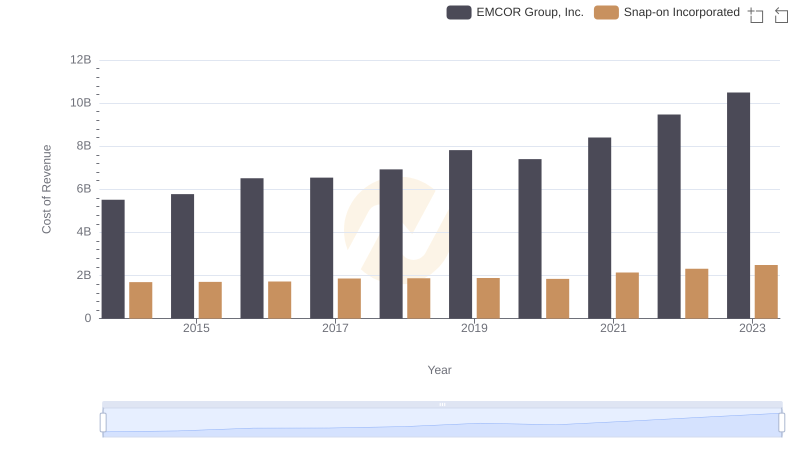

Cost of Revenue Comparison: EMCOR Group, Inc. vs Snap-on Incorporated

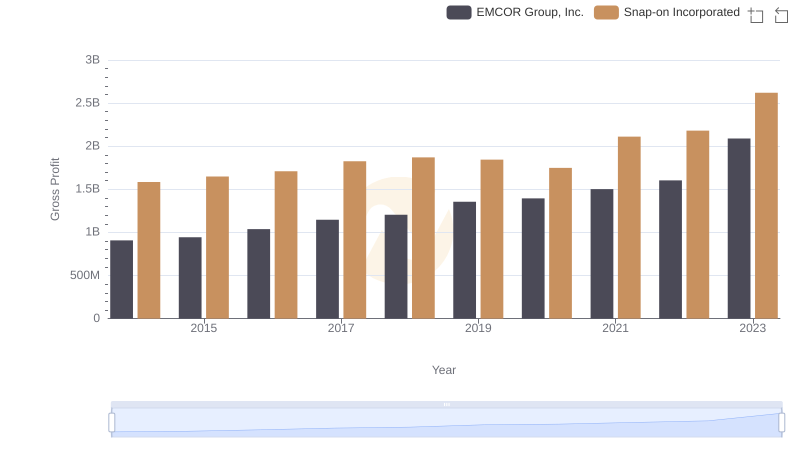

Gross Profit Comparison: EMCOR Group, Inc. and Snap-on Incorporated Trends

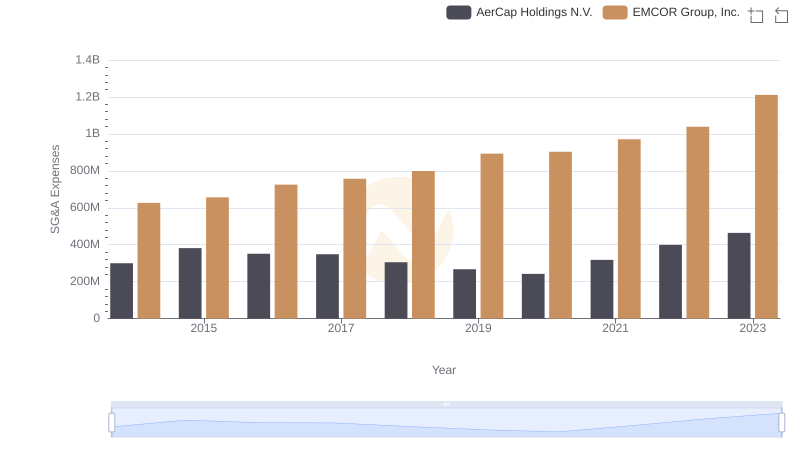

Comparing SG&A Expenses: EMCOR Group, Inc. vs AerCap Holdings N.V. Trends and Insights

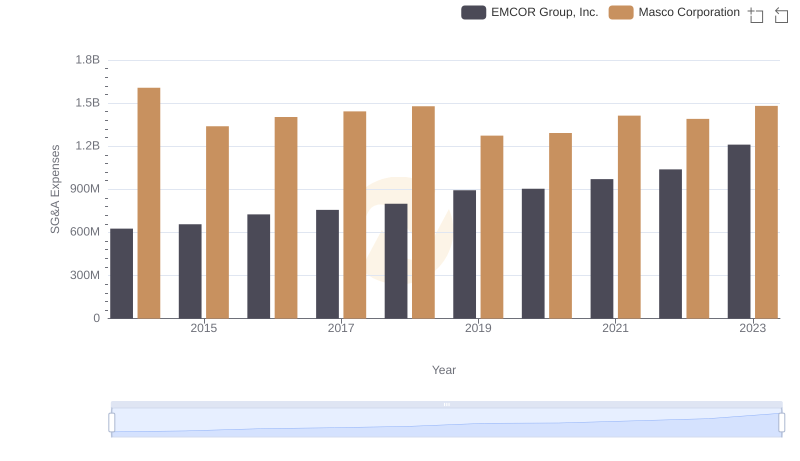

SG&A Efficiency Analysis: Comparing EMCOR Group, Inc. and Masco Corporation

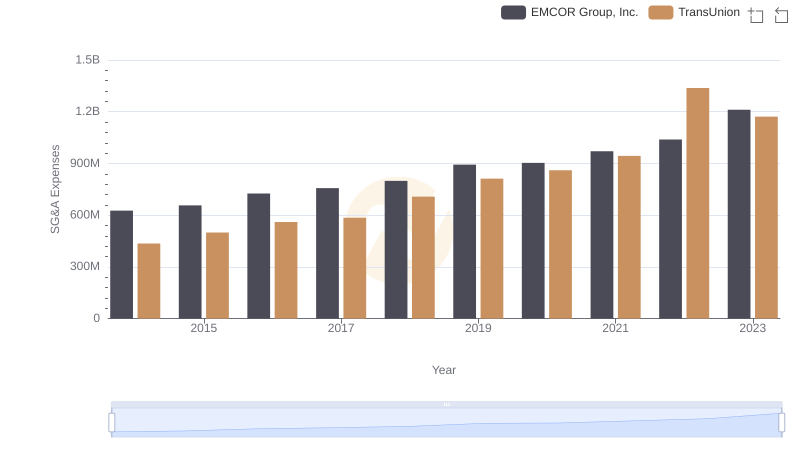

EMCOR Group, Inc. vs TransUnion: SG&A Expense Trends

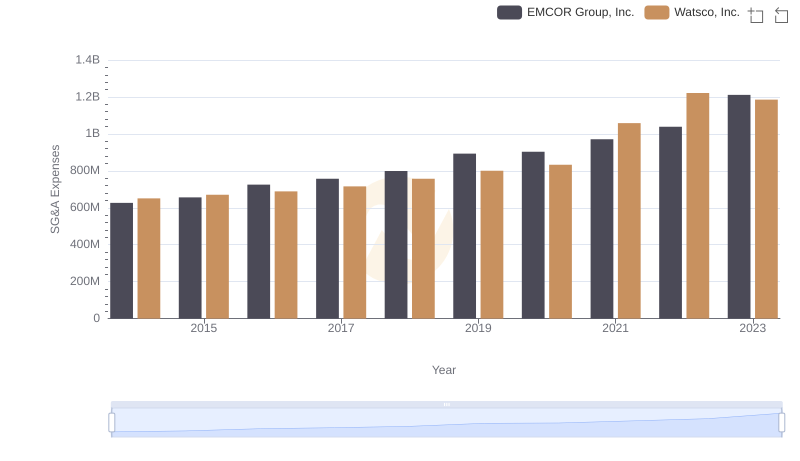

Cost Management Insights: SG&A Expenses for EMCOR Group, Inc. and Watsco, Inc.

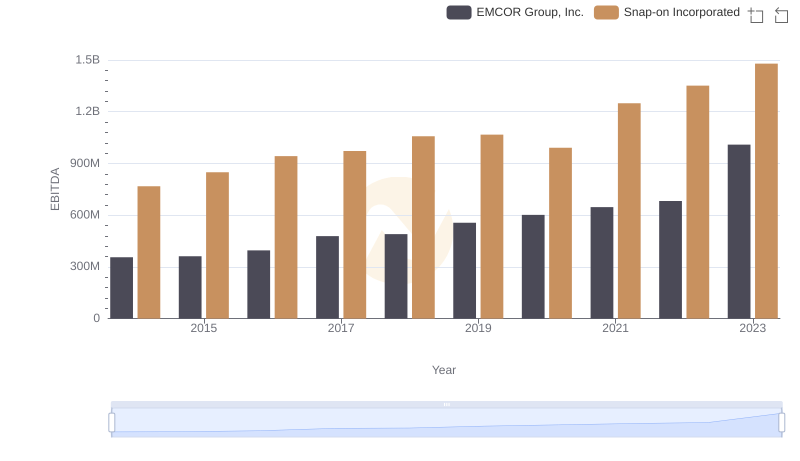

A Professional Review of EBITDA: EMCOR Group, Inc. Compared to Snap-on Incorporated

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs J.B. Hunt Transport Services, Inc.

EMCOR Group, Inc. and RB Global, Inc.: SG&A Spending Patterns Compared