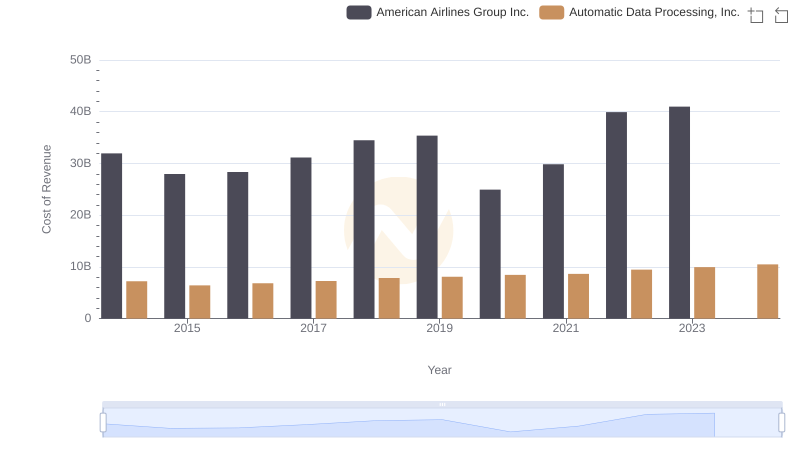

| __timestamp | American Airlines Group Inc. | Automatic Data Processing, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1544000000 | 2762400000 |

| Thursday, January 1, 2015 | 1394000000 | 2496900000 |

| Friday, January 1, 2016 | 1323000000 | 2637000000 |

| Sunday, January 1, 2017 | 1477000000 | 2783200000 |

| Monday, January 1, 2018 | 1520000000 | 2971500000 |

| Tuesday, January 1, 2019 | 1602000000 | 3064200000 |

| Wednesday, January 1, 2020 | 513000000 | 3003000000 |

| Friday, January 1, 2021 | 1098000000 | 3040500000 |

| Saturday, January 1, 2022 | 1815000000 | 3233200000 |

| Sunday, January 1, 2023 | 1799000000 | 3551400000 |

| Monday, January 1, 2024 | 3778900000 |

Igniting the spark of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. This analysis juxtaposes two giants from distinct sectors: Automatic Data Processing, Inc. (ADP) and American Airlines Group Inc. (AAL). Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, reflecting its robust investment in administrative capabilities. In contrast, AAL's SG&A expenses fluctuated, with a notable dip in 2020, likely due to pandemic-induced operational constraints, before rebounding to nearly $1.8 billion in 2023. This comparison highlights the resilience and strategic differences between a tech-driven service provider and an airline navigating turbulent skies. As we look to the future, understanding these trends offers valuable insights into how companies allocate resources to sustain growth and efficiency.

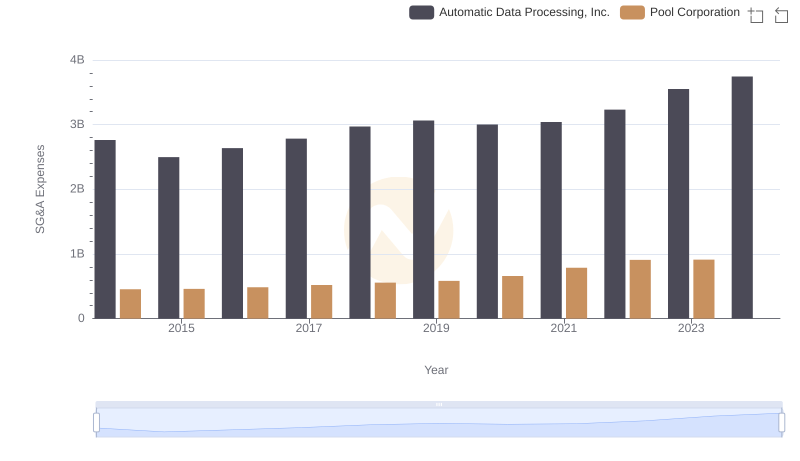

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Pool Corporation

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and U-Haul Holding Company

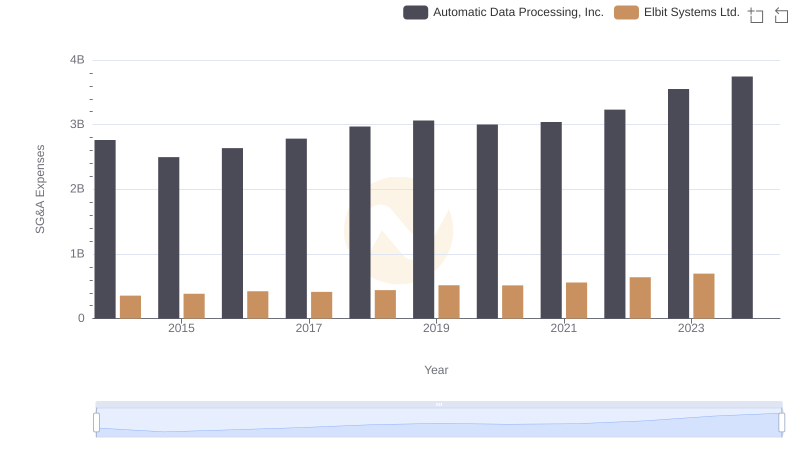

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Elbit Systems Ltd.

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and American Airlines Group Inc.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or C.H. Robinson Worldwide, Inc.

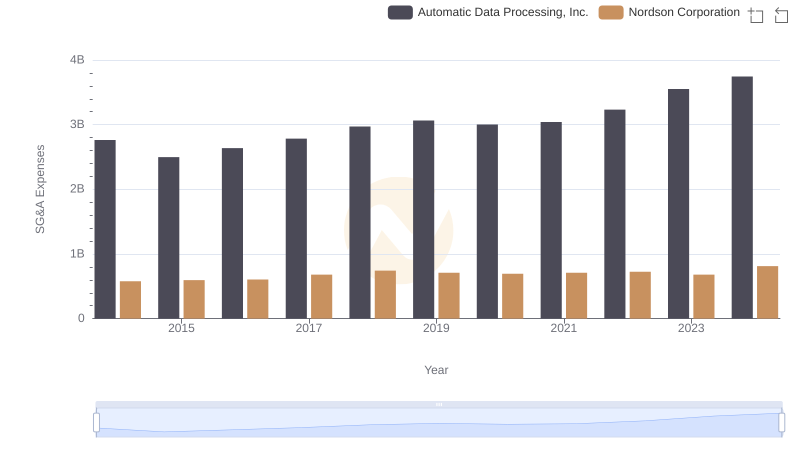

Automatic Data Processing, Inc. vs Nordson Corporation: SG&A Expense Trends

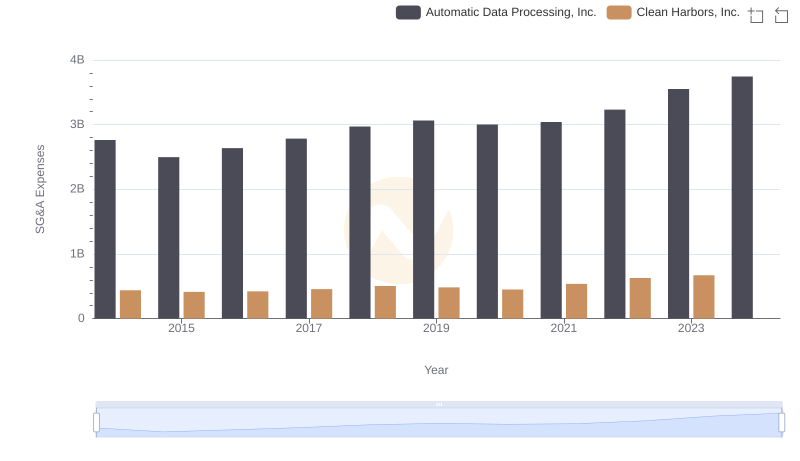

Automatic Data Processing, Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Allegion plc

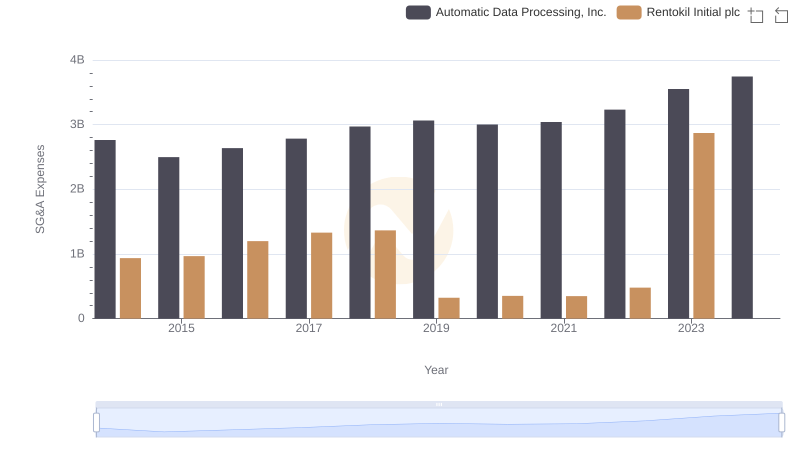

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rentokil Initial plc

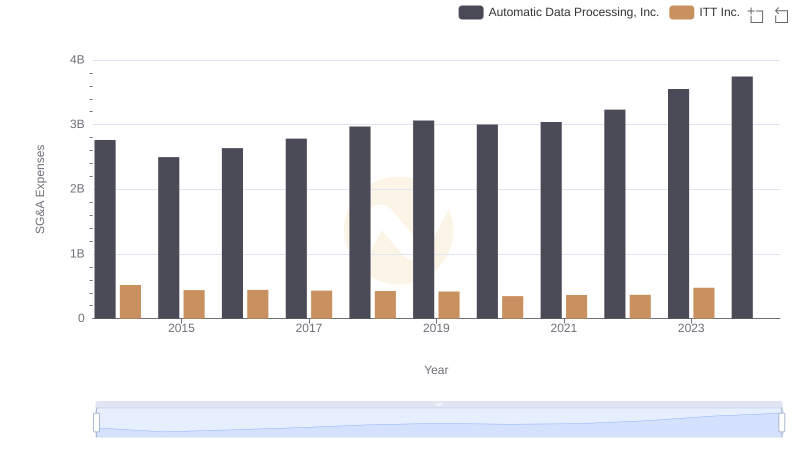

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or ITT Inc.