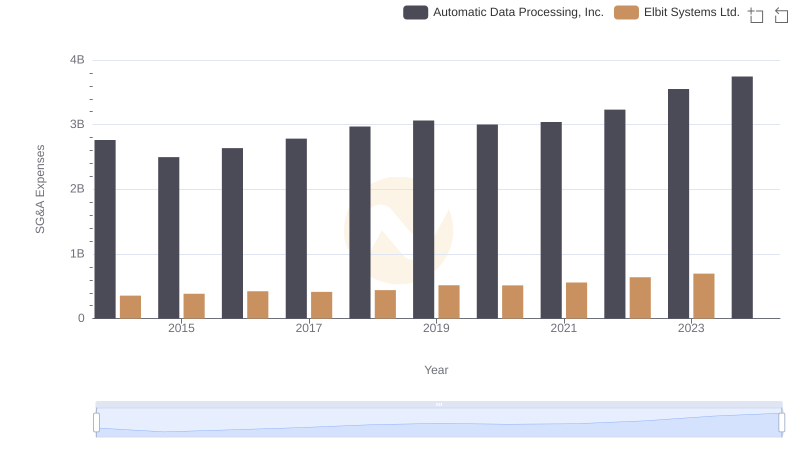

| __timestamp | Automatic Data Processing, Inc. | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 519500000 |

| Thursday, January 1, 2015 | 2496900000 | 441500000 |

| Friday, January 1, 2016 | 2637000000 | 444100000 |

| Sunday, January 1, 2017 | 2783200000 | 433700000 |

| Monday, January 1, 2018 | 2971500000 | 427300000 |

| Tuesday, January 1, 2019 | 3064200000 | 420000000 |

| Wednesday, January 1, 2020 | 3003000000 | 347200000 |

| Friday, January 1, 2021 | 3040500000 | 365100000 |

| Saturday, January 1, 2022 | 3233200000 | 368500000 |

| Sunday, January 1, 2023 | 3551400000 | 476600000 |

| Monday, January 1, 2024 | 3778900000 | 502300000 |

Unleashing insights

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and ITT Inc. have been navigating this financial landscape since 2014. Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, reflecting a 36% increase from 2014. In contrast, ITT Inc. has shown a more stable trend, with expenses fluctuating around $400 million, except for a notable dip in 2020. This suggests that while ADP's expenses are higher, they may be investing more in growth and operations. Meanwhile, ITT's steadiness could indicate a more conservative approach. Missing data for ITT in 2024 leaves room for speculation on their future strategy. Understanding these trends offers valuable insights into each company's operational priorities and financial strategies.

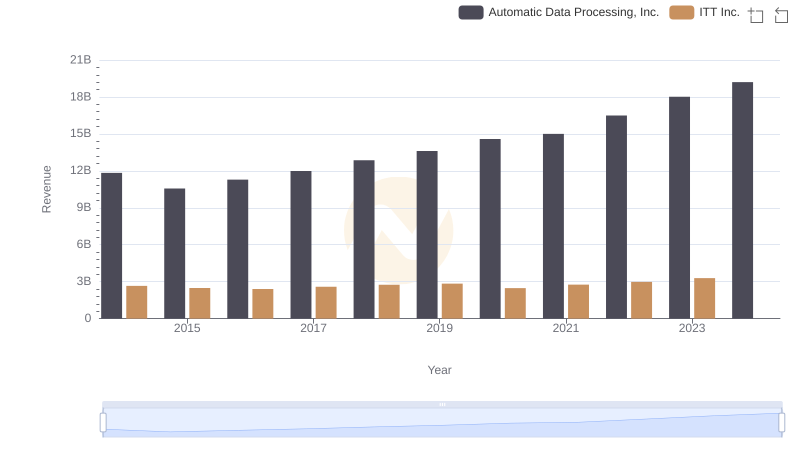

Automatic Data Processing, Inc. and ITT Inc.: A Comprehensive Revenue Analysis

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and U-Haul Holding Company

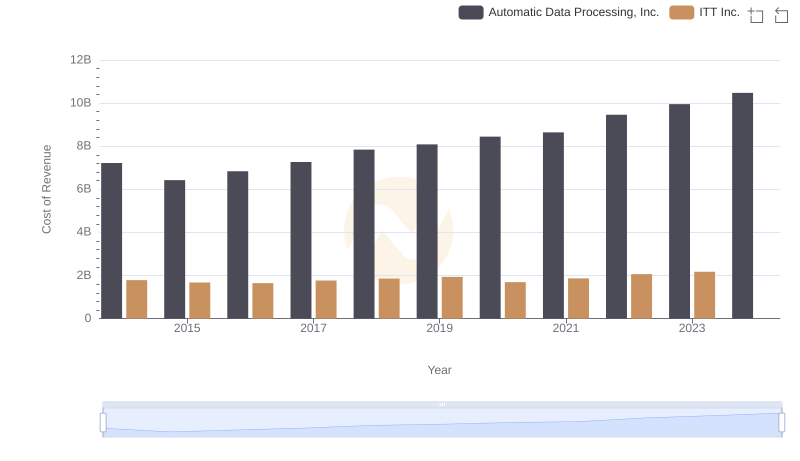

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs ITT Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Elbit Systems Ltd.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or C.H. Robinson Worldwide, Inc.

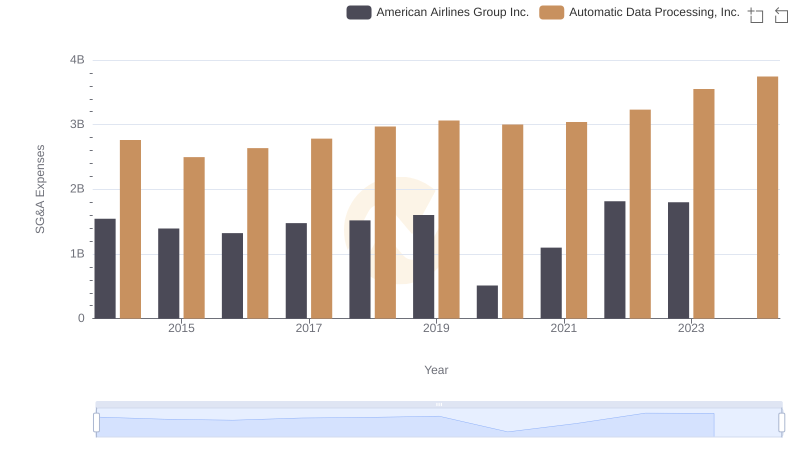

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and American Airlines Group Inc.

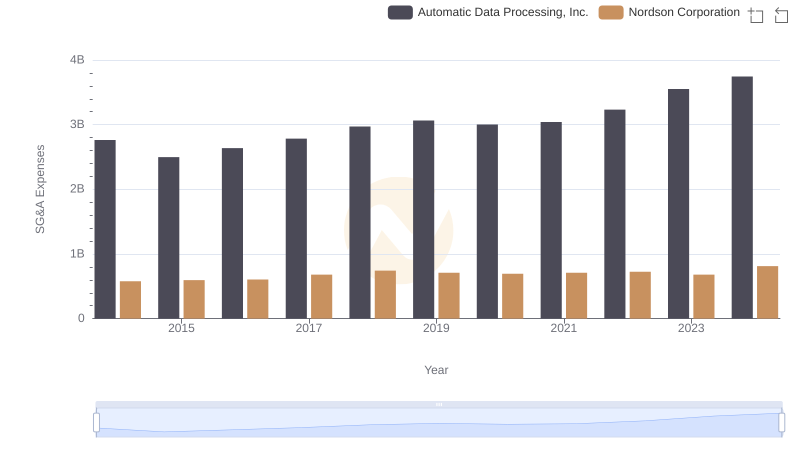

Automatic Data Processing, Inc. vs Nordson Corporation: SG&A Expense Trends

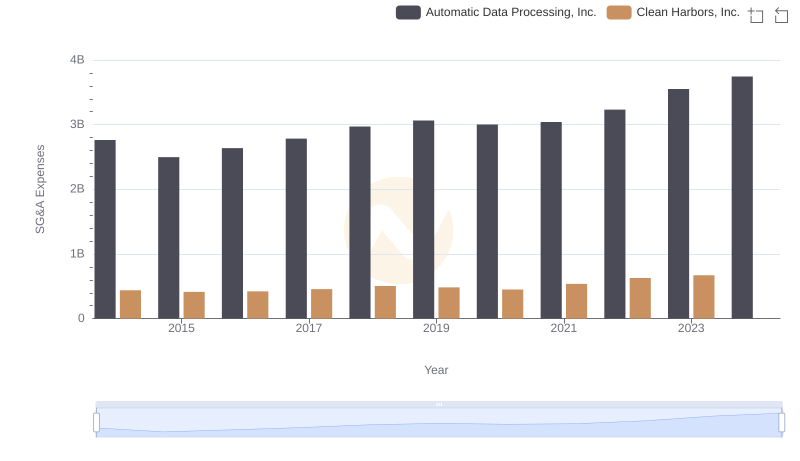

Automatic Data Processing, Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Allegion plc

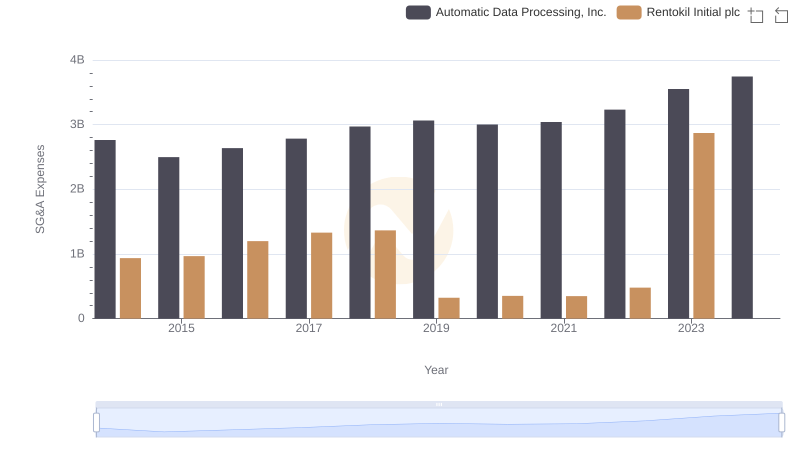

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rentokil Initial plc

EBITDA Performance Review: Automatic Data Processing, Inc. vs ITT Inc.