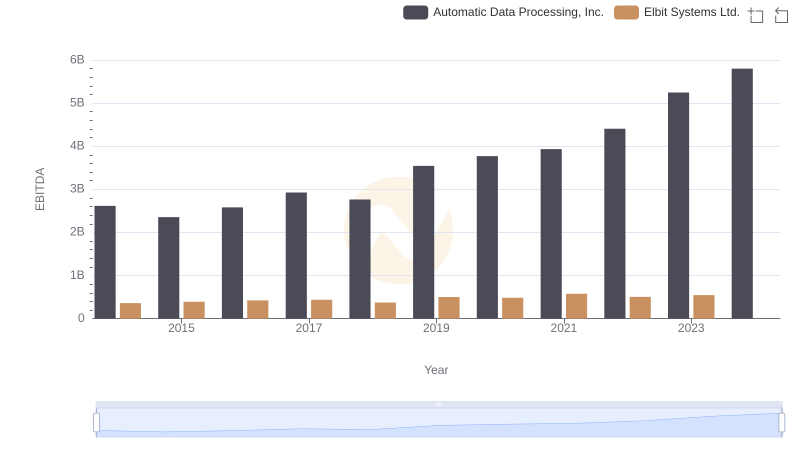

| __timestamp | Automatic Data Processing, Inc. | Elbit Systems Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 356171000 |

| Thursday, January 1, 2015 | 2496900000 | 385059000 |

| Friday, January 1, 2016 | 2637000000 | 422390000 |

| Sunday, January 1, 2017 | 2783200000 | 413560000 |

| Monday, January 1, 2018 | 2971500000 | 441362000 |

| Tuesday, January 1, 2019 | 3064200000 | 516149000 |

| Wednesday, January 1, 2020 | 3003000000 | 514638000 |

| Friday, January 1, 2021 | 3040500000 | 559113000 |

| Saturday, January 1, 2022 | 3233200000 | 639067000 |

| Sunday, January 1, 2023 | 3551400000 | 696022000 |

| Monday, January 1, 2024 | 3778900000 |

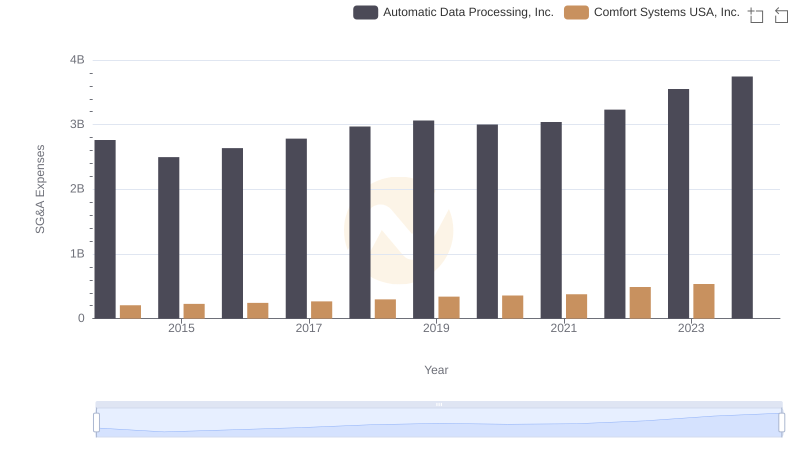

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Automatic Data Processing, Inc. (ADP) and Elbit Systems Ltd., from 2014 to 2023.

ADP, a leader in human resources management, has seen its SG&A expenses grow by approximately 36% over the decade, peaking in 2023. In contrast, Elbit Systems, a defense electronics company, experienced a 95% increase in SG&A expenses, reflecting its strategic expansions.

While ADP's expenses consistently surpassed Elbit's, the latter's rapid growth highlights its aggressive market positioning. Notably, data for 2024 is incomplete, suggesting a need for cautious interpretation. This comparison underscores the diverse financial strategies employed by companies in different sectors, offering valuable insights for investors and analysts alike.

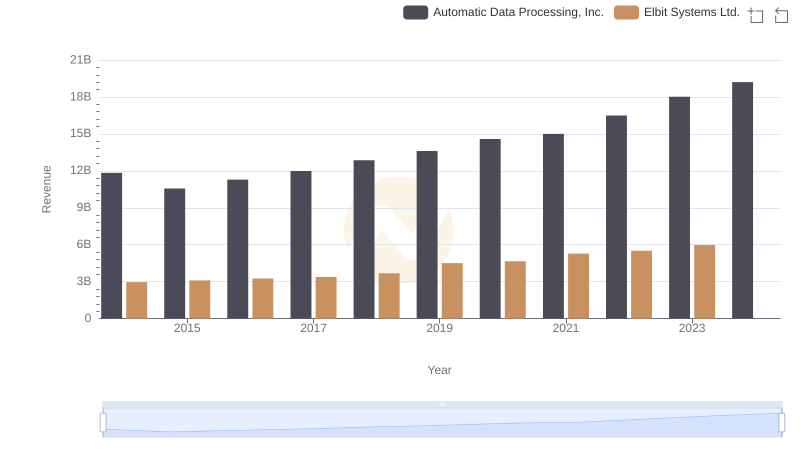

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Elbit Systems Ltd.

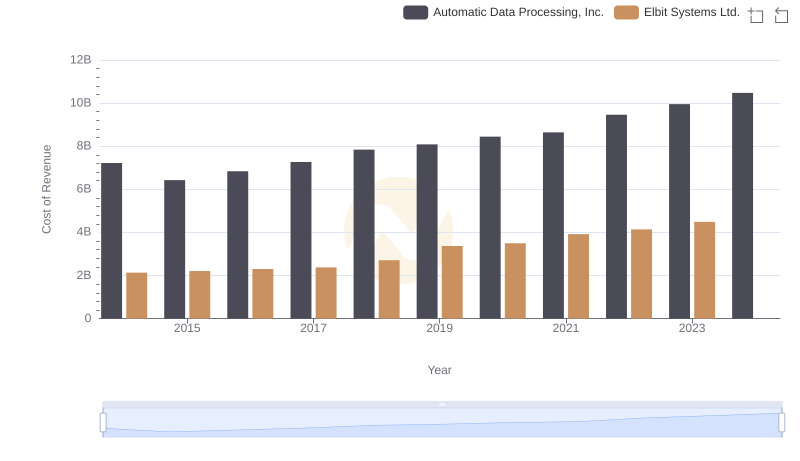

Automatic Data Processing, Inc. vs Elbit Systems Ltd.: Efficiency in Cost of Revenue Explored

Automatic Data Processing, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

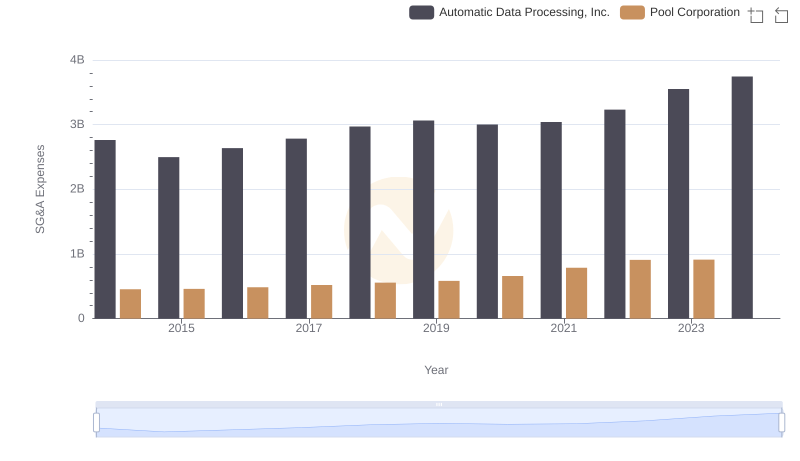

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Pool Corporation

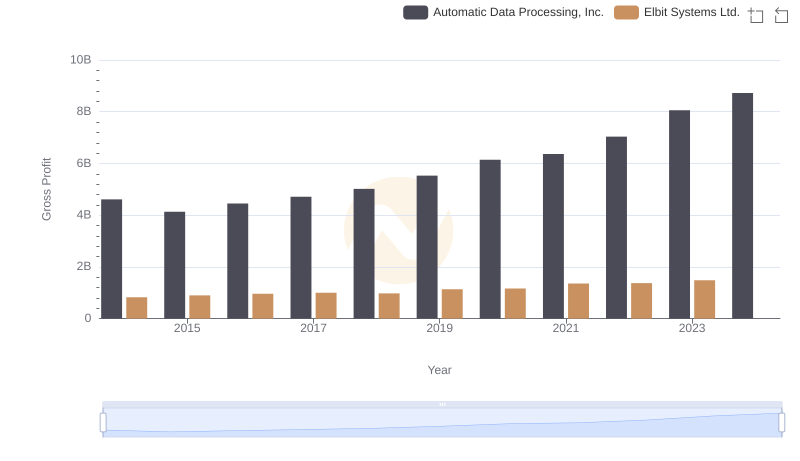

Automatic Data Processing, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and U-Haul Holding Company

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or C.H. Robinson Worldwide, Inc.

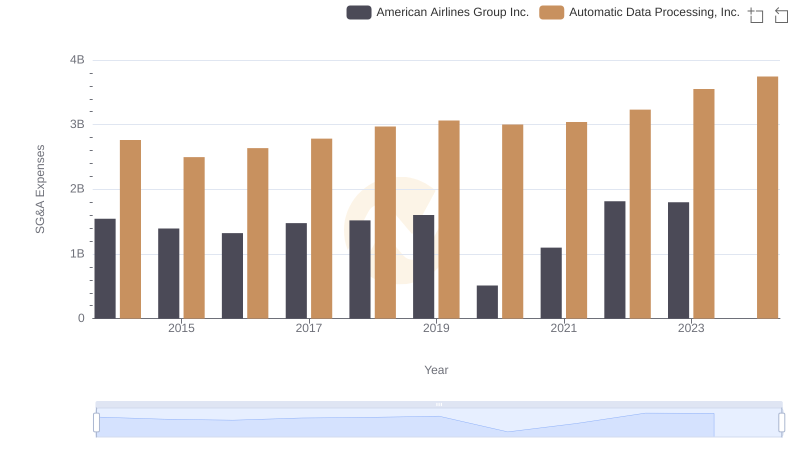

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and American Airlines Group Inc.

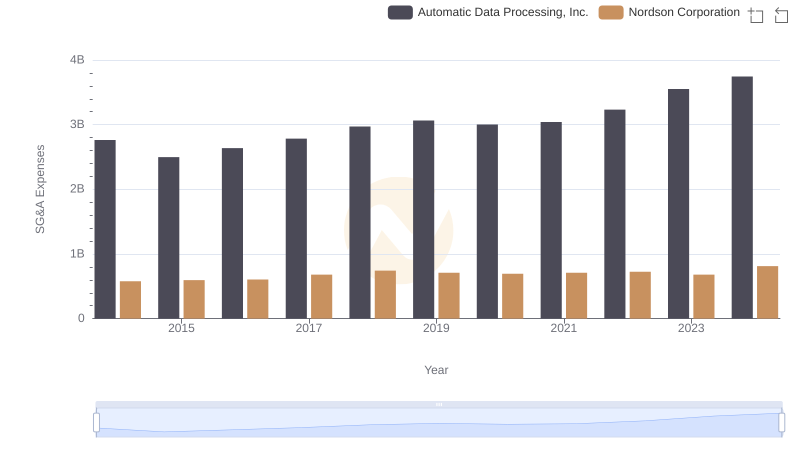

Automatic Data Processing, Inc. vs Nordson Corporation: SG&A Expense Trends

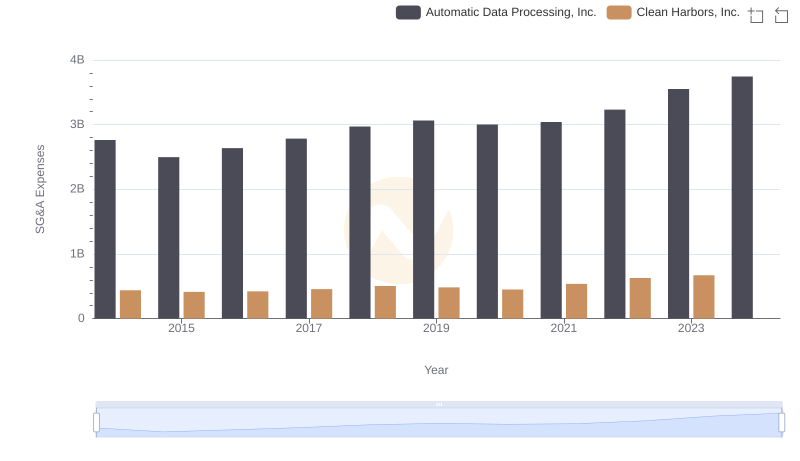

Automatic Data Processing, Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Elbit Systems Ltd.