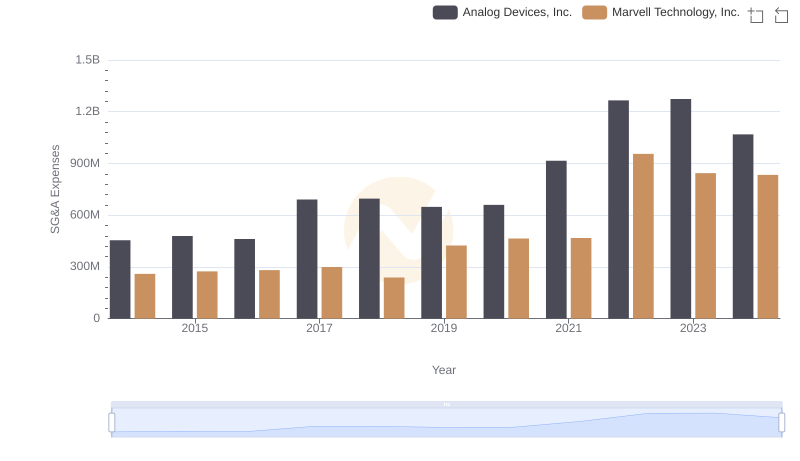

| __timestamp | Analog Devices, Inc. | Motorola Solutions, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 1184000000 |

| Thursday, January 1, 2015 | 478972000 | 1021000000 |

| Friday, January 1, 2016 | 461438000 | 1000000000 |

| Sunday, January 1, 2017 | 691046000 | 979000000 |

| Monday, January 1, 2018 | 695937000 | 1254000000 |

| Tuesday, January 1, 2019 | 648094000 | 1403000000 |

| Wednesday, January 1, 2020 | 659923000 | 1293000000 |

| Friday, January 1, 2021 | 915418000 | 1353000000 |

| Saturday, January 1, 2022 | 1266175000 | 1450000000 |

| Sunday, January 1, 2023 | 1273584000 | 1561000000 |

| Monday, January 1, 2024 | 1068640000 | 1752000000 |

Cracking the code

In the ever-evolving landscape of technology, effective cost management is crucial for sustaining growth and innovation. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Analog Devices, Inc. and Motorola Solutions, Inc., from 2014 to 2023. Over this decade, Motorola Solutions consistently outpaced Analog Devices in SG&A spending, peaking at approximately 1.56 billion in 2023, a 32% increase from 2014. Meanwhile, Analog Devices saw a significant rise, with expenses nearly tripling to 1.27 billion in 2023. Notably, 2024 data for Motorola Solutions is absent, highlighting potential reporting gaps. This financial narrative underscores the strategic allocation of resources in driving competitive advantage and market leadership. As these companies navigate the complexities of the tech industry, their SG&A trends offer valuable insights into their operational priorities and financial health.

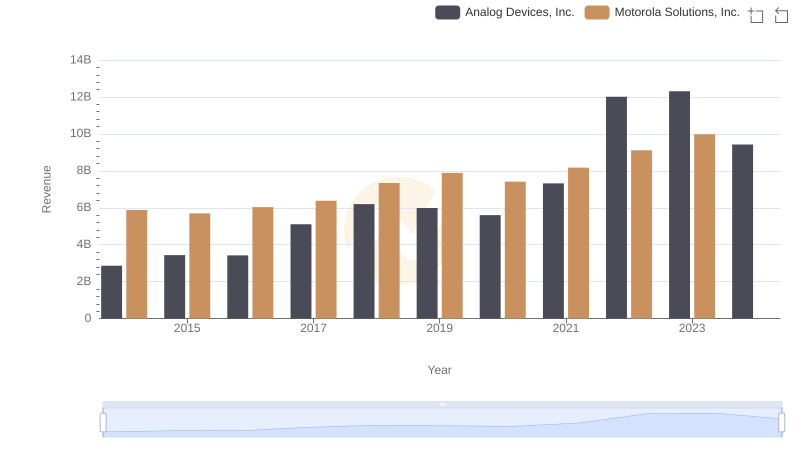

Annual Revenue Comparison: Analog Devices, Inc. vs Motorola Solutions, Inc.

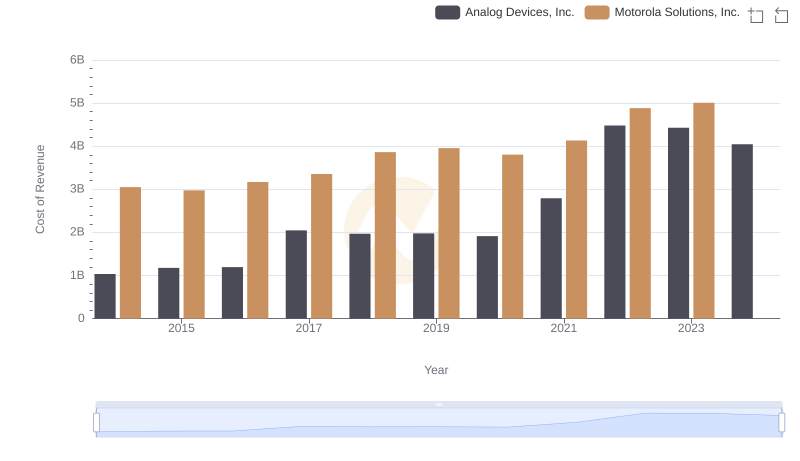

Cost of Revenue Comparison: Analog Devices, Inc. vs Motorola Solutions, Inc.

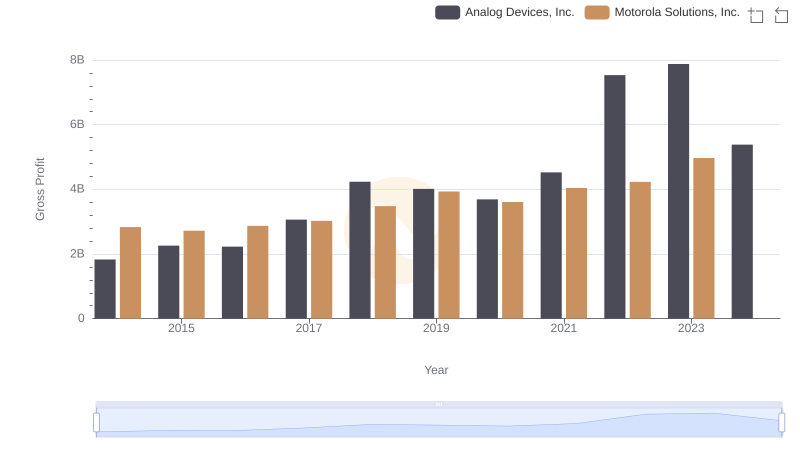

Gross Profit Comparison: Analog Devices, Inc. and Motorola Solutions, Inc. Trends

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

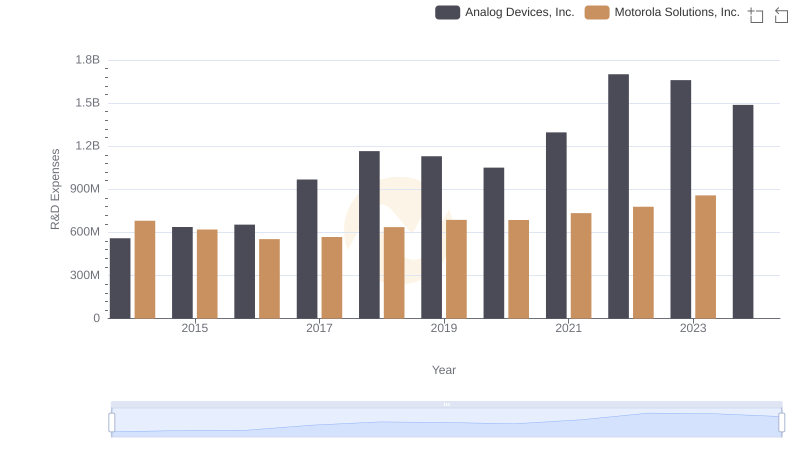

Analyzing R&D Budgets: Analog Devices, Inc. vs Motorola Solutions, Inc.

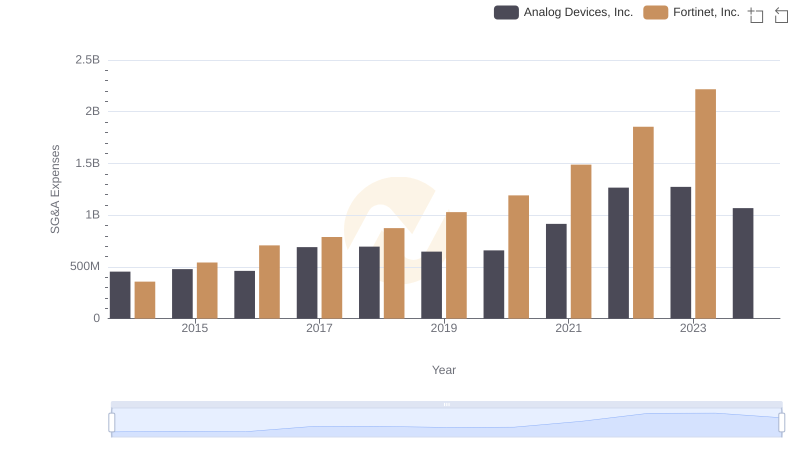

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

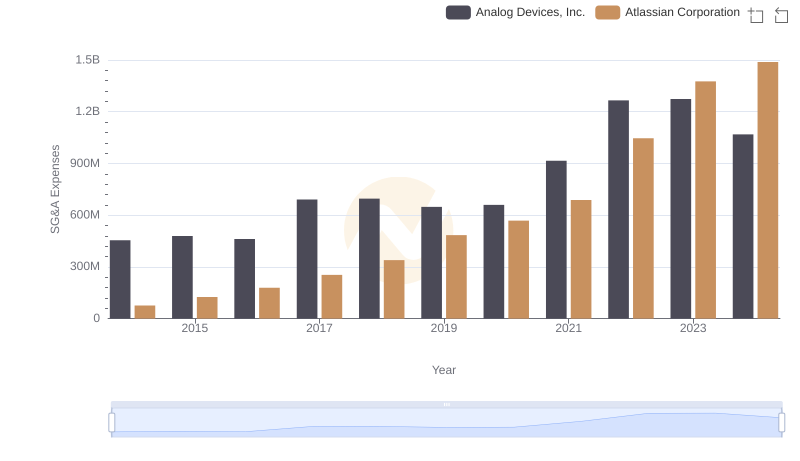

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Atlassian Corporation

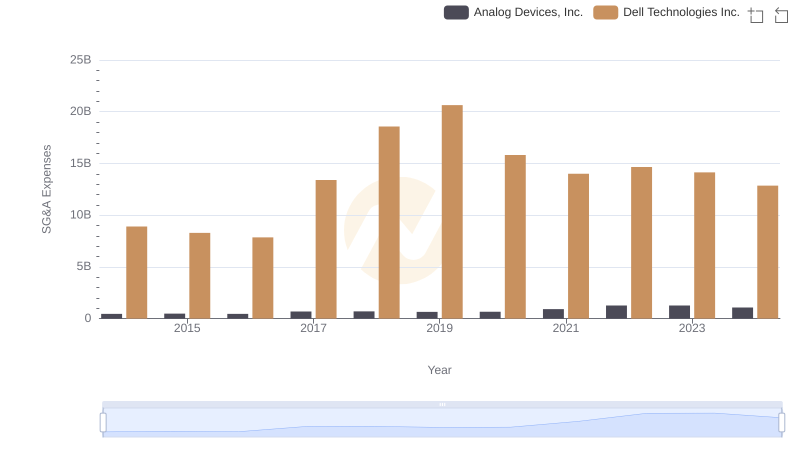

Breaking Down SG&A Expenses: Analog Devices, Inc. vs Dell Technologies Inc.

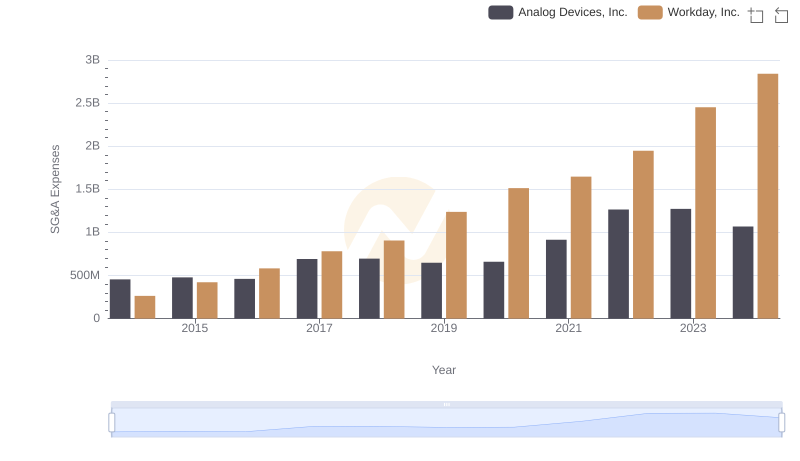

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Workday, Inc.

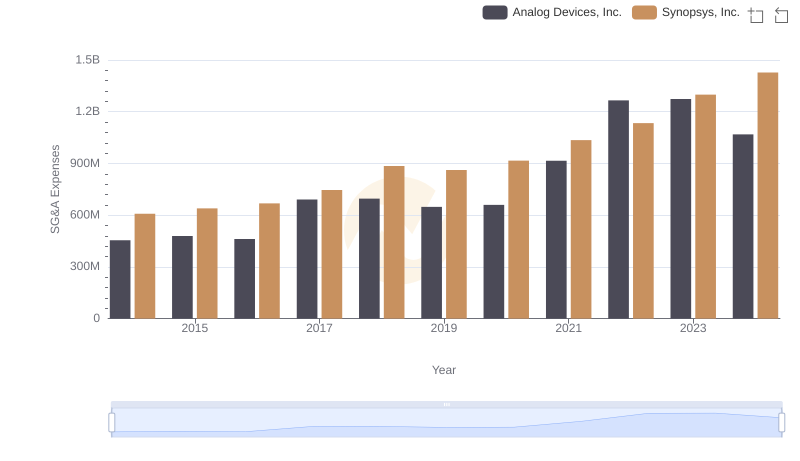

Analog Devices, Inc. vs Synopsys, Inc.: SG&A Expense Trends

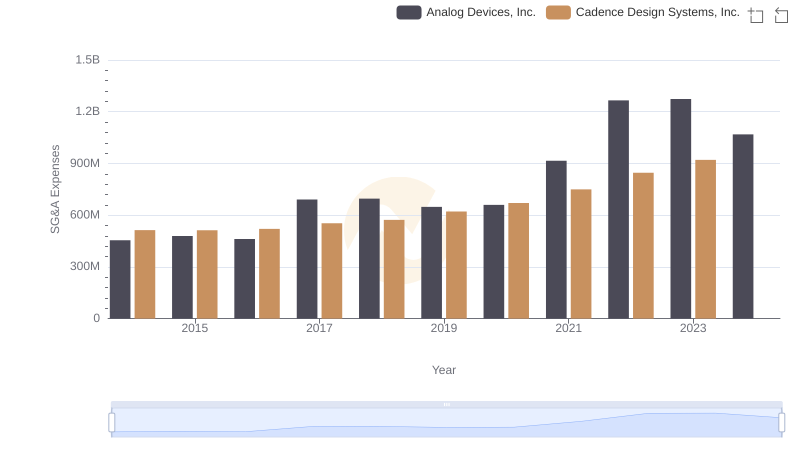

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or Cadence Design Systems, Inc.

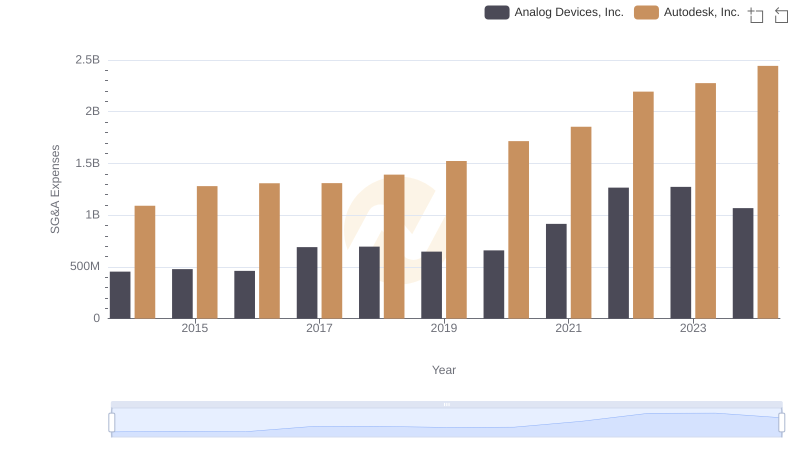

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Autodesk, Inc.