| __timestamp | Analog Devices, Inc. | Workday, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 263294000 |

| Thursday, January 1, 2015 | 478972000 | 421891000 |

| Friday, January 1, 2016 | 461438000 | 582634000 |

| Sunday, January 1, 2017 | 691046000 | 781996000 |

| Monday, January 1, 2018 | 695937000 | 906276000 |

| Tuesday, January 1, 2019 | 648094000 | 1238682000 |

| Wednesday, January 1, 2020 | 659923000 | 1514272000 |

| Friday, January 1, 2021 | 915418000 | 1647241000 |

| Saturday, January 1, 2022 | 1266175000 | 1947933000 |

| Sunday, January 1, 2023 | 1273584000 | 2452180000 |

| Monday, January 1, 2024 | 1068640000 | 2841000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A trends of two industry giants: Analog Devices, Inc. and Workday, Inc., from 2014 to 2024.

Analog Devices has demonstrated a steady increase in SG&A expenses, peaking in 2023 with a 180% rise from 2014. This growth reflects strategic investments in innovation and market expansion, crucial for staying competitive in the semiconductor industry.

Workday, Inc. has seen a more dramatic surge, with SG&A expenses soaring by over 980% during the same period. This sharp increase underscores Workday's aggressive growth strategy in the cloud computing sector, focusing on scaling operations and enhancing customer experience.

Both companies exemplify distinct approaches to cost management, highlighting the importance of aligning SG&A strategies with broader business objectives.

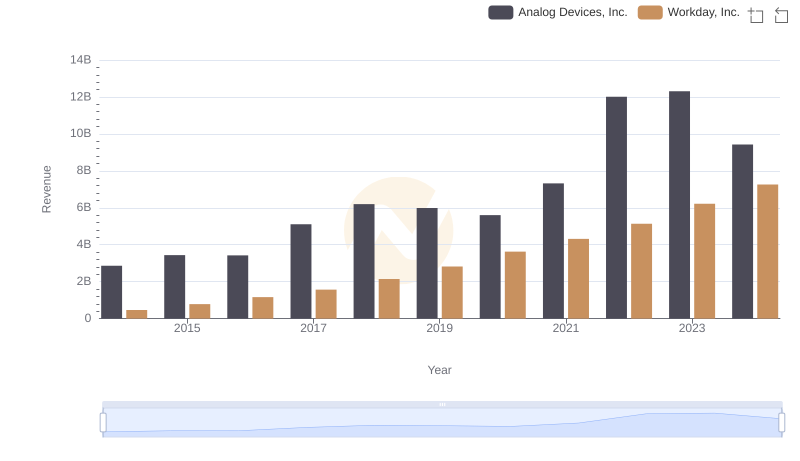

Analog Devices, Inc. vs Workday, Inc.: Examining Key Revenue Metrics

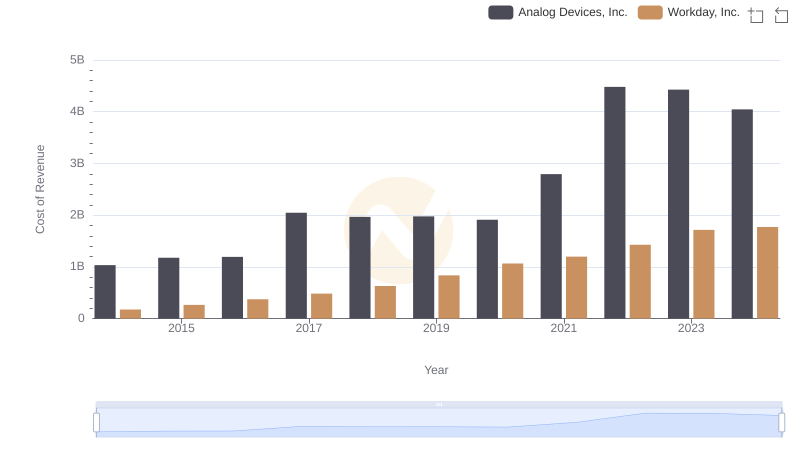

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Workday, Inc.

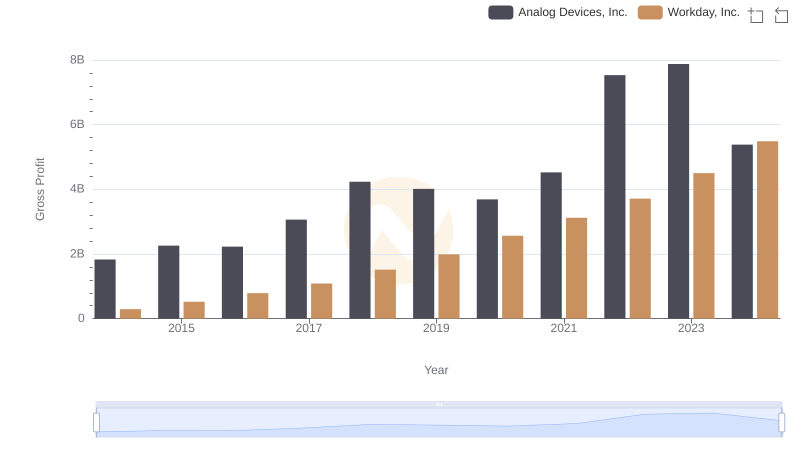

Analog Devices, Inc. vs Workday, Inc.: A Gross Profit Performance Breakdown

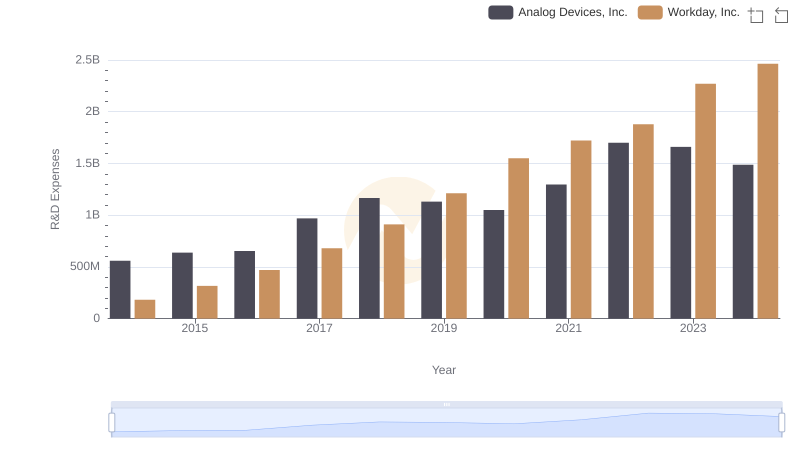

Analog Devices, Inc. or Workday, Inc.: Who Invests More in Innovation?

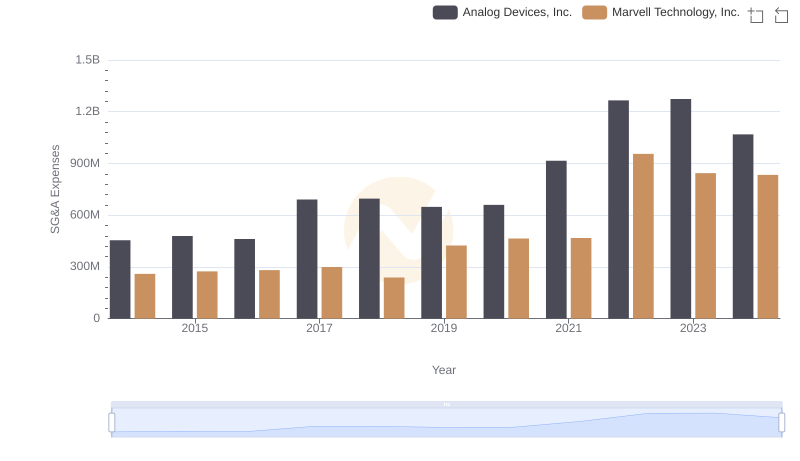

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

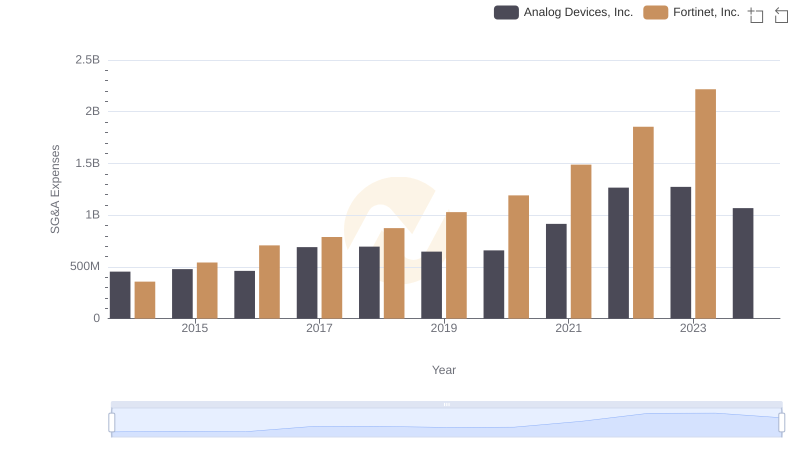

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.

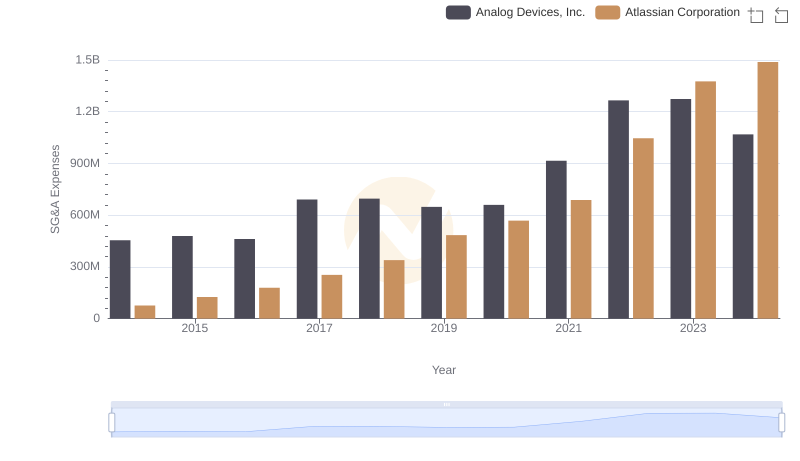

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Atlassian Corporation

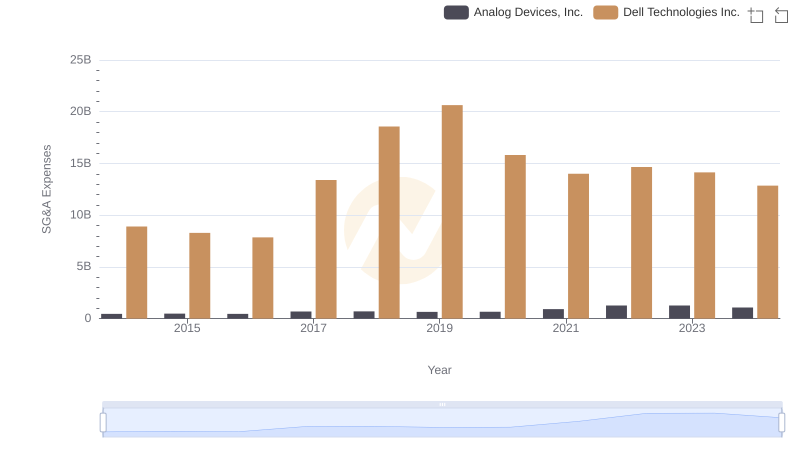

Breaking Down SG&A Expenses: Analog Devices, Inc. vs Dell Technologies Inc.

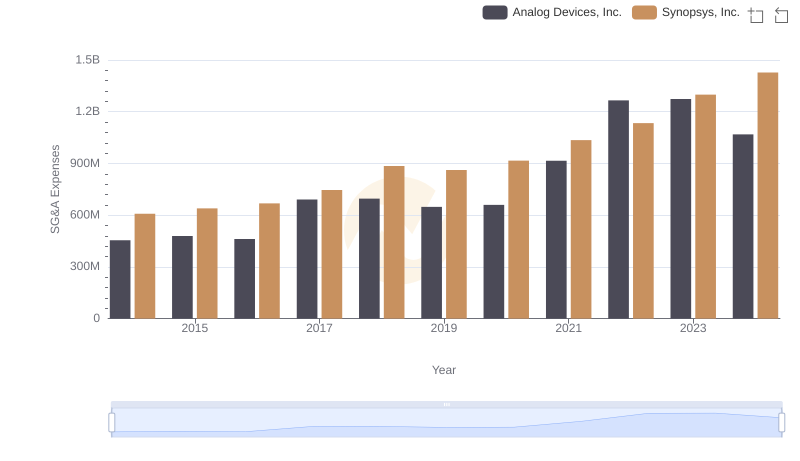

Analog Devices, Inc. vs Synopsys, Inc.: SG&A Expense Trends

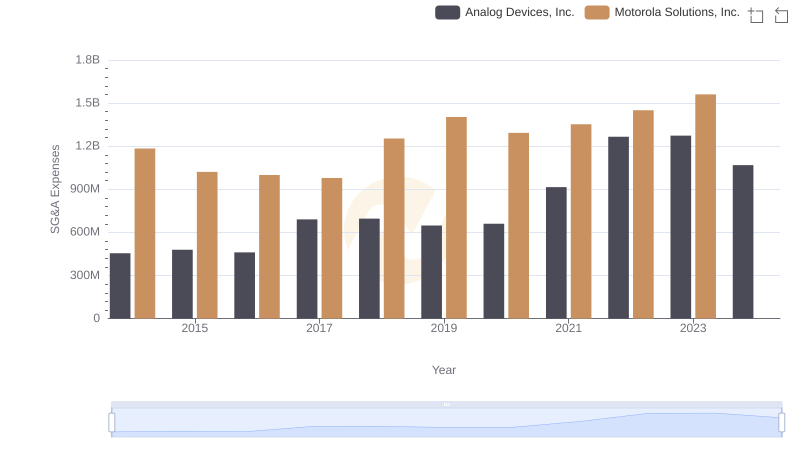

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Motorola Solutions, Inc.

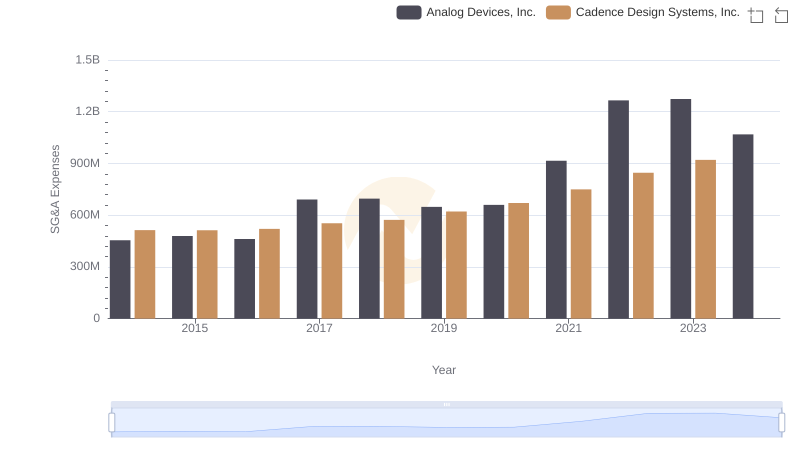

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or Cadence Design Systems, Inc.

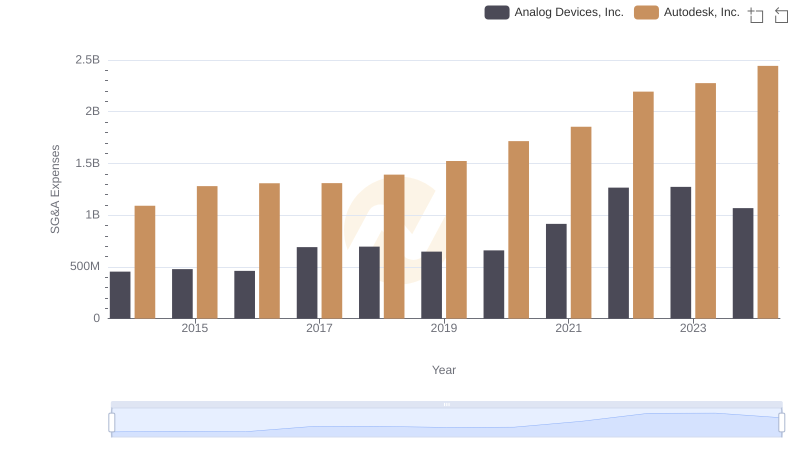

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Autodesk, Inc.