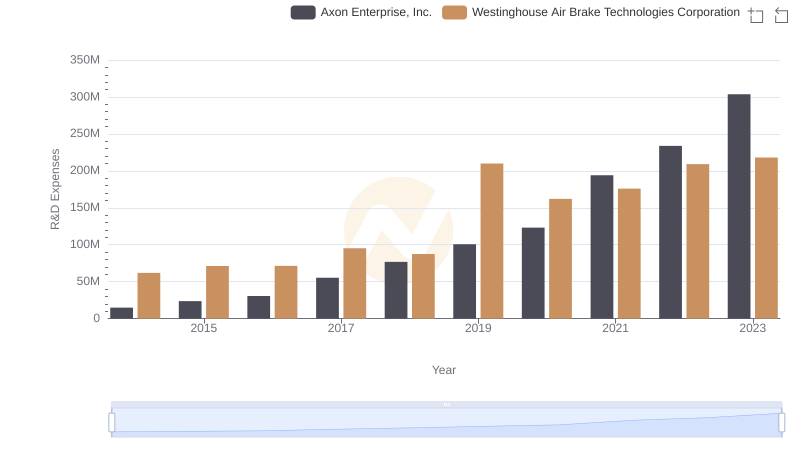

| __timestamp | Axon Enterprise, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 913534000 |

| Thursday, January 1, 2015 | 128647000 | 1026153000 |

| Friday, January 1, 2016 | 170536000 | 901541000 |

| Sunday, January 1, 2017 | 207088000 | 1040597000 |

| Monday, January 1, 2018 | 258583000 | 1211731000 |

| Tuesday, January 1, 2019 | 307286000 | 2077600000 |

| Wednesday, January 1, 2020 | 416331000 | 1898700000 |

| Friday, January 1, 2021 | 540910000 | 2135000000 |

| Saturday, January 1, 2022 | 728638000 | 2292000000 |

| Sunday, January 1, 2023 | 955382000 | 2944000000 |

| Monday, January 1, 2024 | 3366000000 |

Cracking the code

In the ever-evolving landscape of industrial technology, Axon Enterprise, Inc. and Westinghouse Air Brake Technologies Corporation have demonstrated remarkable growth over the past decade. From 2014 to 2023, Axon Enterprise's gross profit surged by an impressive 840%, reflecting its strategic innovations and market expansion. Meanwhile, Westinghouse Air Brake Technologies, a stalwart in the transportation sector, saw a robust 220% increase in gross profit, underscoring its resilience and adaptability.

This data highlights the dynamic nature of industrial growth and the strategic prowess of these two companies.

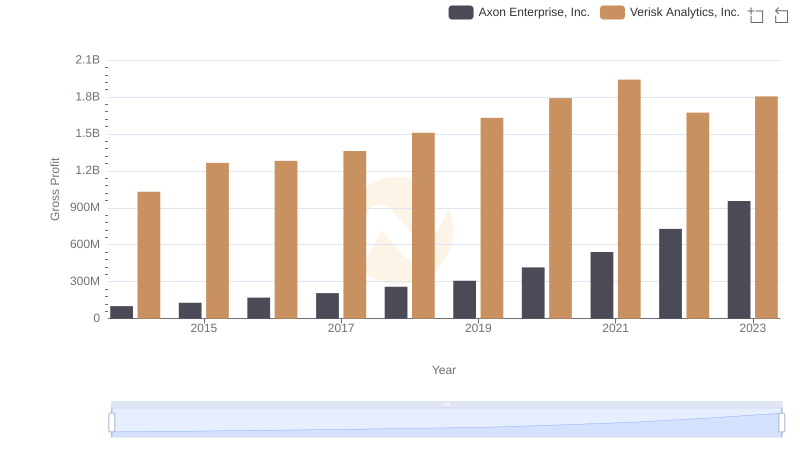

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Verisk Analytics, Inc.

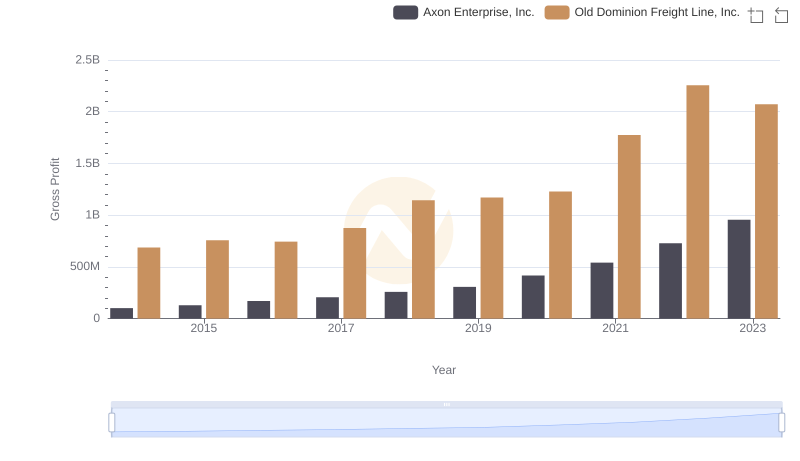

Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.: A Gross Profit Performance Breakdown

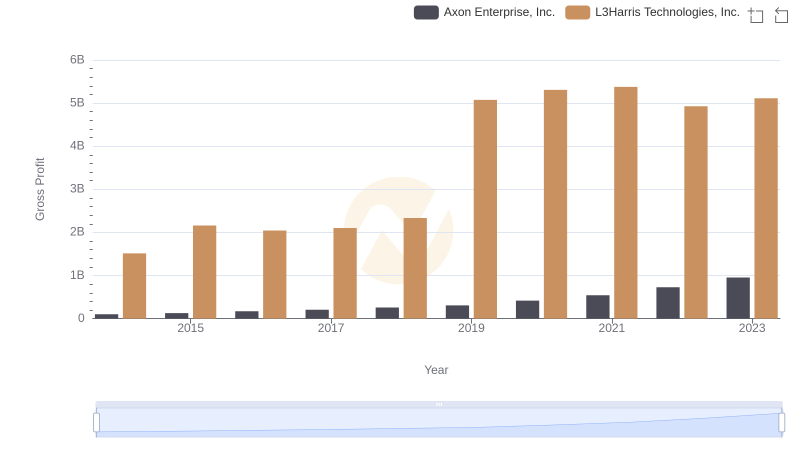

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: A Gross Profit Performance Breakdown

Gross Profit Trends Compared: Axon Enterprise, Inc. vs AMETEK, Inc.

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Ferguson plc

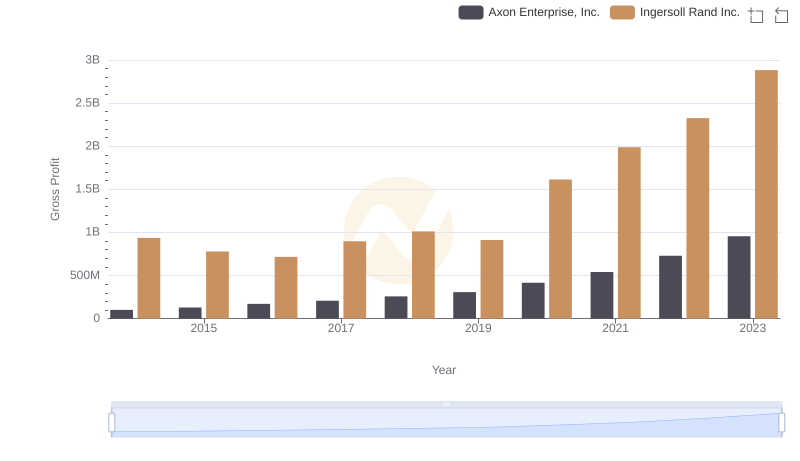

Axon Enterprise, Inc. and Ingersoll Rand Inc.: A Detailed Gross Profit Analysis

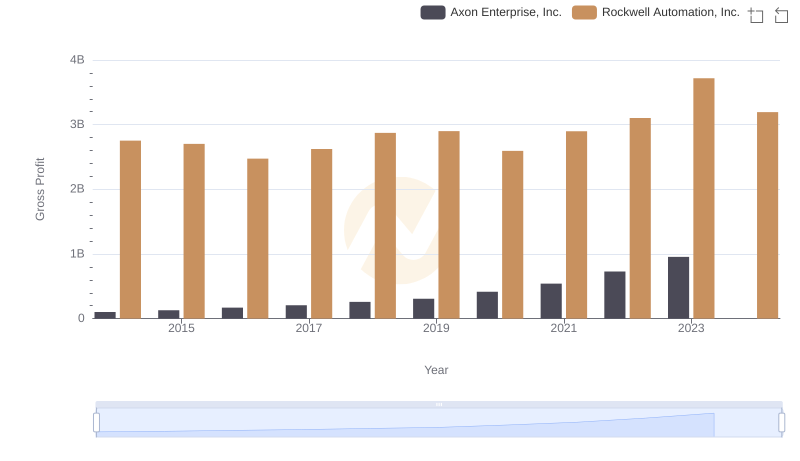

Axon Enterprise, Inc. and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis

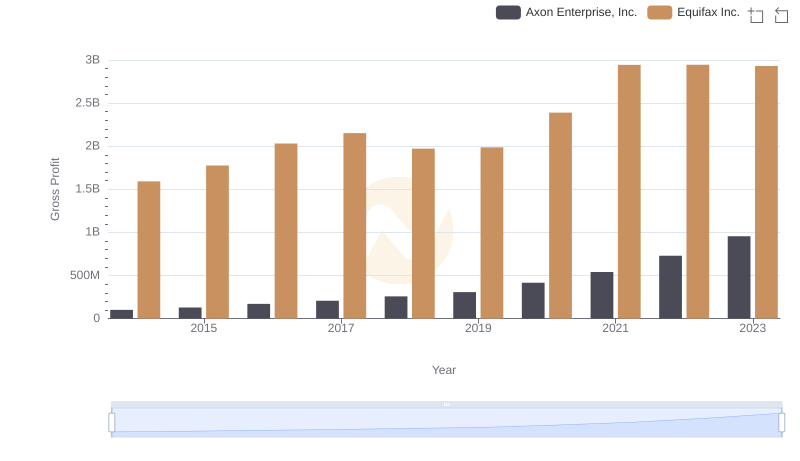

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Equifax Inc.

Axon Enterprise, Inc. or Westinghouse Air Brake Technologies Corporation: Who Invests More in Innovation?

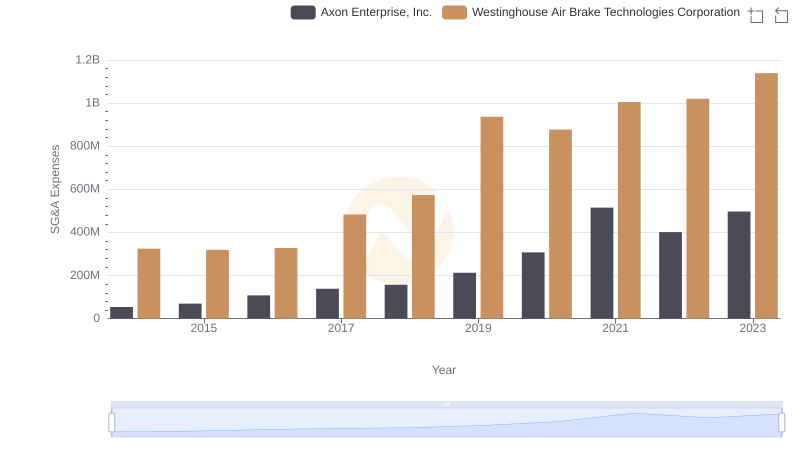

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation