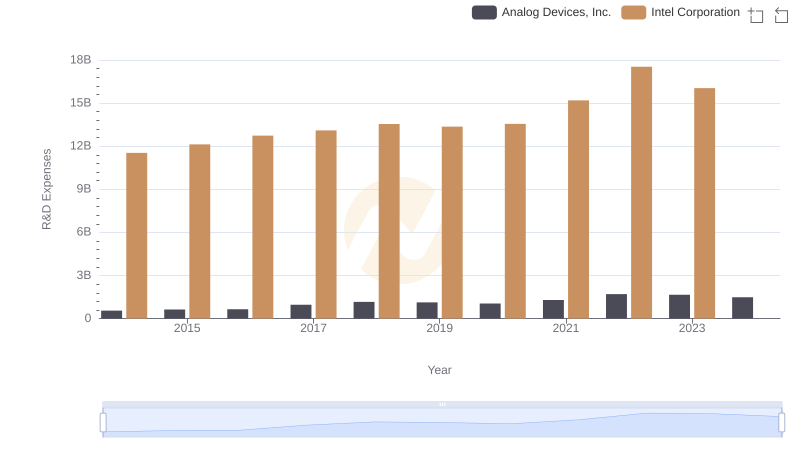

| __timestamp | Analog Devices, Inc. | Intel Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 943421000 | 24191000000 |

| Thursday, January 1, 2015 | 1059384000 | 23067000000 |

| Friday, January 1, 2016 | 1255468000 | 22795000000 |

| Sunday, January 1, 2017 | 1665464000 | 26563000000 |

| Monday, January 1, 2018 | 2706642000 | 32329000000 |

| Tuesday, January 1, 2019 | 2527491000 | 33254000000 |

| Wednesday, January 1, 2020 | 2317701000 | 36115000000 |

| Friday, January 1, 2021 | 2600723000 | 33874000000 |

| Saturday, January 1, 2022 | 5611579000 | 15610000000 |

| Sunday, January 1, 2023 | 6150827000 | 11242000000 |

| Monday, January 1, 2024 | 2032798000 | 1203000000 |

Unlocking the unknown

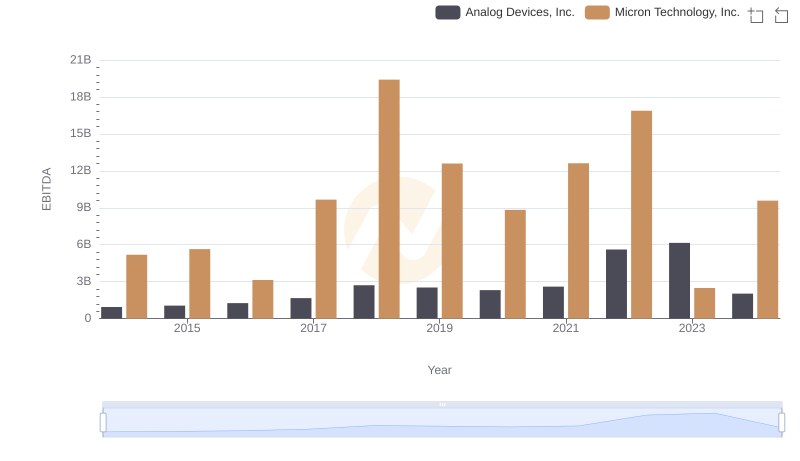

In the ever-evolving landscape of semiconductor giants, Analog Devices, Inc. and Intel Corporation have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, Intel's EBITDA consistently outpaced Analog Devices, with Intel peaking in 2020 at over three times Analog's highest mark. However, a notable shift occurred in 2022, when Analog Devices surged by 116% from the previous year, while Intel's EBITDA halved, reflecting a significant market shift. This trend continued into 2023, with Analog Devices maintaining its momentum, while Intel's figures dwindled further. The data highlights a pivotal moment in the semiconductor industry, where agility and innovation are reshaping traditional hierarchies. As we look to the future, the question remains: will Analog Devices continue its upward trajectory, or will Intel reclaim its dominance? Stay tuned as these industry titans navigate the challenges and opportunities of the digital age.

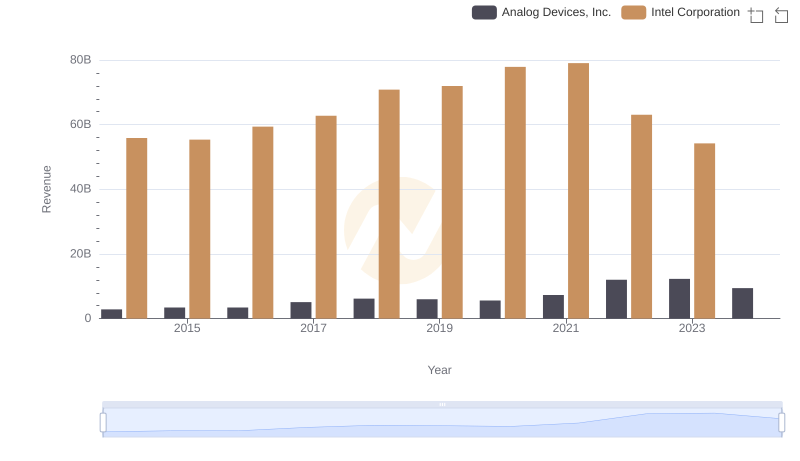

Revenue Insights: Analog Devices, Inc. and Intel Corporation Performance Compared

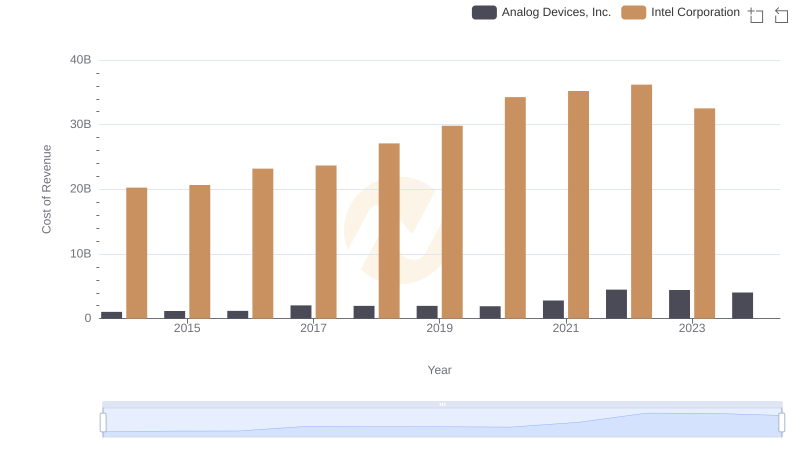

Cost of Revenue: Key Insights for Analog Devices, Inc. and Intel Corporation

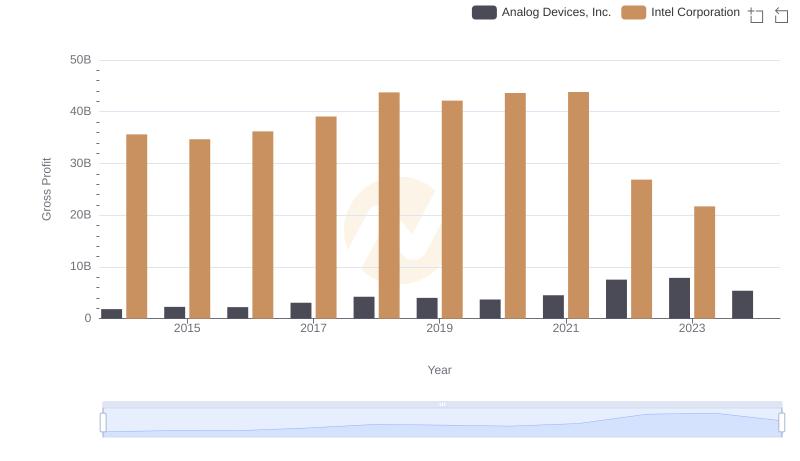

Who Generates Higher Gross Profit? Analog Devices, Inc. or Intel Corporation

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Micron Technology, Inc.

Research and Development Investment: Analog Devices, Inc. vs Intel Corporation

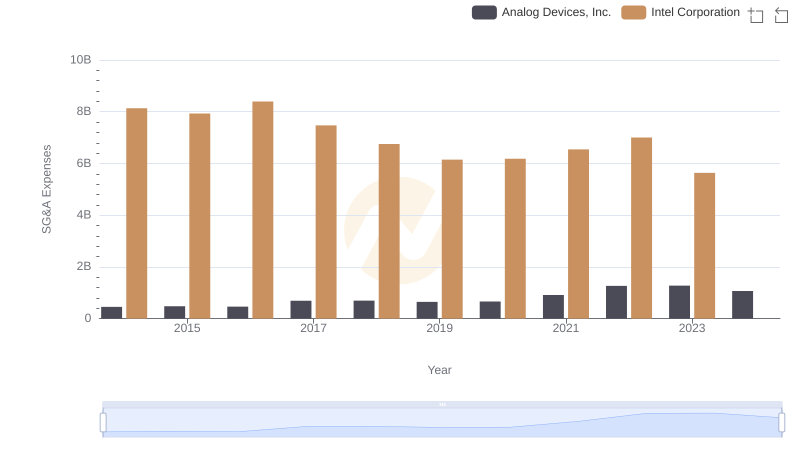

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Intel Corporation

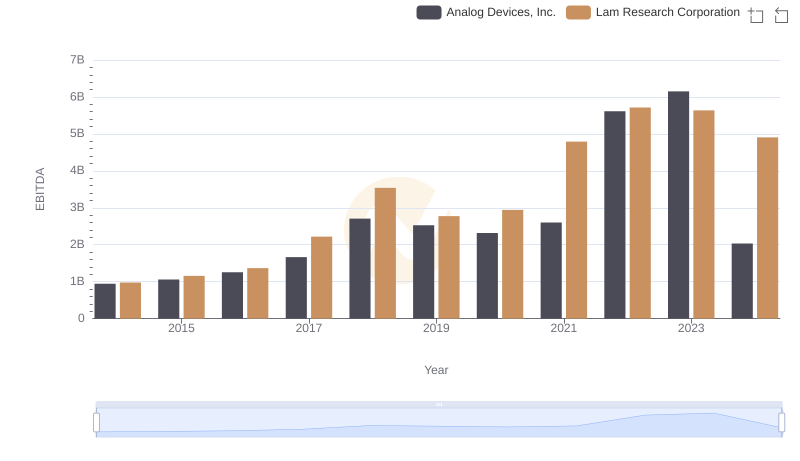

Analog Devices, Inc. vs Lam Research Corporation: In-Depth EBITDA Performance Comparison

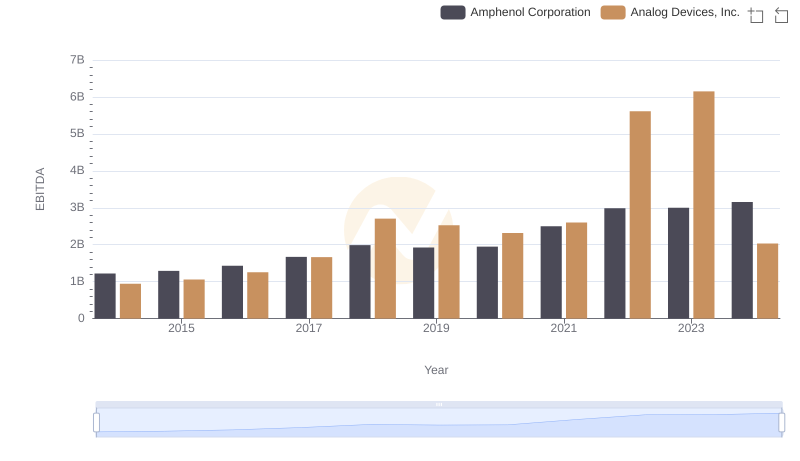

EBITDA Performance Review: Analog Devices, Inc. vs Amphenol Corporation

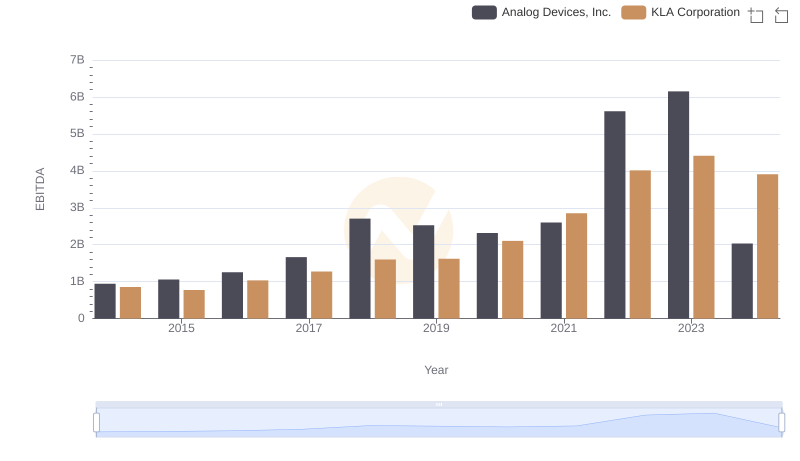

EBITDA Metrics Evaluated: Analog Devices, Inc. vs KLA Corporation

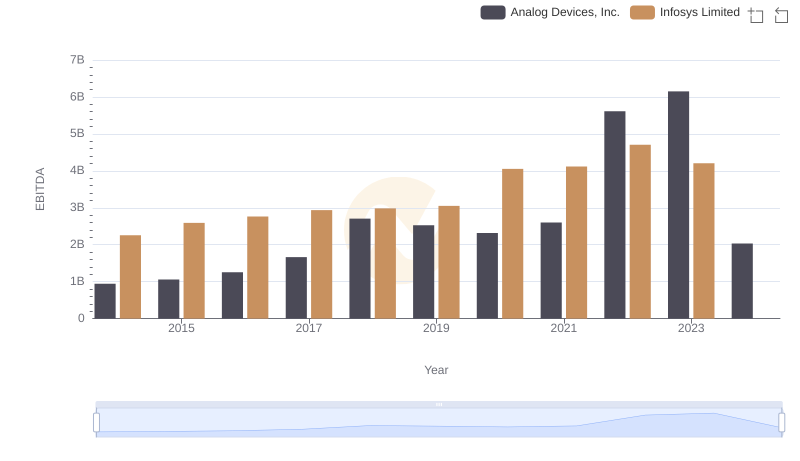

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Infosys Limited

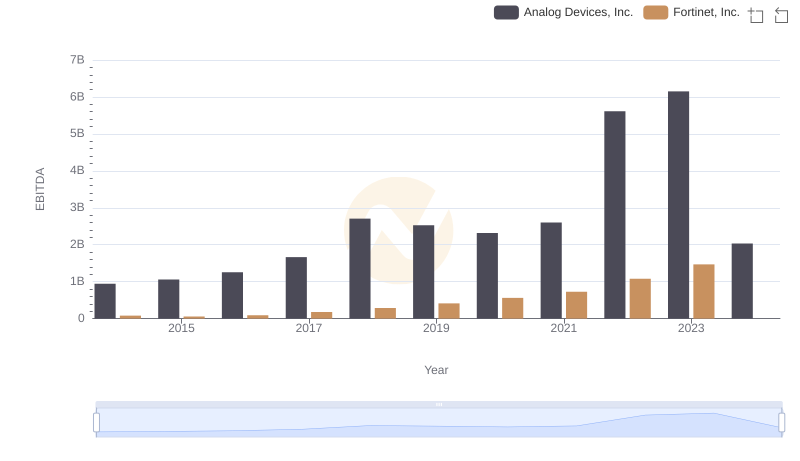

Analog Devices, Inc. and Fortinet, Inc.: A Detailed Examination of EBITDA Performance

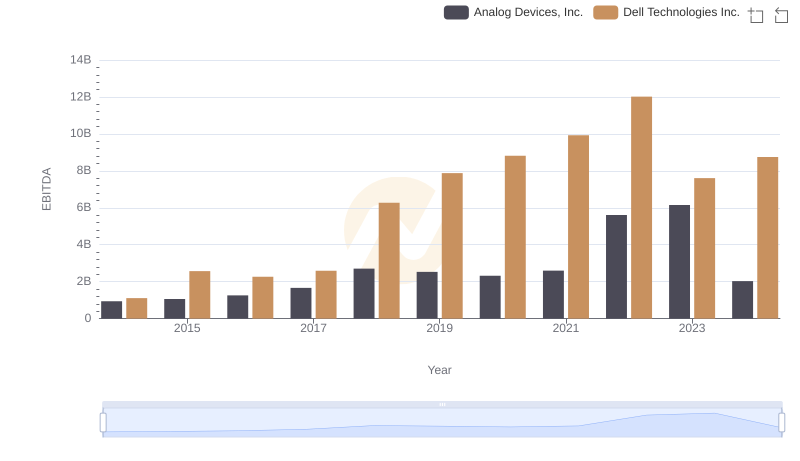

Analog Devices, Inc. vs Dell Technologies Inc.: In-Depth EBITDA Performance Comparison