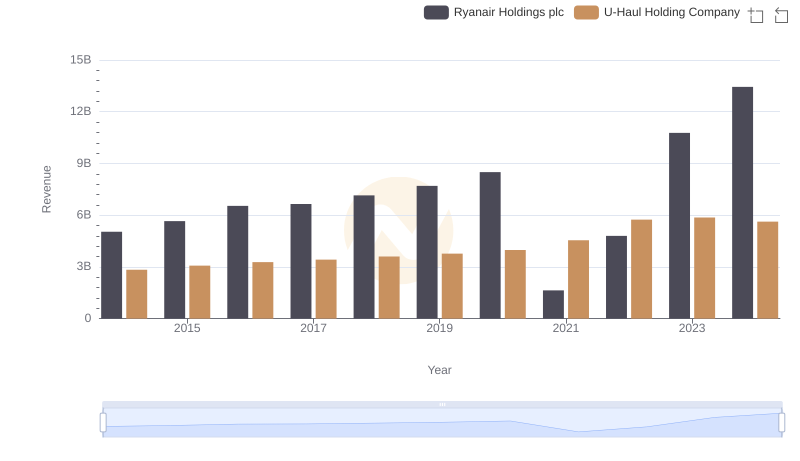

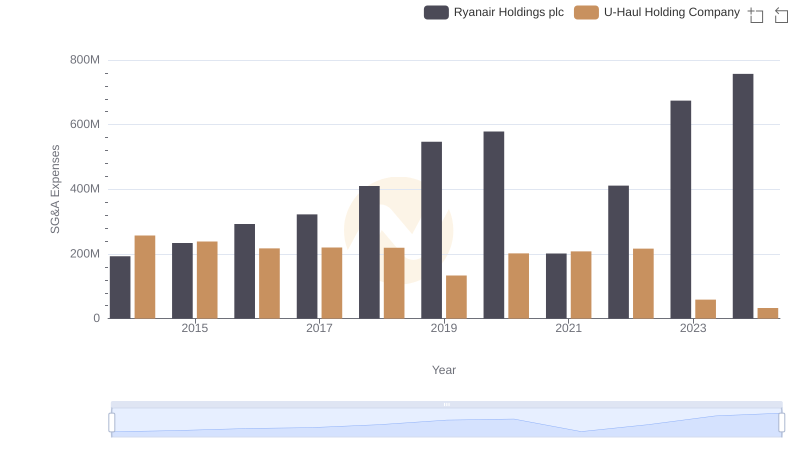

| __timestamp | Ryanair Holdings plc | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 3838100000 | 127270000 |

| Thursday, January 1, 2015 | 3999600000 | 146072000 |

| Friday, January 1, 2016 | 4355900000 | 144990000 |

| Sunday, January 1, 2017 | 4294000000 | 152485000 |

| Monday, January 1, 2018 | 4512300000 | 160489000 |

| Tuesday, January 1, 2019 | 5492800000 | 162142000 |

| Wednesday, January 1, 2020 | 6039900000 | 164018000 |

| Friday, January 1, 2021 | 1702700000 | 214059000 |

| Saturday, January 1, 2022 | 4009800000 | 259585000 |

| Sunday, January 1, 2023 | 7735000000 | 844894000 |

| Monday, January 1, 2024 | 9566400000 | 3976040000 |

Igniting the spark of knowledge

In the ever-evolving landscape of business efficiency, Ryanair Holdings plc and U-Haul Holding Company present a fascinating study in cost management. Over the past decade, Ryanair has consistently demonstrated a robust approach to managing its cost of revenue, with a notable increase of approximately 150% from 2014 to 2024. This growth reflects Ryanair's strategic focus on cost efficiency, crucial for maintaining its competitive edge in the airline industry.

Conversely, U-Haul, a leader in the moving and storage sector, has shown a more modest increase in its cost of revenue, rising by about 300% over the same period. This indicates a different operational strategy, possibly driven by expansion and increased service offerings. The data highlights the contrasting approaches of these two giants, offering valuable insights into how industry-specific factors influence financial strategies.

Breaking Down Revenue Trends: Ryanair Holdings plc vs U-Haul Holding Company

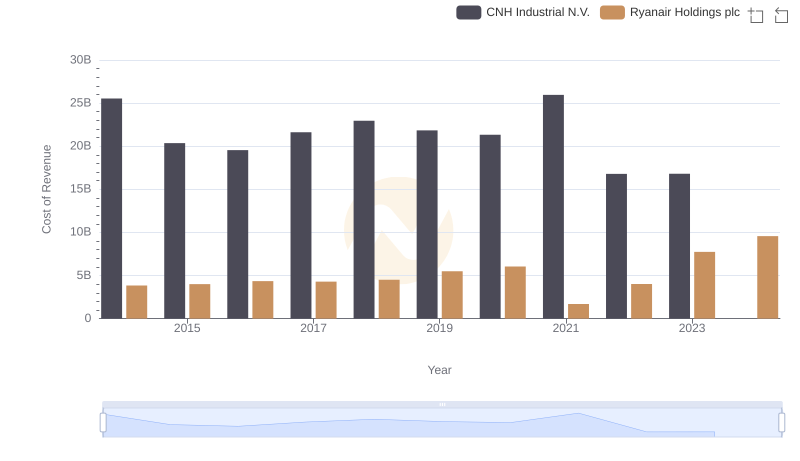

Analyzing Cost of Revenue: Ryanair Holdings plc and CNH Industrial N.V.

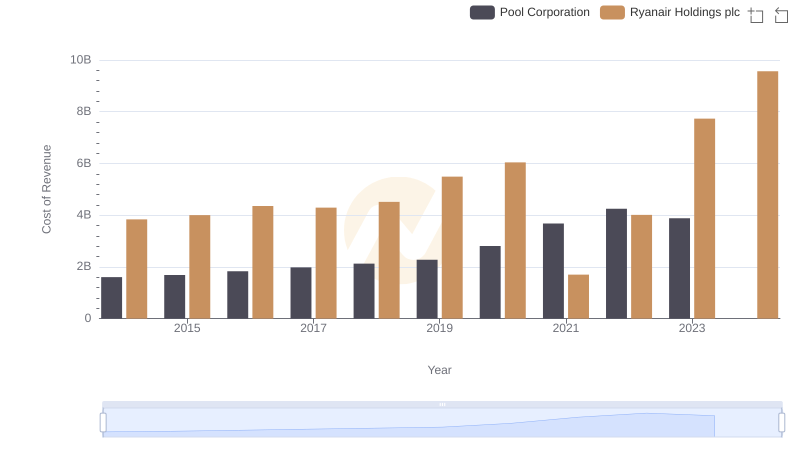

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

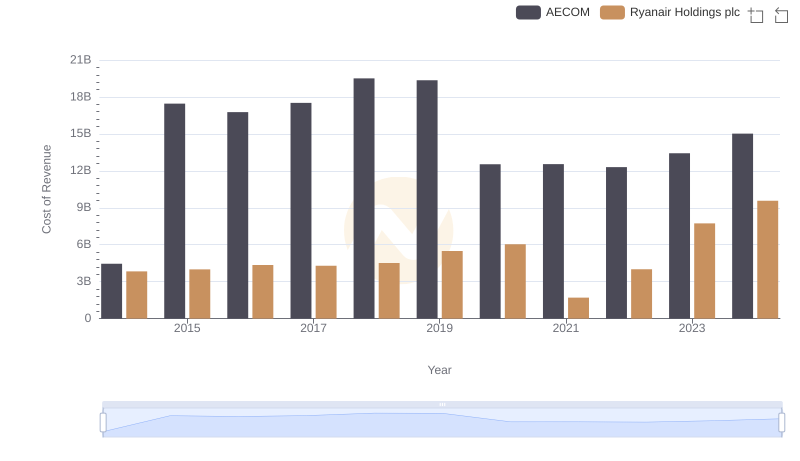

Cost Insights: Breaking Down Ryanair Holdings plc and AECOM's Expenses

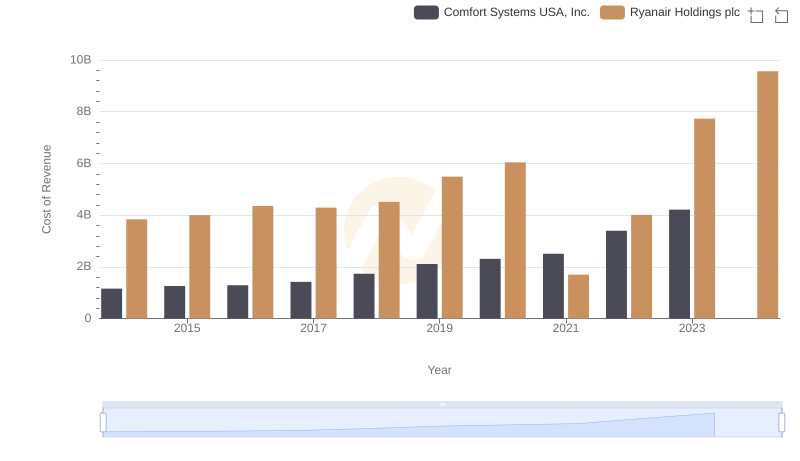

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

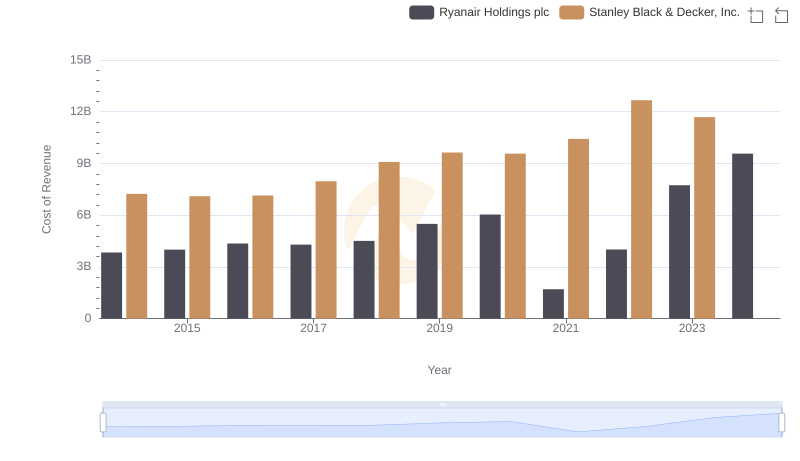

Cost of Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

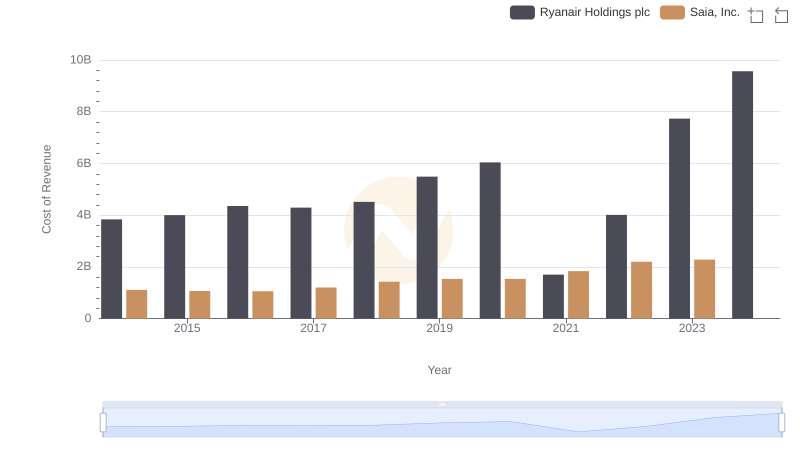

Cost of Revenue: Key Insights for Ryanair Holdings plc and Saia, Inc.

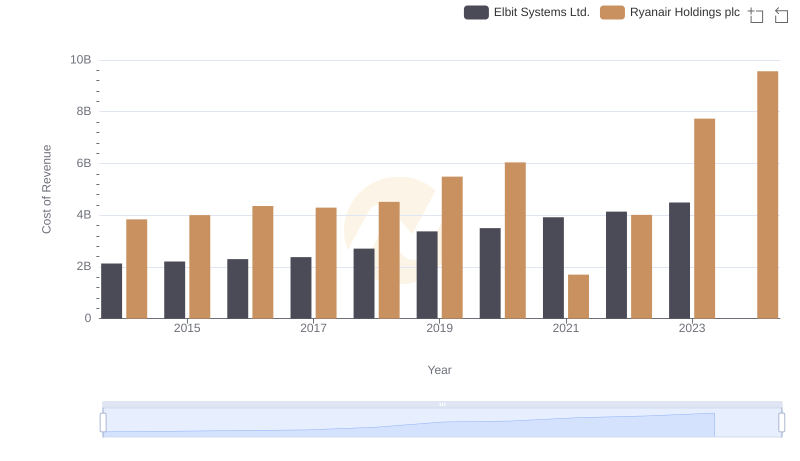

Analyzing Cost of Revenue: Ryanair Holdings plc and Elbit Systems Ltd.

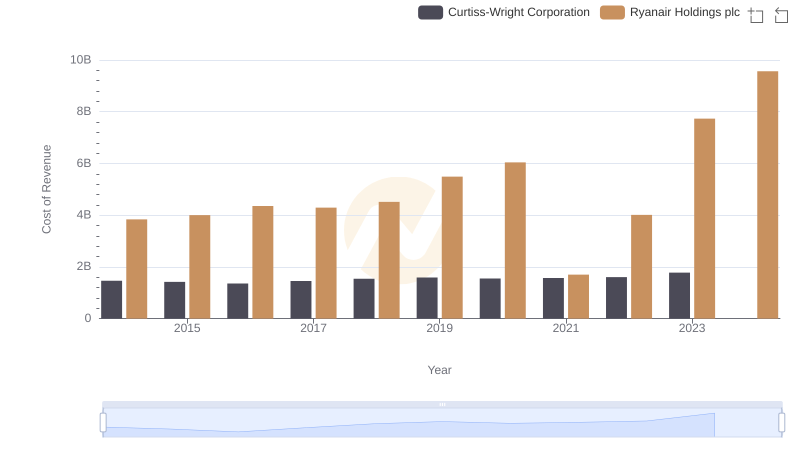

Cost of Revenue Trends: Ryanair Holdings plc vs Curtiss-Wright Corporation

Selling, General, and Administrative Costs: Ryanair Holdings plc vs U-Haul Holding Company

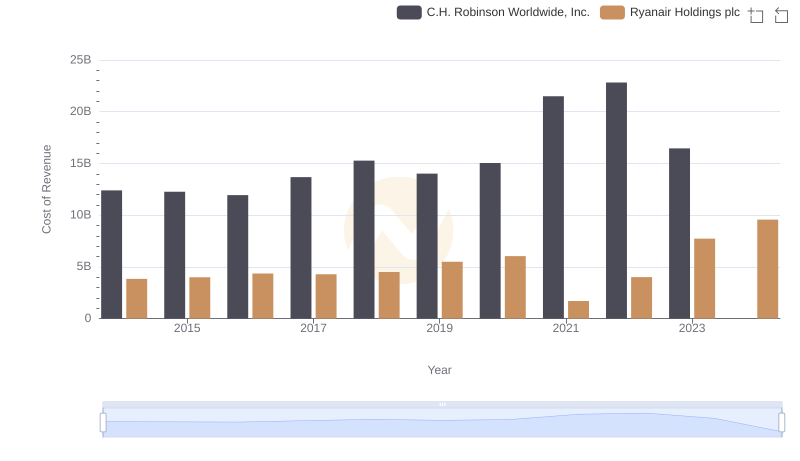

Cost Insights: Breaking Down Ryanair Holdings plc and C.H. Robinson Worldwide, Inc.'s Expenses

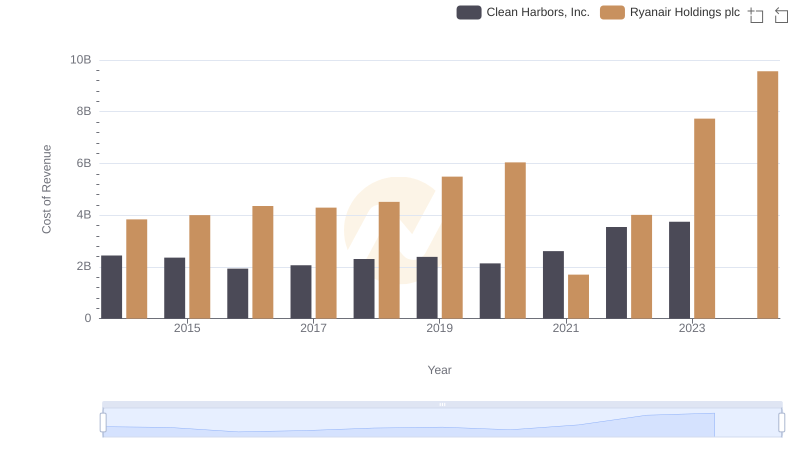

Cost of Revenue Trends: Ryanair Holdings plc vs Clean Harbors, Inc.