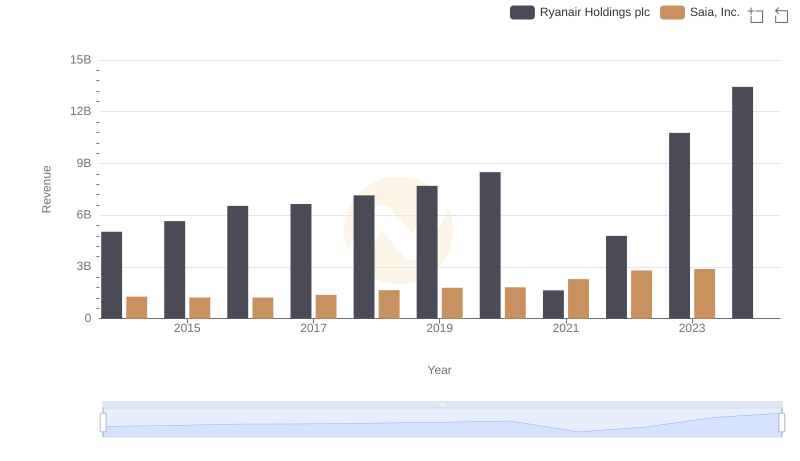

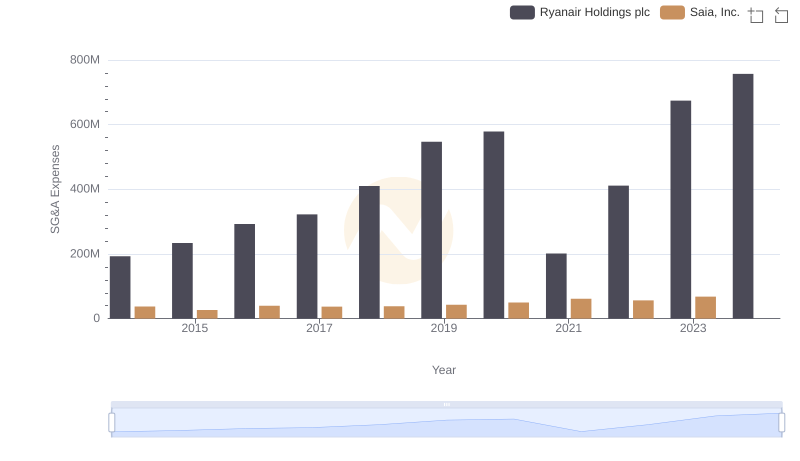

| __timestamp | Ryanair Holdings plc | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838100000 | 1113053000 |

| Thursday, January 1, 2015 | 3999600000 | 1067191000 |

| Friday, January 1, 2016 | 4355900000 | 1058979000 |

| Sunday, January 1, 2017 | 4294000000 | 1203464000 |

| Monday, January 1, 2018 | 4512300000 | 1423779000 |

| Tuesday, January 1, 2019 | 5492800000 | 1537082000 |

| Wednesday, January 1, 2020 | 6039900000 | 1538518000 |

| Friday, January 1, 2021 | 1702700000 | 1837017000 |

| Saturday, January 1, 2022 | 4009800000 | 2201094000 |

| Sunday, January 1, 2023 | 7735000000 | 2282501000 |

| Monday, January 1, 2024 | 9566400000 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. Ryanair Holdings plc, a leader in the airline industry, and Saia, Inc., a prominent player in the logistics sector, offer intriguing insights into cost management over the past decade.

From 2014 to 2023, Ryanair's cost of revenue surged by approximately 150%, peaking in 2023 with a remarkable increase to nearly 9.6 billion. This growth reflects the airline's strategic expansion and operational adjustments. In contrast, Saia, Inc. experienced a steady rise, with a 105% increase over the same period, reaching its highest in 2023 at 2.3 billion. Notably, 2021 marked a significant dip for Ryanair, likely due to pandemic-related disruptions, while Saia showed resilience with consistent growth.

These trends underscore the dynamic nature of cost management in different industries, highlighting the importance of strategic planning and adaptability.

Comparing Revenue Performance: Ryanair Holdings plc or Saia, Inc.?

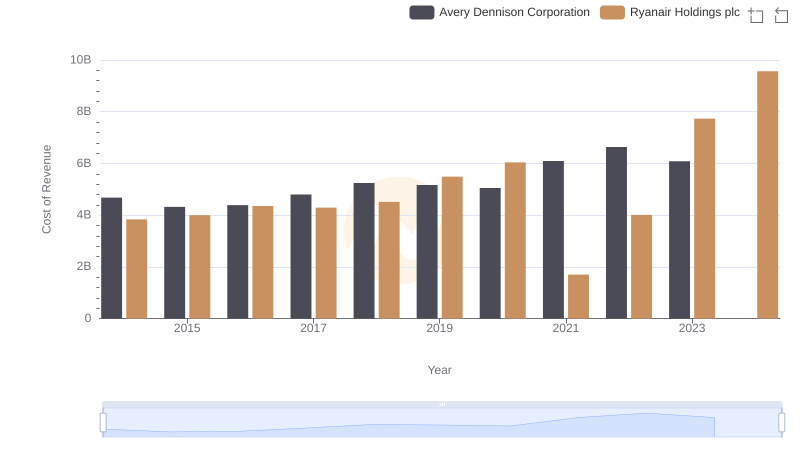

Ryanair Holdings plc vs Avery Dennison Corporation: Efficiency in Cost of Revenue Explored

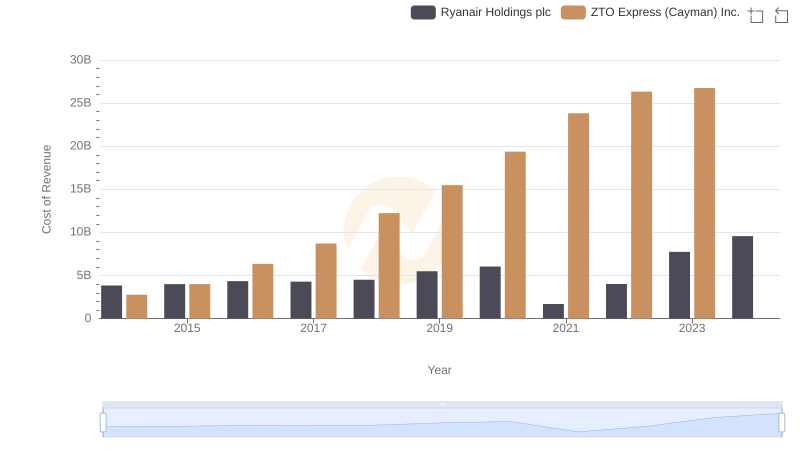

Cost Insights: Breaking Down Ryanair Holdings plc and ZTO Express (Cayman) Inc.'s Expenses

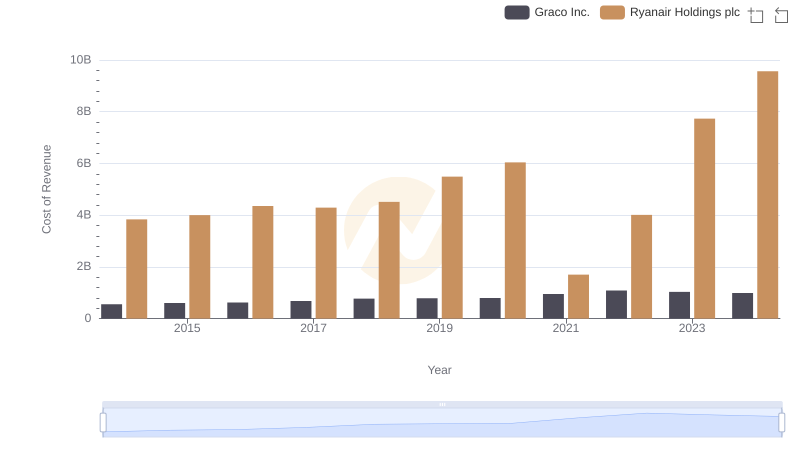

Ryanair Holdings plc vs Graco Inc.: Efficiency in Cost of Revenue Explored

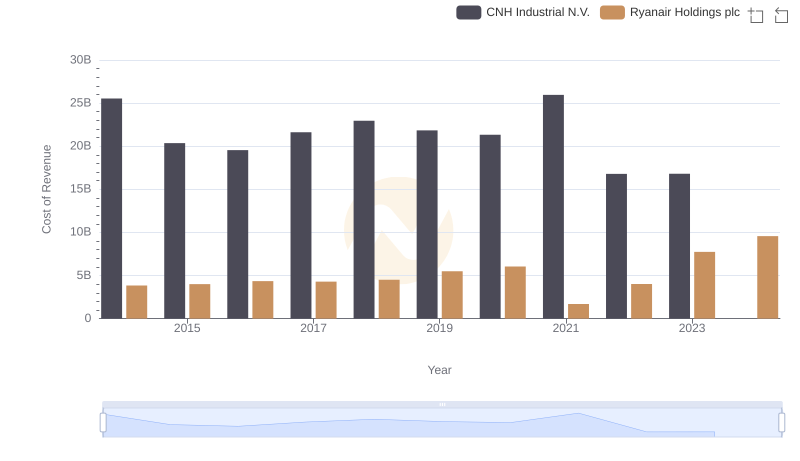

Analyzing Cost of Revenue: Ryanair Holdings plc and CNH Industrial N.V.

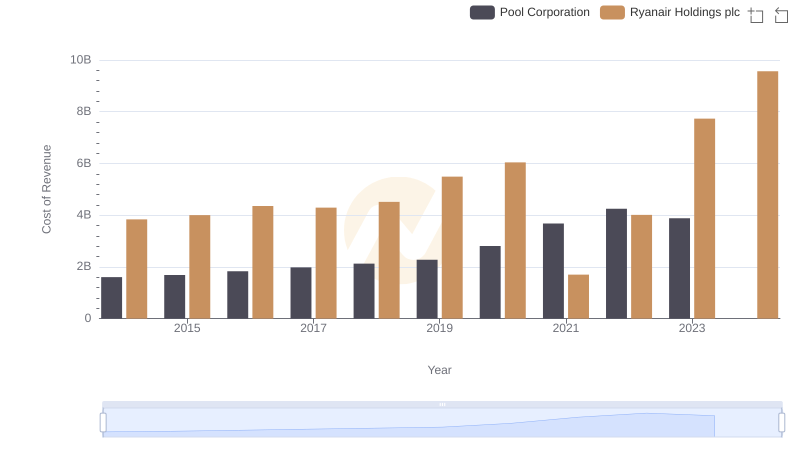

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

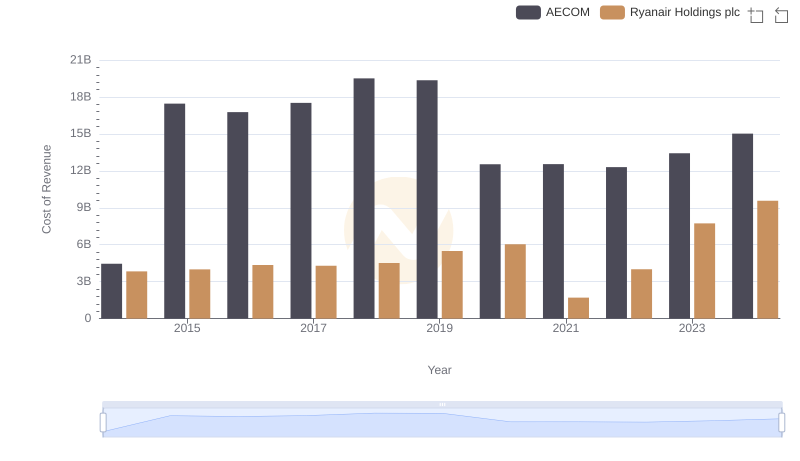

Cost Insights: Breaking Down Ryanair Holdings plc and AECOM's Expenses

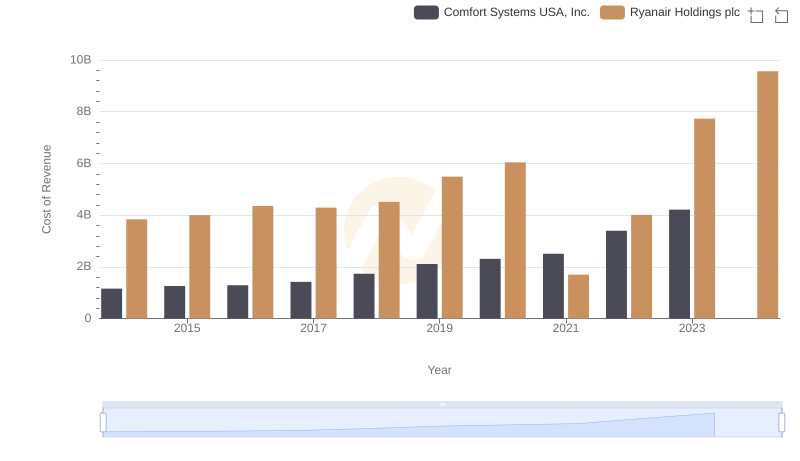

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

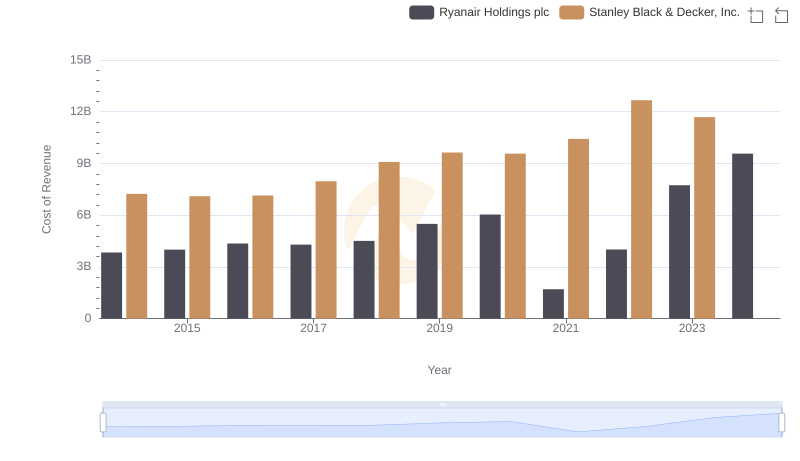

Cost of Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

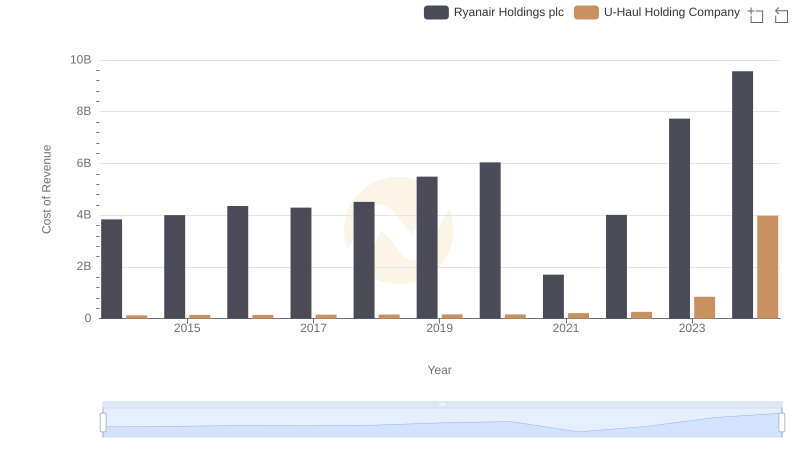

Ryanair Holdings plc vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

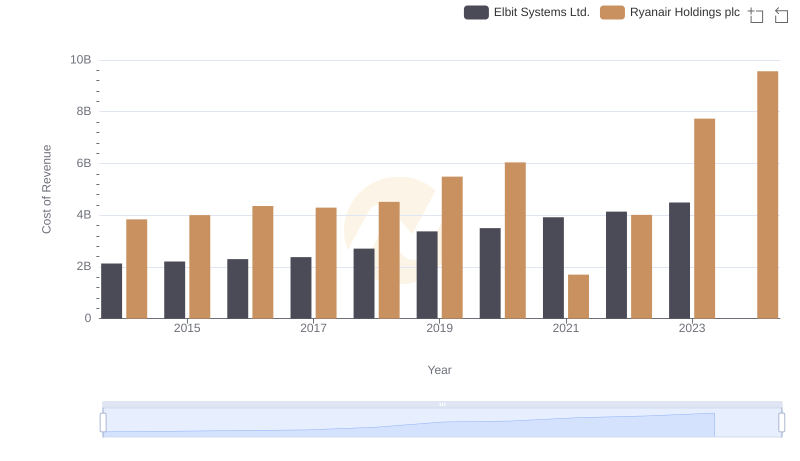

Analyzing Cost of Revenue: Ryanair Holdings plc and Elbit Systems Ltd.

Ryanair Holdings plc vs Saia, Inc.: SG&A Expense Trends