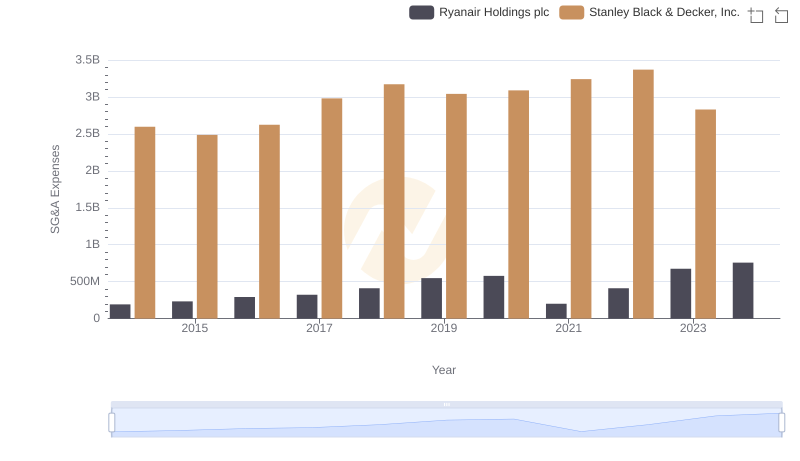

| __timestamp | Ryanair Holdings plc | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838100000 | 7235900000 |

| Thursday, January 1, 2015 | 3999600000 | 7099800000 |

| Friday, January 1, 2016 | 4355900000 | 7139700000 |

| Sunday, January 1, 2017 | 4294000000 | 7969200000 |

| Monday, January 1, 2018 | 4512300000 | 9080500000 |

| Tuesday, January 1, 2019 | 5492800000 | 9636700000 |

| Wednesday, January 1, 2020 | 6039900000 | 9566700000 |

| Friday, January 1, 2021 | 1702700000 | 10423000000 |

| Saturday, January 1, 2022 | 4009800000 | 12663300000 |

| Sunday, January 1, 2023 | 7735000000 | 11683100000 |

| Monday, January 1, 2024 | 9566400000 | 10851300000 |

Unveiling the hidden dimensions of data

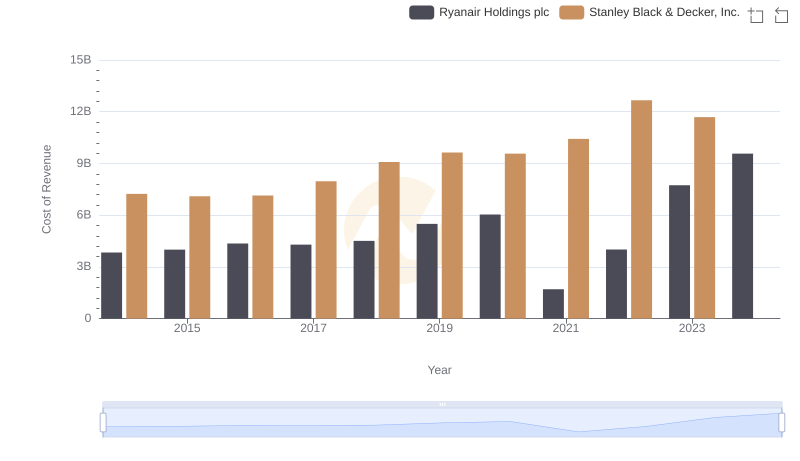

In the ever-evolving landscape of global business, Ryanair Holdings plc and Stanley Black & Decker, Inc. stand as titans in their respective industries. Over the past decade, these companies have showcased contrasting trajectories in their cost of revenue.

Ryanair, Europe's budget airline leader, has seen its cost of revenue soar by approximately 150% from 2014 to 2024. This increase reflects the airline's aggressive expansion strategy and its commitment to maintaining low fares while navigating the challenges of the aviation industry.

Meanwhile, Stanley Black & Decker, a stalwart in the tools and storage sector, experienced a more modest 60% rise in cost of revenue over the same period. This steady growth underscores the company's resilience and adaptability in a competitive market.

It's worth noting that data for Stanley Black & Decker in 2024 is currently unavailable, leaving room for speculation on its future trajectory.

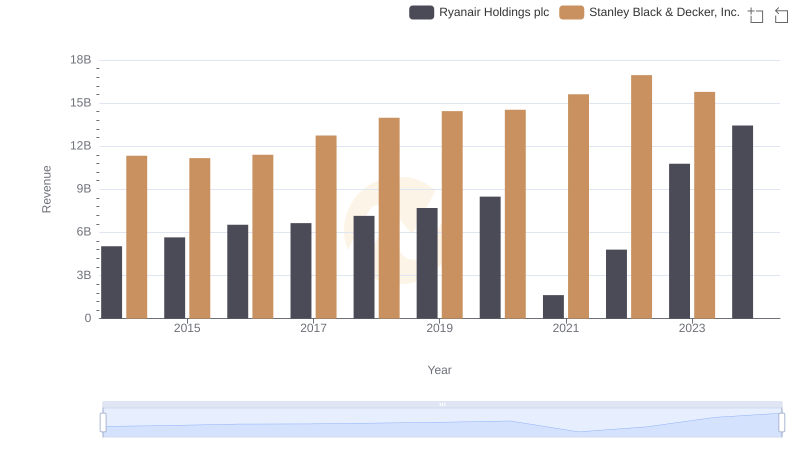

Annual Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

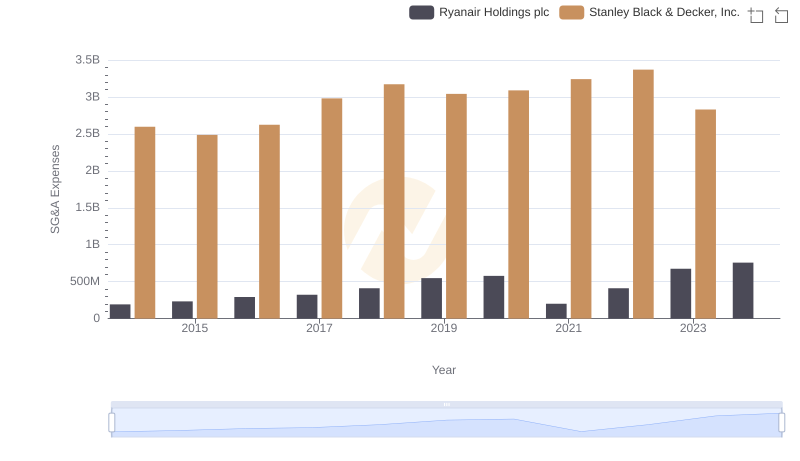

Operational Costs Compared: SG&A Analysis of Ryanair Holdings plc and Stanley Black & Decker, Inc.

Ryanair Holdings plc or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

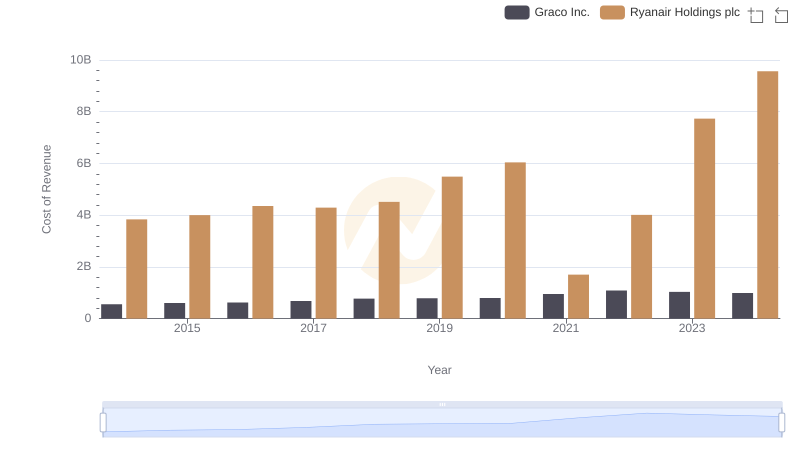

Ryanair Holdings plc vs Graco Inc.: Efficiency in Cost of Revenue Explored

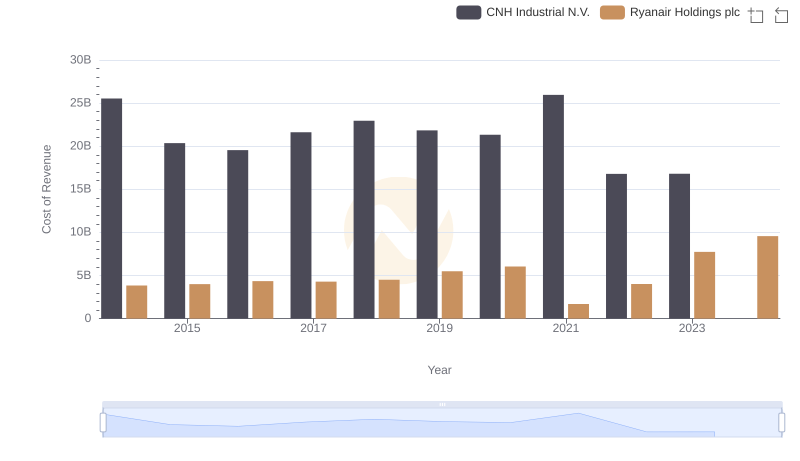

Analyzing Cost of Revenue: Ryanair Holdings plc and CNH Industrial N.V.

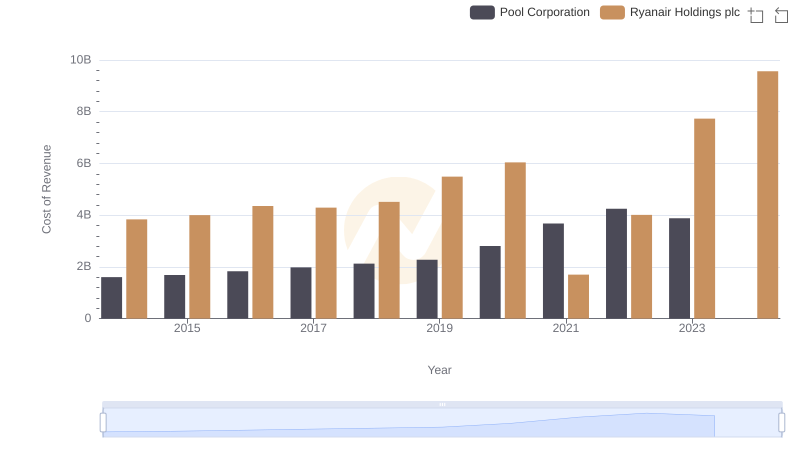

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

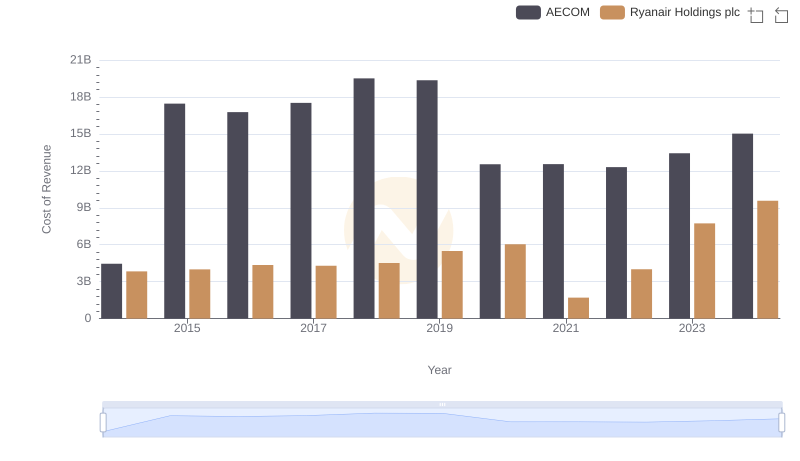

Cost Insights: Breaking Down Ryanair Holdings plc and AECOM's Expenses

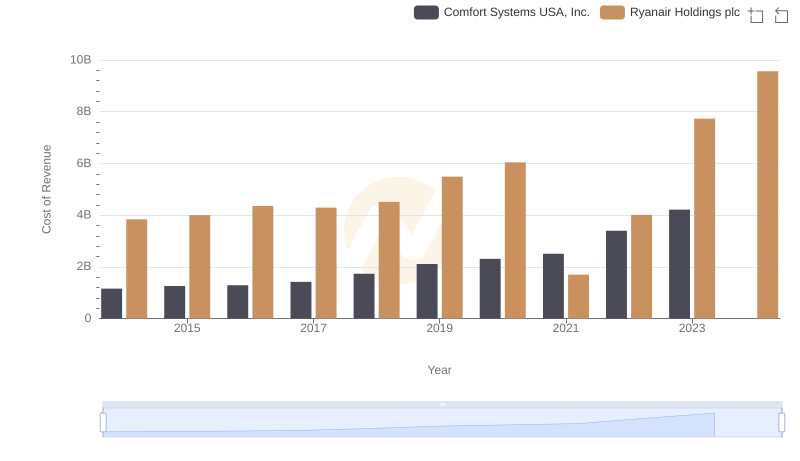

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

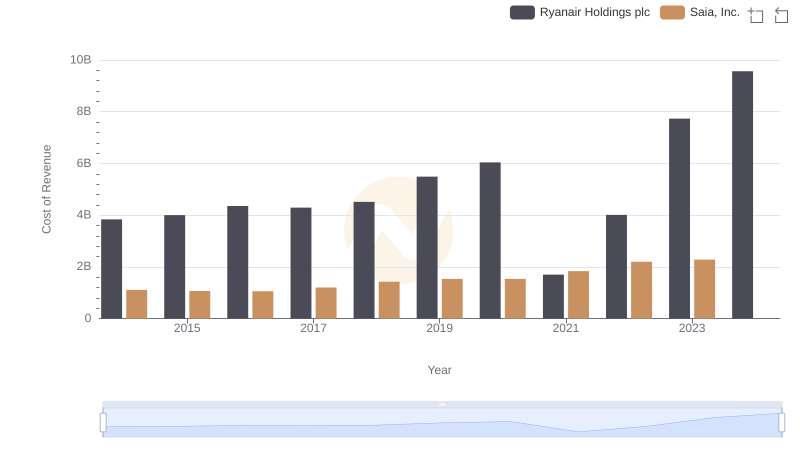

Cost of Revenue: Key Insights for Ryanair Holdings plc and Saia, Inc.

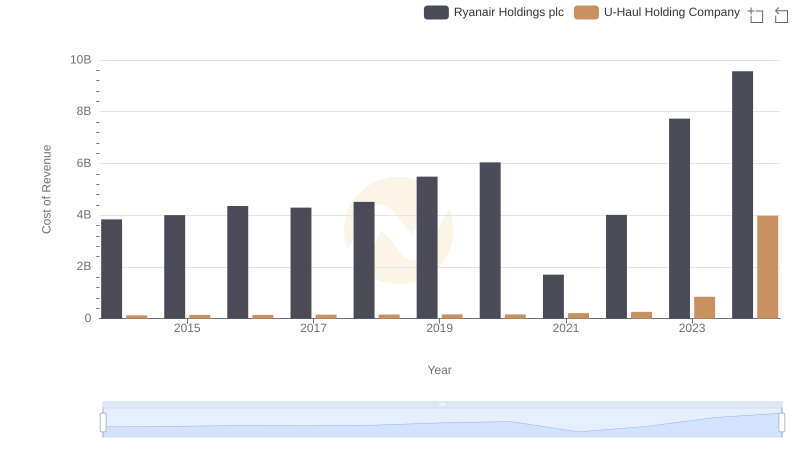

Ryanair Holdings plc vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

SG&A Efficiency Analysis: Comparing Ryanair Holdings plc and Stanley Black & Decker, Inc.