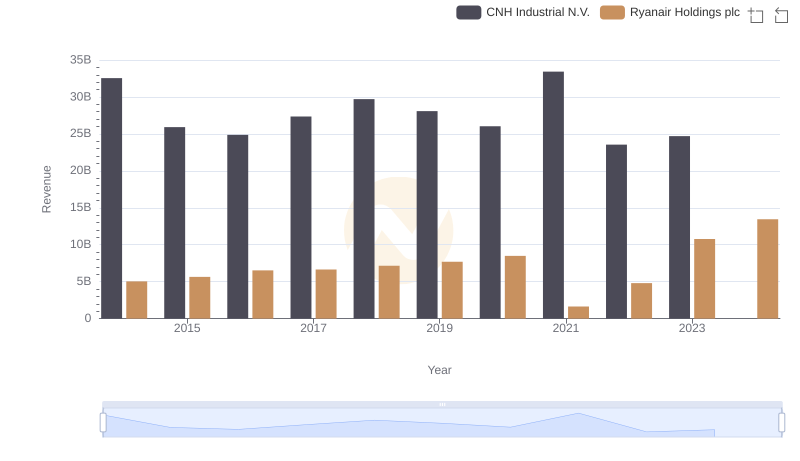

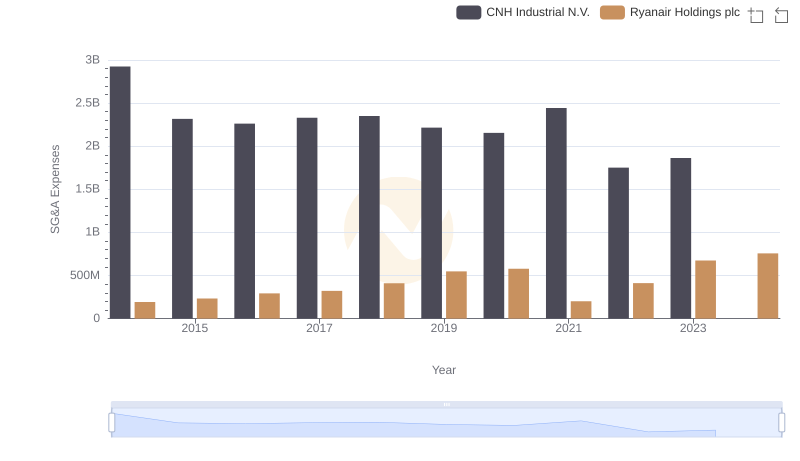

| __timestamp | CNH Industrial N.V. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 25534000000 | 3838100000 |

| Thursday, January 1, 2015 | 20357000000 | 3999600000 |

| Friday, January 1, 2016 | 19539000000 | 4355900000 |

| Sunday, January 1, 2017 | 21621000000 | 4294000000 |

| Monday, January 1, 2018 | 22958000000 | 4512300000 |

| Tuesday, January 1, 2019 | 21832000000 | 5492800000 |

| Wednesday, January 1, 2020 | 21327000000 | 6039900000 |

| Friday, January 1, 2021 | 25951000000 | 1702700000 |

| Saturday, January 1, 2022 | 16797000000 | 4009800000 |

| Sunday, January 1, 2023 | 16805000000 | 7735000000 |

| Monday, January 1, 2024 | 9566400000 |

In pursuit of knowledge

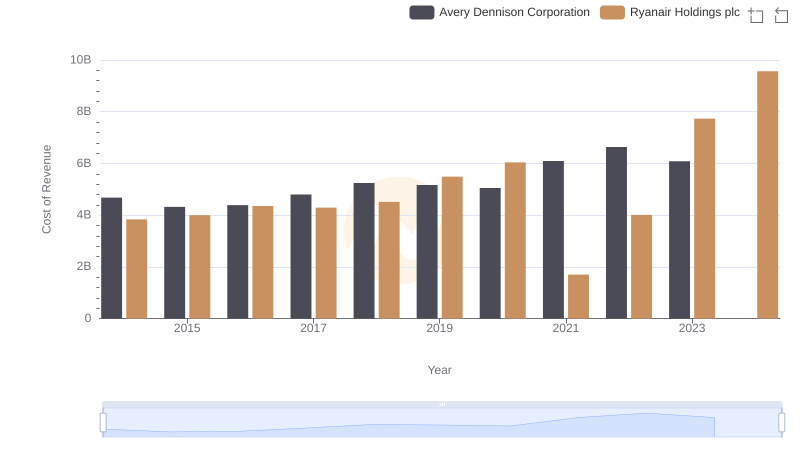

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis delves into the cost of revenue trends for Ryanair Holdings plc and CNH Industrial N.V. from 2014 to 2023.

Ryanair Holdings plc, a leader in the aviation industry, has seen a remarkable 150% increase in its cost of revenue from 2014 to 2023, peaking at approximately €9.57 billion in 2023. This surge reflects the airline's aggressive expansion and operational scaling.

Conversely, CNH Industrial N.V., a major player in the capital goods sector, experienced a 34% decline in its cost of revenue over the same period, dropping to around €16.8 billion in 2023. This reduction may indicate strategic cost management and efficiency improvements.

The data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting.

Breaking Down Revenue Trends: Ryanair Holdings plc vs CNH Industrial N.V.

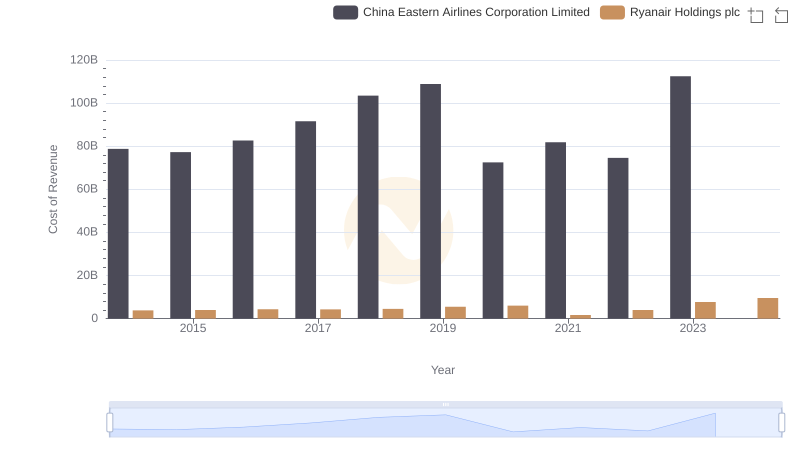

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: Efficiency in Cost of Revenue Explored

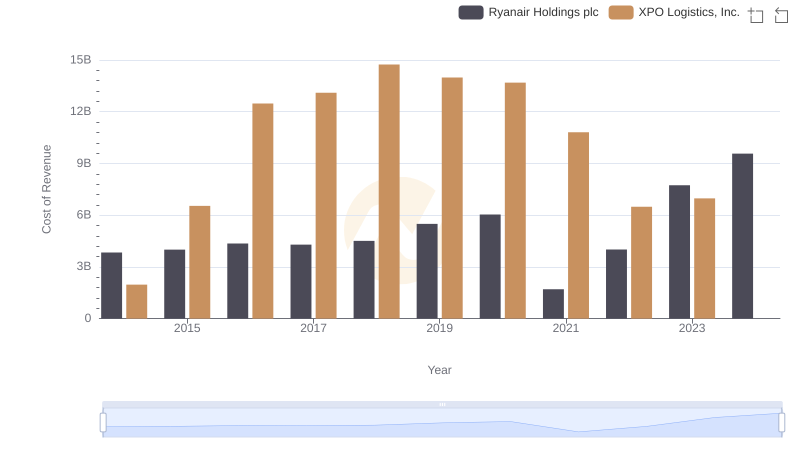

Cost of Revenue: Key Insights for Ryanair Holdings plc and XPO Logistics, Inc.

Ryanair Holdings plc vs Avery Dennison Corporation: Efficiency in Cost of Revenue Explored

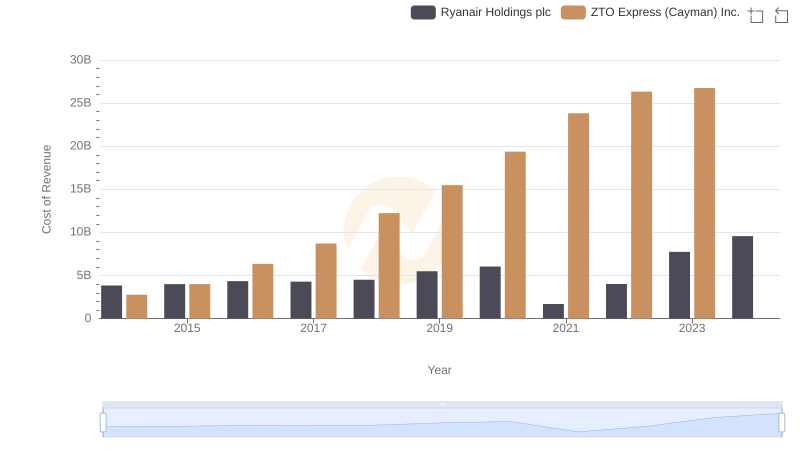

Cost Insights: Breaking Down Ryanair Holdings plc and ZTO Express (Cayman) Inc.'s Expenses

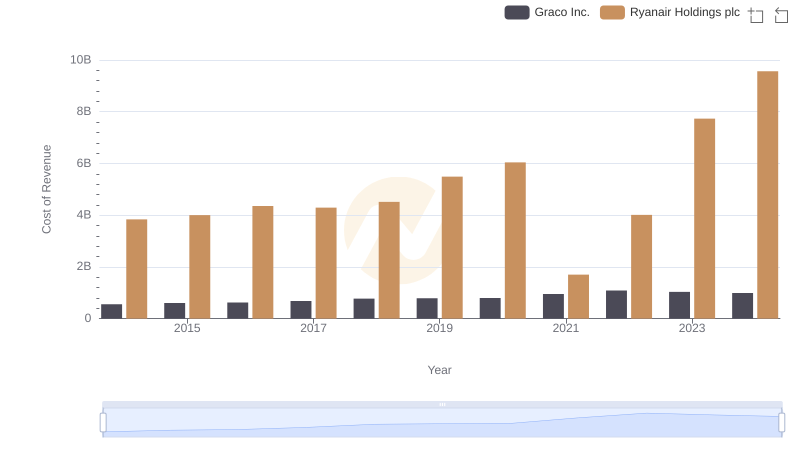

Ryanair Holdings plc vs Graco Inc.: Efficiency in Cost of Revenue Explored

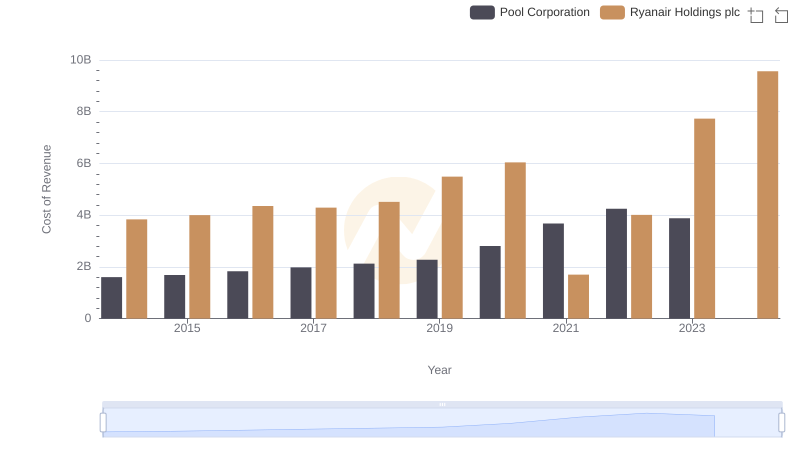

Cost Insights: Breaking Down Ryanair Holdings plc and Pool Corporation's Expenses

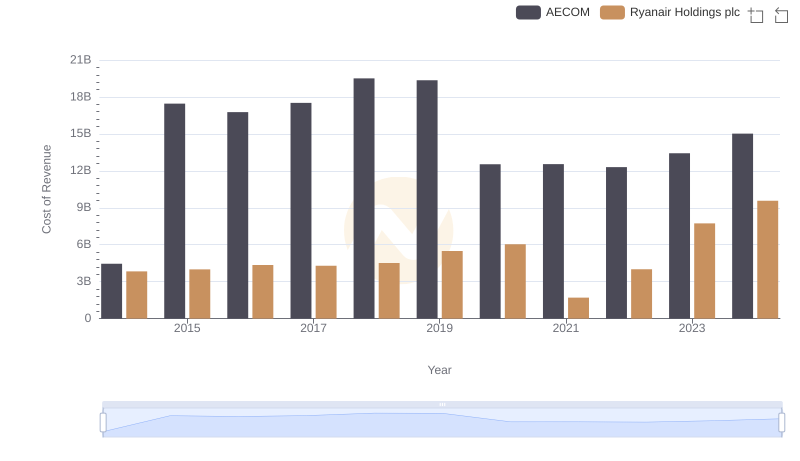

Cost Insights: Breaking Down Ryanair Holdings plc and AECOM's Expenses

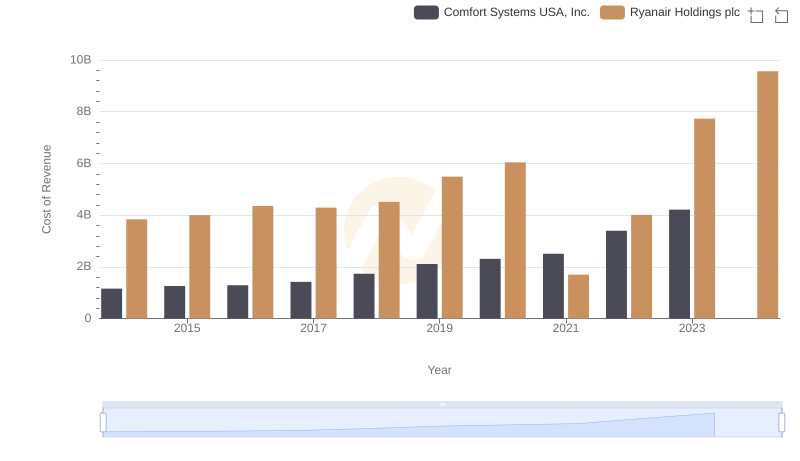

Cost of Revenue Trends: Ryanair Holdings plc vs Comfort Systems USA, Inc.

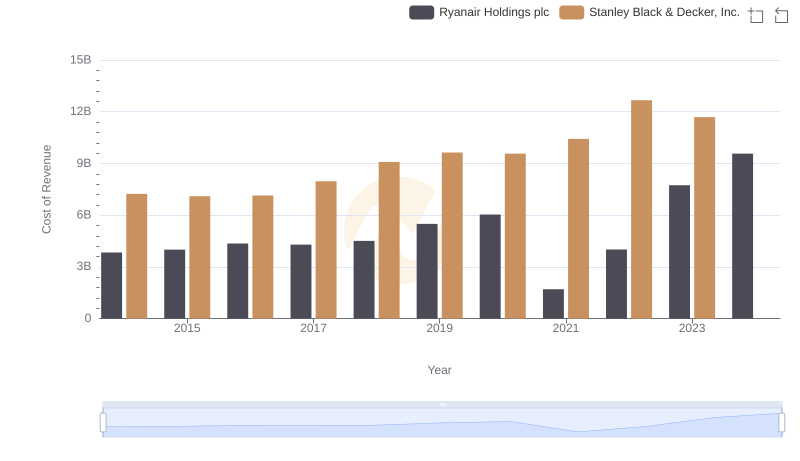

Cost of Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

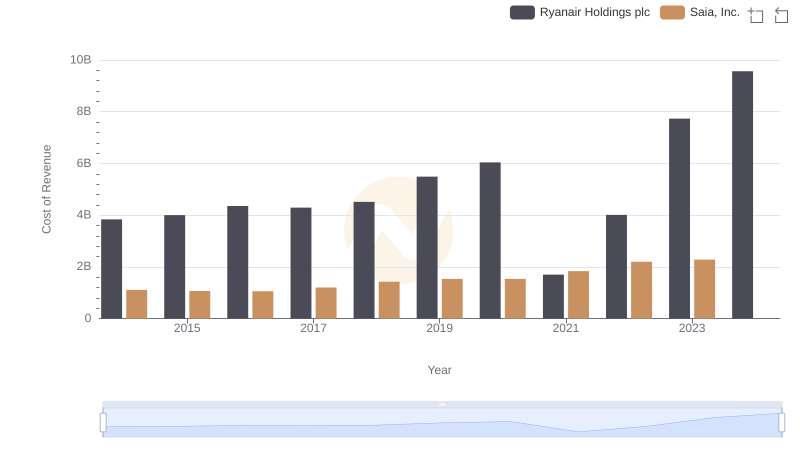

Cost of Revenue: Key Insights for Ryanair Holdings plc and Saia, Inc.

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and CNH Industrial N.V.