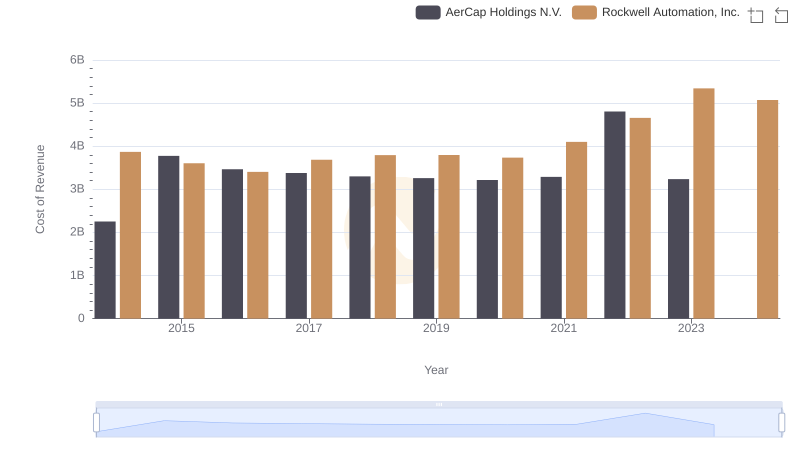

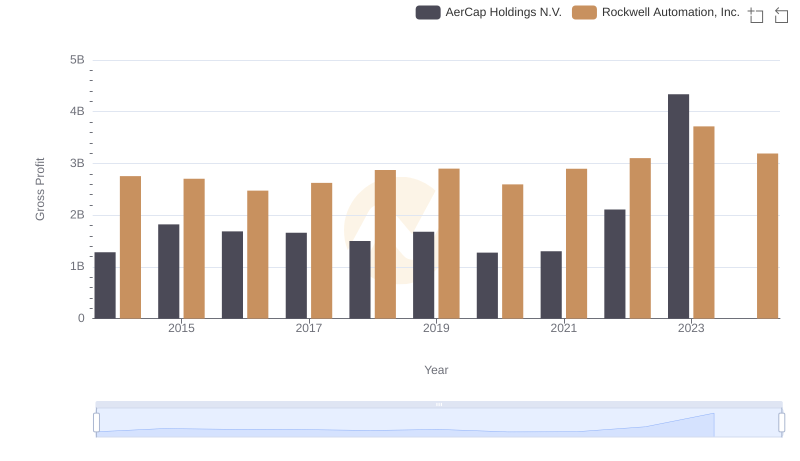

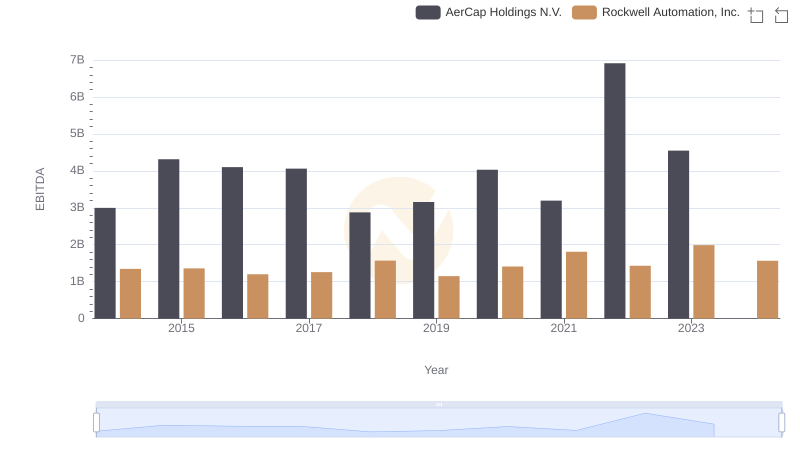

| __timestamp | AerCap Holdings N.V. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 1570100000 |

| Thursday, January 1, 2015 | 381308000 | 1506400000 |

| Friday, January 1, 2016 | 351012000 | 1467400000 |

| Sunday, January 1, 2017 | 348291000 | 1591500000 |

| Monday, January 1, 2018 | 305226000 | 1599000000 |

| Tuesday, January 1, 2019 | 267458000 | 1538500000 |

| Wednesday, January 1, 2020 | 242161000 | 1479800000 |

| Friday, January 1, 2021 | 317888000 | 1680000000 |

| Saturday, January 1, 2022 | 399530000 | 1766700000 |

| Sunday, January 1, 2023 | 464128000 | 2023700000 |

| Monday, January 1, 2024 | 2002600000 |

Unlocking the unknown

In the competitive landscape of industrial automation and aviation leasing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Rockwell Automation, Inc. and AerCap Holdings N.V. have shown distinct approaches over the past decade.

From 2014 to 2023, Rockwell Automation consistently reported higher SG&A expenses, peaking at approximately $2 billion in 2023. This reflects a steady increase, with a notable 29% rise from 2014. In contrast, AerCap Holdings demonstrated a more fluctuating pattern, with expenses reaching around $464 million in 2023, marking a 55% increase from 2014.

While Rockwell's expenses are significantly higher, their growth rate is more stable compared to AerCap's. This suggests that Rockwell may prioritize expansive operational strategies, whereas AerCap might focus on cost efficiency. The absence of 2024 data for AerCap leaves room for speculation on future trends.

Analyzing Cost of Revenue: Rockwell Automation, Inc. and AerCap Holdings N.V.

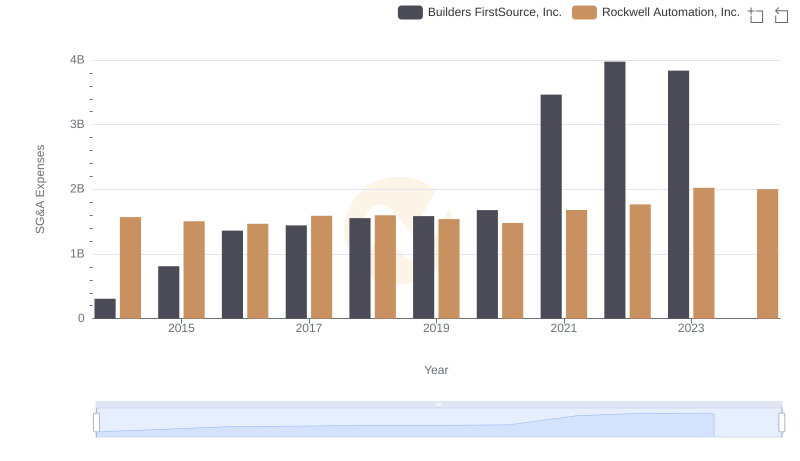

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Builders FirstSource, Inc.

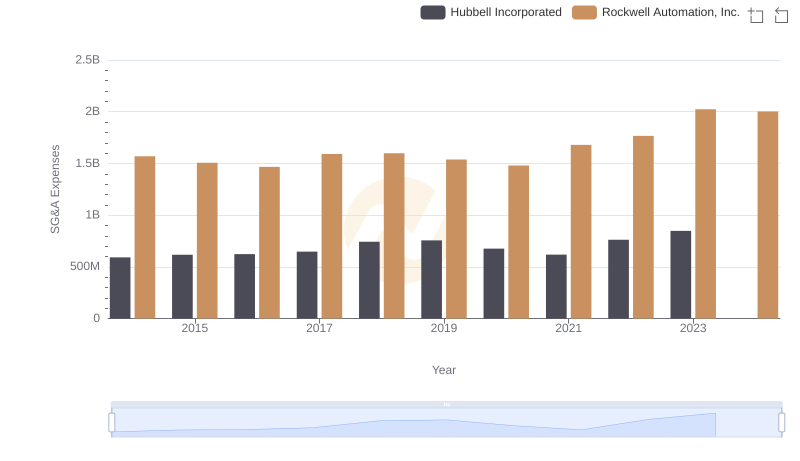

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Hubbell Incorporated

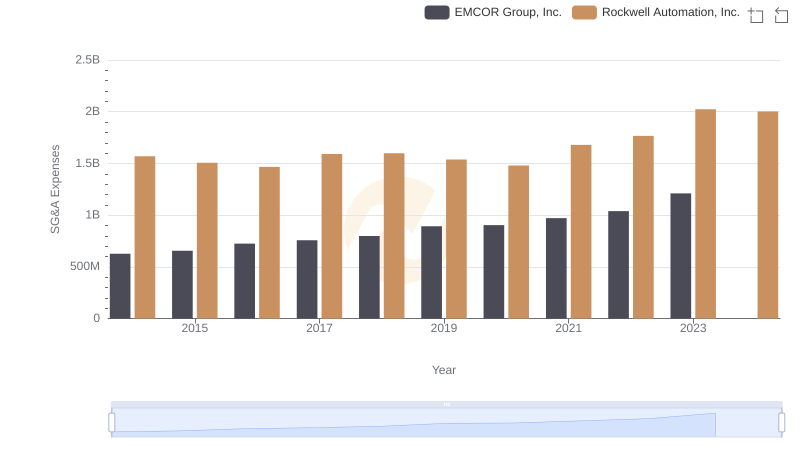

Comparing SG&A Expenses: Rockwell Automation, Inc. vs EMCOR Group, Inc. Trends and Insights

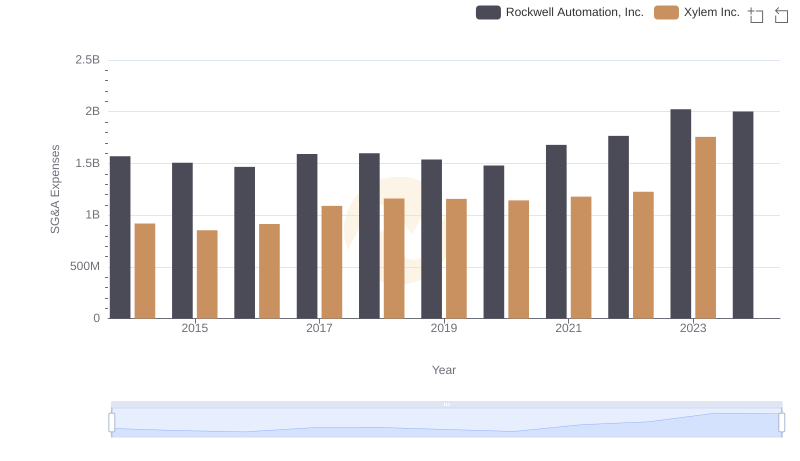

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Xylem Inc.

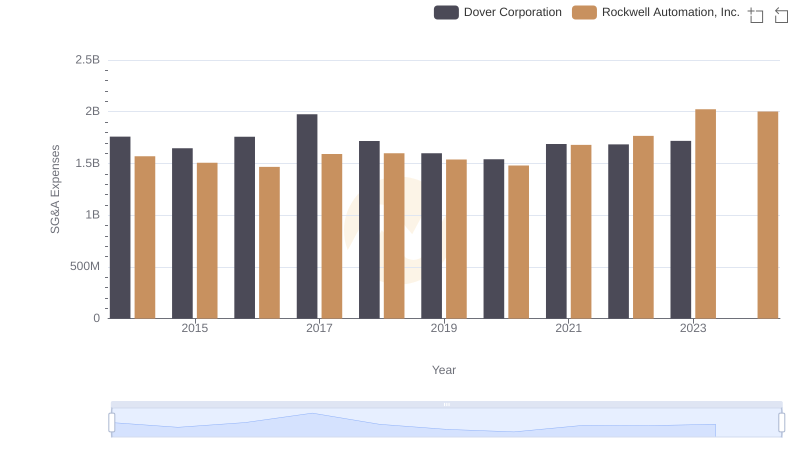

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Dover Corporation

Gross Profit Comparison: Rockwell Automation, Inc. and AerCap Holdings N.V. Trends

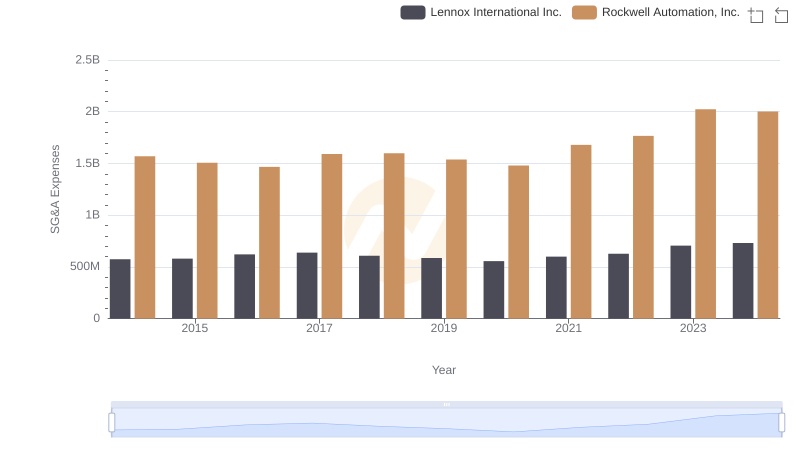

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Lennox International Inc.

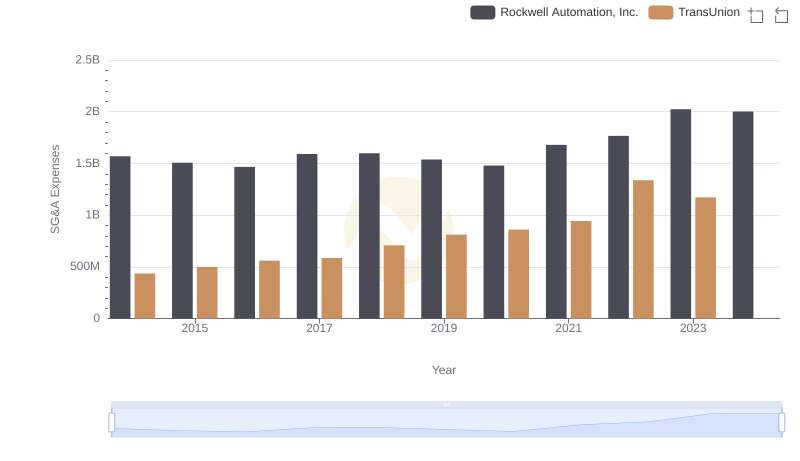

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs TransUnion

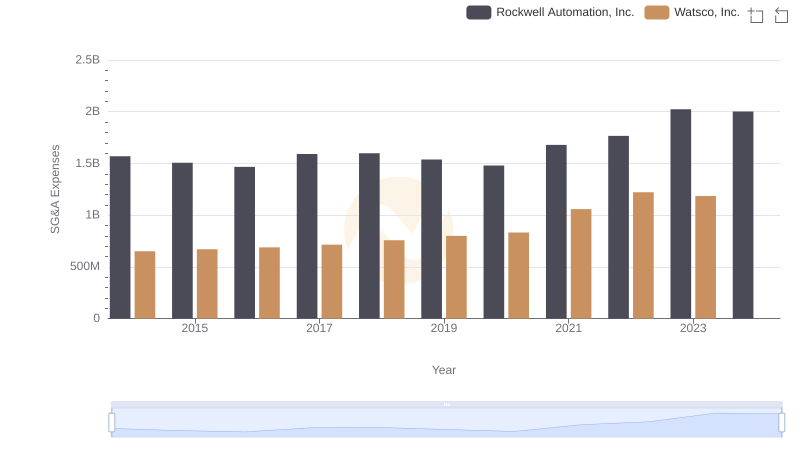

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Watsco, Inc.

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs AerCap Holdings N.V.