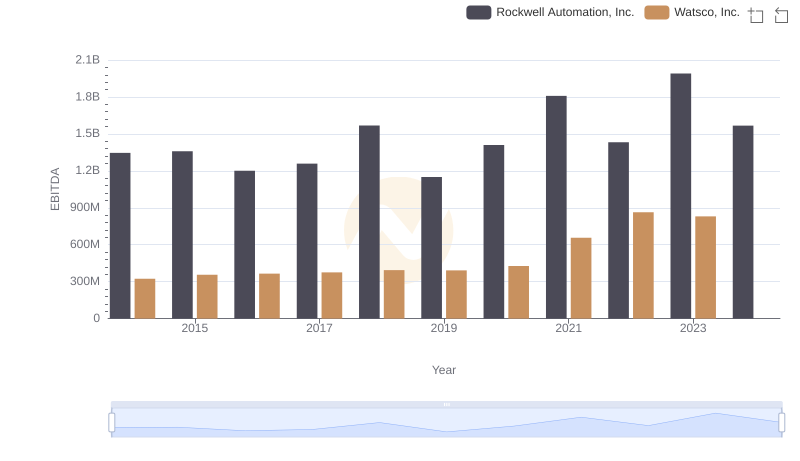

| __timestamp | Rockwell Automation, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 650655000 |

| Thursday, January 1, 2015 | 1506400000 | 670609000 |

| Friday, January 1, 2016 | 1467400000 | 688952000 |

| Sunday, January 1, 2017 | 1591500000 | 715671000 |

| Monday, January 1, 2018 | 1599000000 | 757452000 |

| Tuesday, January 1, 2019 | 1538500000 | 800328000 |

| Wednesday, January 1, 2020 | 1479800000 | 833051000 |

| Friday, January 1, 2021 | 1680000000 | 1058316000 |

| Saturday, January 1, 2022 | 1766700000 | 1221382000 |

| Sunday, January 1, 2023 | 2023700000 | 1185626000 |

| Monday, January 1, 2024 | 2002600000 | 1262938000 |

In pursuit of knowledge

In the ever-evolving landscape of industrial automation and HVAC distribution, Rockwell Automation, Inc. and Watsco, Inc. have demonstrated distinct trajectories in their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Rockwell Automation's SG&A expenses have surged by approximately 29%, reflecting strategic investments in innovation and market expansion. In contrast, Watsco, Inc. has seen a remarkable 82% increase, underscoring its aggressive growth strategy in the HVAC sector.

The data reveals a pivotal year in 2023, where Rockwell Automation's expenses peaked at over $2 billion, while Watsco's expenses slightly declined from their 2022 high. This divergence highlights the dynamic nature of operational strategies in response to market demands. Notably, the absence of 2024 data for Watsco suggests a potential shift or recalibration in their financial reporting or strategy.

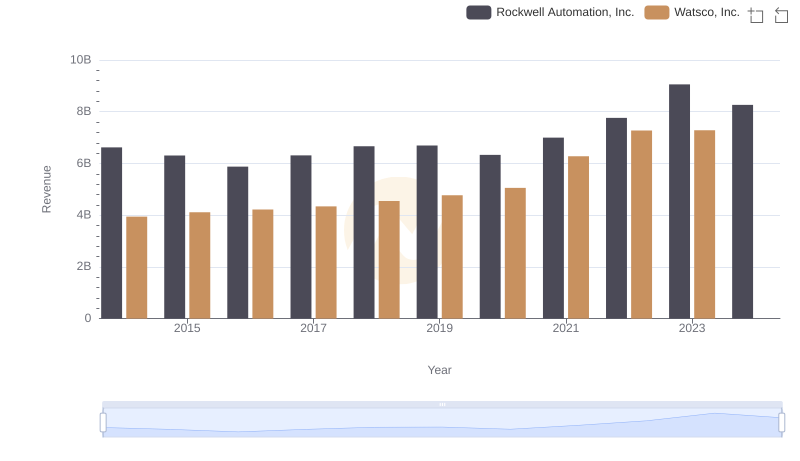

Annual Revenue Comparison: Rockwell Automation, Inc. vs Watsco, Inc.

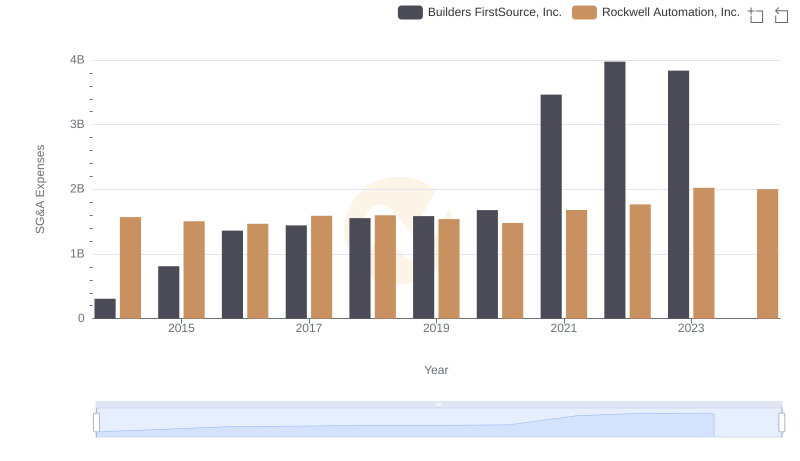

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Builders FirstSource, Inc.

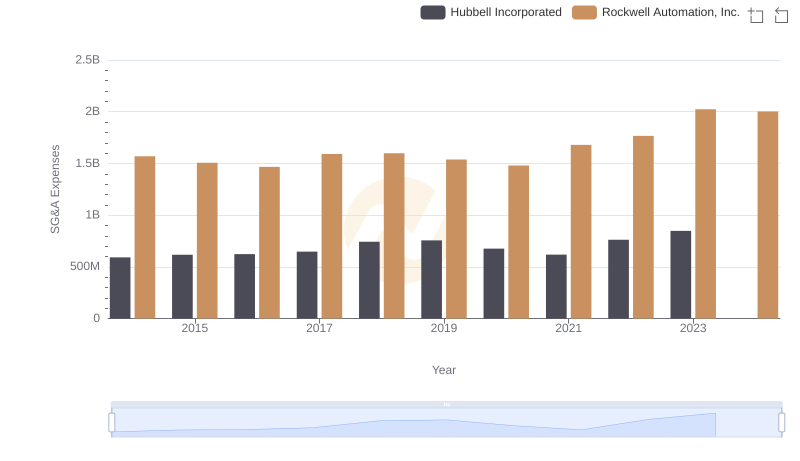

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Hubbell Incorporated

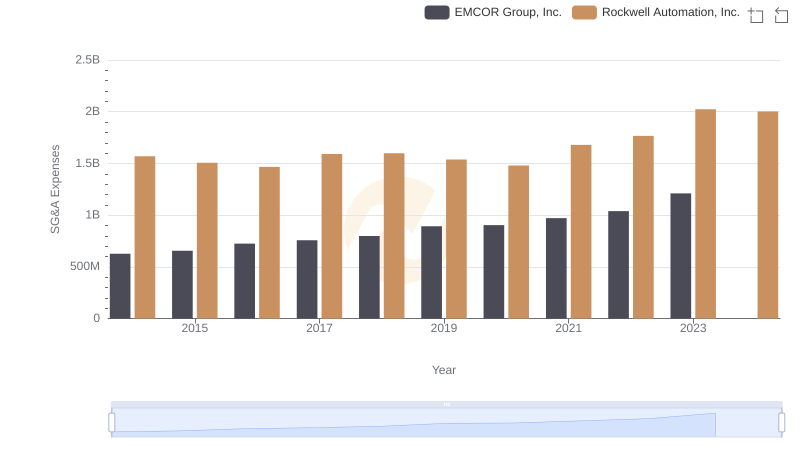

Comparing SG&A Expenses: Rockwell Automation, Inc. vs EMCOR Group, Inc. Trends and Insights

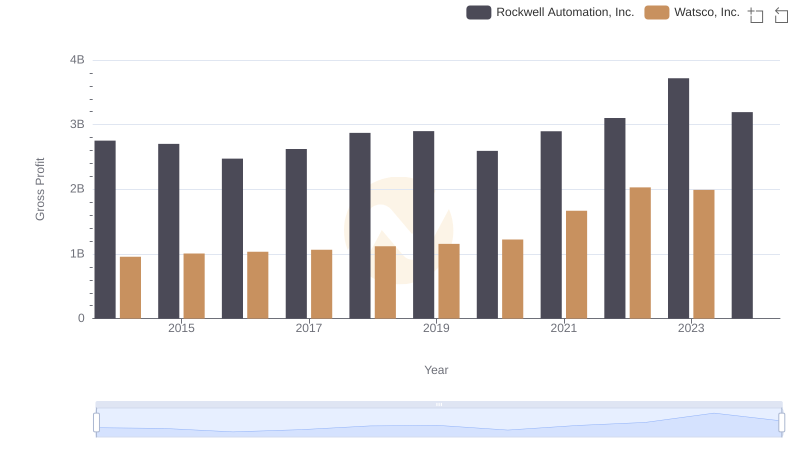

Rockwell Automation, Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

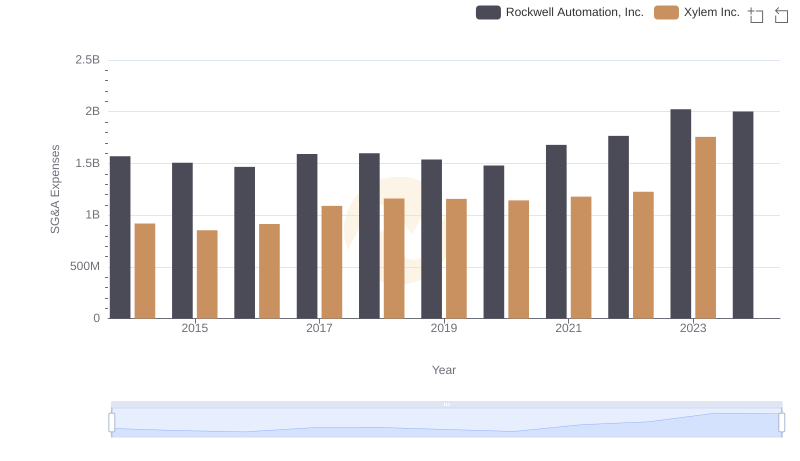

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Xylem Inc.

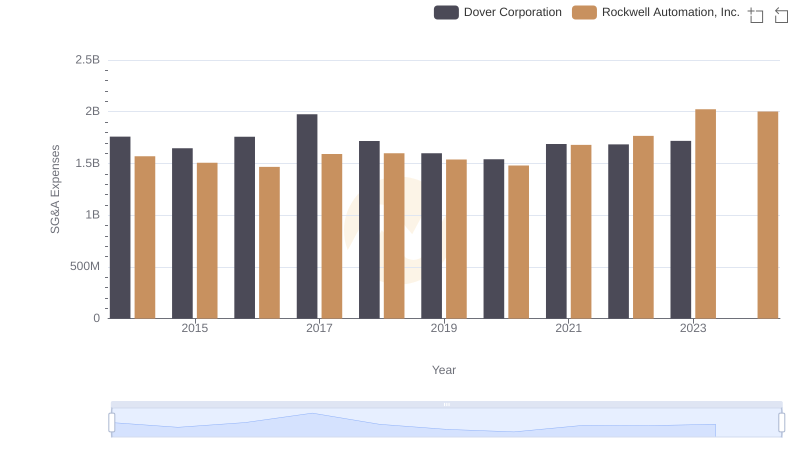

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Dover Corporation

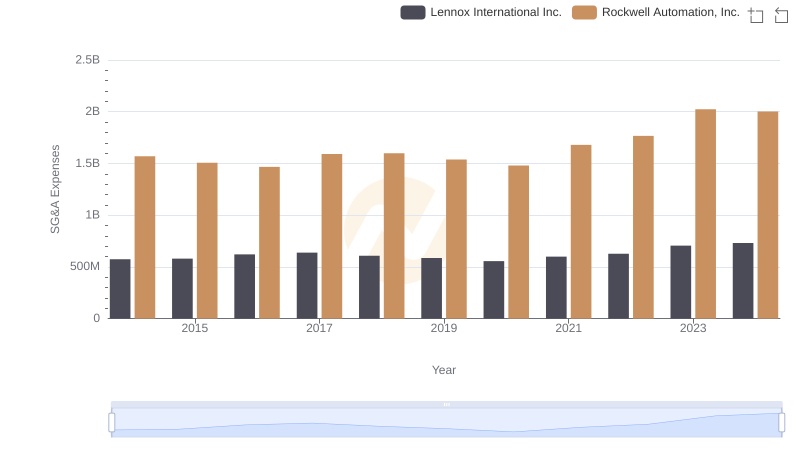

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Lennox International Inc.

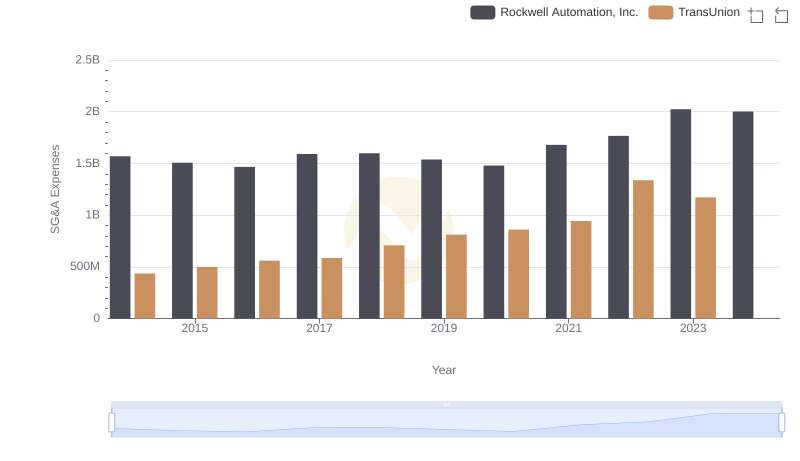

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs TransUnion

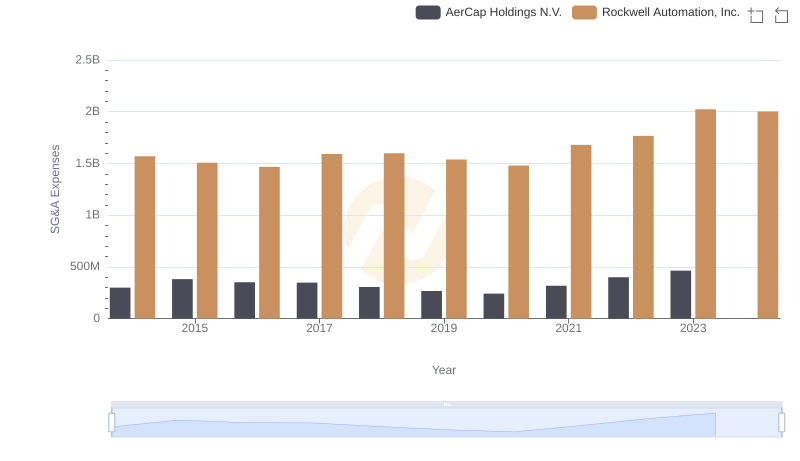

Rockwell Automation, Inc. or AerCap Holdings N.V.: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs Watsco, Inc.