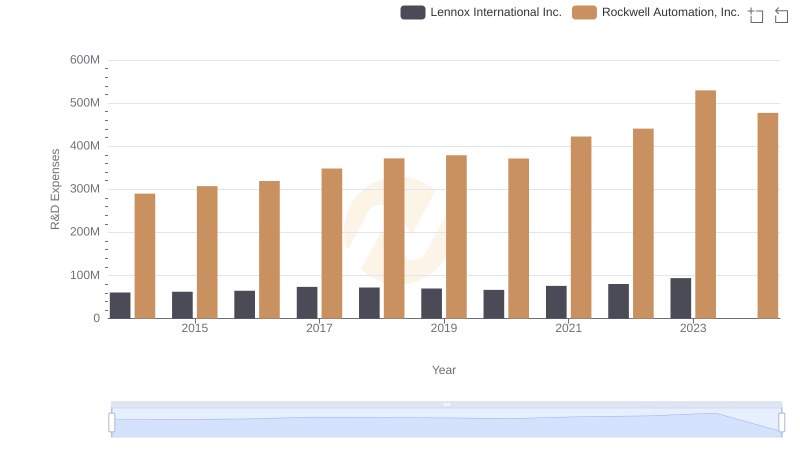

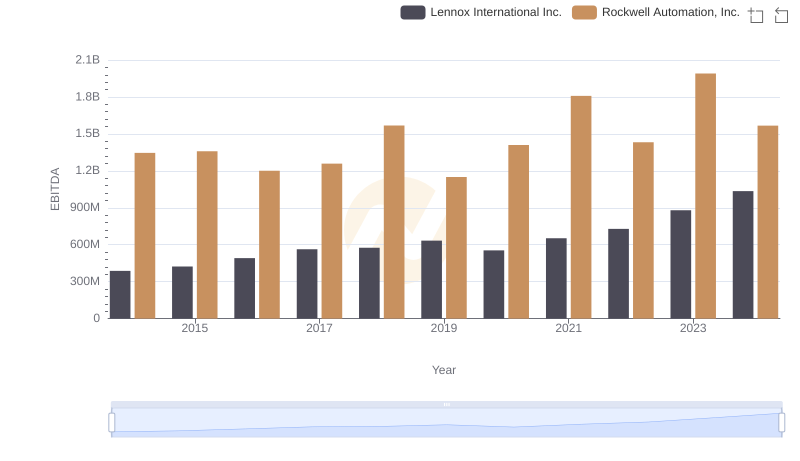

| __timestamp | Lennox International Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 1570100000 |

| Thursday, January 1, 2015 | 580500000 | 1506400000 |

| Friday, January 1, 2016 | 621000000 | 1467400000 |

| Sunday, January 1, 2017 | 637700000 | 1591500000 |

| Monday, January 1, 2018 | 608200000 | 1599000000 |

| Tuesday, January 1, 2019 | 585900000 | 1538500000 |

| Wednesday, January 1, 2020 | 555900000 | 1479800000 |

| Friday, January 1, 2021 | 598900000 | 1680000000 |

| Saturday, January 1, 2022 | 627200000 | 1766700000 |

| Sunday, January 1, 2023 | 705500000 | 2023700000 |

| Monday, January 1, 2024 | 730600000 | 2002600000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial automation and climate control, Rockwell Automation, Inc. and Lennox International Inc. stand as titans. Over the past decade, these companies have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Rockwell Automation's SG&A expenses have surged by approximately 28%, reflecting its aggressive expansion and innovation strategies. In contrast, Lennox International has seen a more modest increase of around 27%, indicating a steady, controlled growth approach.

The data reveals that Rockwell Automation consistently outpaces Lennox in SG&A spending, with 2023 marking a peak at over 2 billion dollars. This trend underscores Rockwell's commitment to maintaining its competitive edge through strategic investments. Meanwhile, Lennox's expenses reached their zenith in 2024, highlighting its focus on sustainable growth. These insights offer a window into the financial strategies that drive these industry leaders.

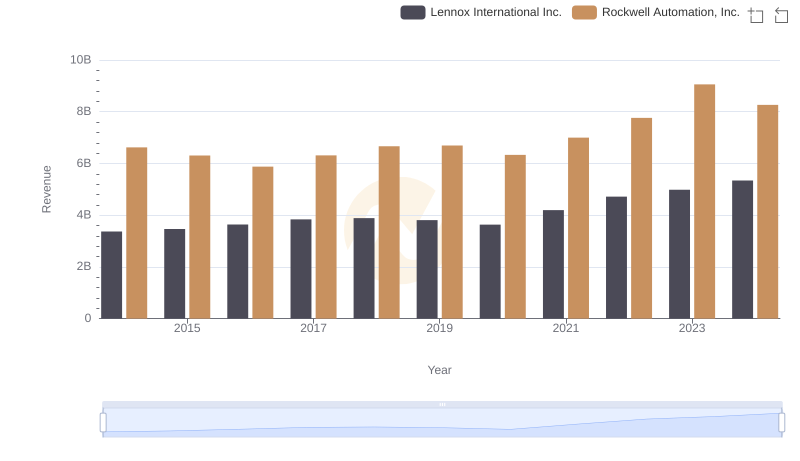

Revenue Insights: Rockwell Automation, Inc. and Lennox International Inc. Performance Compared

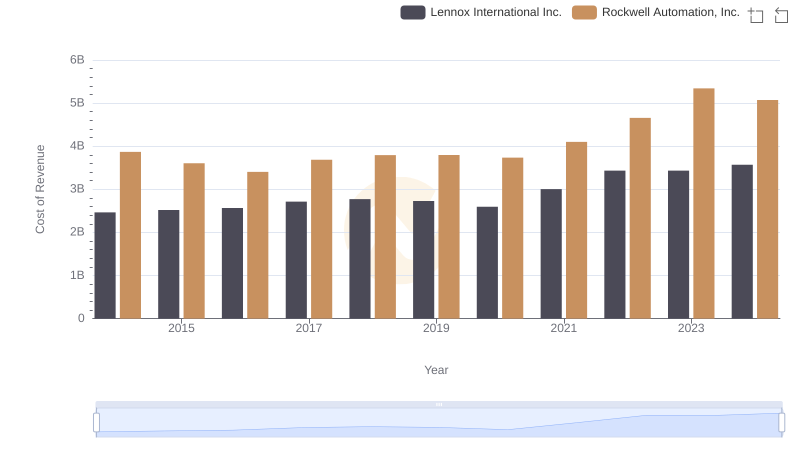

Cost of Revenue Trends: Rockwell Automation, Inc. vs Lennox International Inc.

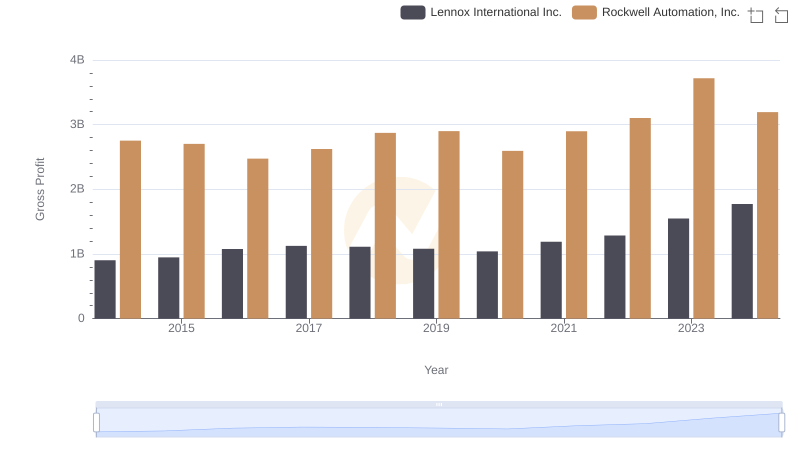

Rockwell Automation, Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

Rockwell Automation, Inc. or Lennox International Inc.: Who Invests More in Innovation?

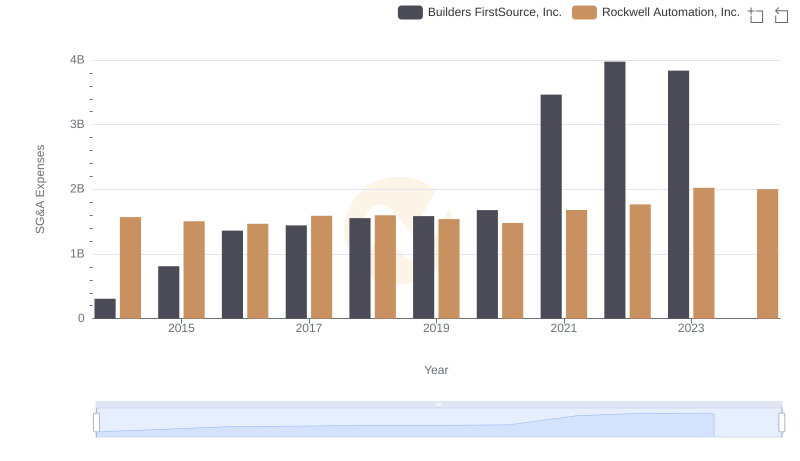

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Builders FirstSource, Inc.

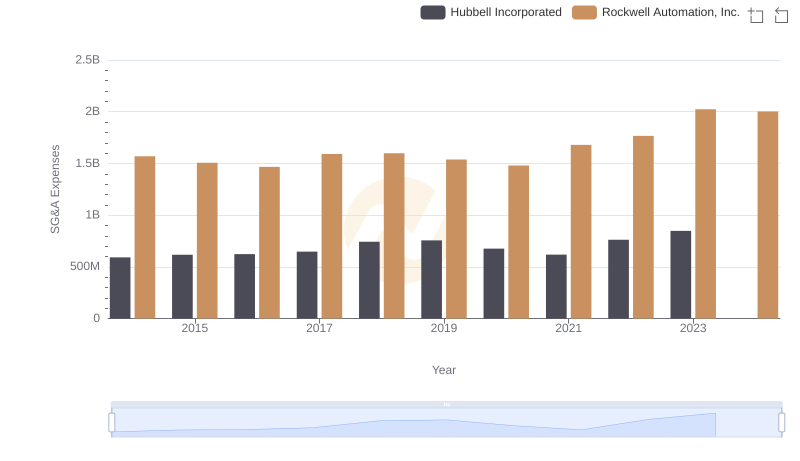

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Hubbell Incorporated

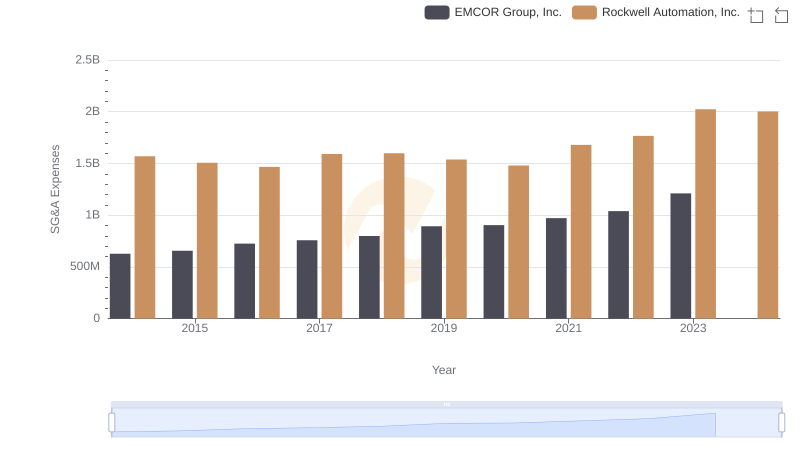

Comparing SG&A Expenses: Rockwell Automation, Inc. vs EMCOR Group, Inc. Trends and Insights

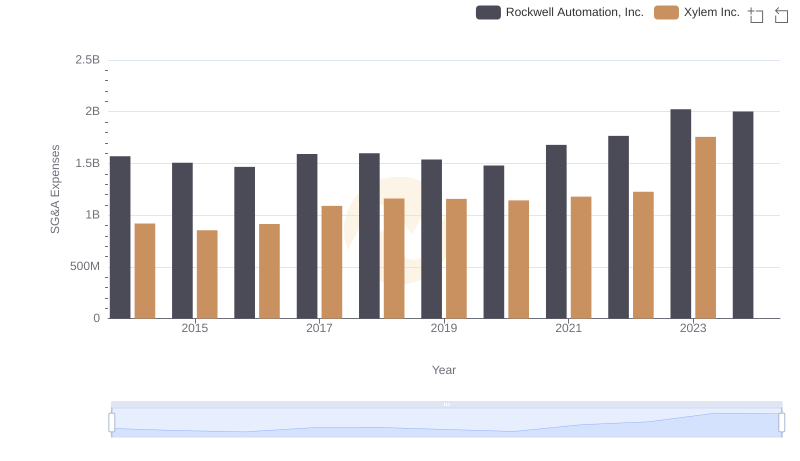

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Xylem Inc.

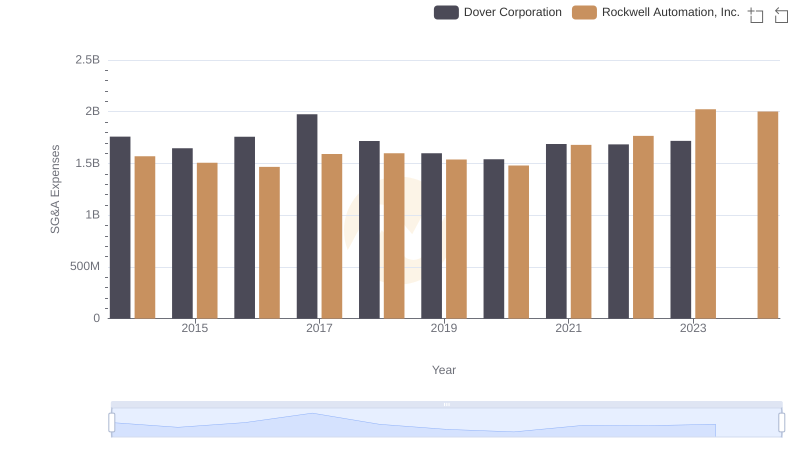

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Dover Corporation

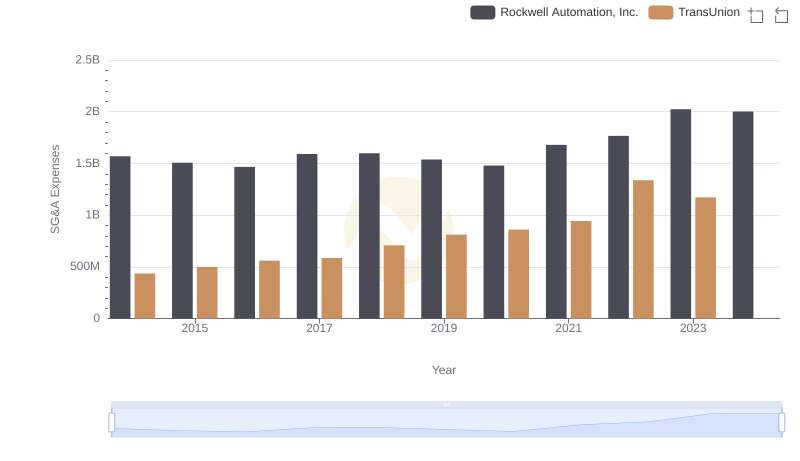

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs TransUnion

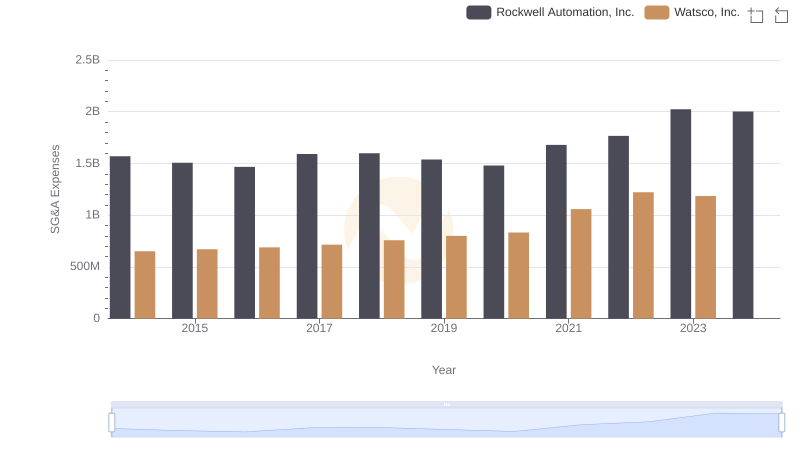

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Watsco, Inc.

EBITDA Performance Review: Rockwell Automation, Inc. vs Lennox International Inc.