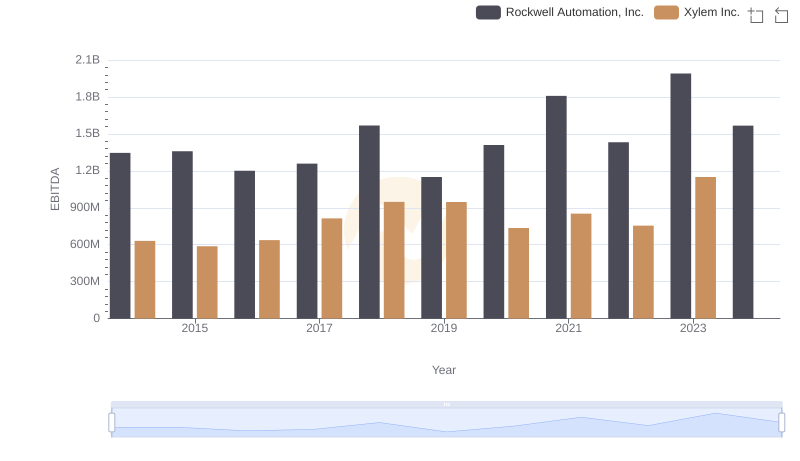

| __timestamp | Rockwell Automation, Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 920000000 |

| Thursday, January 1, 2015 | 1506400000 | 854000000 |

| Friday, January 1, 2016 | 1467400000 | 915000000 |

| Sunday, January 1, 2017 | 1591500000 | 1090000000 |

| Monday, January 1, 2018 | 1599000000 | 1161000000 |

| Tuesday, January 1, 2019 | 1538500000 | 1158000000 |

| Wednesday, January 1, 2020 | 1479800000 | 1143000000 |

| Friday, January 1, 2021 | 1680000000 | 1179000000 |

| Saturday, January 1, 2022 | 1766700000 | 1227000000 |

| Sunday, January 1, 2023 | 2023700000 | 1757000000 |

| Monday, January 1, 2024 | 2002600000 |

Unlocking the unknown

In the competitive landscape of industrial automation and water technology, Rockwell Automation, Inc. and Xylem Inc. have been pivotal players. Over the past decade, from 2014 to 2023, these companies have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. Rockwell Automation has seen a steady increase in SG&A costs, peaking at approximately $2 billion in 2023, marking a 29% rise from 2014. In contrast, Xylem Inc. has shown a more conservative approach, with a 91% increase over the same period, reaching around $1.76 billion in 2023. This divergence highlights Rockwell's aggressive expansion and Xylem's cautious scaling. However, data for 2024 remains incomplete, leaving room for speculation on future trends. As these industry leaders continue to evolve, their SG&A strategies will be crucial in maintaining competitive advantage.

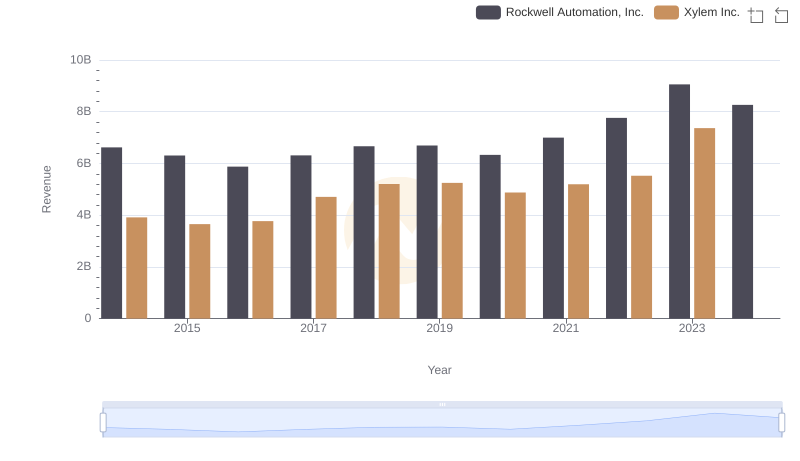

Revenue Showdown: Rockwell Automation, Inc. vs Xylem Inc.

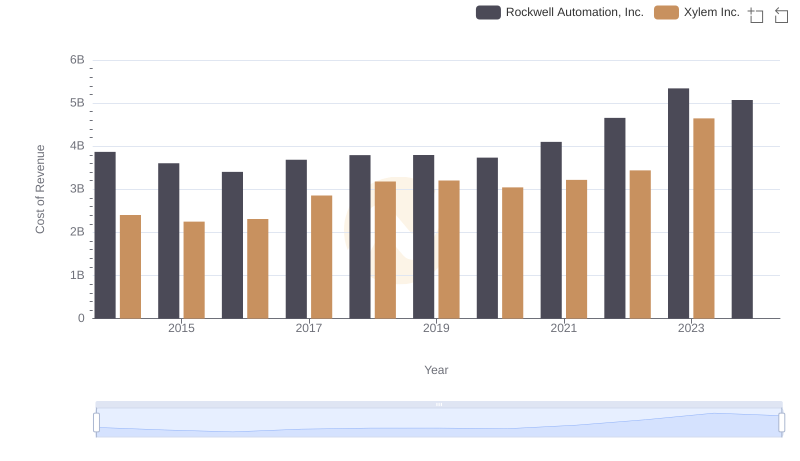

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Xylem Inc.

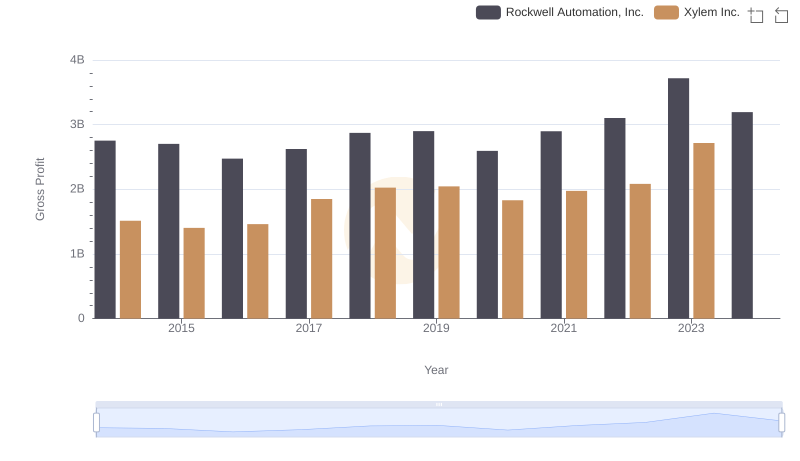

Gross Profit Comparison: Rockwell Automation, Inc. and Xylem Inc. Trends

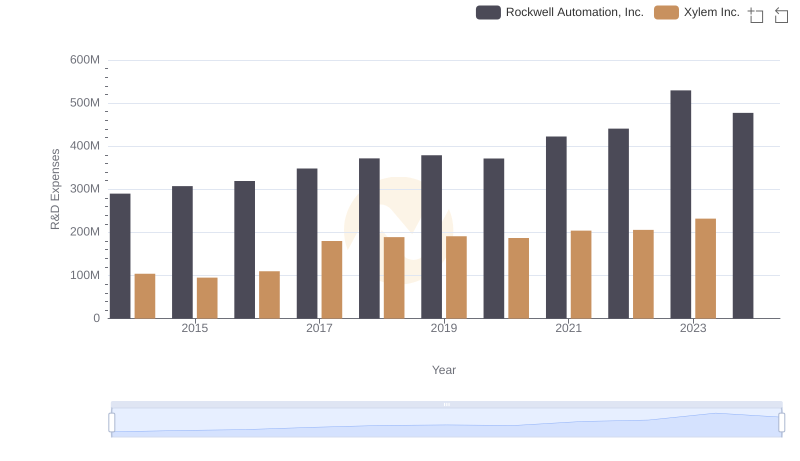

Analyzing R&D Budgets: Rockwell Automation, Inc. vs Xylem Inc.

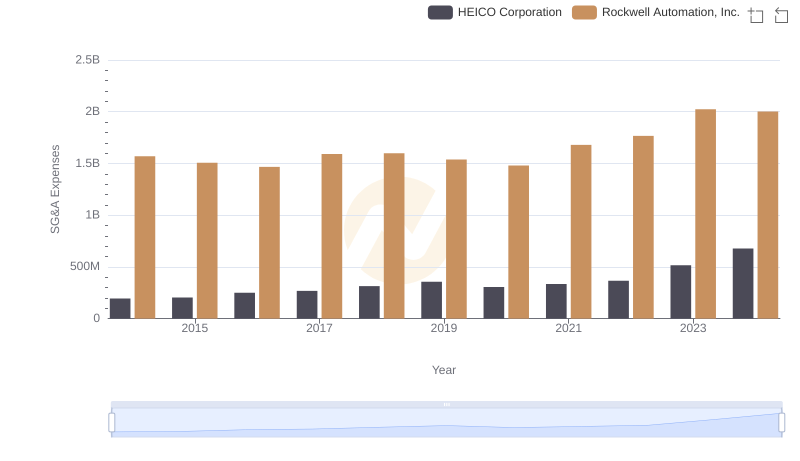

Comparing SG&A Expenses: Rockwell Automation, Inc. vs HEICO Corporation Trends and Insights

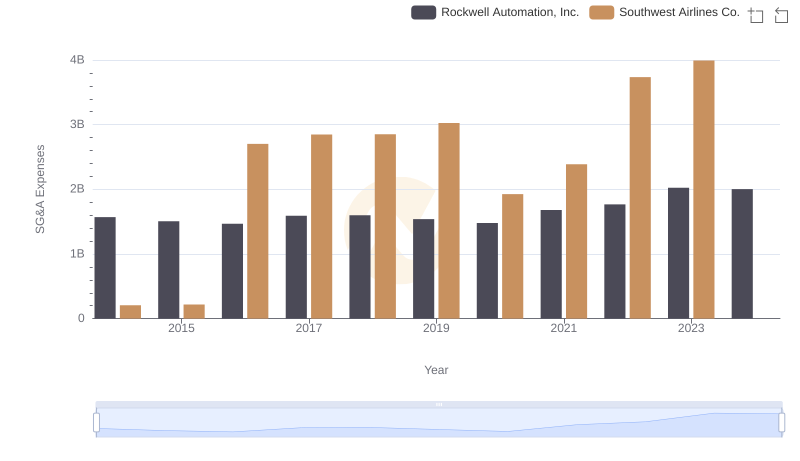

Rockwell Automation, Inc. and Southwest Airlines Co.: SG&A Spending Patterns Compared

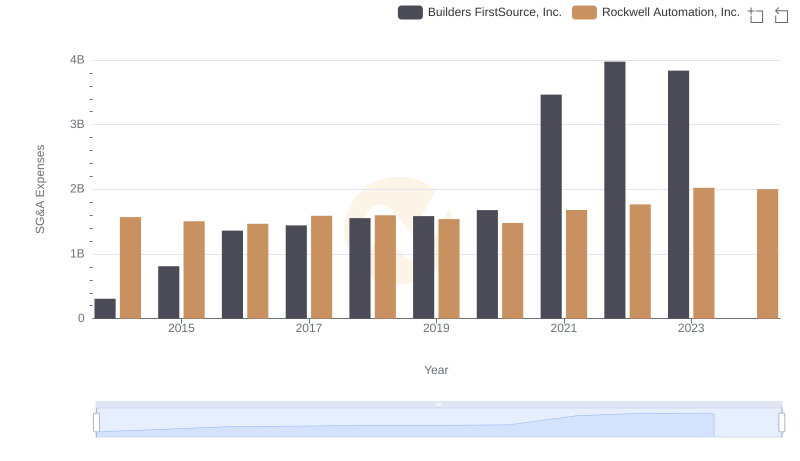

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Builders FirstSource, Inc.

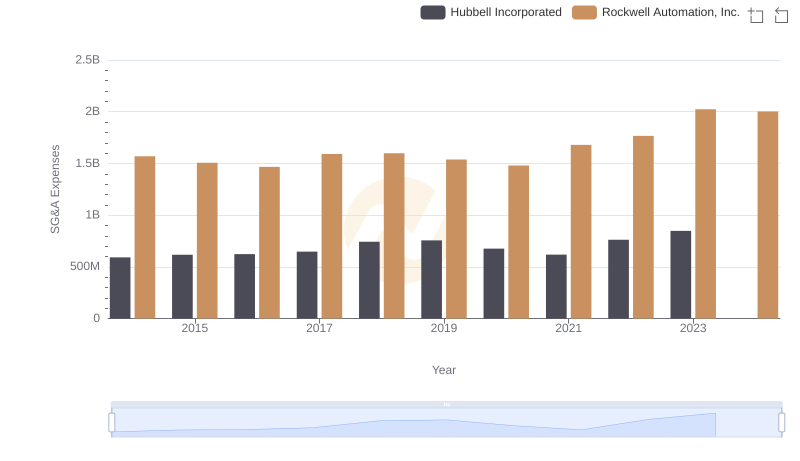

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Hubbell Incorporated

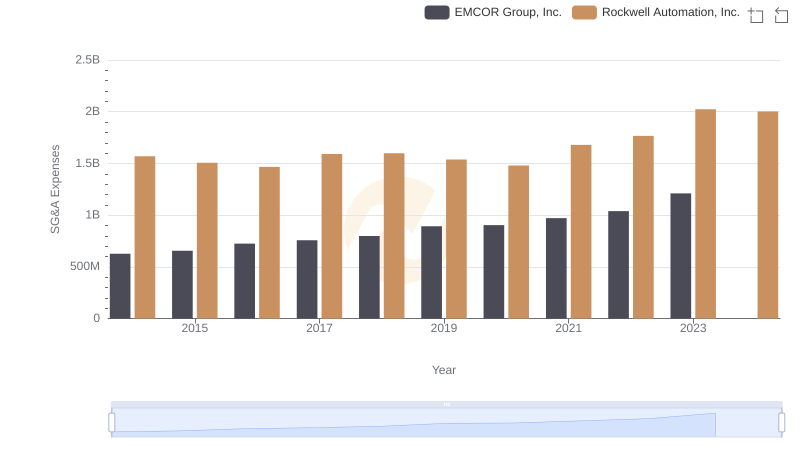

Comparing SG&A Expenses: Rockwell Automation, Inc. vs EMCOR Group, Inc. Trends and Insights

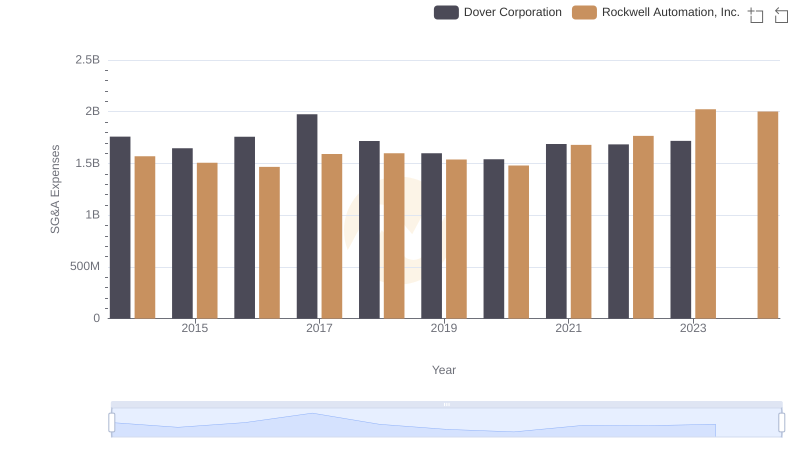

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Dover Corporation

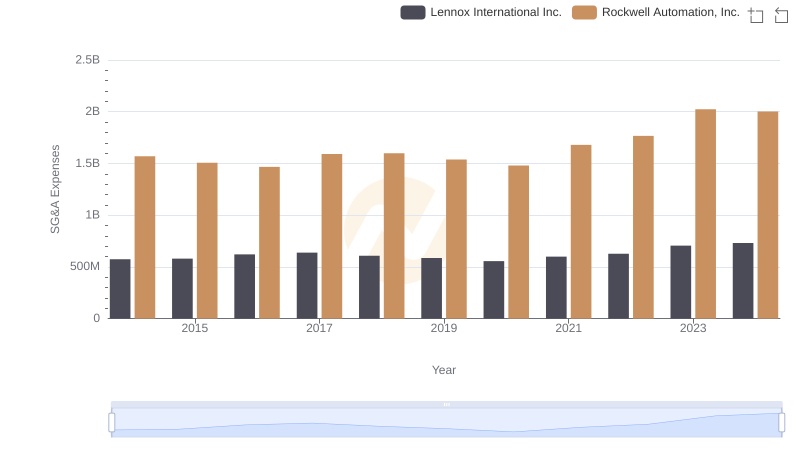

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Lennox International Inc.

Professional EBITDA Benchmarking: Rockwell Automation, Inc. vs Xylem Inc.