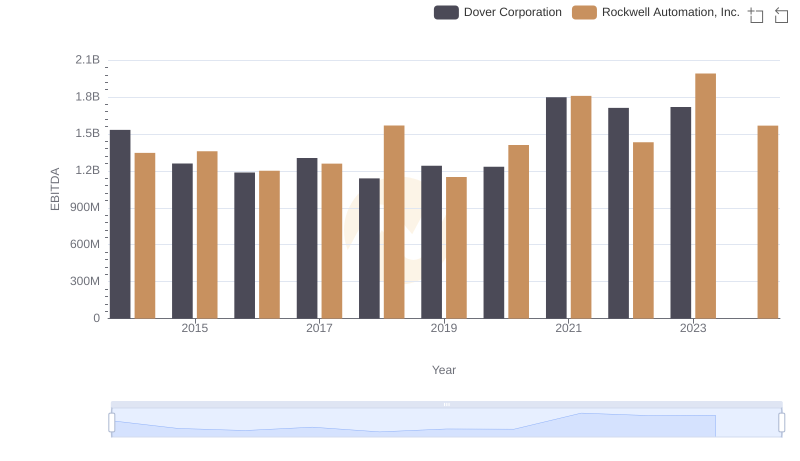

| __timestamp | Dover Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1758765000 | 1570100000 |

| Thursday, January 1, 2015 | 1647382000 | 1506400000 |

| Friday, January 1, 2016 | 1757523000 | 1467400000 |

| Sunday, January 1, 2017 | 1975932000 | 1591500000 |

| Monday, January 1, 2018 | 1716444000 | 1599000000 |

| Tuesday, January 1, 2019 | 1599098000 | 1538500000 |

| Wednesday, January 1, 2020 | 1541032000 | 1479800000 |

| Friday, January 1, 2021 | 1688278000 | 1680000000 |

| Saturday, January 1, 2022 | 1684226000 | 1766700000 |

| Sunday, January 1, 2023 | 1718290000 | 2023700000 |

| Monday, January 1, 2024 | 1752266000 | 2002600000 |

Infusing magic into the data realm

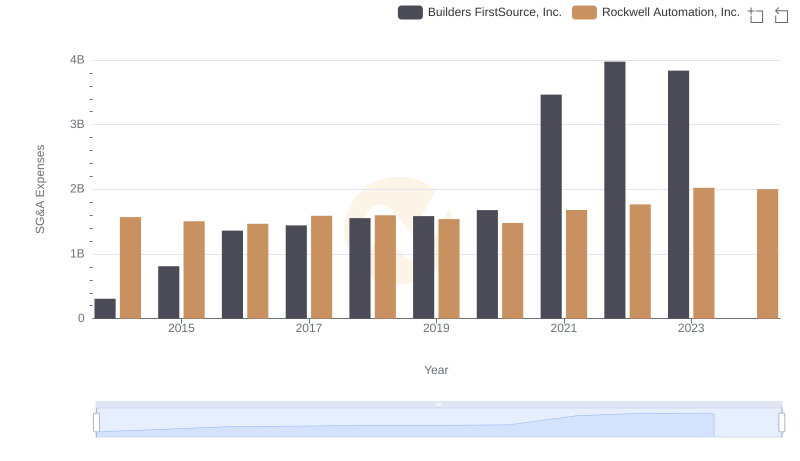

In the ever-evolving landscape of industrial automation and manufacturing, cost management remains a pivotal focus. Rockwell Automation, Inc. and Dover Corporation, two stalwarts in their respective fields, have demonstrated intriguing trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Dover Corporation's SG&A expenses have shown a modest fluctuation, peaking in 2017 and gradually stabilizing thereafter. In contrast, Rockwell Automation, Inc. has experienced a more dynamic trajectory, with a notable 29% increase in expenses from 2014 to 2023. This surge reflects strategic investments and expansion efforts.

Interestingly, data for Dover Corporation in 2024 is absent, leaving room for speculation on future financial strategies. As these industry leaders continue to adapt, their cost management strategies will undoubtedly shape their competitive edge.

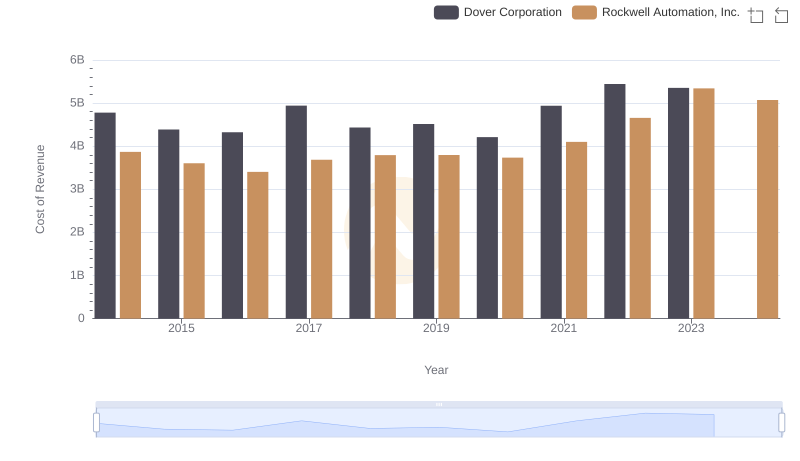

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Dover Corporation

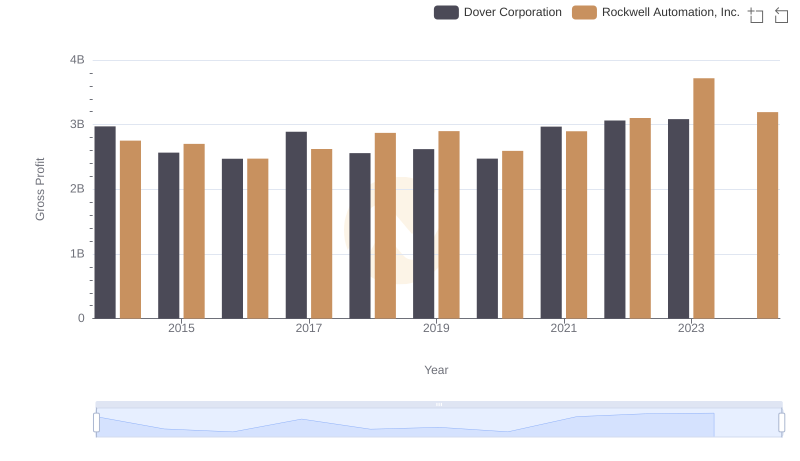

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and Dover Corporation

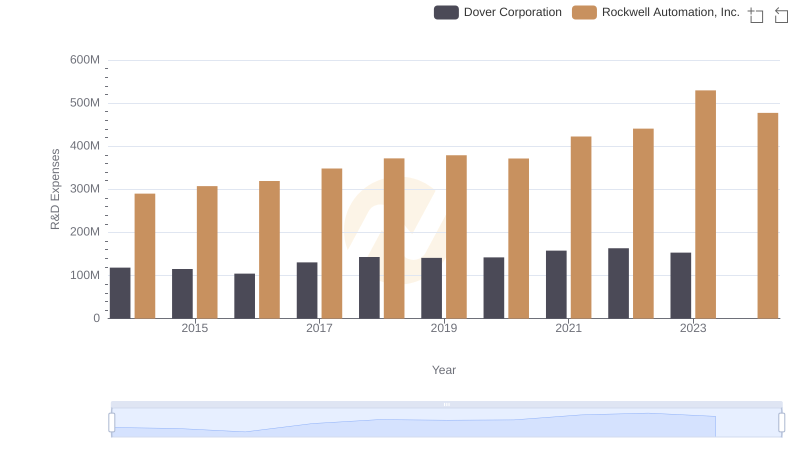

Analyzing R&D Budgets: Rockwell Automation, Inc. vs Dover Corporation

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Builders FirstSource, Inc.

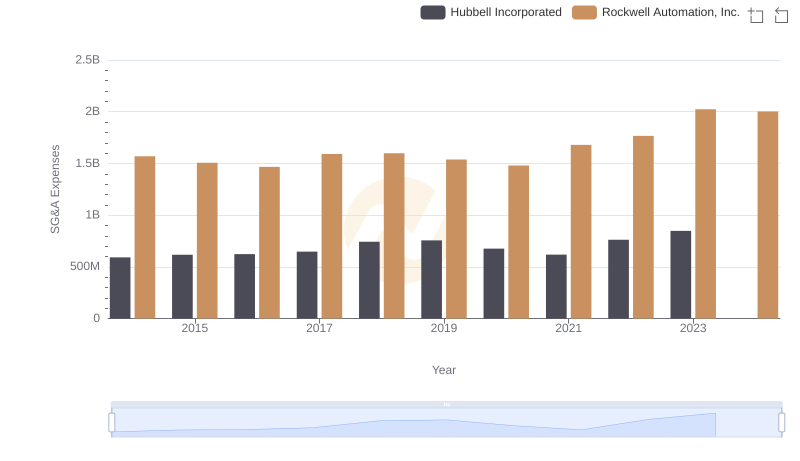

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Hubbell Incorporated

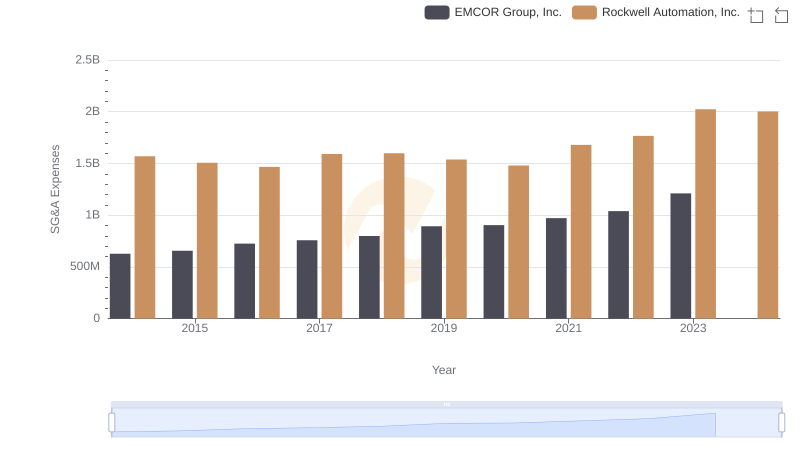

Comparing SG&A Expenses: Rockwell Automation, Inc. vs EMCOR Group, Inc. Trends and Insights

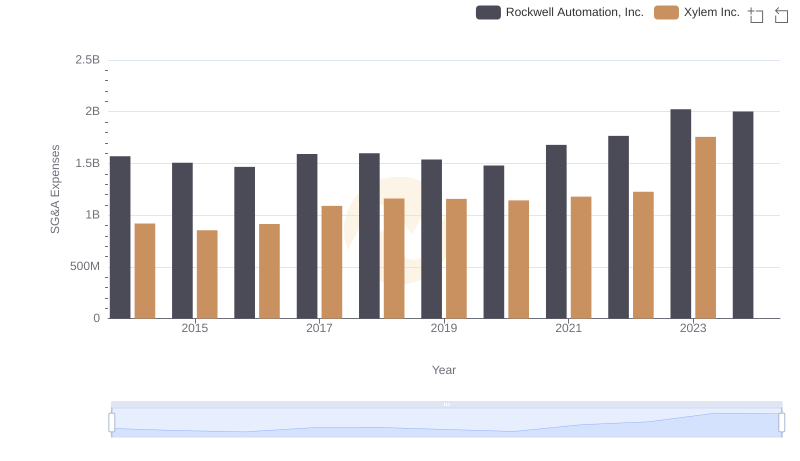

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Xylem Inc.

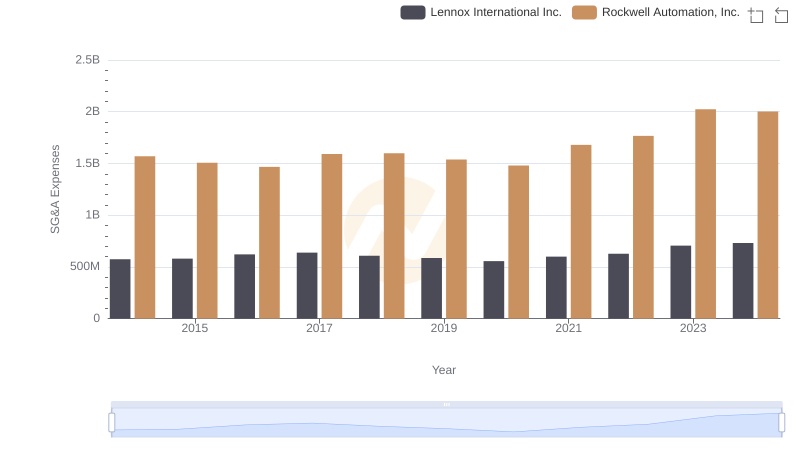

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Lennox International Inc.

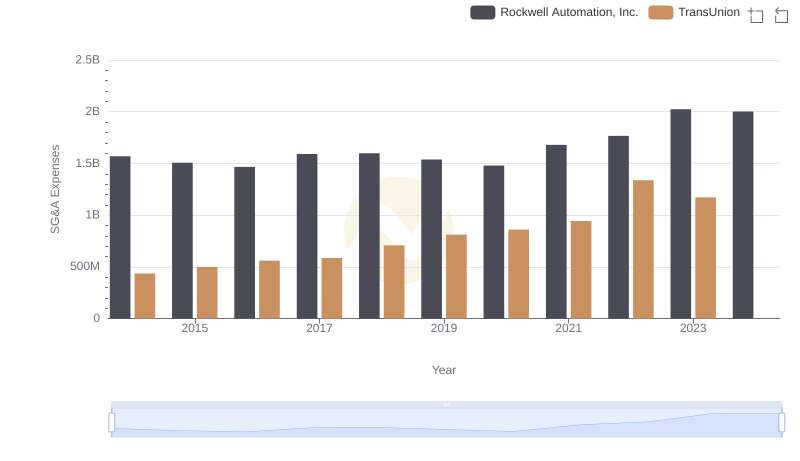

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs TransUnion

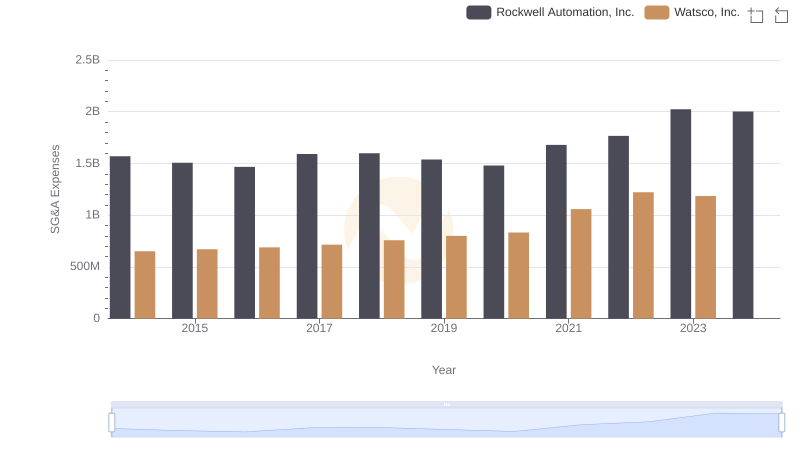

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Watsco, Inc.

EBITDA Performance Review: Rockwell Automation, Inc. vs Dover Corporation