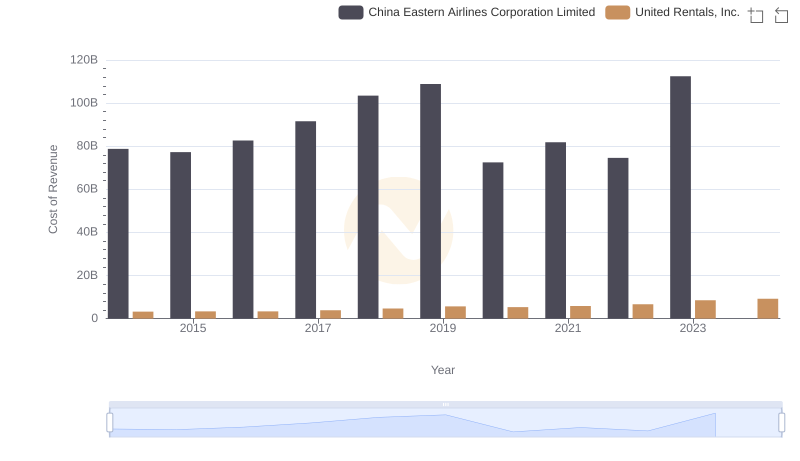

| __timestamp | China Eastern Airlines Corporation Limited | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 90185000000 | 5685000000 |

| Thursday, January 1, 2015 | 93969000000 | 5817000000 |

| Friday, January 1, 2016 | 98904000000 | 5762000000 |

| Sunday, January 1, 2017 | 102475000000 | 6641000000 |

| Monday, January 1, 2018 | 115210000000 | 8047000000 |

| Tuesday, January 1, 2019 | 120796000000 | 9351000000 |

| Wednesday, January 1, 2020 | 58470000000 | 8530000000 |

| Friday, January 1, 2021 | 66887000000 | 9716000000 |

| Saturday, January 1, 2022 | 46111000000 | 11642000000 |

| Sunday, January 1, 2023 | 113741000000 | 14332000000 |

| Monday, January 1, 2024 | 15345000000 |

Unlocking the unknown

In the ever-evolving landscape of global business, United Rentals, Inc. and China Eastern Airlines Corporation Limited stand as titans in their respective industries. Over the past decade, these companies have showcased remarkable revenue trajectories, reflecting broader economic trends and sector-specific challenges.

From 2014 to 2023, United Rentals, Inc. has seen a steady climb in revenue, with a notable 152% increase from 2014 to 2023. This growth underscores the robust demand for equipment rental services in North America, driven by infrastructure development and construction booms.

Conversely, China Eastern Airlines experienced a more volatile revenue pattern. Despite a 26% dip in 2022, the airline rebounded in 2023, achieving a 146% increase from its 2022 low. This fluctuation highlights the airline industry's sensitivity to global events, such as the COVID-19 pandemic.

Both companies exemplify resilience and adaptability, navigating their unique challenges to maintain competitive edges in their markets.

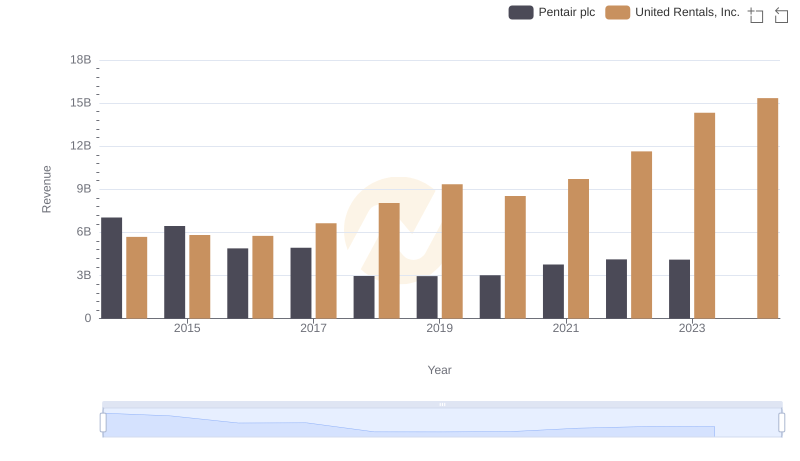

Revenue Showdown: United Rentals, Inc. vs Pentair plc

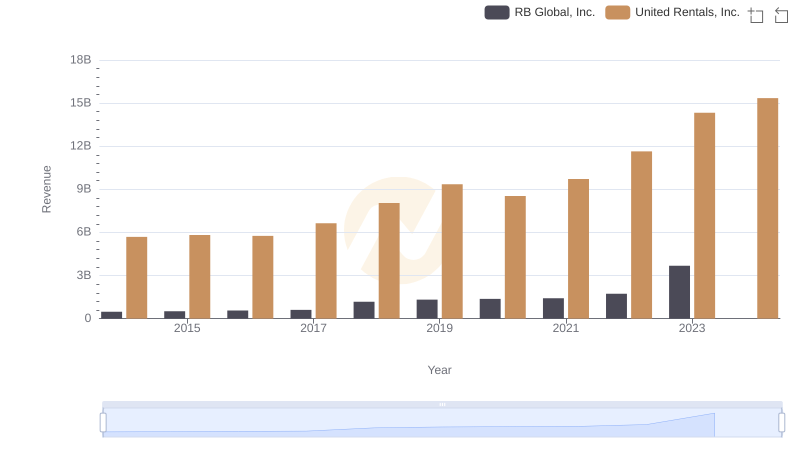

Revenue Insights: United Rentals, Inc. and RB Global, Inc. Performance Compared

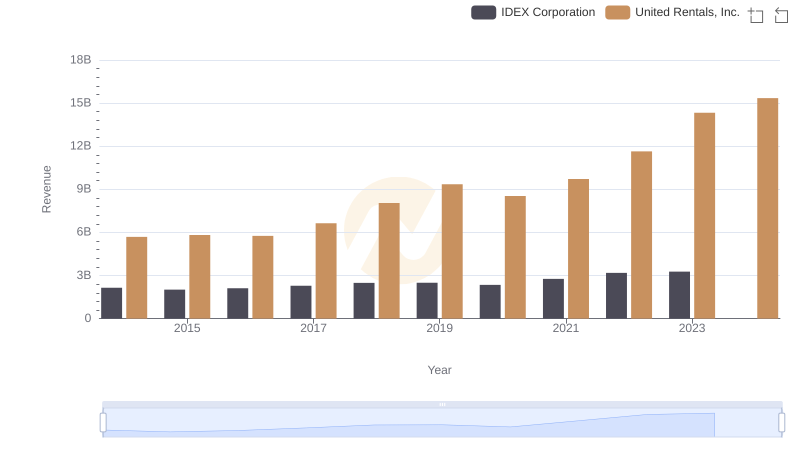

United Rentals, Inc. and IDEX Corporation: A Comprehensive Revenue Analysis

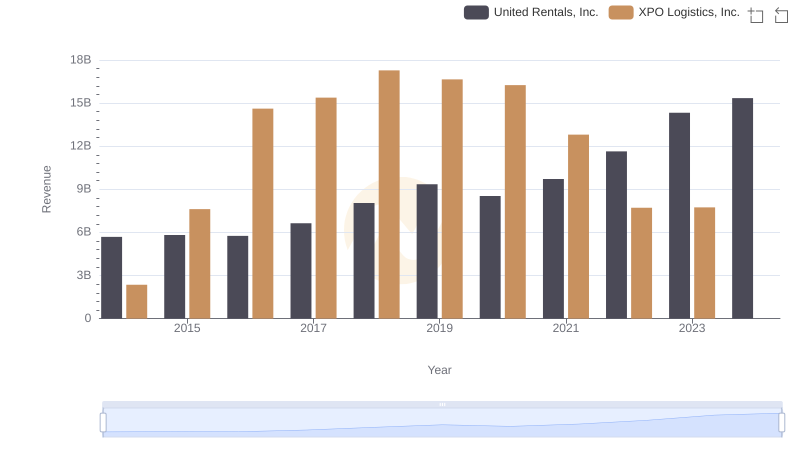

United Rentals, Inc. and XPO Logistics, Inc.: A Comprehensive Revenue Analysis

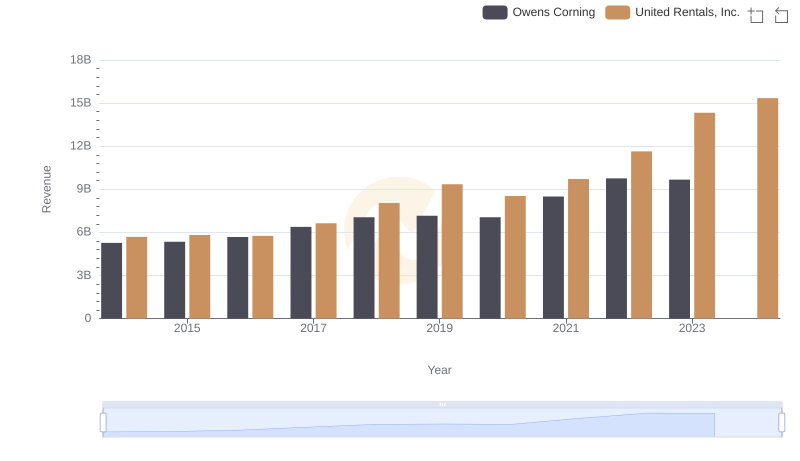

United Rentals, Inc. vs Owens Corning: Annual Revenue Growth Compared

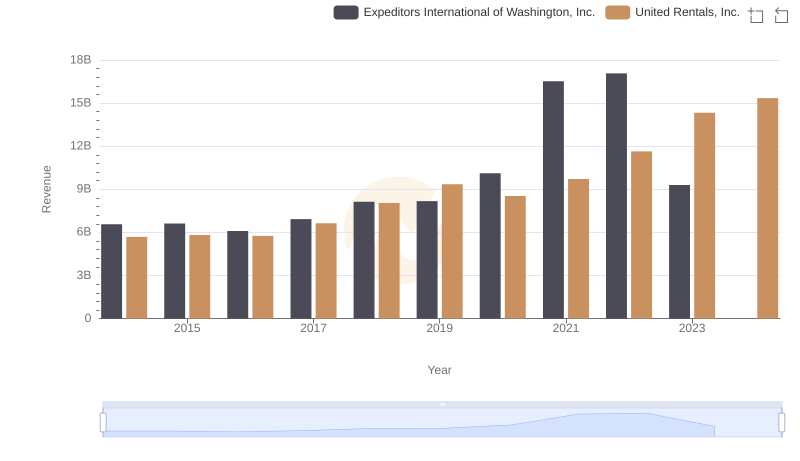

Comparing Revenue Performance: United Rentals, Inc. or Expeditors International of Washington, Inc.?

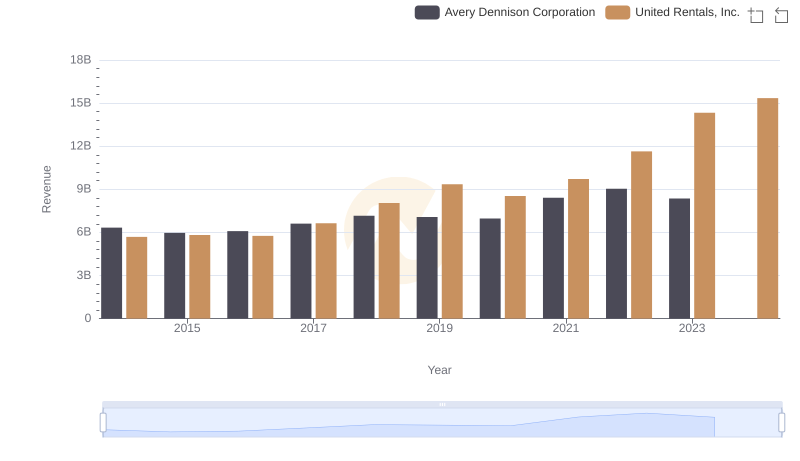

United Rentals, Inc. vs Avery Dennison Corporation: Examining Key Revenue Metrics

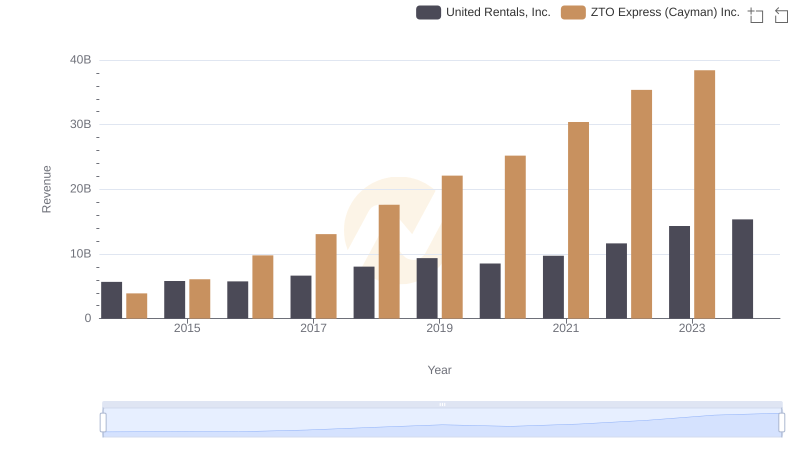

United Rentals, Inc. and ZTO Express (Cayman) Inc.: A Comprehensive Revenue Analysis

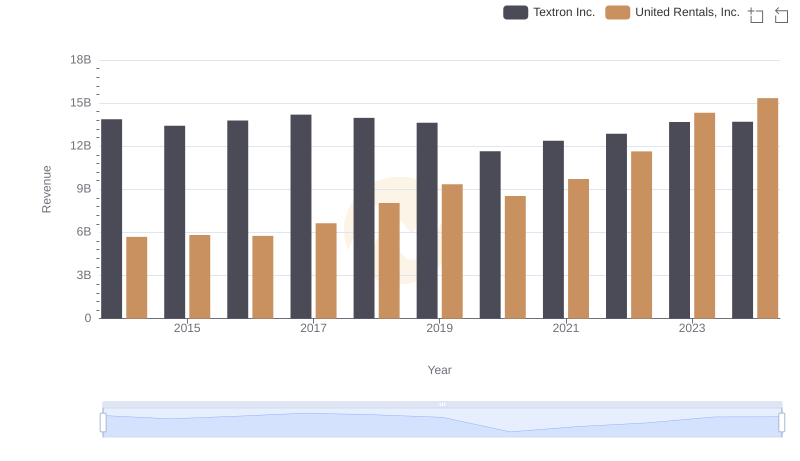

Revenue Insights: United Rentals, Inc. and Textron Inc. Performance Compared

Cost of Revenue: Key Insights for United Rentals, Inc. and China Eastern Airlines Corporation Limited

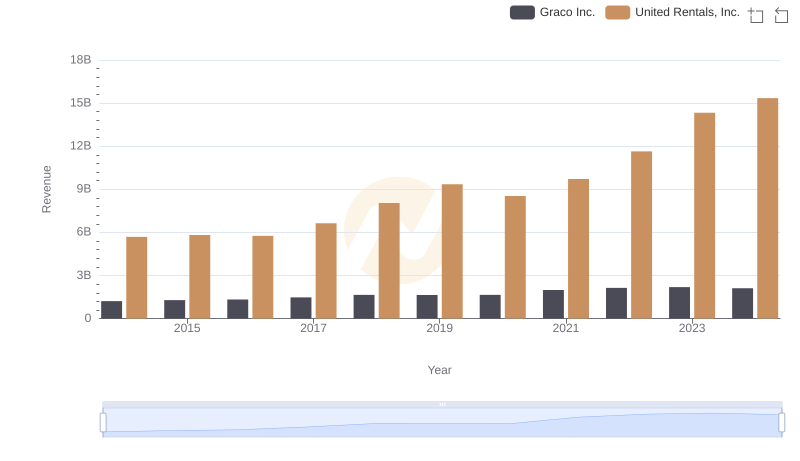

Who Generates More Revenue? United Rentals, Inc. or Graco Inc.

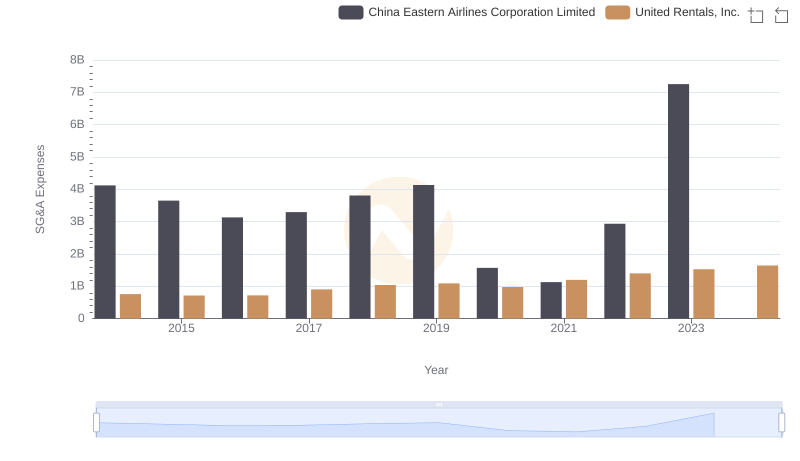

United Rentals, Inc. or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?