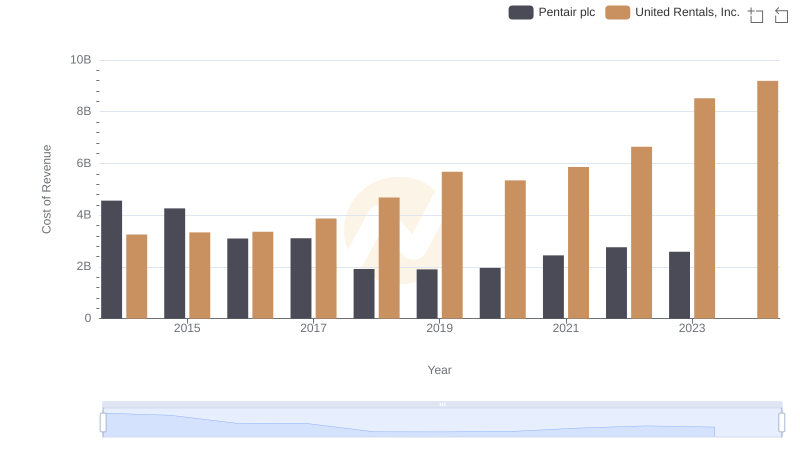

| __timestamp | Pentair plc | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7039000000 | 5685000000 |

| Thursday, January 1, 2015 | 6449000000 | 5817000000 |

| Friday, January 1, 2016 | 4890000000 | 5762000000 |

| Sunday, January 1, 2017 | 4936500000 | 6641000000 |

| Monday, January 1, 2018 | 2965100000 | 8047000000 |

| Tuesday, January 1, 2019 | 2957200000 | 9351000000 |

| Wednesday, January 1, 2020 | 3017800000 | 8530000000 |

| Friday, January 1, 2021 | 3764800000 | 9716000000 |

| Saturday, January 1, 2022 | 4121800000 | 11642000000 |

| Sunday, January 1, 2023 | 4104500000 | 14332000000 |

| Monday, January 1, 2024 | 4082800000 | 15345000000 |

Unlocking the unknown

In the competitive landscape of the construction and industrial sectors, revenue serves as a vital indicator of a company's market position and operational success. United Rentals, Inc. and Pentair plc are two prominent players in their respective fields, each showcasing a unique trajectory of growth and adaptation in the face of market challenges. This article delves into the revenue performance of these companies from 2014 to 2023, offering insights into their financial health and strategic positioning.

From 2014 to 2023, United Rentals, Inc. has consistently outperformed Pentair plc in terms of revenue generation. In 2014, United Rentals reported approximately $5.7 billion in revenue, while Pentair's revenue was slightly higher at about $7.0 billion. However, the following years marked a significant divergence in their financial trajectories.

By 2023, United Rentals had achieved a remarkable revenue of approximately $14.3 billion, reflecting an impressive growth rate of over 150% since 2014. In stark contrast, Pentair's revenue fluctuated, peaking at around $6.4 billion in 2015 and experiencing a downward trend until 2019, where it dipped to about $3.0 billion. Despite some recovery in subsequent years, Pentair's revenue remained significantly lower than that of United Rentals, reaching approximately $4.1 billion in 2023.

The revenue trends reveal a compelling narrative of resilience and strategic growth for United Rentals. The company experienced a steady increase in revenue from 2016 onwards, with notable peaks in 2021 and 2022, where revenues soared to approximately $9.7 billion and $11.6 billion, respectively. This upward trajectory underscores United Rentals' ability to capitalize on market opportunities and expand its service offerings.

Conversely, Pentair plc's revenue trajectory has been more volatile. After its peak in 2015, the company struggled to maintain consistent growth. The data highlights a concerning trend, with revenues dropping below $3.0 billion in 2019, a stark contrast to its earlier performance. Although Pentair has shown signs of recovery, the company has yet to reclaim its former revenue highs, raising questions about its competitive strategies and market positioning.

As we look ahead, the revenue showdown between United Rentals and Pentair plc presents a fascinating case study in corporate strategy and market dynamics. United Rentals' robust growth indicates a strong market presence and effective management practices, positioning it well for future opportunities. Meanwhile, Pentair's challenges suggest a need for strategic reevaluation and potential restructuring to enhance its competitive edge.

In conclusion, the revenue performance of these two companies over the past decade not only reflects their individual strategies but also highlights broader trends within the construction and industrial sectors. Stakeholders and investors would do well to monitor these developments closely, as they may signal shifts in market leadership and investment opportunities in the years to come.

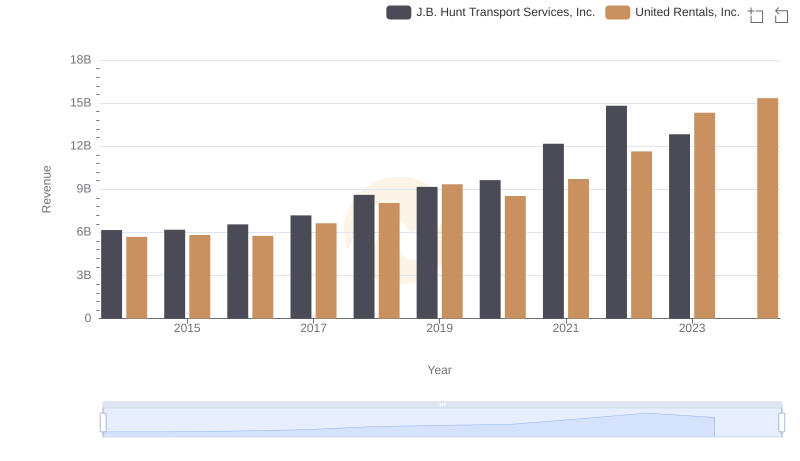

United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.: Examining Key Revenue Metrics

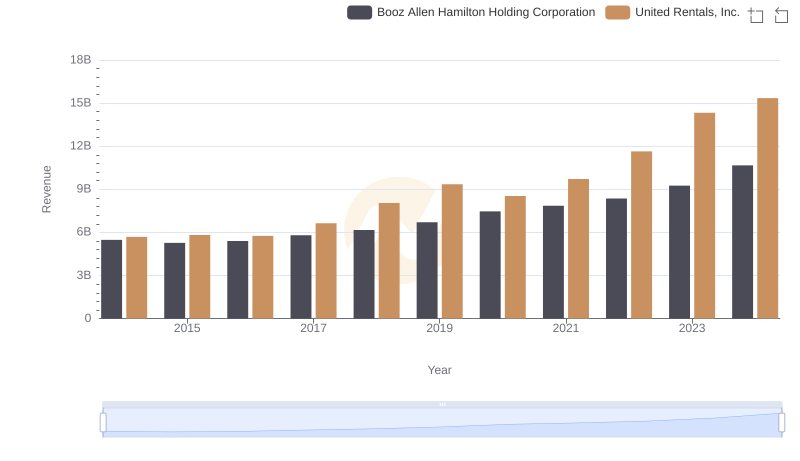

United Rentals, Inc. and Booz Allen Hamilton Holding Corporation: A Comprehensive Revenue Analysis

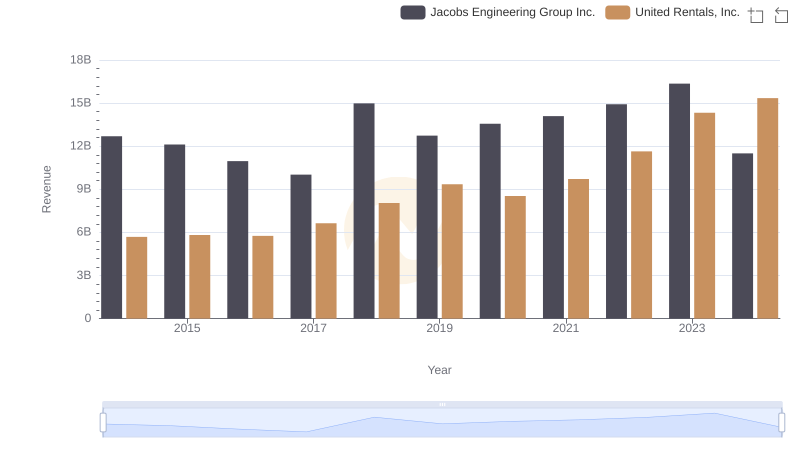

United Rentals, Inc. vs Jacobs Engineering Group Inc.: Annual Revenue Growth Compared

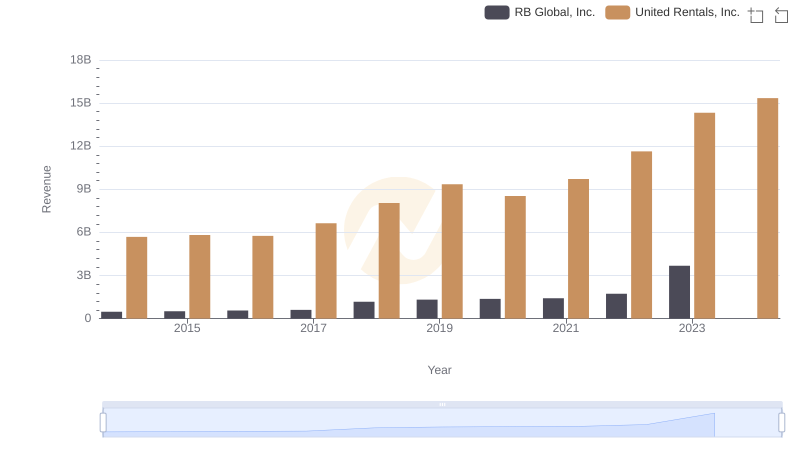

Revenue Insights: United Rentals, Inc. and RB Global, Inc. Performance Compared

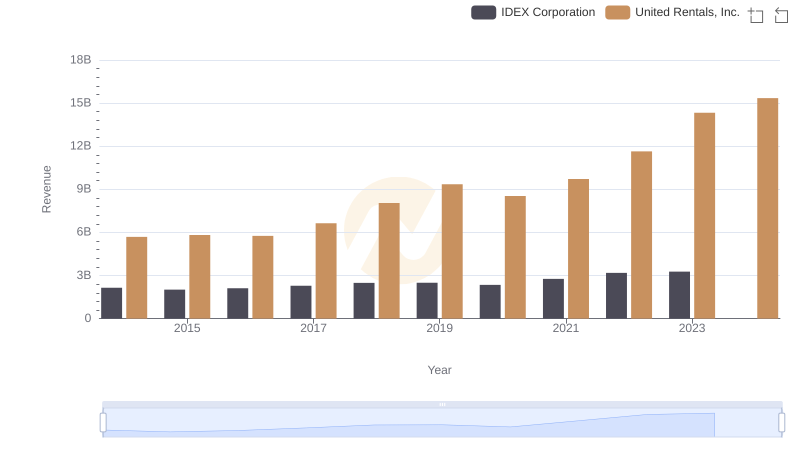

United Rentals, Inc. and IDEX Corporation: A Comprehensive Revenue Analysis

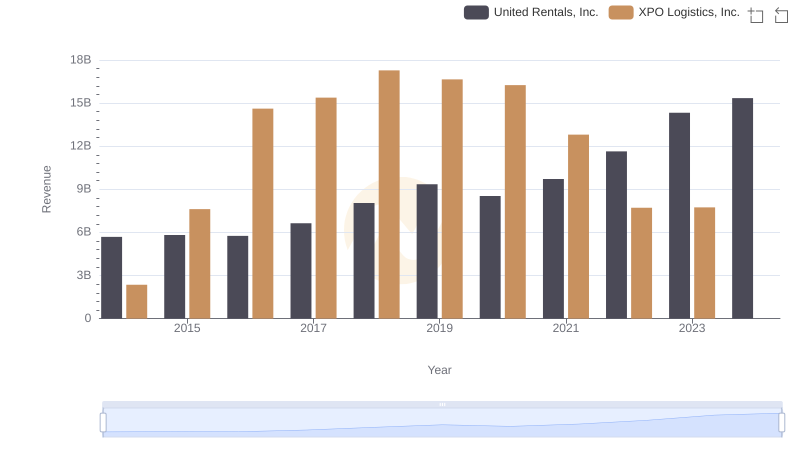

United Rentals, Inc. and XPO Logistics, Inc.: A Comprehensive Revenue Analysis

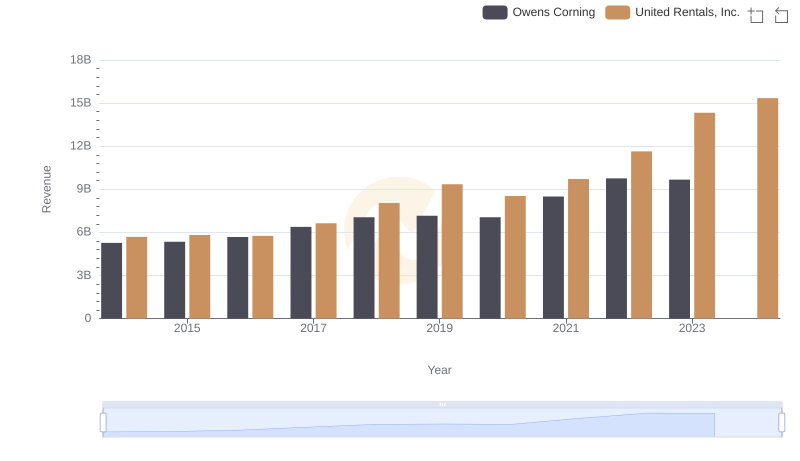

United Rentals, Inc. vs Owens Corning: Annual Revenue Growth Compared

Analyzing Cost of Revenue: United Rentals, Inc. and Pentair plc

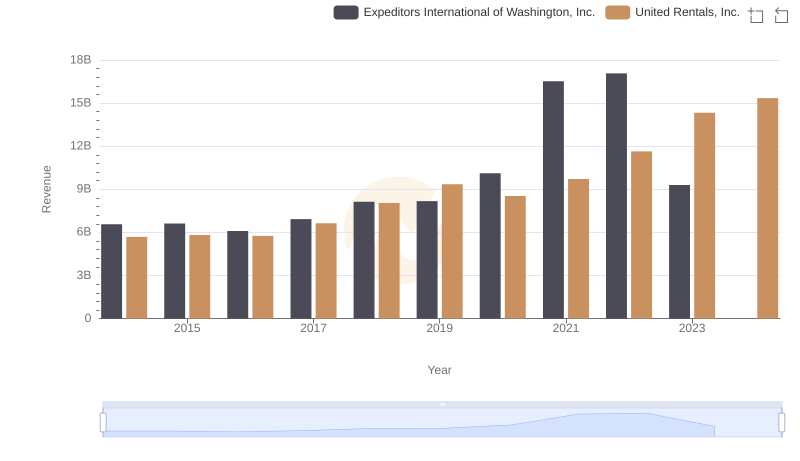

Comparing Revenue Performance: United Rentals, Inc. or Expeditors International of Washington, Inc.?

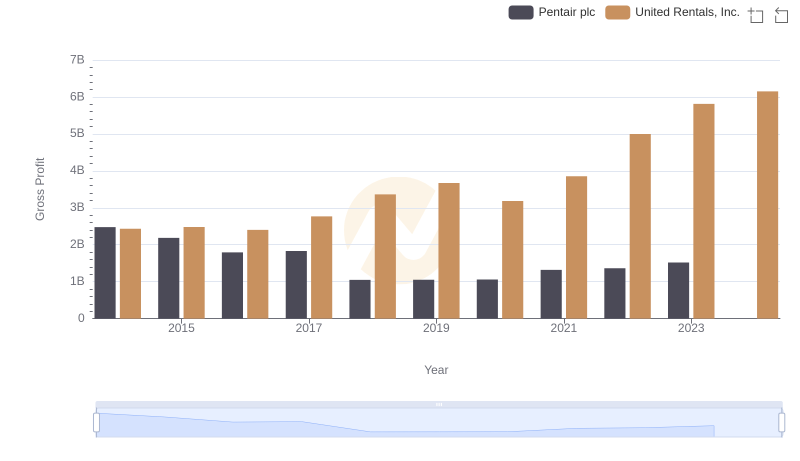

Who Generates Higher Gross Profit? United Rentals, Inc. or Pentair plc

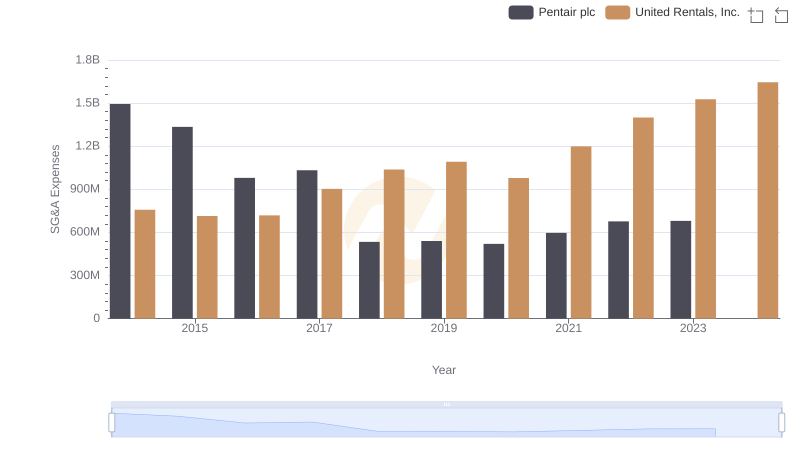

United Rentals, Inc. vs Pentair plc: SG&A Expense Trends

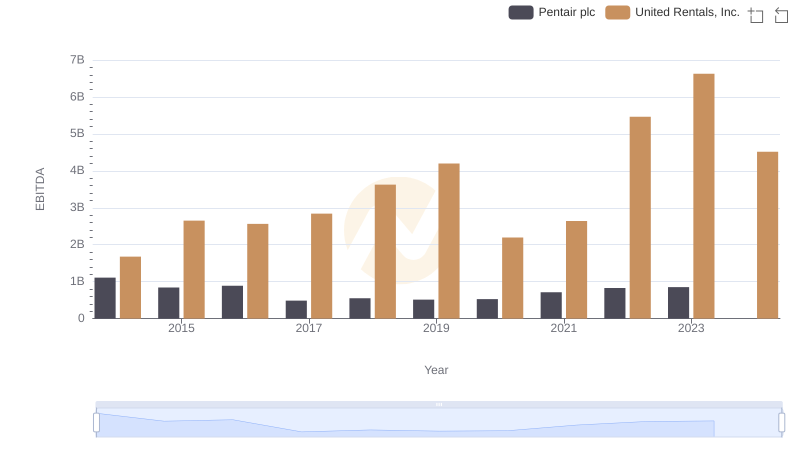

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Pentair plc