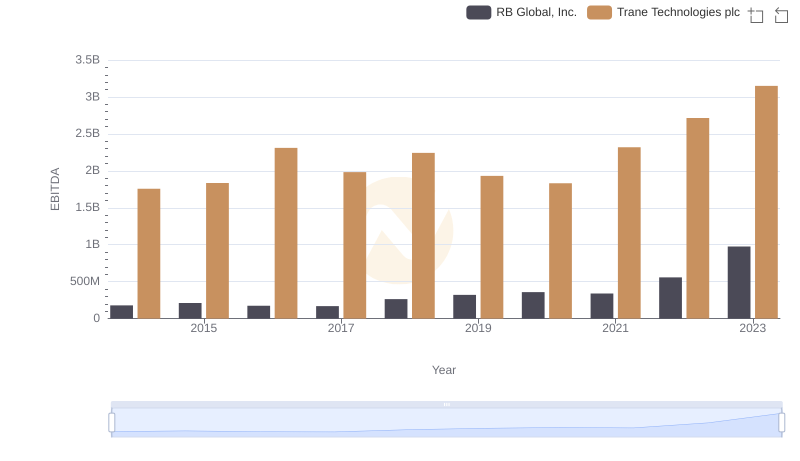

| __timestamp | IDEX Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 504019000 | 1757000000 |

| Thursday, January 1, 2015 | 505071000 | 1835000000 |

| Friday, January 1, 2016 | 507871000 | 2311000000 |

| Sunday, January 1, 2017 | 591033000 | 1982500000 |

| Monday, January 1, 2018 | 657092000 | 2242400000 |

| Tuesday, January 1, 2019 | 647793000 | 1931200000 |

| Wednesday, January 1, 2020 | 604602000 | 1831900000 |

| Friday, January 1, 2021 | 720500000 | 2319200000 |

| Saturday, January 1, 2022 | 909800000 | 2715500000 |

| Sunday, January 1, 2023 | 964100000 | 3149900000 |

| Monday, January 1, 2024 | 677200000 | 3859600000 |

Igniting the spark of knowledge

In the competitive landscape of industrial manufacturing, Trane Technologies plc and IDEX Corporation have showcased remarkable financial resilience over the past decade. From 2014 to 2023, Trane Technologies has consistently outperformed IDEX in terms of EBITDA, with a staggering 79% increase from 2014 to 2023. In contrast, IDEX Corporation has seen a robust 91% growth in the same period, albeit from a smaller base.

This financial journey highlights the dynamic nature of the industrial sector, where strategic innovation and market adaptation are key to sustained growth.

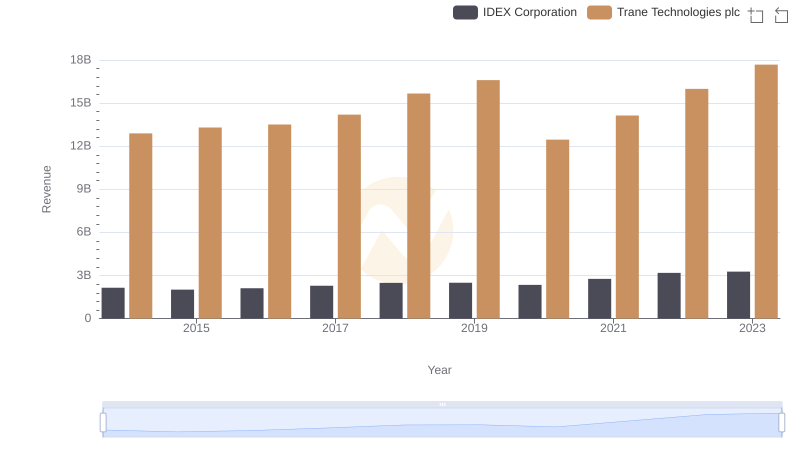

Who Generates More Revenue? Trane Technologies plc or IDEX Corporation

Comparing Cost of Revenue Efficiency: Trane Technologies plc vs IDEX Corporation

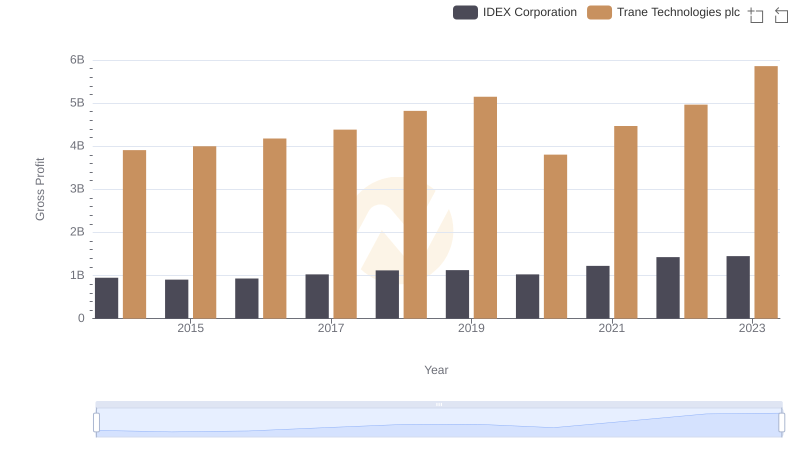

Trane Technologies plc vs IDEX Corporation: A Gross Profit Performance Breakdown

Professional EBITDA Benchmarking: Trane Technologies plc vs Booz Allen Hamilton Holding Corporation

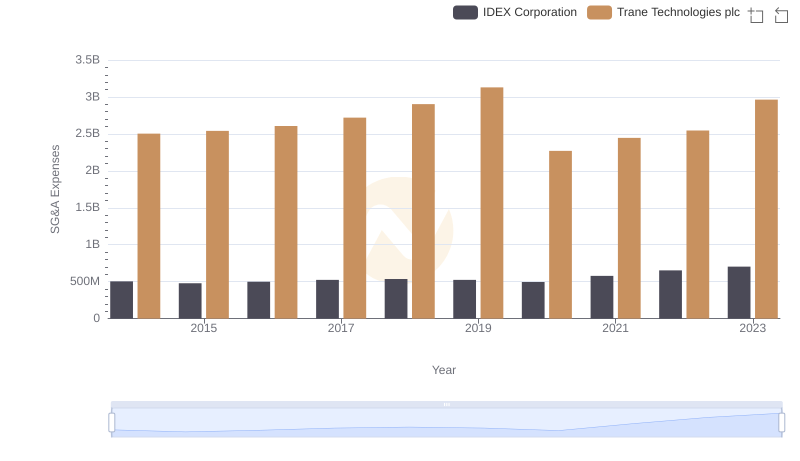

Trane Technologies plc vs IDEX Corporation: SG&A Expense Trends

Comprehensive EBITDA Comparison: Trane Technologies plc vs RB Global, Inc.

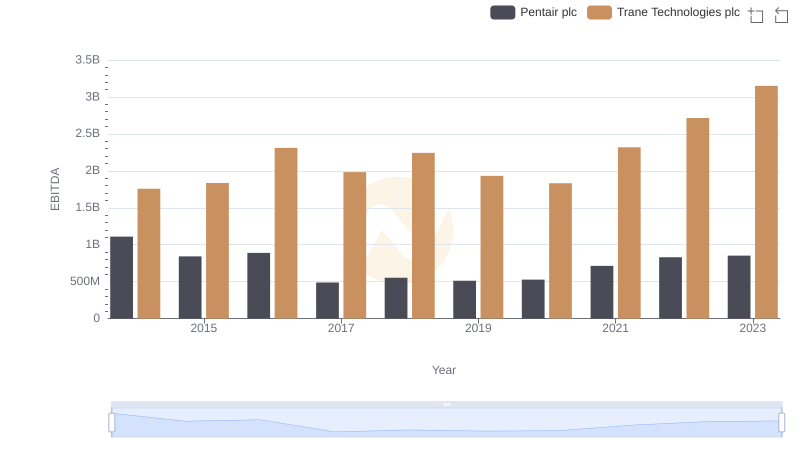

EBITDA Performance Review: Trane Technologies plc vs Pentair plc

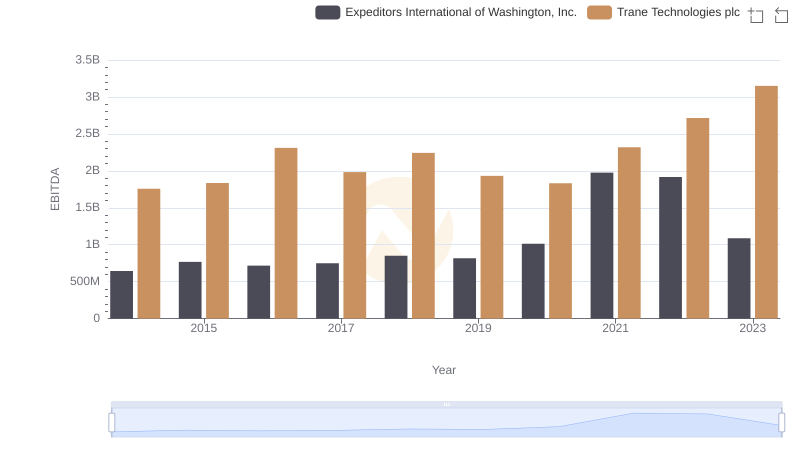

Trane Technologies plc vs Expeditors International of Washington, Inc.: In-Depth EBITDA Performance Comparison

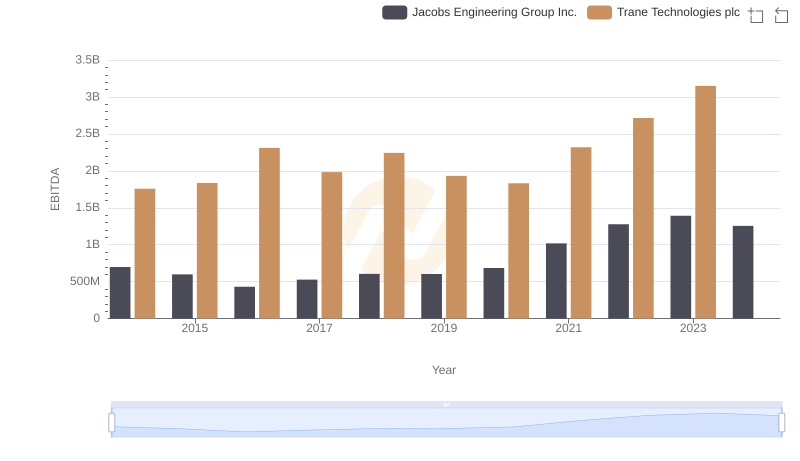

EBITDA Analysis: Evaluating Trane Technologies plc Against Jacobs Engineering Group Inc.

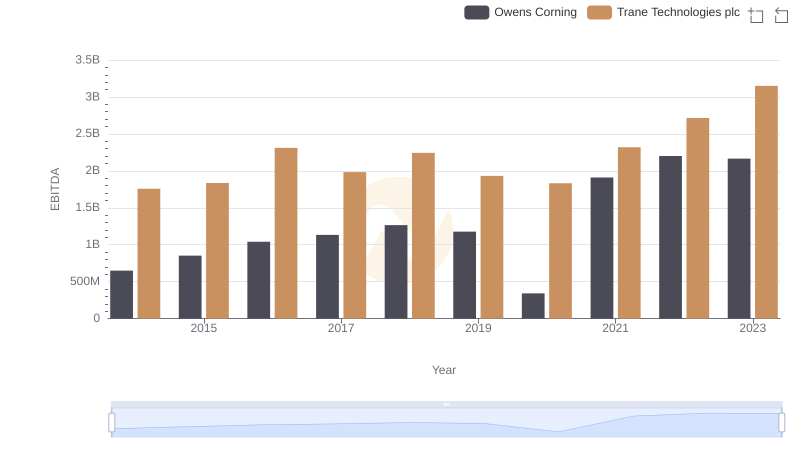

A Professional Review of EBITDA: Trane Technologies plc Compared to Owens Corning

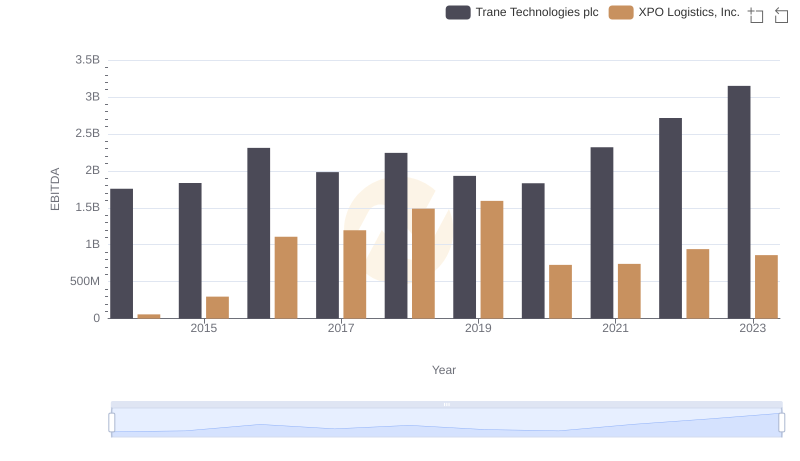

A Professional Review of EBITDA: Trane Technologies plc Compared to XPO Logistics, Inc.

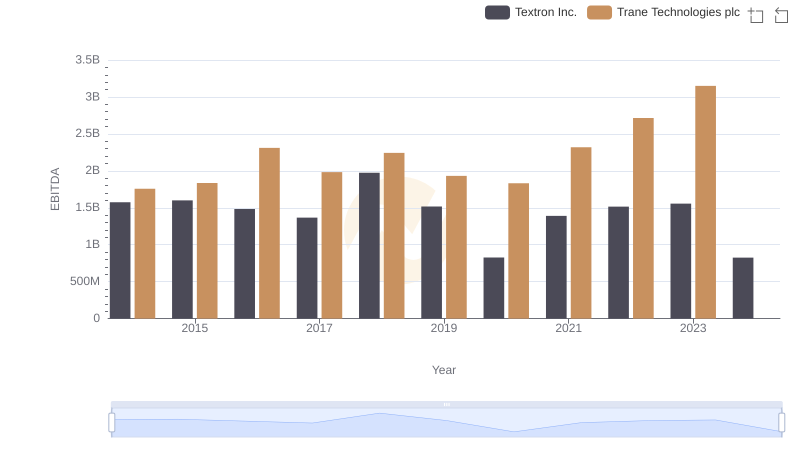

A Professional Review of EBITDA: Trane Technologies plc Compared to Textron Inc.