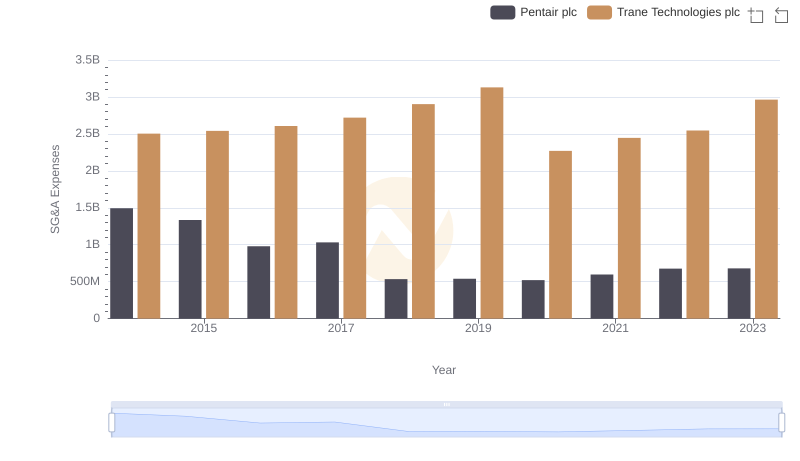

| __timestamp | Pentair plc | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1109300000 | 1757000000 |

| Thursday, January 1, 2015 | 842400000 | 1835000000 |

| Friday, January 1, 2016 | 890400000 | 2311000000 |

| Sunday, January 1, 2017 | 488600000 | 1982500000 |

| Monday, January 1, 2018 | 552800000 | 2242400000 |

| Tuesday, January 1, 2019 | 513200000 | 1931200000 |

| Wednesday, January 1, 2020 | 527600000 | 1831900000 |

| Friday, January 1, 2021 | 714400000 | 2319200000 |

| Saturday, January 1, 2022 | 830400000 | 2715500000 |

| Sunday, January 1, 2023 | 852000000 | 3149900000 |

| Monday, January 1, 2024 | 803800000 | 3859600000 |

Infusing magic into the data realm

In the competitive landscape of industrial manufacturing, Trane Technologies plc and Pentair plc have showcased distinct trajectories in their EBITDA performance over the past decade. From 2014 to 2023, Trane Technologies has consistently outperformed Pentair, with its EBITDA growing by approximately 79%, reaching a peak in 2023. This growth highlights Trane's strategic focus on innovation and operational efficiency.

Conversely, Pentair's EBITDA has experienced fluctuations, with a notable dip in 2017, but has since rebounded, achieving a 74% increase from its lowest point. This recovery underscores Pentair's resilience and adaptability in a dynamic market.

The data reveals a compelling narrative of two industry giants navigating economic challenges and opportunities, with Trane Technologies emerging as a leader in EBITDA growth. As the industrial sector evolves, these companies' financial strategies will be pivotal in shaping their future success.

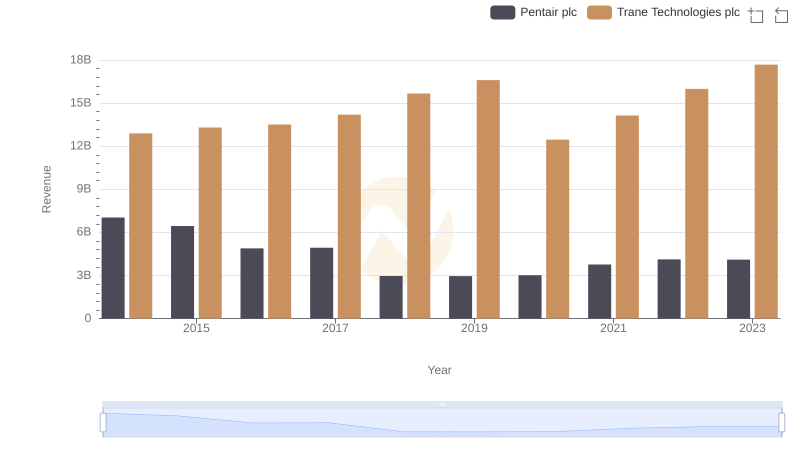

Trane Technologies plc vs Pentair plc: Examining Key Revenue Metrics

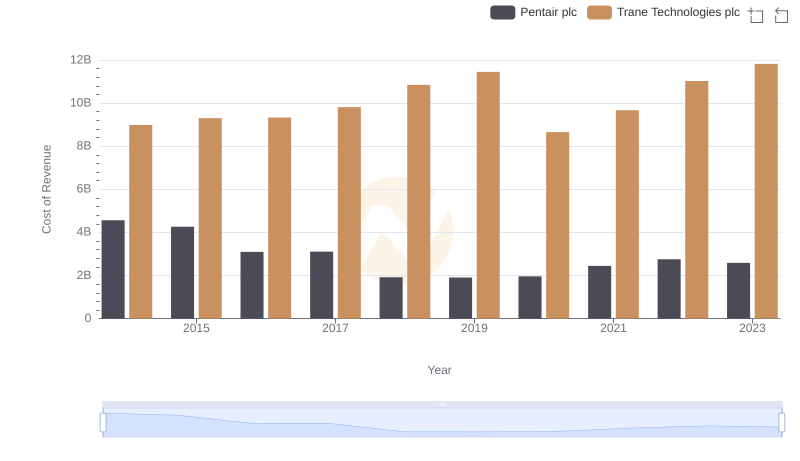

Analyzing Cost of Revenue: Trane Technologies plc and Pentair plc

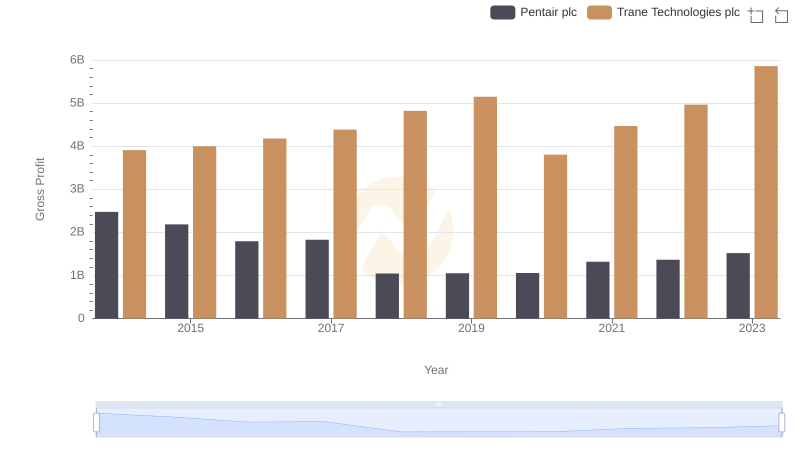

Trane Technologies plc and Pentair plc: A Detailed Gross Profit Analysis

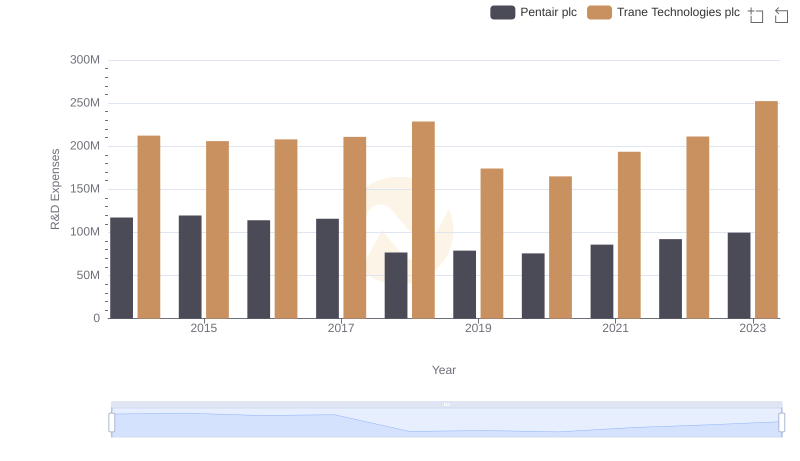

Research and Development: Comparing Key Metrics for Trane Technologies plc and Pentair plc

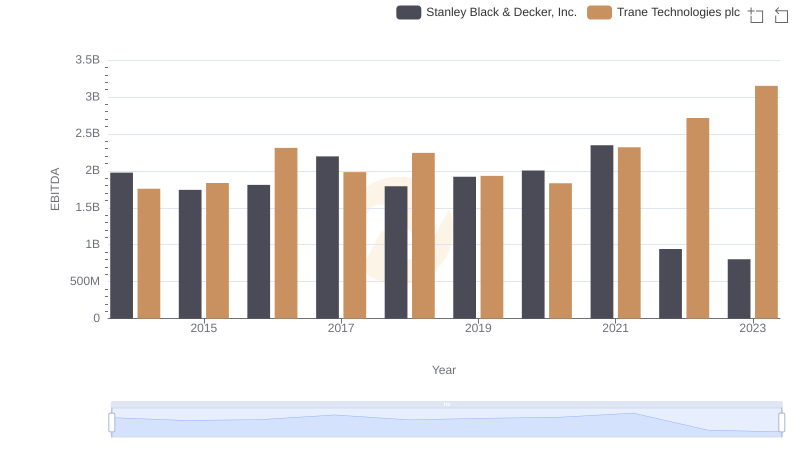

EBITDA Metrics Evaluated: Trane Technologies plc vs Stanley Black & Decker, Inc.

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Pentair plc

Professional EBITDA Benchmarking: Trane Technologies plc vs Booz Allen Hamilton Holding Corporation

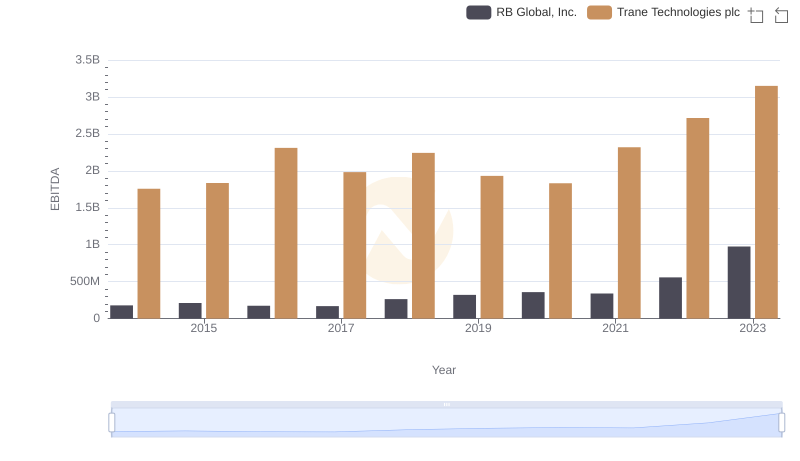

Comprehensive EBITDA Comparison: Trane Technologies plc vs RB Global, Inc.

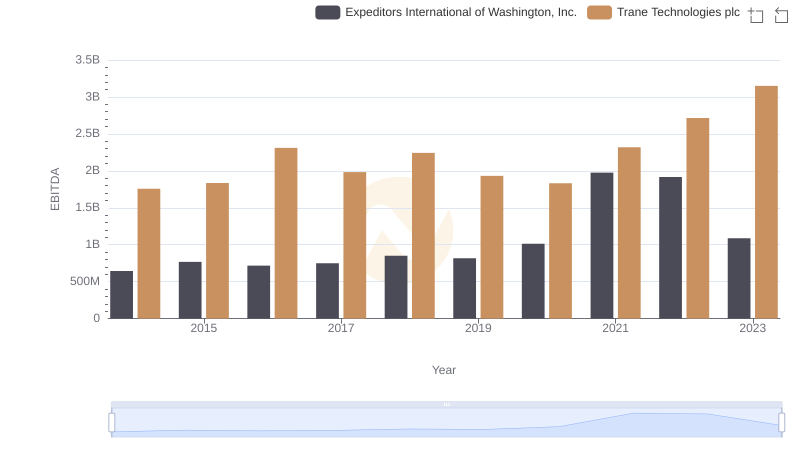

Trane Technologies plc vs Expeditors International of Washington, Inc.: In-Depth EBITDA Performance Comparison

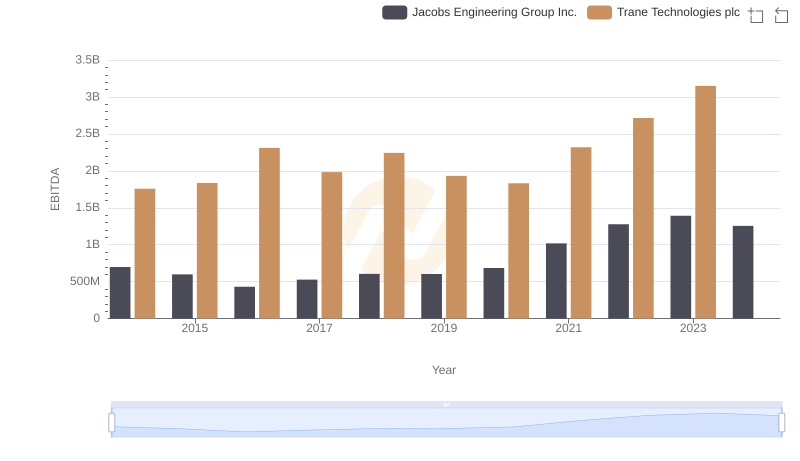

EBITDA Analysis: Evaluating Trane Technologies plc Against Jacobs Engineering Group Inc.

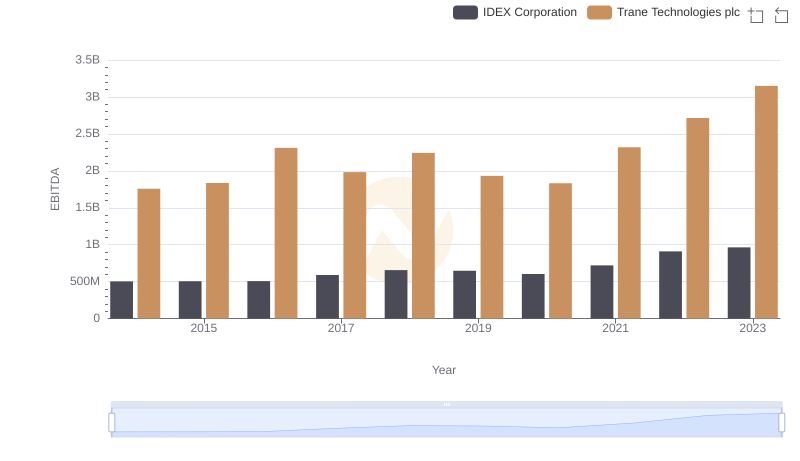

Professional EBITDA Benchmarking: Trane Technologies plc vs IDEX Corporation