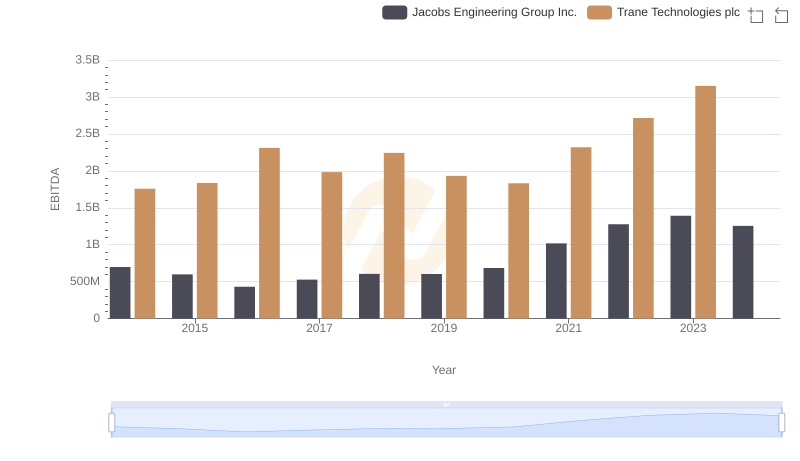

| __timestamp | Booz Allen Hamilton Holding Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 1757000000 |

| Thursday, January 1, 2015 | 520410000 | 1835000000 |

| Friday, January 1, 2016 | 506120000 | 2311000000 |

| Sunday, January 1, 2017 | 561524000 | 1982500000 |

| Monday, January 1, 2018 | 577061000 | 2242400000 |

| Tuesday, January 1, 2019 | 663731000 | 1931200000 |

| Wednesday, January 1, 2020 | 745424000 | 1831900000 |

| Friday, January 1, 2021 | 834449000 | 2319200000 |

| Saturday, January 1, 2022 | 826865000 | 2715500000 |

| Sunday, January 1, 2023 | 958150000 | 3149900000 |

| Monday, January 1, 2024 | 1199992000 | 3859600000 |

In pursuit of knowledge

In the competitive landscape of professional services and industrial solutions, Trane Technologies plc and Booz Allen Hamilton Holding Corporation stand out as industry leaders. Over the past decade, Trane Technologies has consistently outperformed Booz Allen Hamilton in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Trane Technologies' EBITDA surged by approximately 79%, peaking at an impressive $3.15 billion in 2023. In contrast, Booz Allen Hamilton experienced a steady increase of around 126%, reaching $1.2 billion in 2024. This growth highlights Booz Allen Hamilton's strategic expansion in consulting services. However, the data for 2024 is incomplete for Trane Technologies, indicating potential future updates. This analysis underscores the dynamic nature of these sectors and the strategic maneuvers companies employ to maintain their competitive edge.

Cost of Revenue Trends: Trane Technologies plc vs Booz Allen Hamilton Holding Corporation

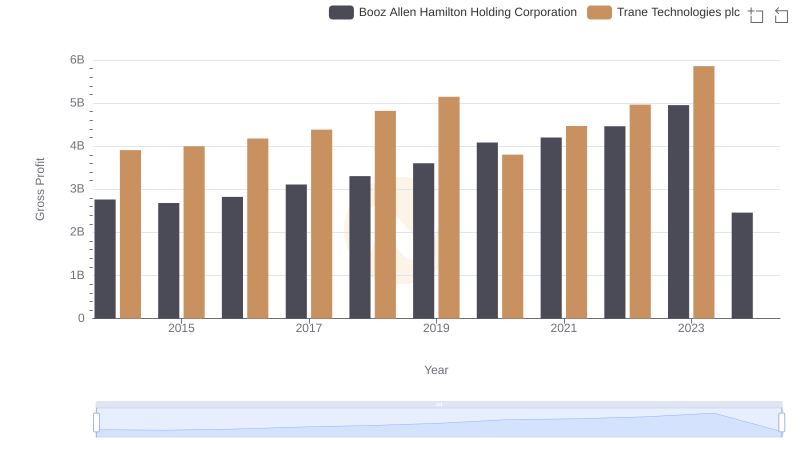

Key Insights on Gross Profit: Trane Technologies plc vs Booz Allen Hamilton Holding Corporation

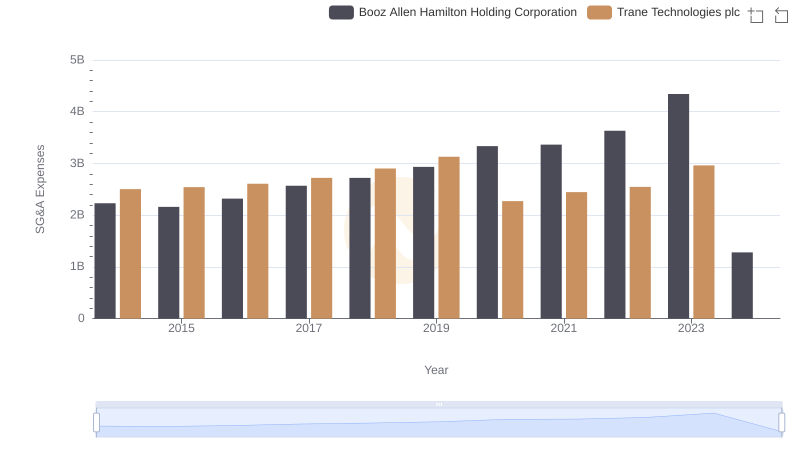

Trane Technologies plc and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

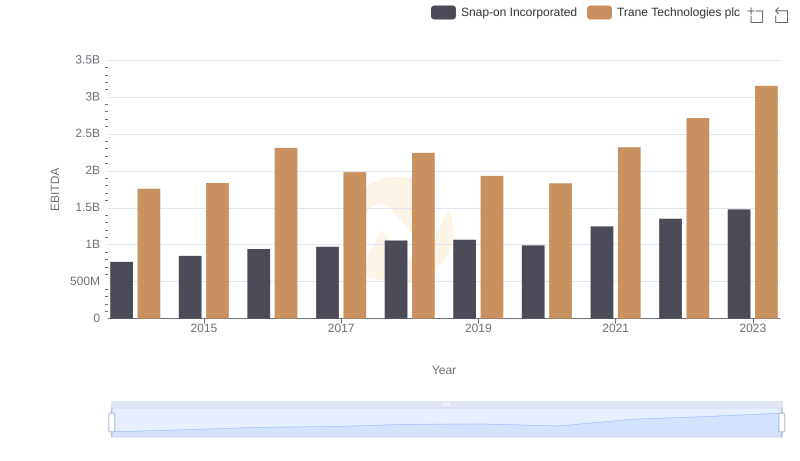

A Professional Review of EBITDA: Trane Technologies plc Compared to Snap-on Incorporated

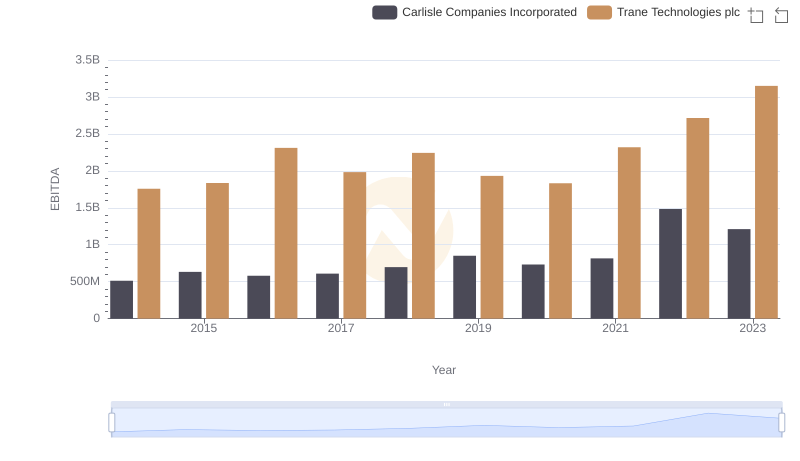

A Professional Review of EBITDA: Trane Technologies plc Compared to Carlisle Companies Incorporated

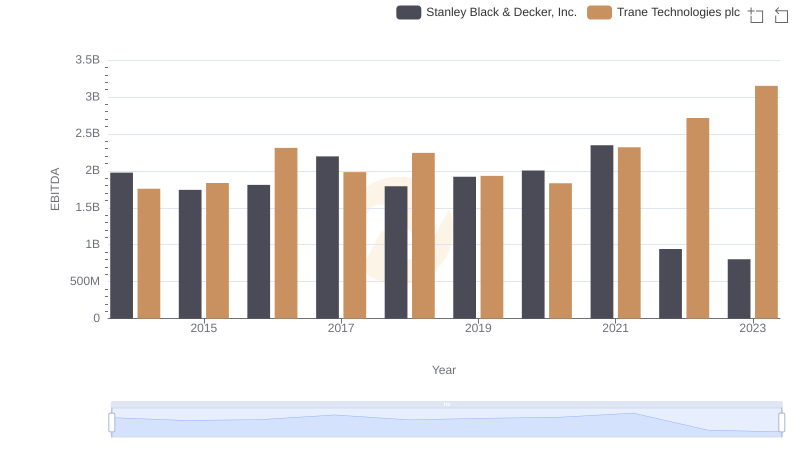

EBITDA Metrics Evaluated: Trane Technologies plc vs Stanley Black & Decker, Inc.

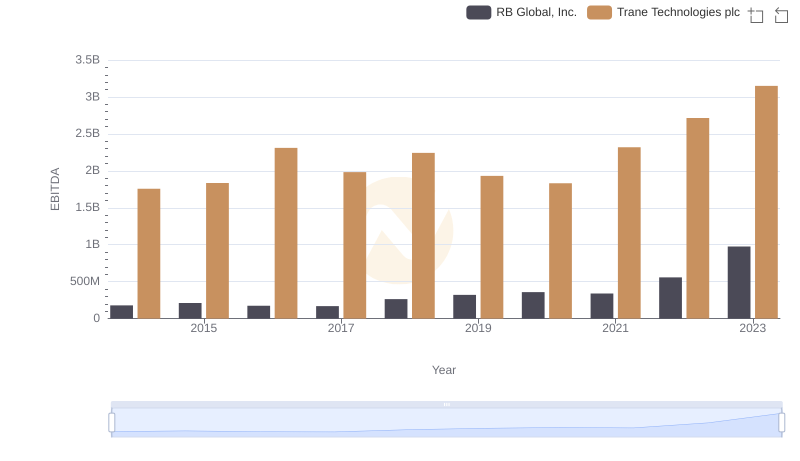

Comprehensive EBITDA Comparison: Trane Technologies plc vs RB Global, Inc.

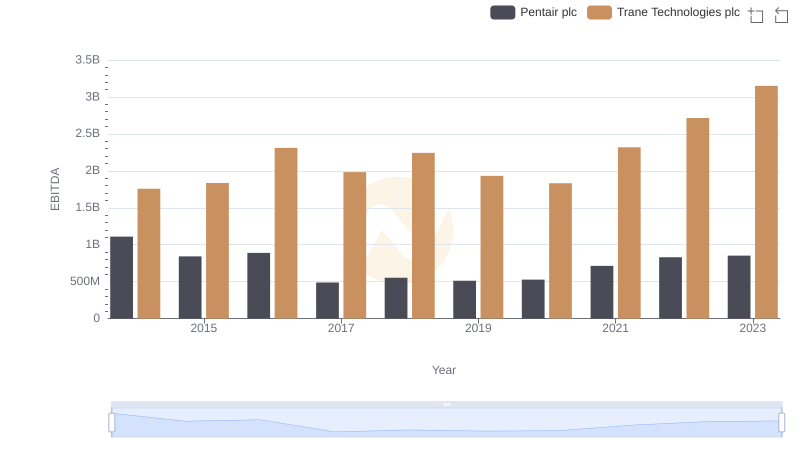

EBITDA Performance Review: Trane Technologies plc vs Pentair plc

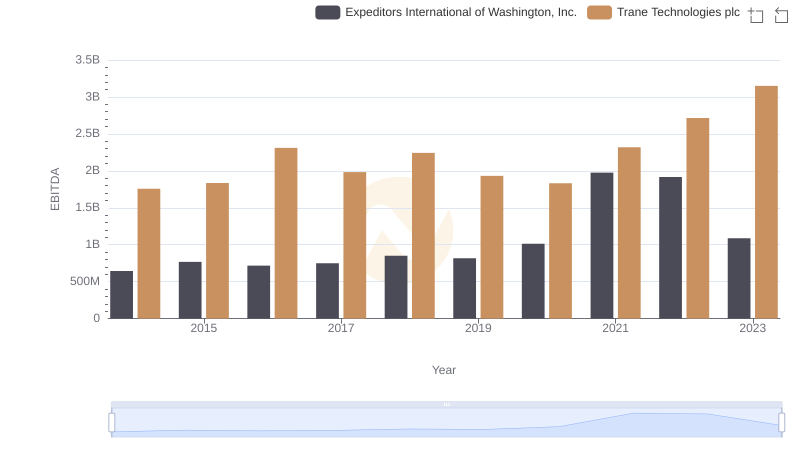

Trane Technologies plc vs Expeditors International of Washington, Inc.: In-Depth EBITDA Performance Comparison

EBITDA Analysis: Evaluating Trane Technologies plc Against Jacobs Engineering Group Inc.