| __timestamp | Curtiss-Wright Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 401669000 | 585590000 |

| Thursday, January 1, 2015 | 412042000 | 660570000 |

| Friday, January 1, 2016 | 405217000 | 671786000 |

| Sunday, January 1, 2017 | 441085000 | 783749000 |

| Monday, January 1, 2018 | 493171000 | 1046059000 |

| Tuesday, January 1, 2019 | 530221000 | 1078007000 |

| Wednesday, January 1, 2020 | 414499000 | 1168149000 |

| Friday, January 1, 2021 | 509134000 | 1651501000 |

| Saturday, January 1, 2022 | 548202000 | 2118962000 |

| Sunday, January 1, 2023 | 630635000 | 1972689000 |

| Monday, January 1, 2024 | 674592000 |

Igniting the spark of knowledge

In the competitive landscape of the transportation and aerospace sectors, Old Dominion Freight Line, Inc. and Curtiss-Wright Corporation stand as formidable players. Over the past decade, Old Dominion has consistently outperformed Curtiss-Wright in terms of EBITDA, showcasing a remarkable growth trajectory. From 2014 to 2023, Old Dominion's EBITDA surged by approximately 237%, peaking in 2022. In contrast, Curtiss-Wright experienced a more modest growth of around 57% during the same period. This divergence highlights Old Dominion's strategic prowess in capitalizing on market opportunities, particularly in the logistics sector. As we delve into the numbers, it's evident that Old Dominion's ability to adapt and innovate has been pivotal in its financial success. Meanwhile, Curtiss-Wright's steady growth reflects its resilience and commitment to maintaining a strong foothold in the aerospace industry. This comparison not only underscores the dynamic nature of these industries but also offers valuable insights for investors and industry enthusiasts alike.

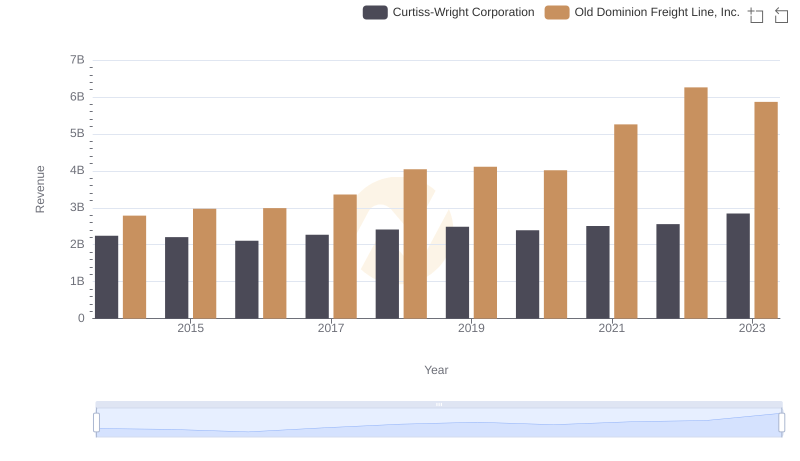

Annual Revenue Comparison: Old Dominion Freight Line, Inc. vs Curtiss-Wright Corporation

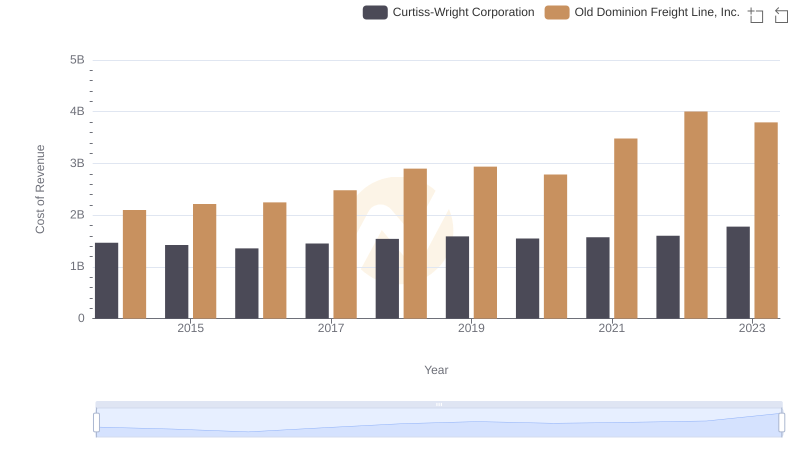

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Curtiss-Wright Corporation

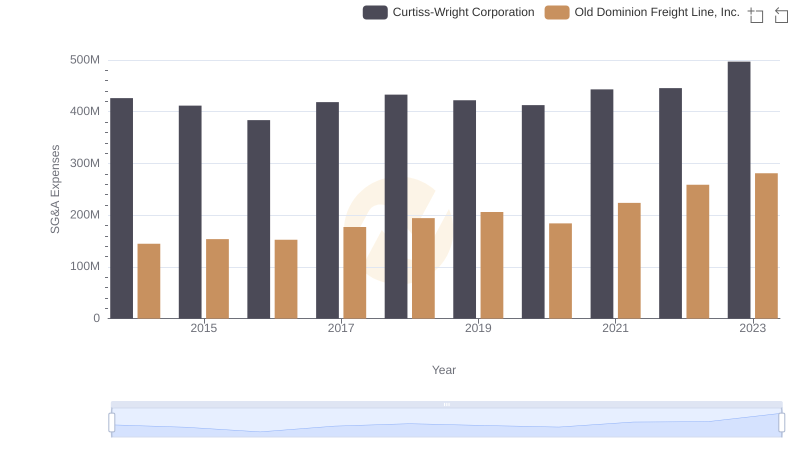

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Curtiss-Wright Corporation

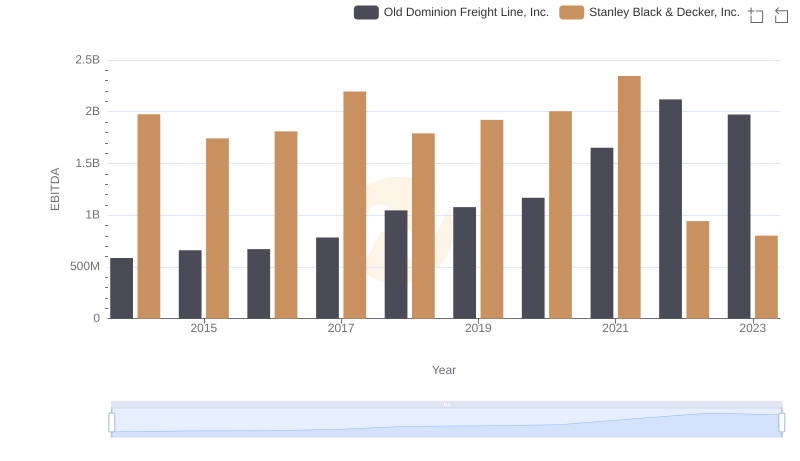

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Stanley Black & Decker, Inc.

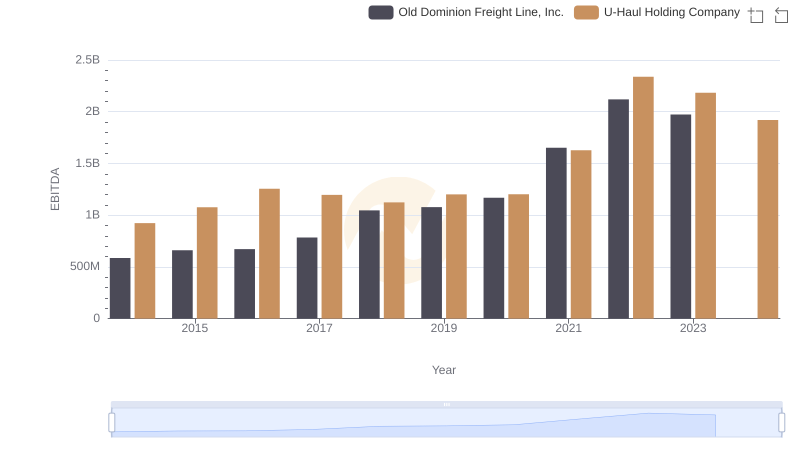

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and U-Haul Holding Company

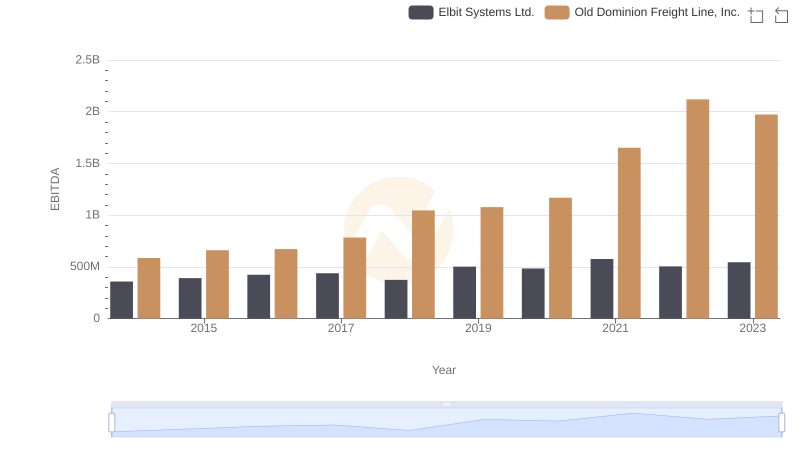

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Elbit Systems Ltd.

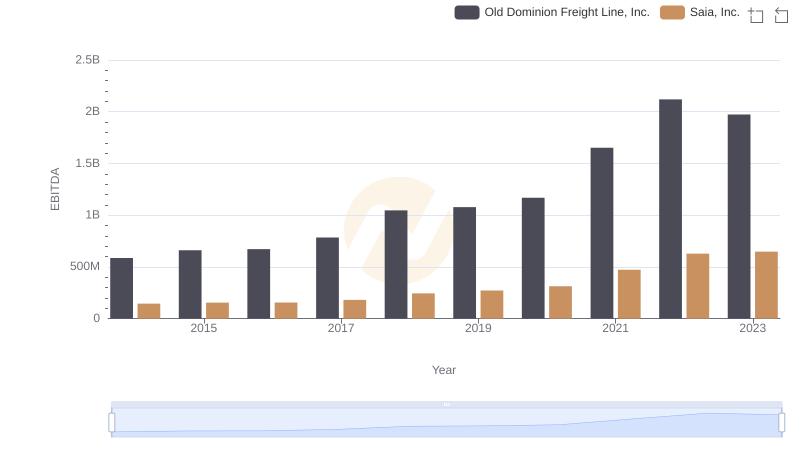

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Saia, Inc.

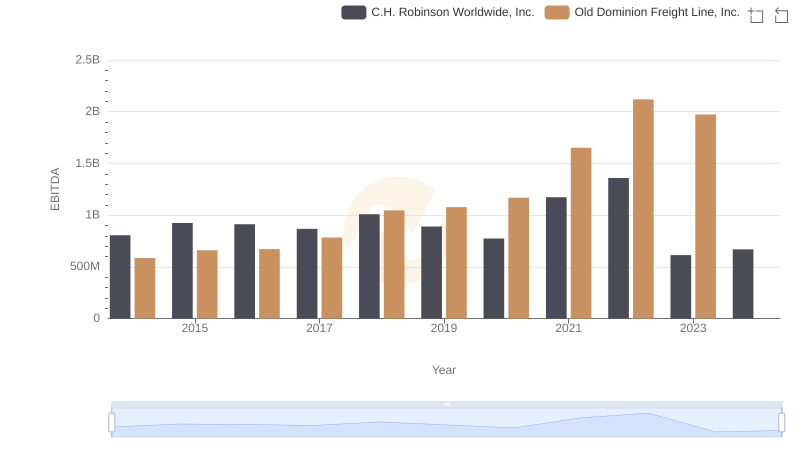

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to C.H. Robinson Worldwide, Inc.

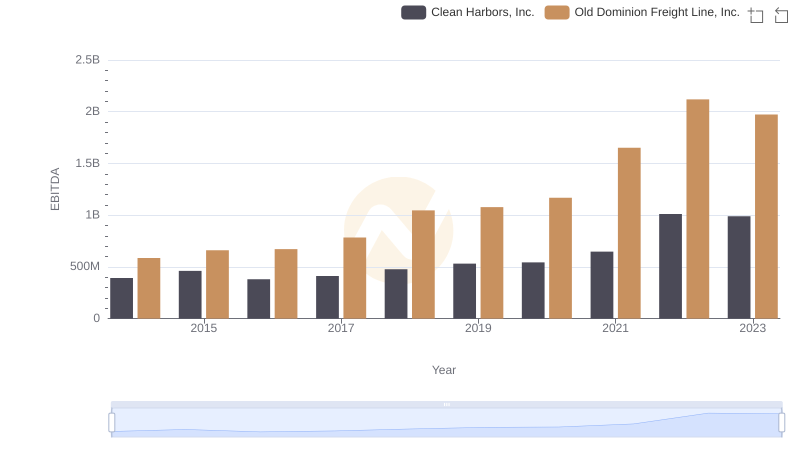

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and Clean Harbors, Inc.

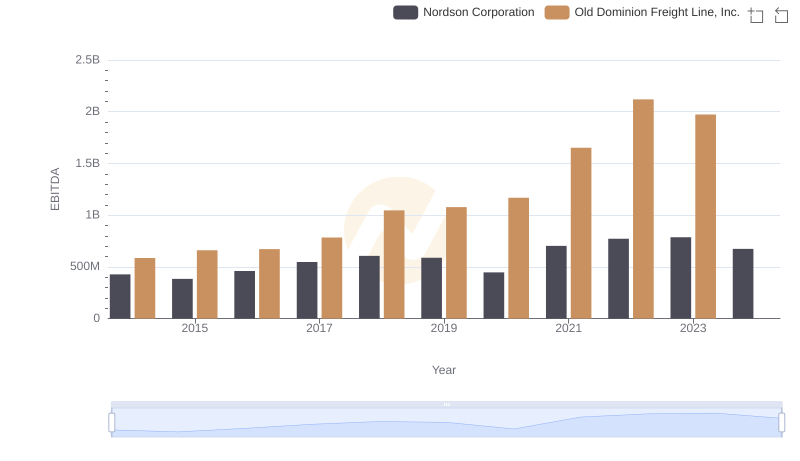

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Nordson Corporation

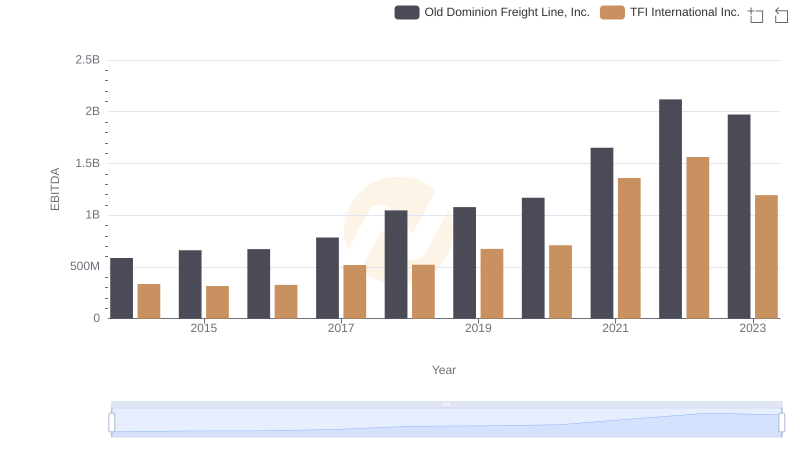

Old Dominion Freight Line, Inc. vs TFI International Inc.: In-Depth EBITDA Performance Comparison