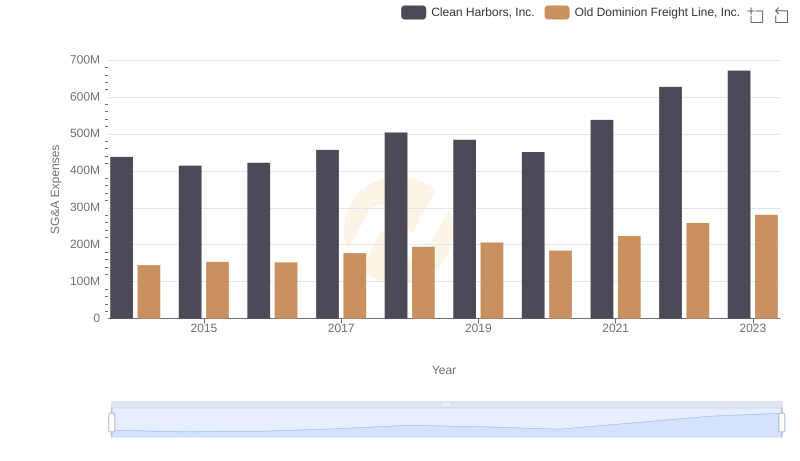

| __timestamp | Clean Harbors, Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 393092000 | 585590000 |

| Thursday, January 1, 2015 | 461019000 | 660570000 |

| Friday, January 1, 2016 | 380027000 | 671786000 |

| Sunday, January 1, 2017 | 411975000 | 783749000 |

| Monday, January 1, 2018 | 477159000 | 1046059000 |

| Tuesday, January 1, 2019 | 531861000 | 1078007000 |

| Wednesday, January 1, 2020 | 544047000 | 1168149000 |

| Friday, January 1, 2021 | 647725000 | 1651501000 |

| Saturday, January 1, 2022 | 1011488000 | 2118962000 |

| Sunday, January 1, 2023 | 989565000 | 1972689000 |

| Monday, January 1, 2024 | 799401000 |

Unveiling the hidden dimensions of data

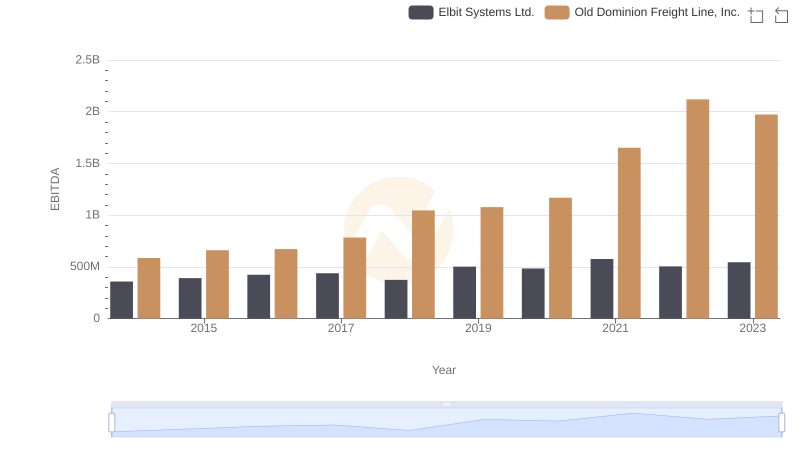

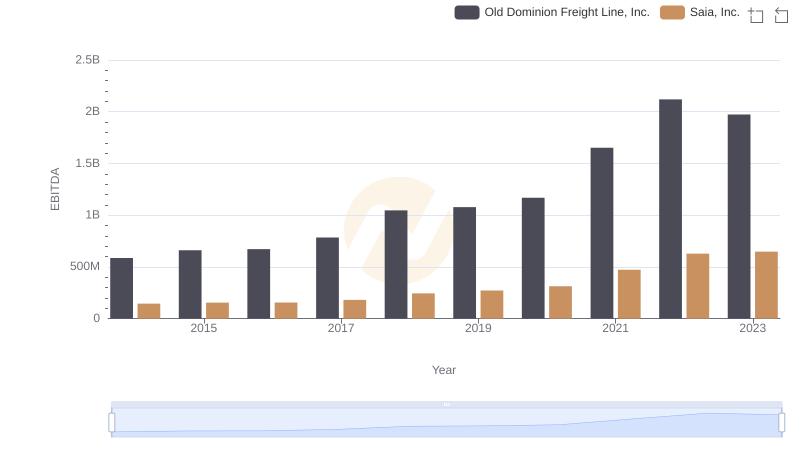

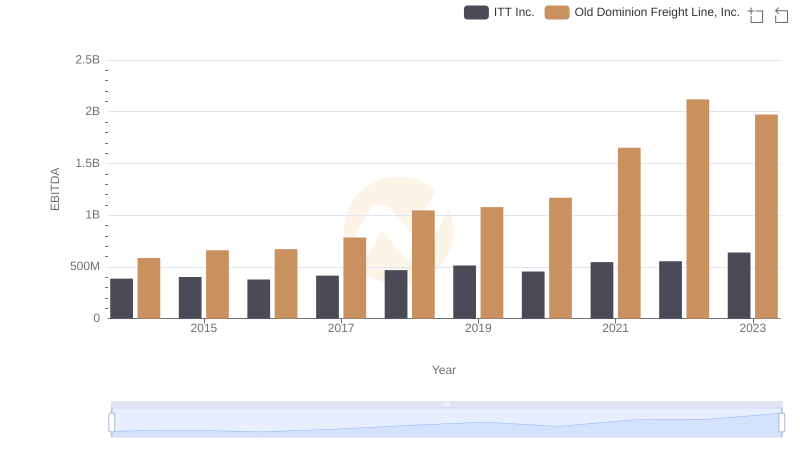

In the ever-evolving landscape of the transportation and environmental services sectors, Old Dominion Freight Line, Inc. and Clean Harbors, Inc. have demonstrated remarkable EBITDA growth over the past decade. From 2014 to 2023, Old Dominion's EBITDA surged by approximately 237%, reflecting its robust operational efficiency and market expansion. Meanwhile, Clean Harbors experienced a commendable 152% increase, underscoring its strategic initiatives in environmental services.

This analysis provides a compelling snapshot of how strategic management and market dynamics can drive financial performance in competitive industries.

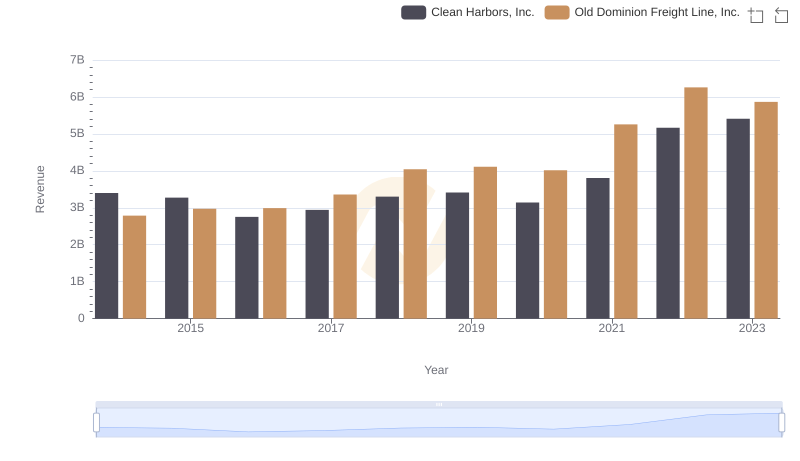

Breaking Down Revenue Trends: Old Dominion Freight Line, Inc. vs Clean Harbors, Inc.

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Elbit Systems Ltd.

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Clean Harbors, Inc.

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Saia, Inc.

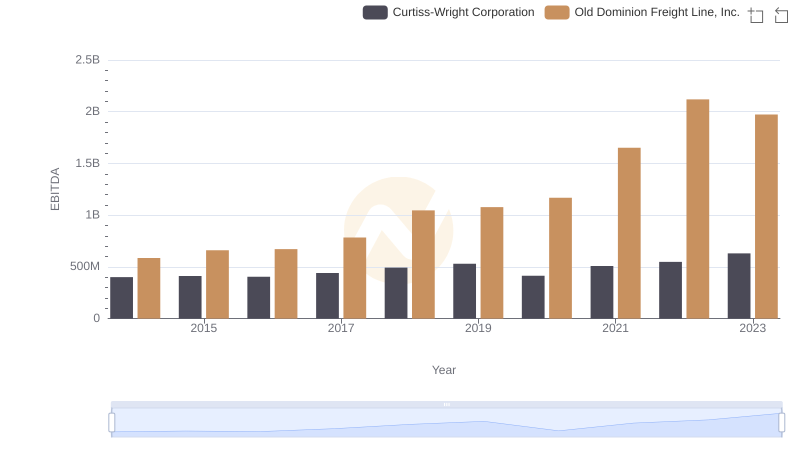

Professional EBITDA Benchmarking: Old Dominion Freight Line, Inc. vs Curtiss-Wright Corporation

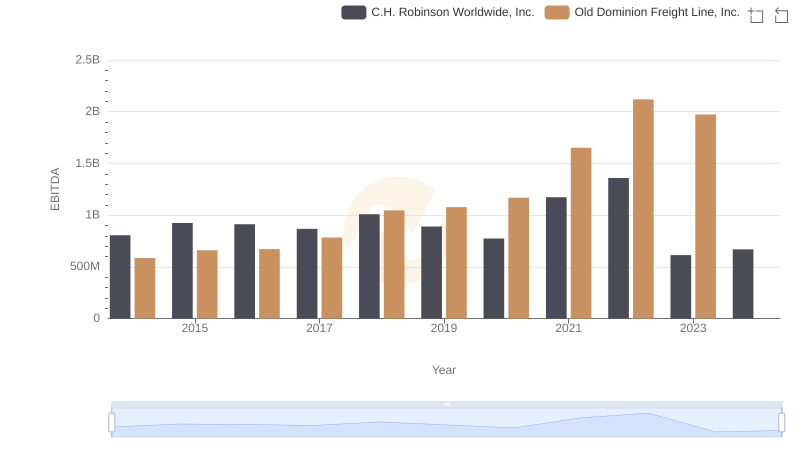

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to C.H. Robinson Worldwide, Inc.

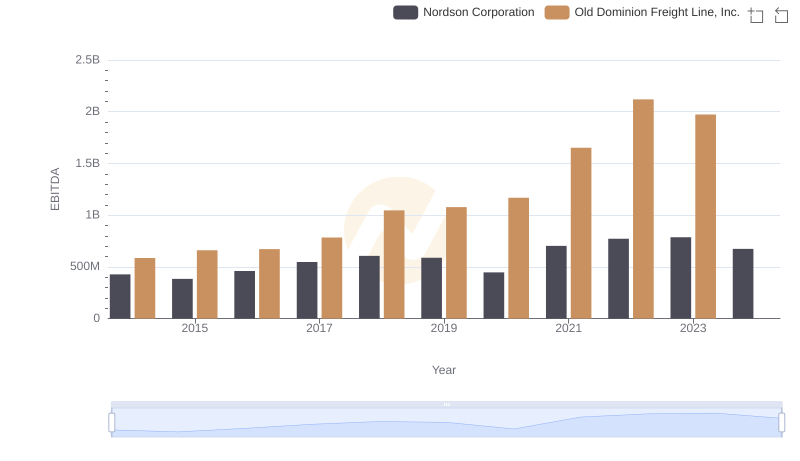

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Nordson Corporation

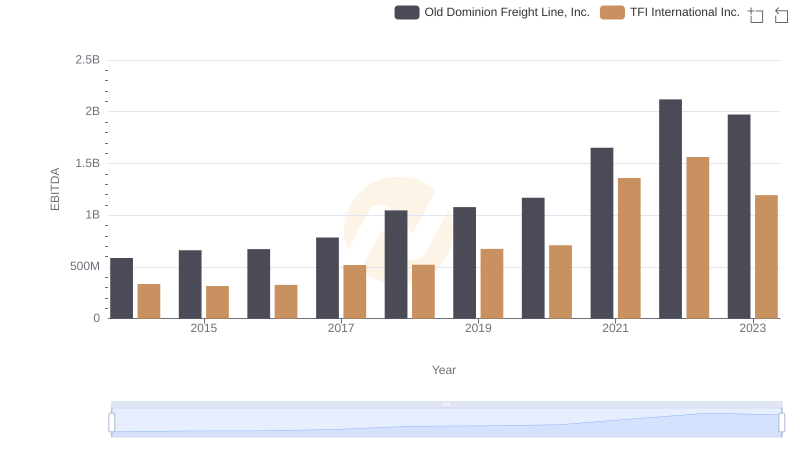

Old Dominion Freight Line, Inc. vs TFI International Inc.: In-Depth EBITDA Performance Comparison

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs ITT Inc.