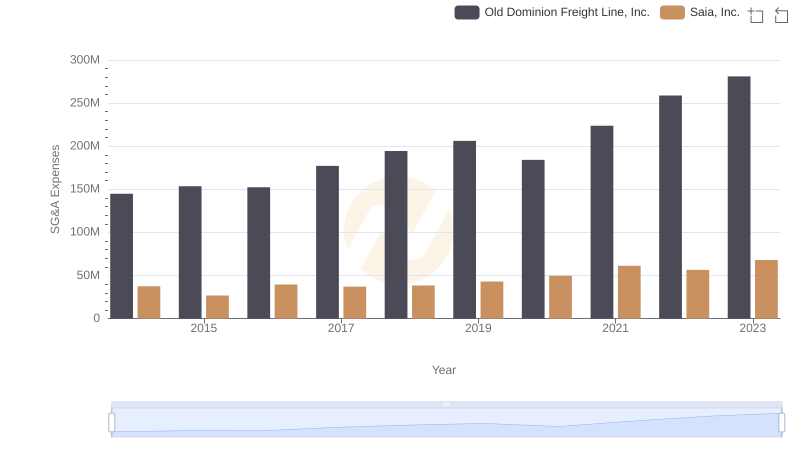

| __timestamp | Old Dominion Freight Line, Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 585590000 | 144715000 |

| Thursday, January 1, 2015 | 660570000 | 154995000 |

| Friday, January 1, 2016 | 671786000 | 156092000 |

| Sunday, January 1, 2017 | 783749000 | 181629000 |

| Monday, January 1, 2018 | 1046059000 | 243709000 |

| Tuesday, January 1, 2019 | 1078007000 | 271318000 |

| Wednesday, January 1, 2020 | 1168149000 | 312448000 |

| Friday, January 1, 2021 | 1651501000 | 472947000 |

| Saturday, January 1, 2022 | 2118962000 | 627741000 |

| Sunday, January 1, 2023 | 1972689000 | 647607000 |

Cracking the code

In the competitive world of freight and logistics, Old Dominion Freight Line, Inc. and Saia, Inc. have emerged as key players over the past decade. From 2014 to 2023, Old Dominion's EBITDA surged by an impressive 237%, peaking in 2022. This growth reflects their strategic expansion and operational efficiency. Meanwhile, Saia, Inc. also demonstrated robust growth, with EBITDA increasing by approximately 347% during the same period, showcasing their resilience and adaptability in a dynamic market.

Old Dominion consistently outperformed Saia, maintaining an EBITDA that was, on average, 3.5 times higher. However, Saia's rapid growth trajectory, especially post-2020, highlights their potential to close this gap. As the logistics industry continues to evolve, these companies' financial performances offer valuable insights into their strategic directions and market positioning.

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Saia, Inc.

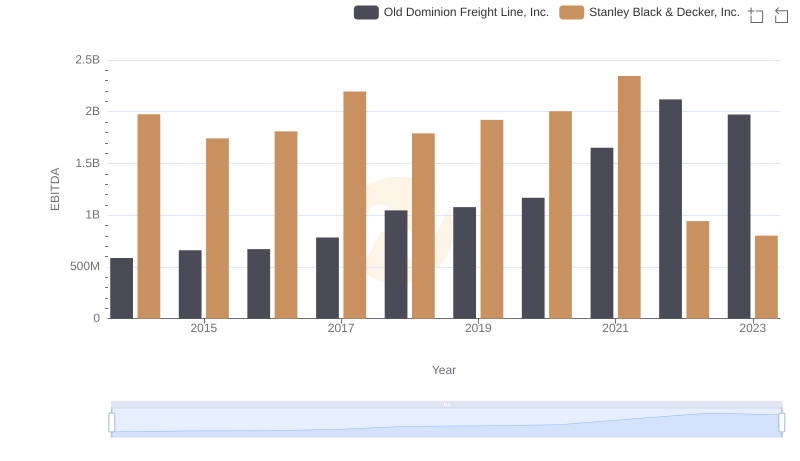

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Stanley Black & Decker, Inc.

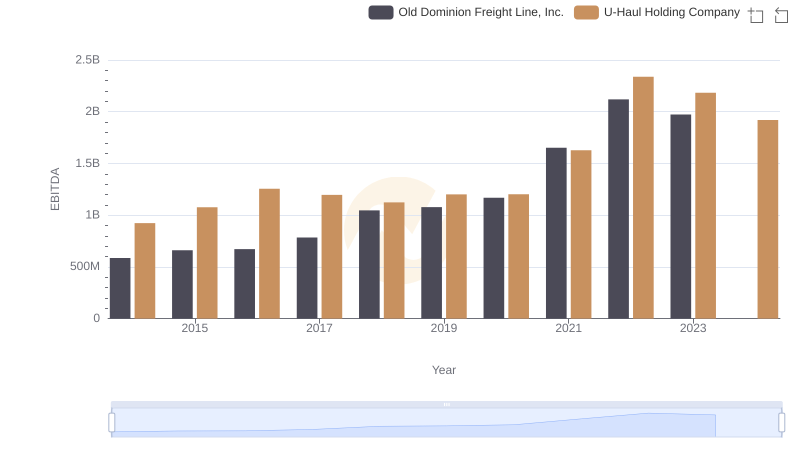

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and U-Haul Holding Company

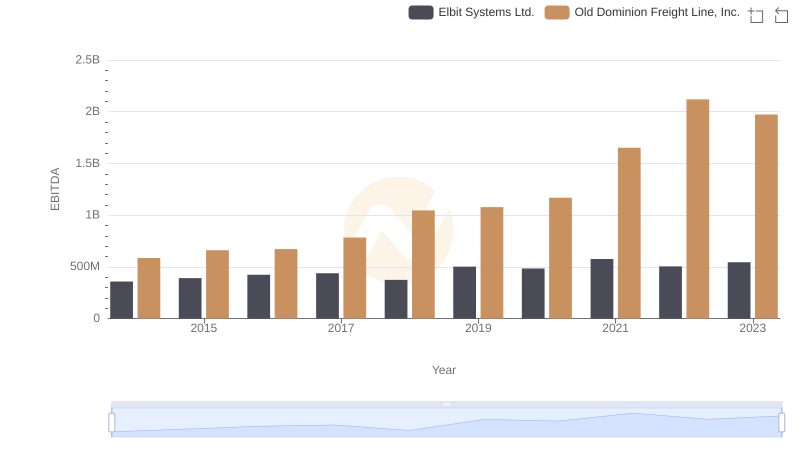

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Elbit Systems Ltd.

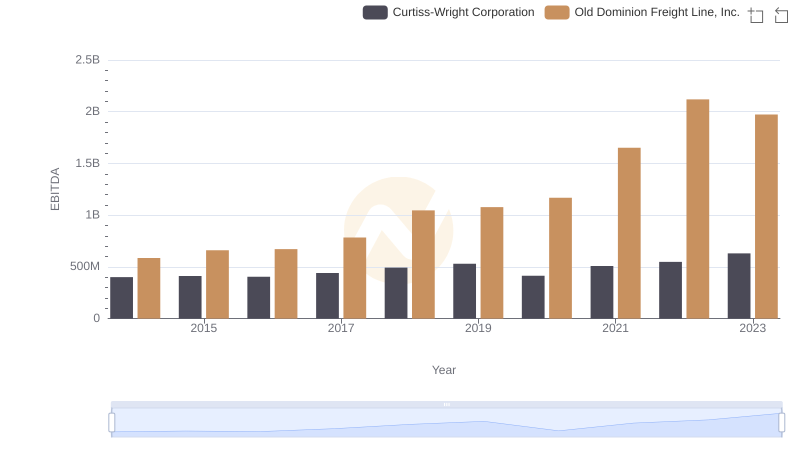

Professional EBITDA Benchmarking: Old Dominion Freight Line, Inc. vs Curtiss-Wright Corporation

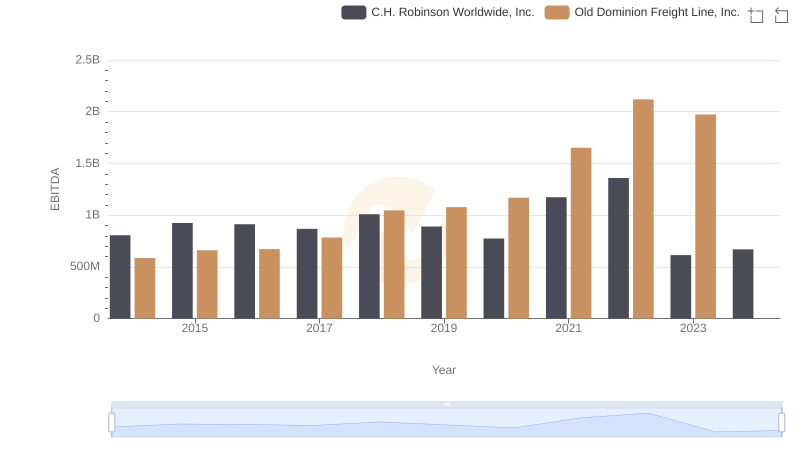

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to C.H. Robinson Worldwide, Inc.

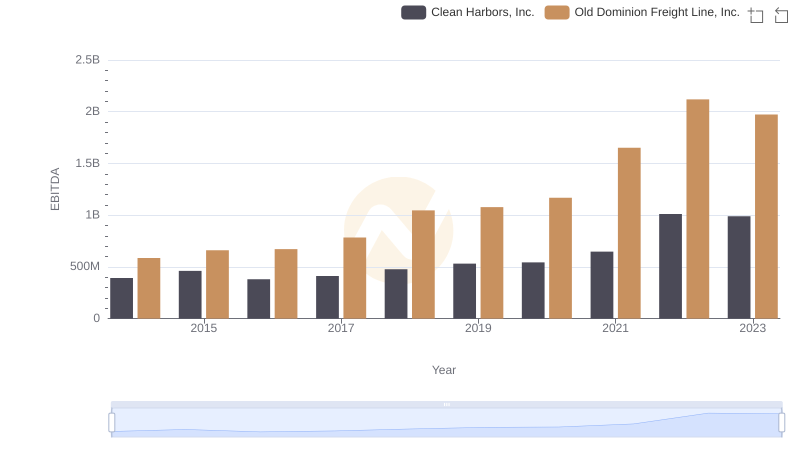

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and Clean Harbors, Inc.

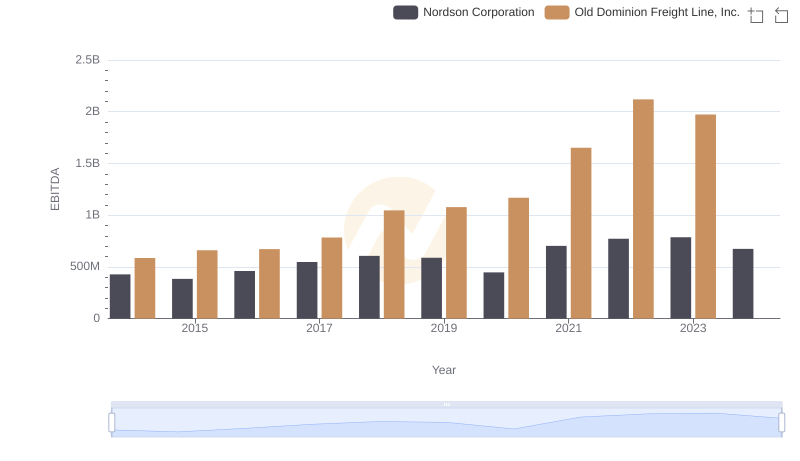

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Nordson Corporation