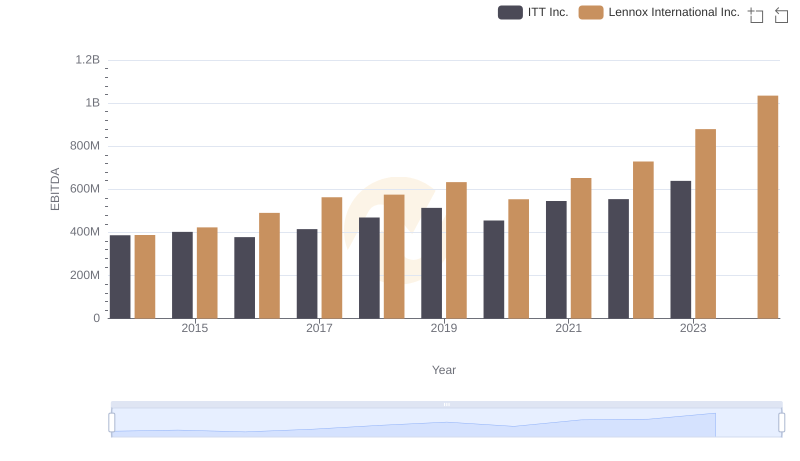

| __timestamp | Allegion plc | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 365700000 | 387700000 |

| Thursday, January 1, 2015 | 315400000 | 423600000 |

| Friday, January 1, 2016 | 422600000 | 490800000 |

| Sunday, January 1, 2017 | 523300000 | 562900000 |

| Monday, January 1, 2018 | 617600000 | 575200000 |

| Tuesday, January 1, 2019 | 614300000 | 633300000 |

| Wednesday, January 1, 2020 | 497700000 | 553900000 |

| Friday, January 1, 2021 | 657300000 | 652500000 |

| Saturday, January 1, 2022 | 688300000 | 729000000 |

| Sunday, January 1, 2023 | 819300000 | 879500000 |

| Monday, January 1, 2024 | 919800000 | 1034800000 |

Cracking the code

In the competitive landscape of the HVAC and security industries, Lennox International Inc. and Allegion plc have demonstrated notable financial trajectories over the past decade. Since 2014, Lennox International has consistently outperformed Allegion in terms of EBITDA, showcasing a robust growth pattern. By 2023, Lennox's EBITDA surged by approximately 127% from its 2014 figures, reaching nearly $880 million. In contrast, Allegion's EBITDA grew by about 124% over the same period, peaking at around $819 million. This upward trend highlights Lennox's strategic market positioning and operational efficiency. However, it's worth noting that data for Allegion in 2024 is currently unavailable, which may impact future comparisons. As these industry giants continue to evolve, stakeholders and investors should keep a keen eye on their financial health and strategic initiatives.

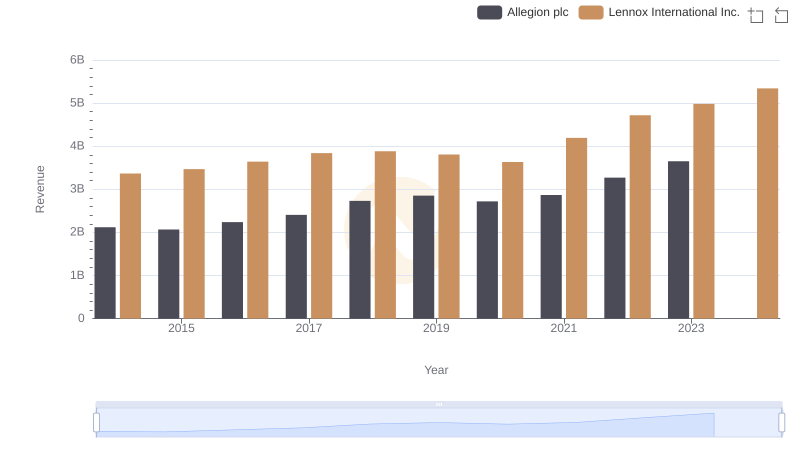

Annual Revenue Comparison: Lennox International Inc. vs Allegion plc

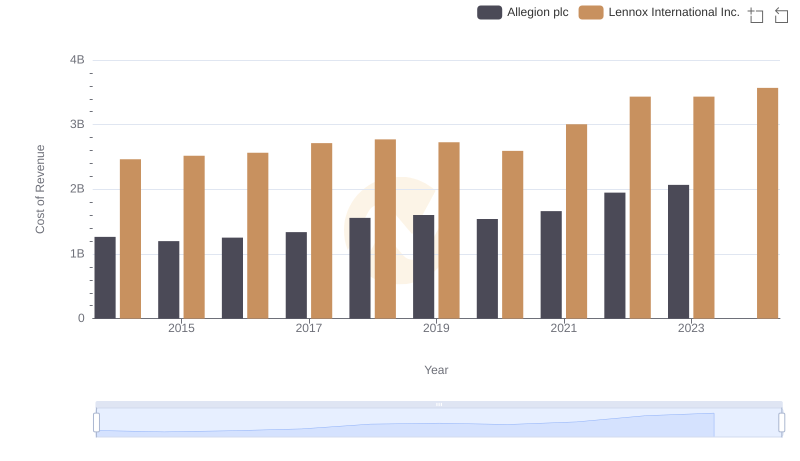

Analyzing Cost of Revenue: Lennox International Inc. and Allegion plc

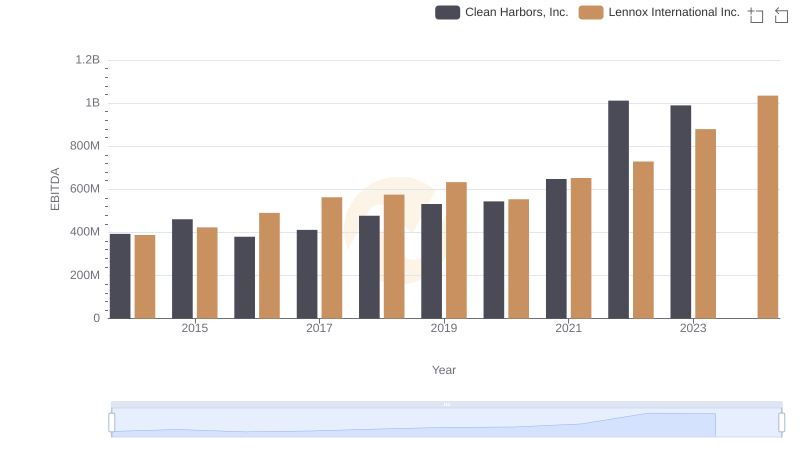

Comparative EBITDA Analysis: Lennox International Inc. vs Clean Harbors, Inc.

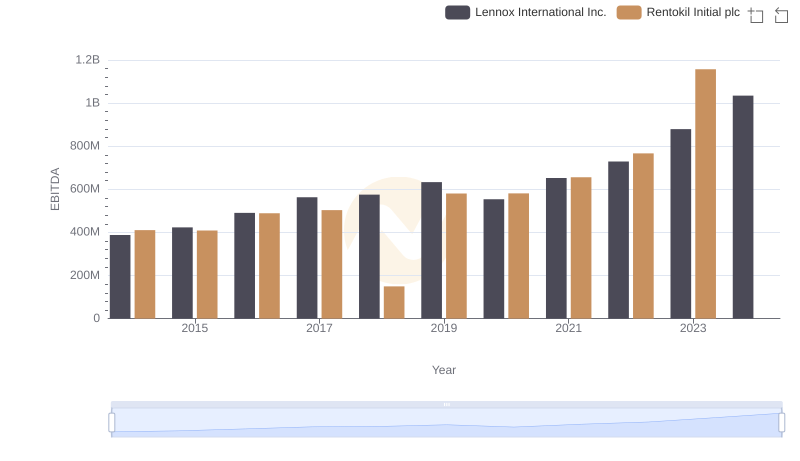

Lennox International Inc. vs Rentokil Initial plc: In-Depth EBITDA Performance Comparison

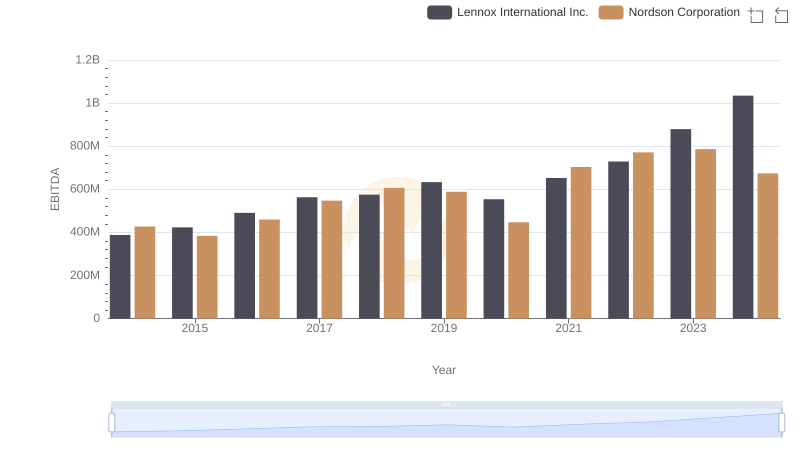

Lennox International Inc. vs Nordson Corporation: In-Depth EBITDA Performance Comparison

Professional EBITDA Benchmarking: Lennox International Inc. vs Curtiss-Wright Corporation

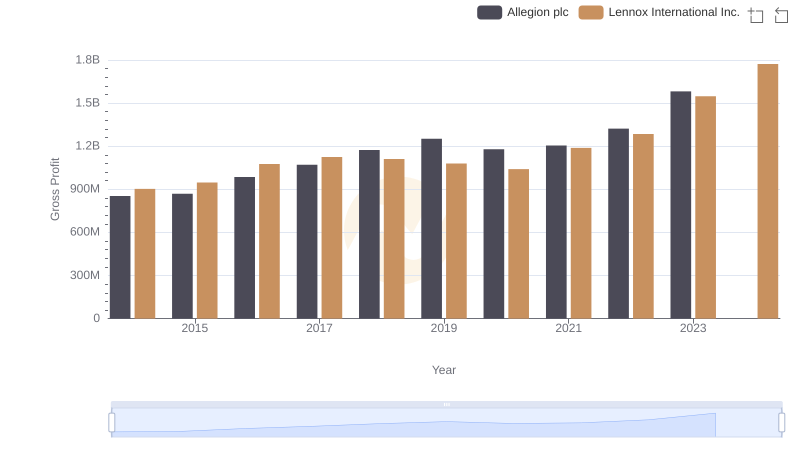

Key Insights on Gross Profit: Lennox International Inc. vs Allegion plc

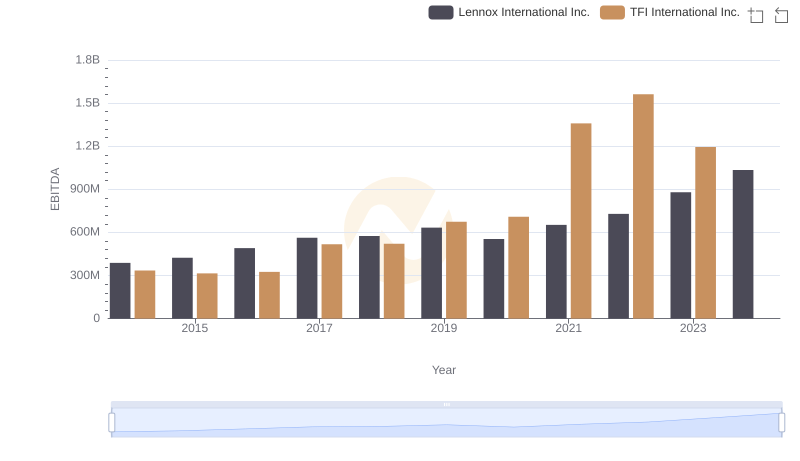

A Professional Review of EBITDA: Lennox International Inc. Compared to TFI International Inc.

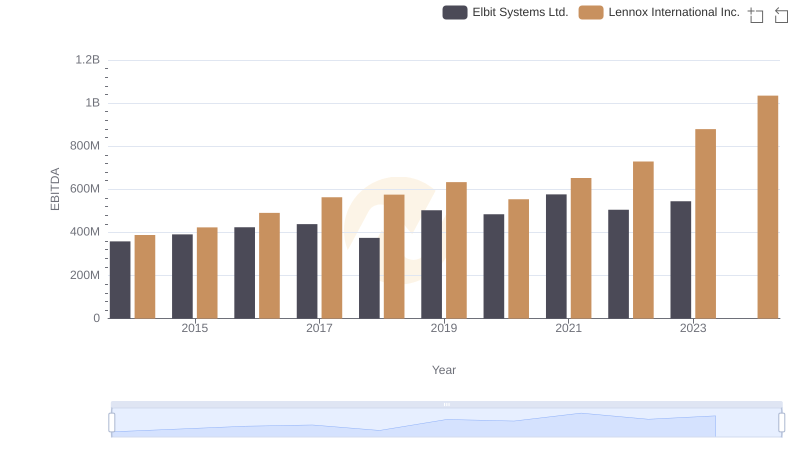

Professional EBITDA Benchmarking: Lennox International Inc. vs Elbit Systems Ltd.

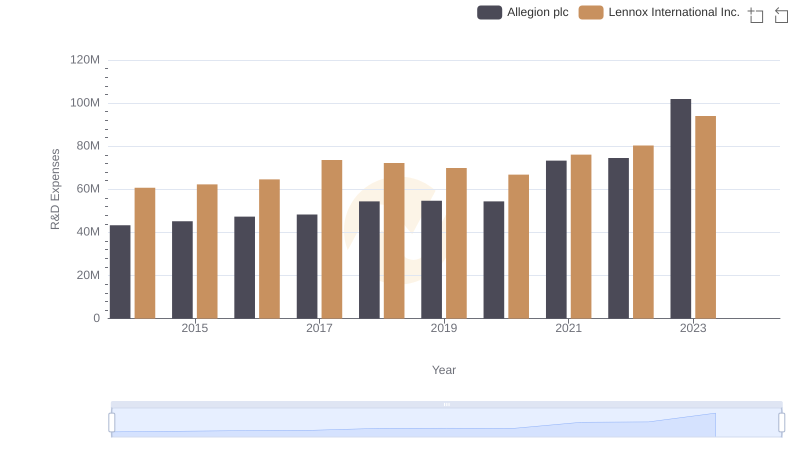

Research and Development: Comparing Key Metrics for Lennox International Inc. and Allegion plc

Comprehensive EBITDA Comparison: Lennox International Inc. vs ITT Inc.

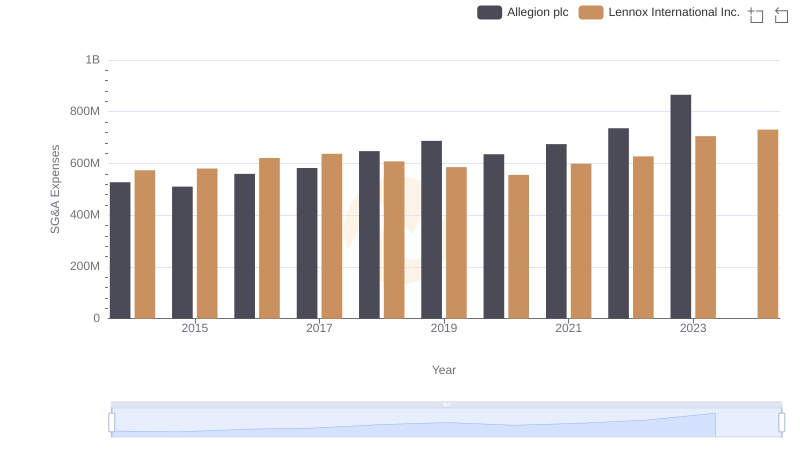

Who Optimizes SG&A Costs Better? Lennox International Inc. or Allegion plc