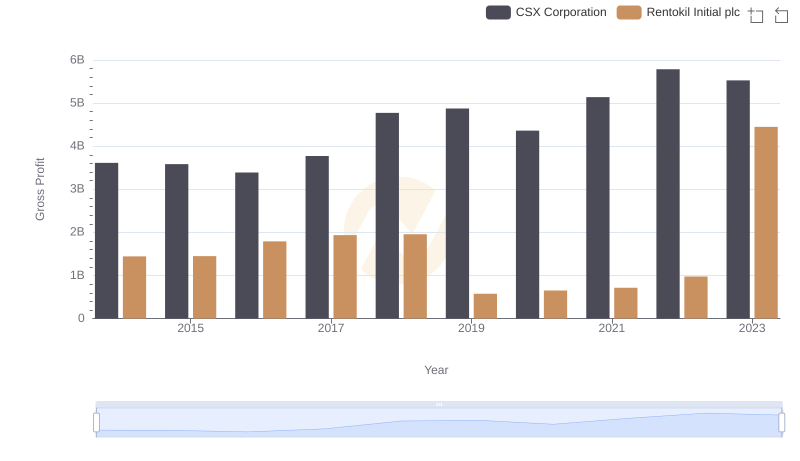

| __timestamp | CSX Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4740000000 | 410400000 |

| Thursday, January 1, 2015 | 4890000000 | 408700000 |

| Friday, January 1, 2016 | 4640000000 | 489000000 |

| Sunday, January 1, 2017 | 5113000000 | 503200000 |

| Monday, January 1, 2018 | 6274000000 | 149800000 |

| Tuesday, January 1, 2019 | 6402000000 | 580600000 |

| Wednesday, January 1, 2020 | 5764000000 | 581000000 |

| Friday, January 1, 2021 | 6653000000 | 656000000 |

| Saturday, January 1, 2022 | 7390000000 | 767000000 |

| Sunday, January 1, 2023 | 7340000000 | 1157000000 |

Unleashing the power of data

In the world of corporate finance, EBITDA serves as a crucial indicator of a company's operational performance. This article delves into the EBITDA trends of two industry titans: CSX Corporation, a leader in the transportation sector, and Rentokil Initial plc, a prominent player in the pest control and hygiene services industry.

From 2014 to 2023, CSX Corporation demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 55%, peaking in 2022. This growth reflects the company's strategic initiatives and operational efficiencies. In contrast, Rentokil Initial plc, while smaller in scale, showcased a remarkable 182% increase in EBITDA over the same period, highlighting its aggressive expansion and market penetration strategies.

Despite the economic challenges, both companies have shown resilience. CSX's consistent growth underscores its dominance in the transportation sector, while Rentokil's impressive percentage increase signals its rising influence in the global market.

Who Generates More Revenue? CSX Corporation or Rentokil Initial plc

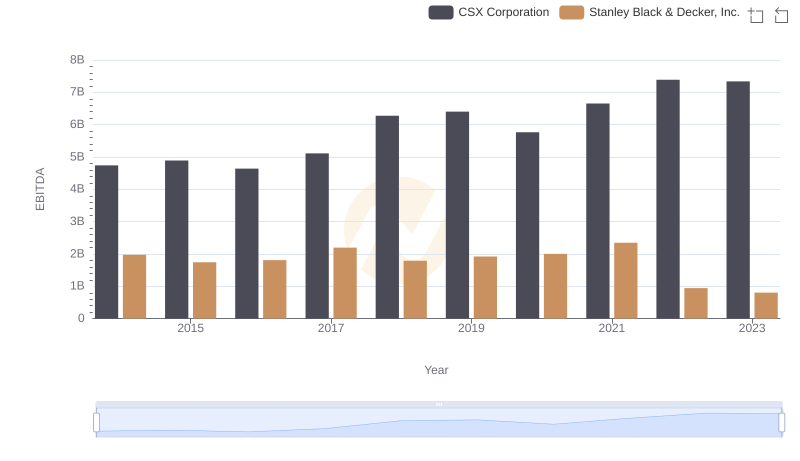

A Professional Review of EBITDA: CSX Corporation Compared to Stanley Black & Decker, Inc.

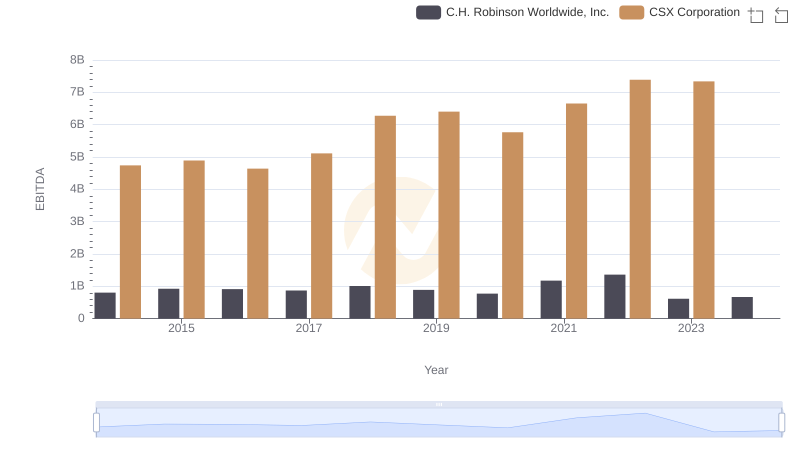

A Professional Review of EBITDA: CSX Corporation Compared to C.H. Robinson Worldwide, Inc.

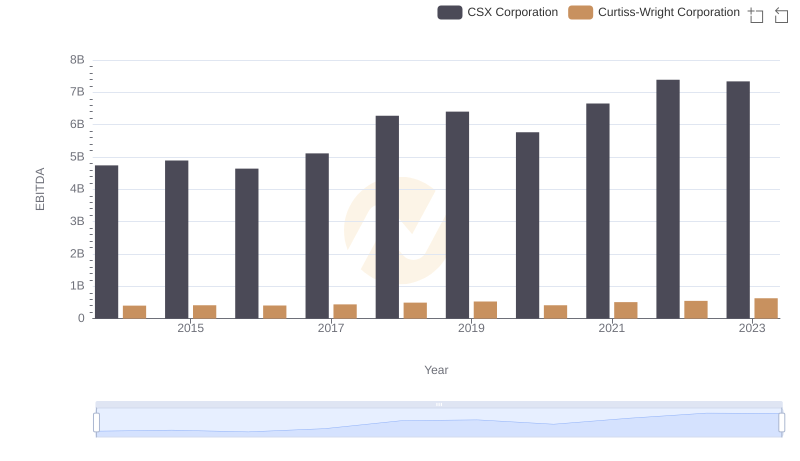

CSX Corporation and Curtiss-Wright Corporation: A Detailed Examination of EBITDA Performance

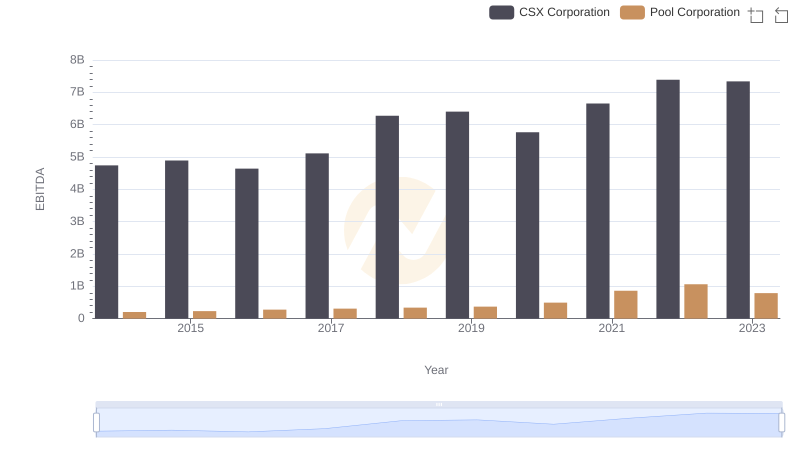

EBITDA Performance Review: CSX Corporation vs Pool Corporation

Gross Profit Comparison: CSX Corporation and Rentokil Initial plc Trends

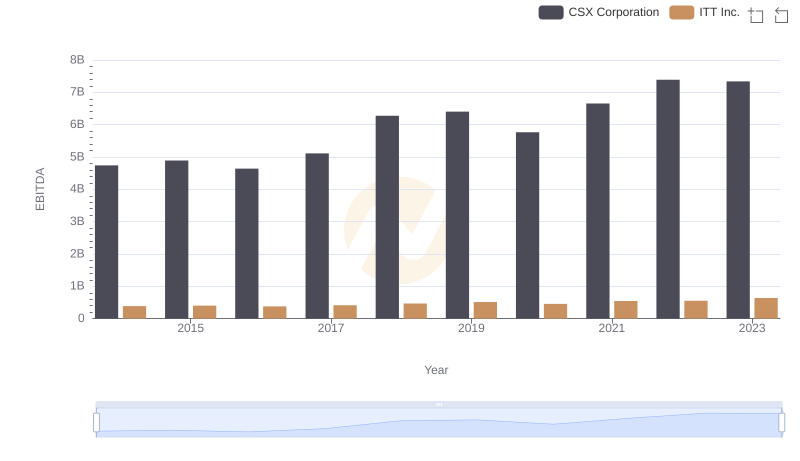

CSX Corporation and ITT Inc.: A Detailed Examination of EBITDA Performance

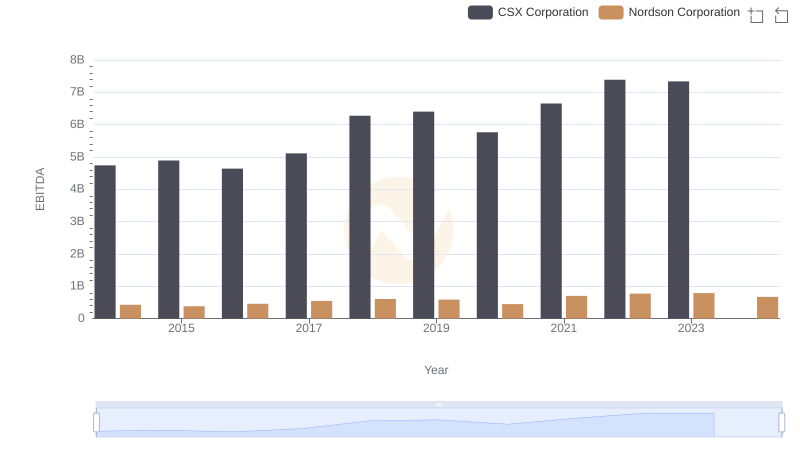

A Professional Review of EBITDA: CSX Corporation Compared to Nordson Corporation

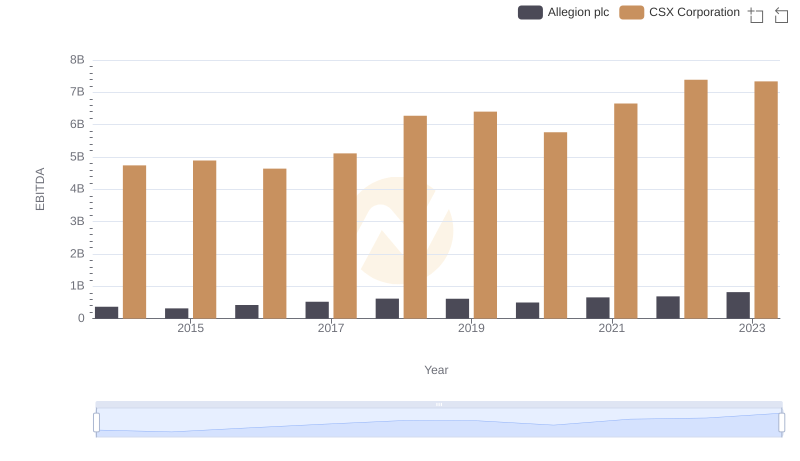

Professional EBITDA Benchmarking: CSX Corporation vs Allegion plc

A Side-by-Side Analysis of EBITDA: CSX Corporation and TFI International Inc.