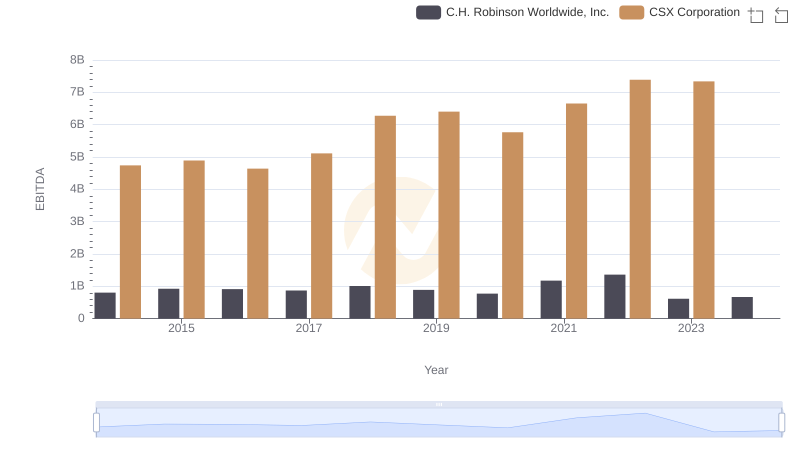

| __timestamp | CSX Corporation | Nordson Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4740000000 | 427302000 |

| Thursday, January 1, 2015 | 4890000000 | 384160000 |

| Friday, January 1, 2016 | 4640000000 | 460120000 |

| Sunday, January 1, 2017 | 5113000000 | 547746000 |

| Monday, January 1, 2018 | 6274000000 | 606502000 |

| Tuesday, January 1, 2019 | 6402000000 | 588493000 |

| Wednesday, January 1, 2020 | 5764000000 | 446951000 |

| Friday, January 1, 2021 | 6653000000 | 703550000 |

| Saturday, January 1, 2022 | 7390000000 | 771615000 |

| Sunday, January 1, 2023 | 7340000000 | 786742000 |

| Monday, January 1, 2024 | 674001000 |

Unleashing the power of data

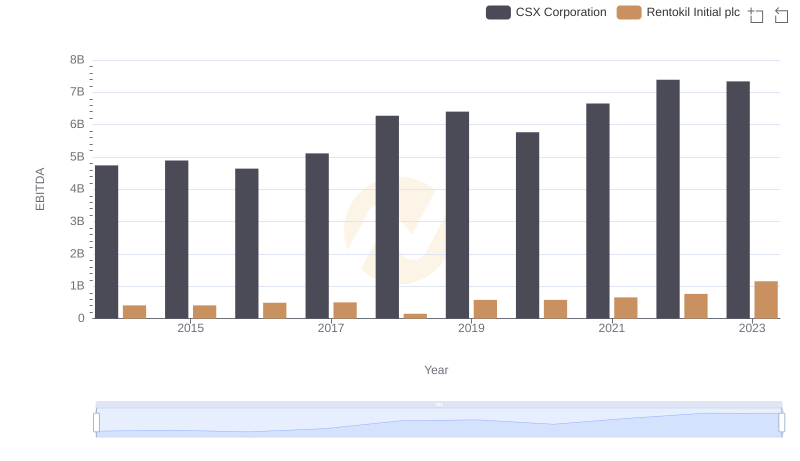

In the ever-evolving landscape of American industry, the financial health of companies is often gauged by their EBITDA, a key indicator of operational performance. Over the past decade, CSX Corporation and Nordson Corporation have showcased contrasting trajectories.

From 2014 to 2023, CSX Corporation's EBITDA surged by approximately 55%, peaking in 2022. This growth reflects the company's strategic initiatives in optimizing rail operations and expanding its market reach. In contrast, Nordson Corporation, a leader in precision technology, experienced a steady EBITDA increase of about 84% over the same period, highlighting its resilience and adaptability in a competitive market.

Interestingly, 2024 data for CSX is missing, leaving room for speculation on its future performance. As these giants continue to navigate economic challenges, their financial journeys offer valuable insights into the broader industrial landscape.

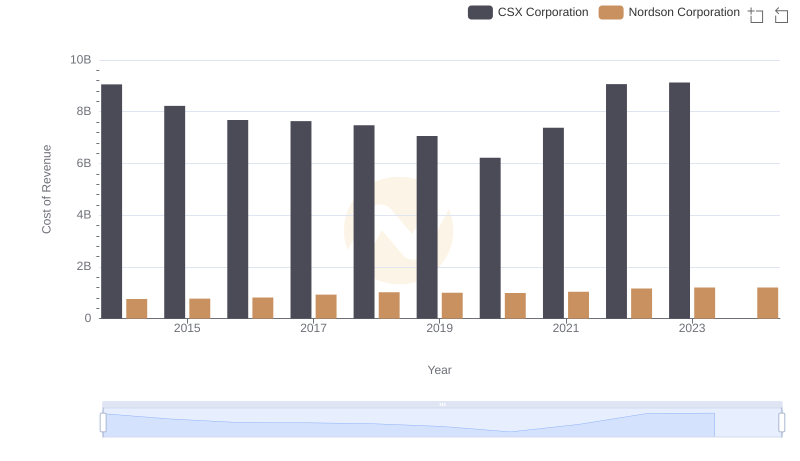

Cost Insights: Breaking Down CSX Corporation and Nordson Corporation's Expenses

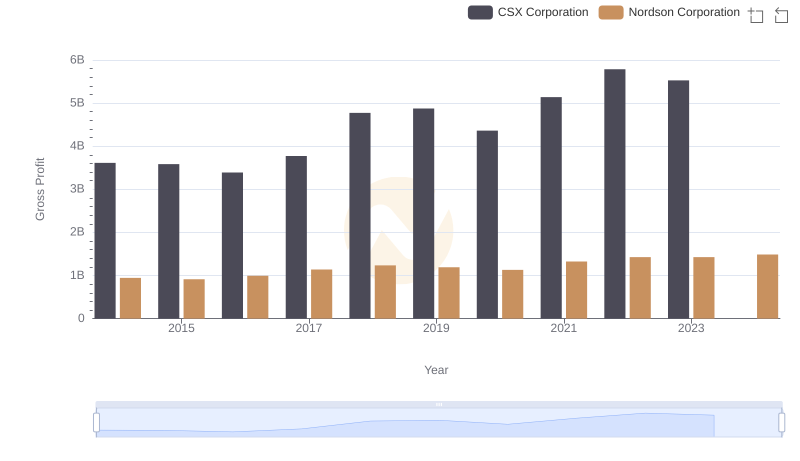

Gross Profit Trends Compared: CSX Corporation vs Nordson Corporation

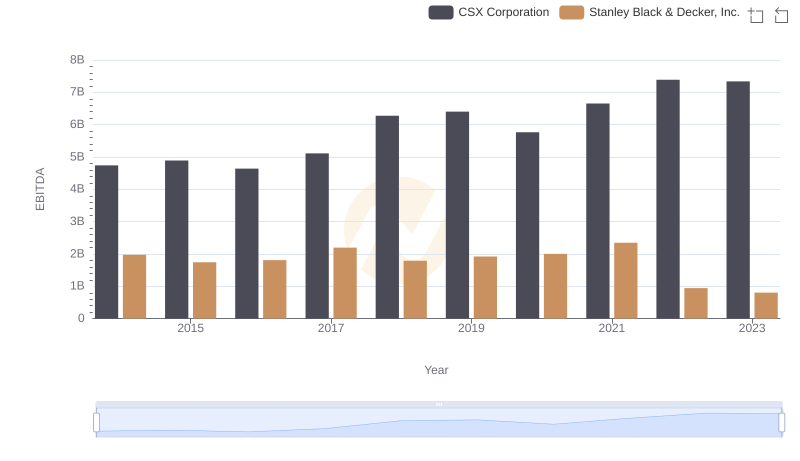

A Professional Review of EBITDA: CSX Corporation Compared to Stanley Black & Decker, Inc.

A Professional Review of EBITDA: CSX Corporation Compared to C.H. Robinson Worldwide, Inc.

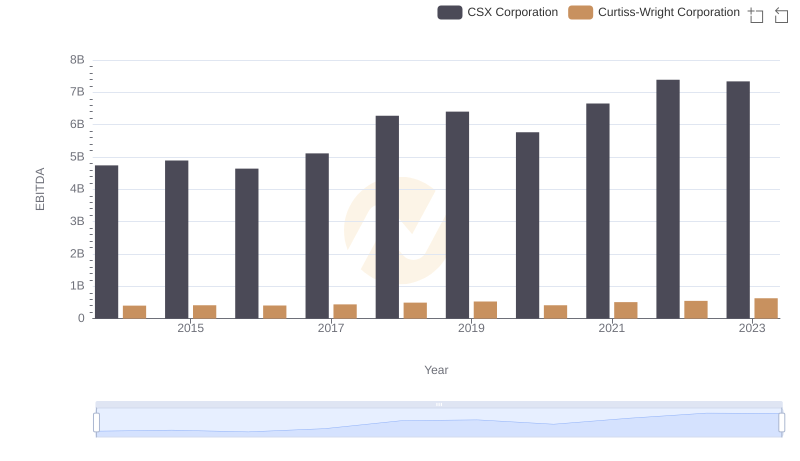

CSX Corporation and Curtiss-Wright Corporation: A Detailed Examination of EBITDA Performance

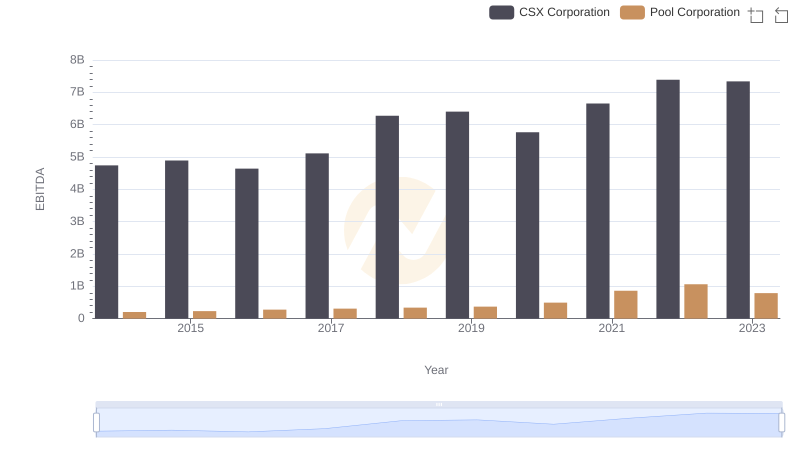

EBITDA Performance Review: CSX Corporation vs Pool Corporation

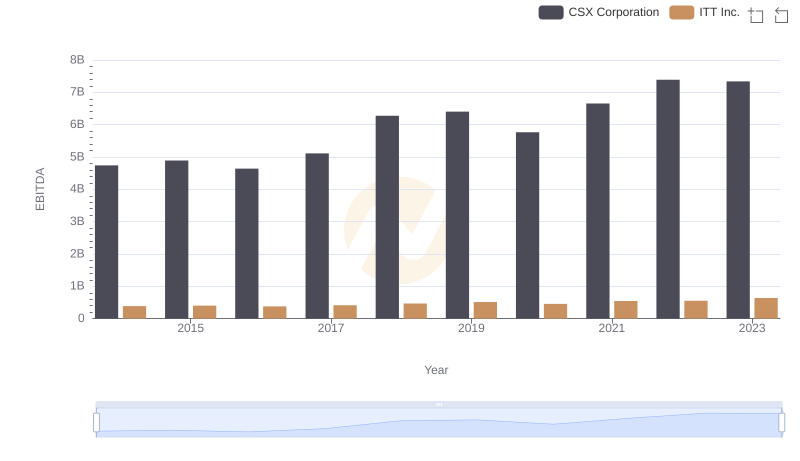

CSX Corporation and ITT Inc.: A Detailed Examination of EBITDA Performance

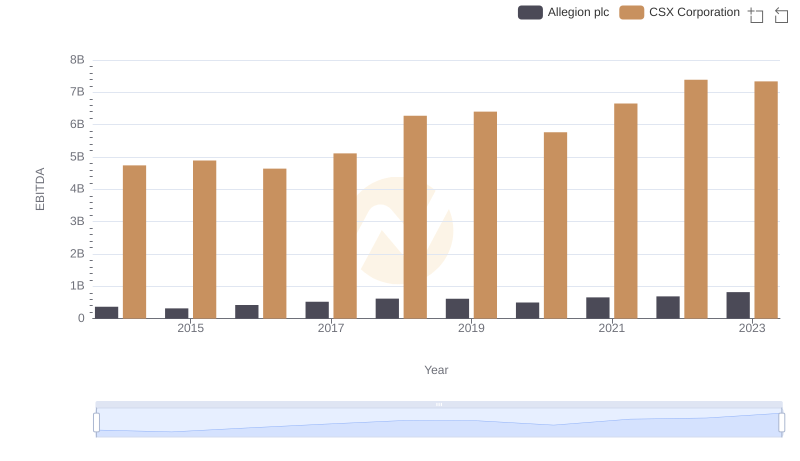

Professional EBITDA Benchmarking: CSX Corporation vs Allegion plc

Professional EBITDA Benchmarking: CSX Corporation vs Rentokil Initial plc

A Side-by-Side Analysis of EBITDA: CSX Corporation and TFI International Inc.