| __timestamp | CSX Corporation | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 12669000000 | 1740800000 |

| Thursday, January 1, 2015 | 11811000000 | 1759000000 |

| Friday, January 1, 2016 | 11069000000 | 2168100000 |

| Sunday, January 1, 2017 | 11408000000 | 2412300000 |

| Monday, January 1, 2018 | 12250000000 | 2472300000 |

| Tuesday, January 1, 2019 | 11937000000 | 2676200000 |

| Wednesday, January 1, 2020 | 10583000000 | 2789400000 |

| Friday, January 1, 2021 | 12522000000 | 2953900000 |

| Saturday, January 1, 2022 | 14853000000 | 3714000000 |

| Sunday, January 1, 2023 | 14657000000 | 5375000000 |

Unleashing the power of data

In the competitive world of business, revenue generation is a key indicator of success. Over the past decade, CSX Corporation and Rentokil Initial plc have been vying for dominance in their respective industries. From 2014 to 2023, CSX Corporation consistently outperformed Rentokil Initial plc, generating nearly four times more revenue on average. In 2022, CSX Corporation reached its peak with a 48% increase in revenue compared to 2014, while Rentokil Initial plc saw a 114% rise in the same period, showcasing its rapid growth trajectory.

Despite Rentokil's impressive growth, CSX's revenue in 2023 was still approximately 2.7 times higher. This data highlights the resilience and market strength of CSX Corporation, while also acknowledging Rentokil's significant strides in revenue expansion. As we look to the future, the question remains: can Rentokil continue its upward trend and close the gap?

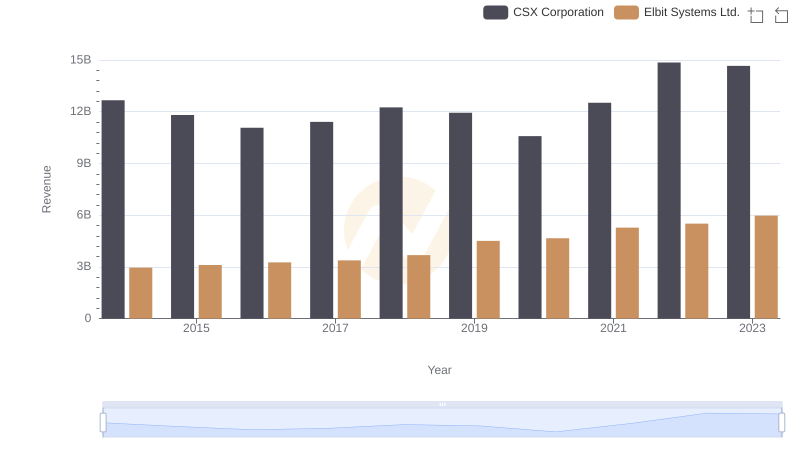

CSX Corporation vs Elbit Systems Ltd.: Annual Revenue Growth Compared

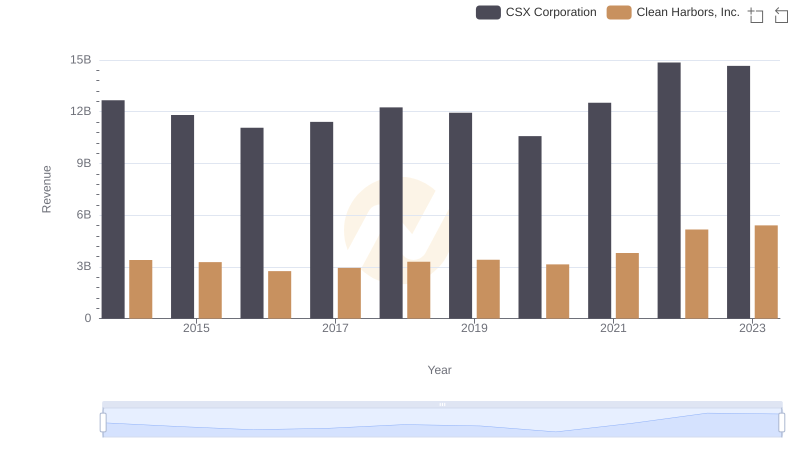

Revenue Insights: CSX Corporation and Clean Harbors, Inc. Performance Compared

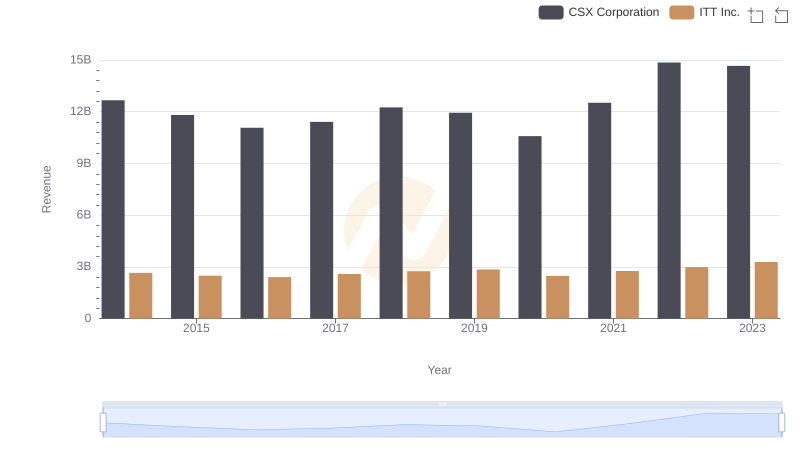

CSX Corporation vs ITT Inc.: Annual Revenue Growth Compared

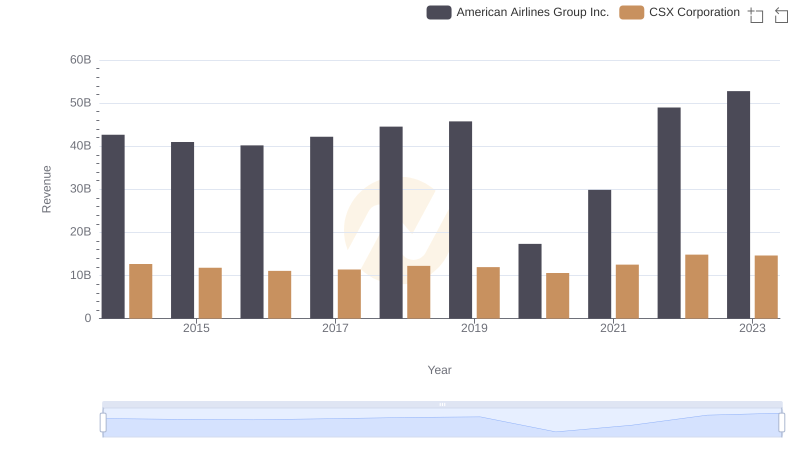

Annual Revenue Comparison: CSX Corporation vs American Airlines Group Inc.

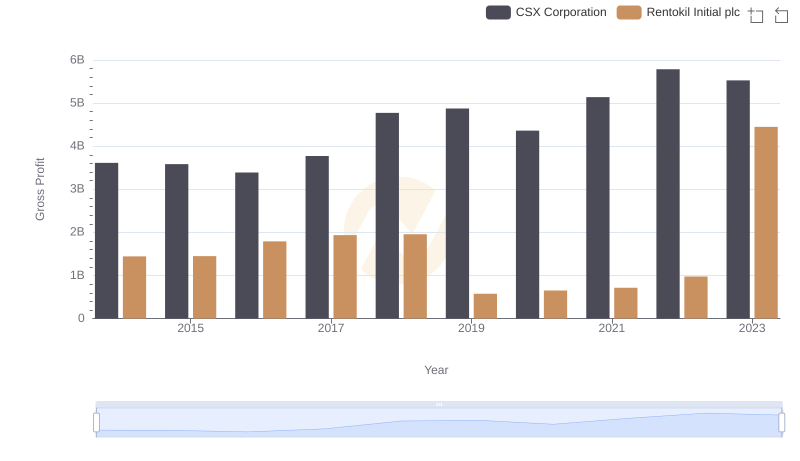

Gross Profit Comparison: CSX Corporation and Rentokil Initial plc Trends

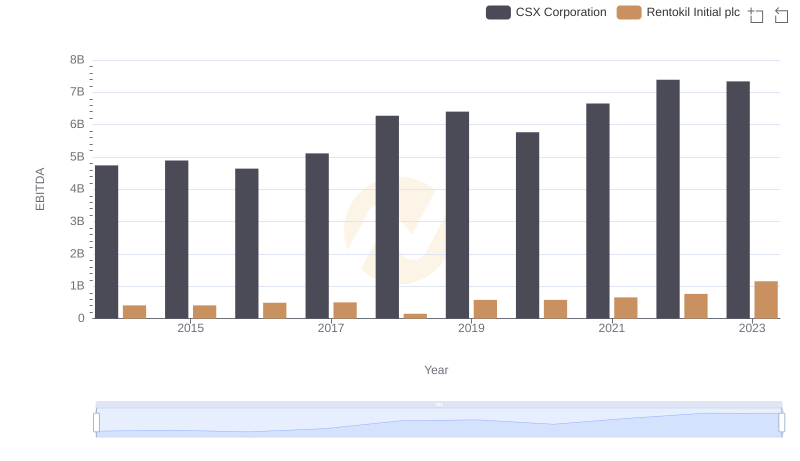

Professional EBITDA Benchmarking: CSX Corporation vs Rentokil Initial plc