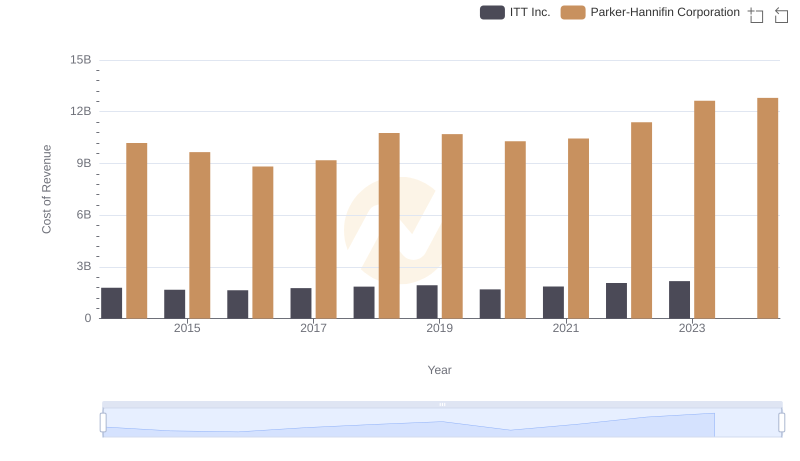

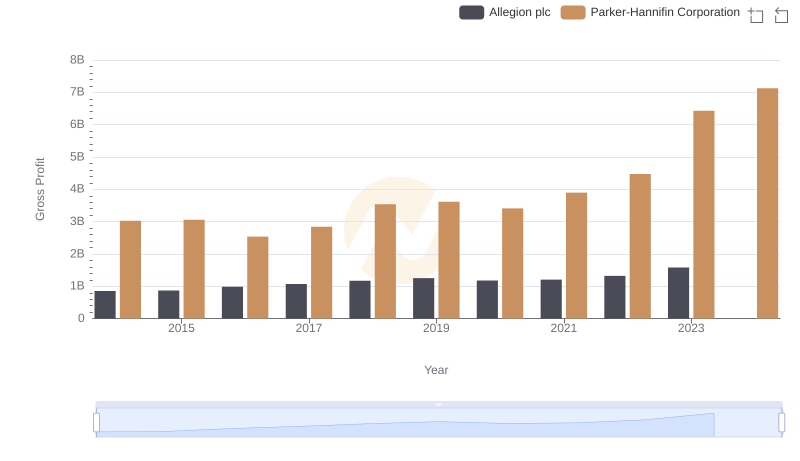

| __timestamp | ITT Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 866400000 | 3027744000 |

| Thursday, January 1, 2015 | 809100000 | 3056499000 |

| Friday, January 1, 2016 | 758200000 | 2537369000 |

| Sunday, January 1, 2017 | 817200000 | 2840350000 |

| Monday, January 1, 2018 | 887200000 | 3539551000 |

| Tuesday, January 1, 2019 | 910100000 | 3616840000 |

| Wednesday, January 1, 2020 | 782200000 | 3409002000 |

| Friday, January 1, 2021 | 899500000 | 3897960000 |

| Saturday, January 1, 2022 | 922300000 | 4474341000 |

| Sunday, January 1, 2023 | 1107300000 | 6429302000 |

| Monday, January 1, 2024 | 1247300000 | 7127790000 |

Igniting the spark of knowledge

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and ITT Inc. have long been titans. Over the past decade, Parker-Hannifin has consistently outperformed ITT Inc. in terms of gross profit. From 2014 to 2023, Parker-Hannifin's gross profit surged by over 110%, peaking at approximately $6.43 billion in 2023. In contrast, ITT Inc. experienced a more modest growth of around 28%, reaching its highest gross profit of about $1.11 billion in the same year.

The data reveals a significant gap between the two companies, with Parker-Hannifin's gross profit consistently being three to four times higher than ITT Inc.'s. This trend underscores Parker-Hannifin's robust market position and strategic prowess. As we look to the future, the absence of ITT Inc.'s 2024 data leaves room for speculation on whether it can close the gap.

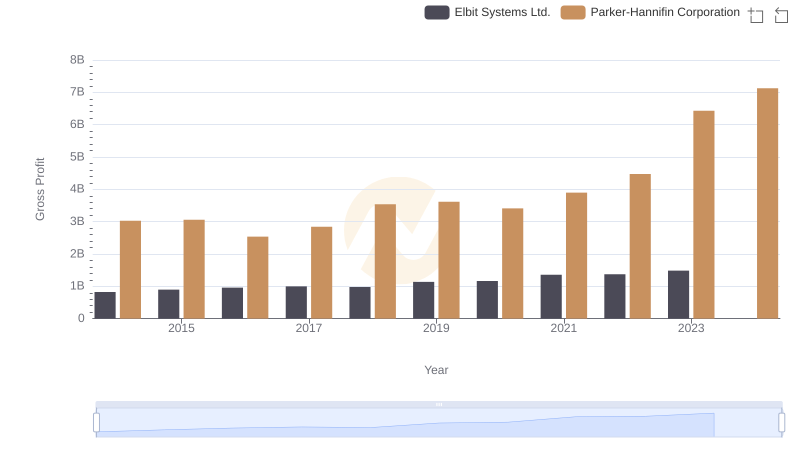

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Elbit Systems Ltd.

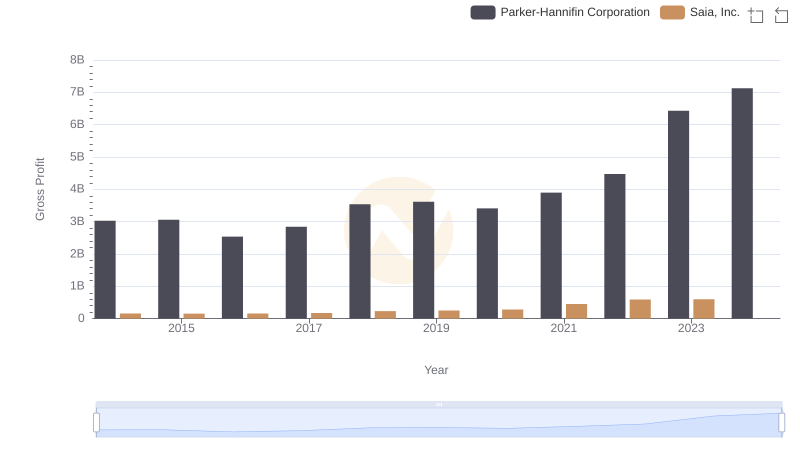

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Saia, Inc.

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

Cost of Revenue Trends: Parker-Hannifin Corporation vs ITT Inc.

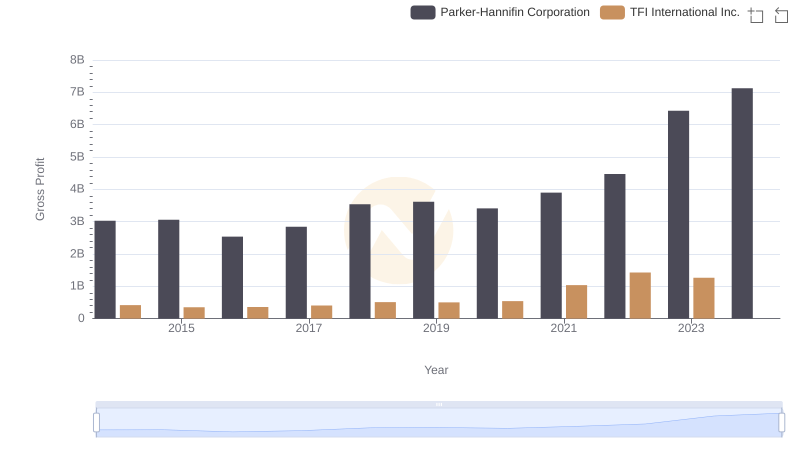

Gross Profit Comparison: Parker-Hannifin Corporation and TFI International Inc. Trends

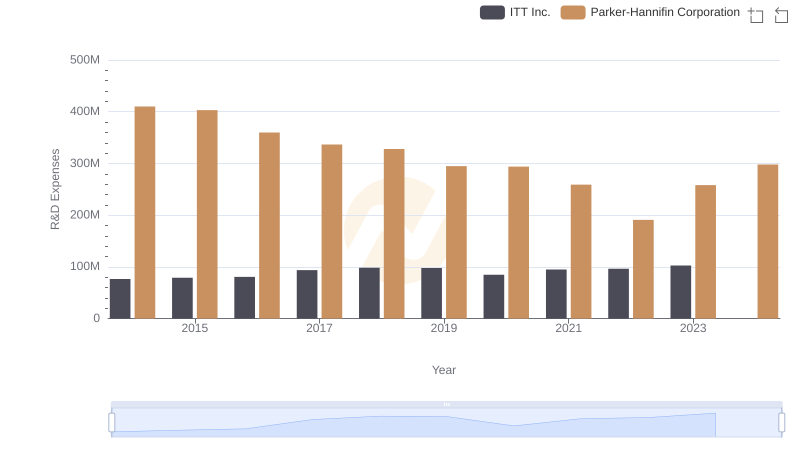

R&D Spending Showdown: Parker-Hannifin Corporation vs ITT Inc.

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Allegion plc

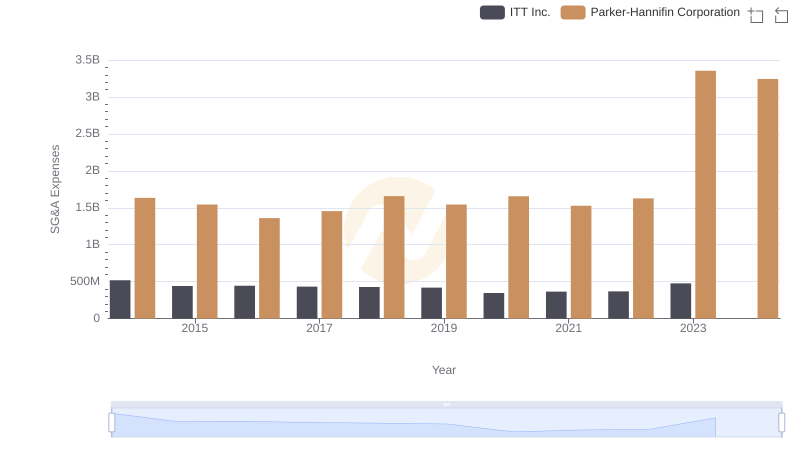

Parker-Hannifin Corporation or ITT Inc.: Who Manages SG&A Costs Better?

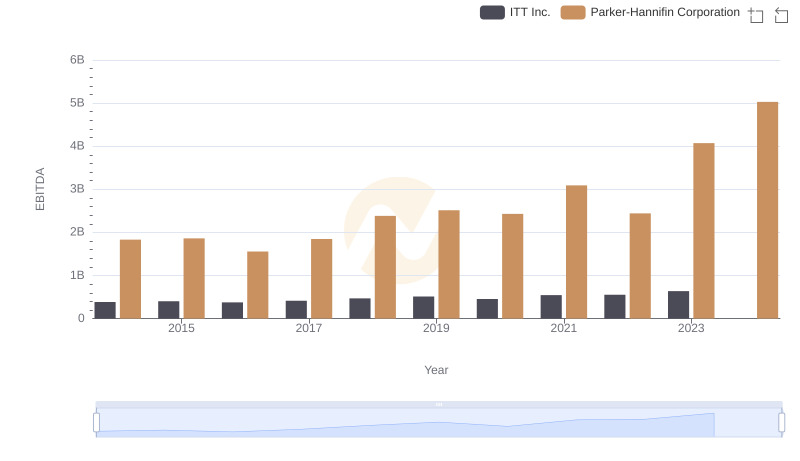

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to ITT Inc.