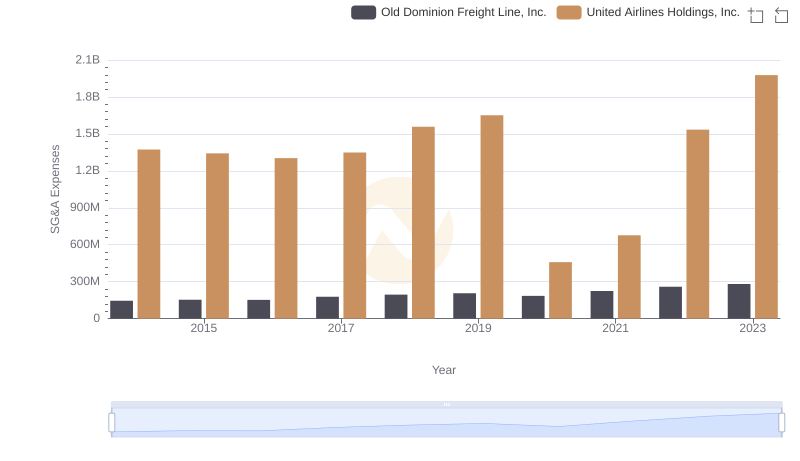

| __timestamp | Old Dominion Freight Line, Inc. | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 227306000 |

| Thursday, January 1, 2015 | 153589000 | 312690000 |

| Friday, January 1, 2016 | 152391000 | 301600000 |

| Sunday, January 1, 2017 | 177205000 | 322800000 |

| Monday, January 1, 2018 | 194368000 | 378700000 |

| Tuesday, January 1, 2019 | 206125000 | 603500000 |

| Wednesday, January 1, 2020 | 184185000 | 413900000 |

| Friday, January 1, 2021 | 223757000 | 422700000 |

| Saturday, January 1, 2022 | 258883000 | 381500000 |

| Sunday, January 1, 2023 | 281053000 | 389300000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Old Dominion Freight Line, Inc. and Verisk Analytics, Inc., from 2014 to 2023. Over this period, Verisk Analytics consistently outspent Old Dominion, with SG&A expenses peaking in 2019 at approximately 603 million, a staggering 160% higher than Old Dominion's peak in 2023. Notably, Old Dominion's expenses grew by nearly 94% from 2014 to 2023, reflecting strategic investments in operational efficiency. Meanwhile, Verisk's expenses fluctuated, indicating potential shifts in business strategy. This comparative insight not only highlights the financial strategies of these companies but also underscores the broader economic trends influencing their operational decisions.

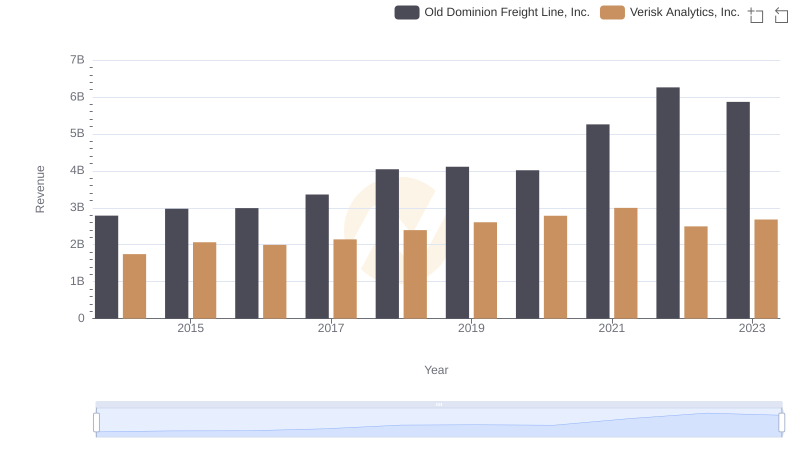

Old Dominion Freight Line, Inc. vs Verisk Analytics, Inc.: Examining Key Revenue Metrics

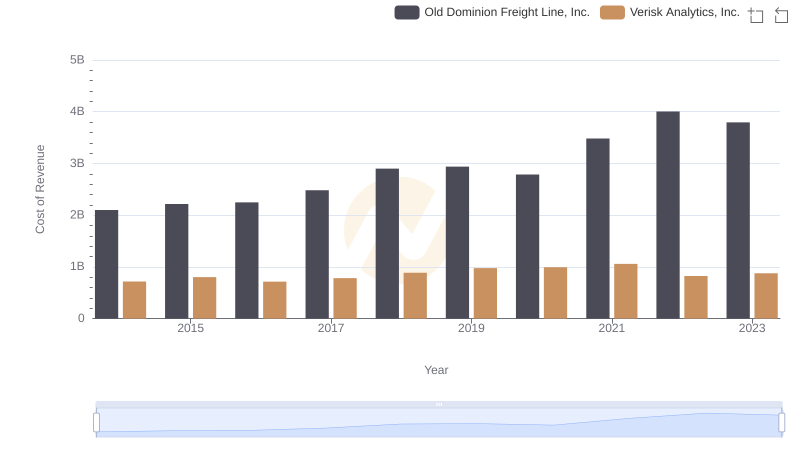

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Verisk Analytics, Inc.

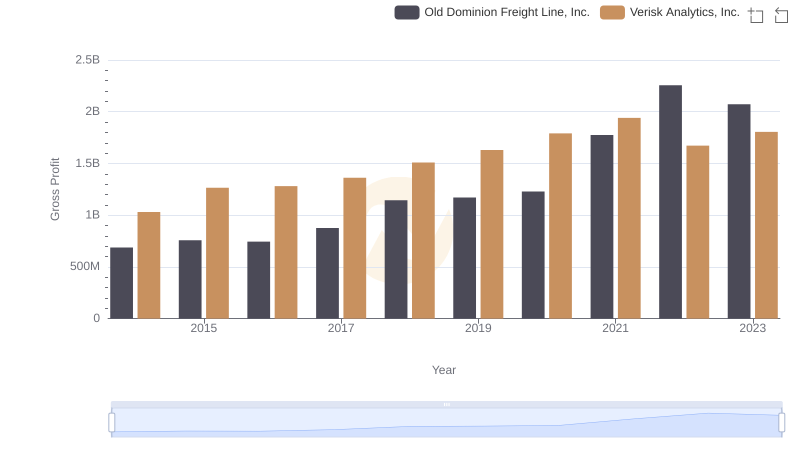

Gross Profit Analysis: Comparing Old Dominion Freight Line, Inc. and Verisk Analytics, Inc.

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or United Airlines Holdings, Inc.

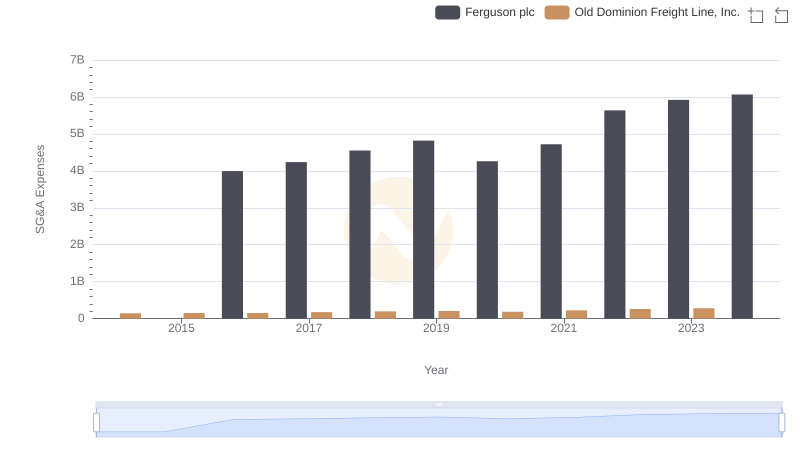

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Ferguson plc

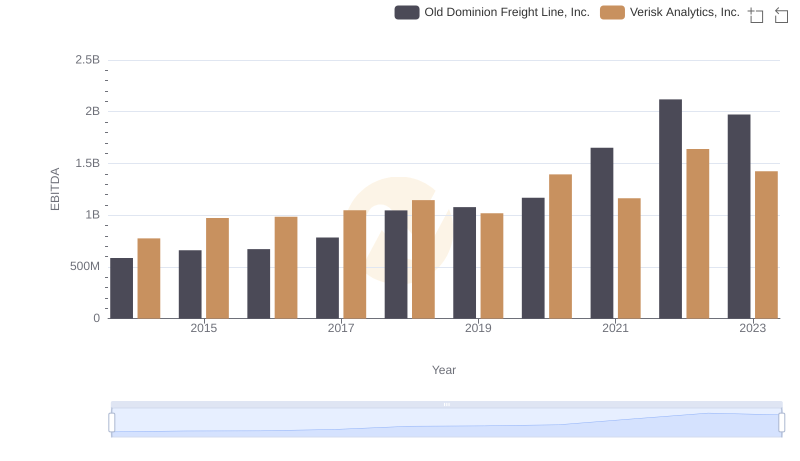

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Verisk Analytics, Inc.

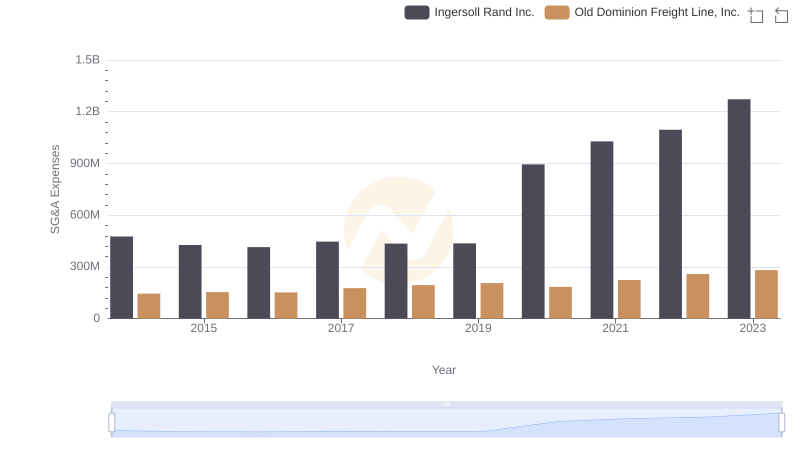

Old Dominion Freight Line, Inc. vs Ingersoll Rand Inc.: SG&A Expense Trends

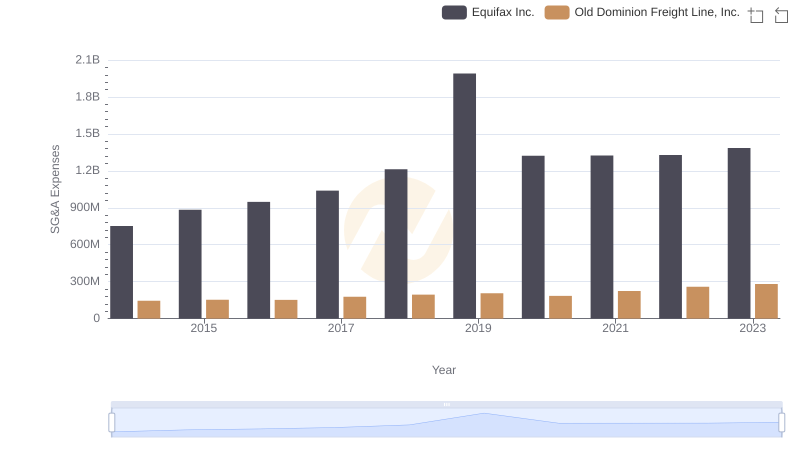

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Equifax Inc.

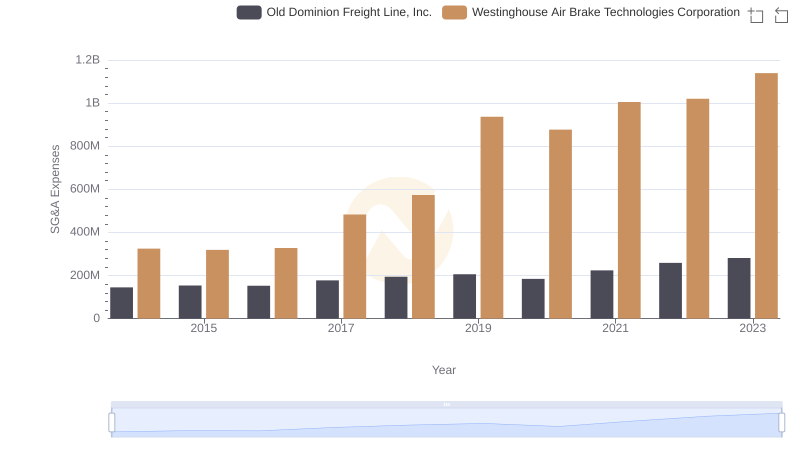

Old Dominion Freight Line, Inc. or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?

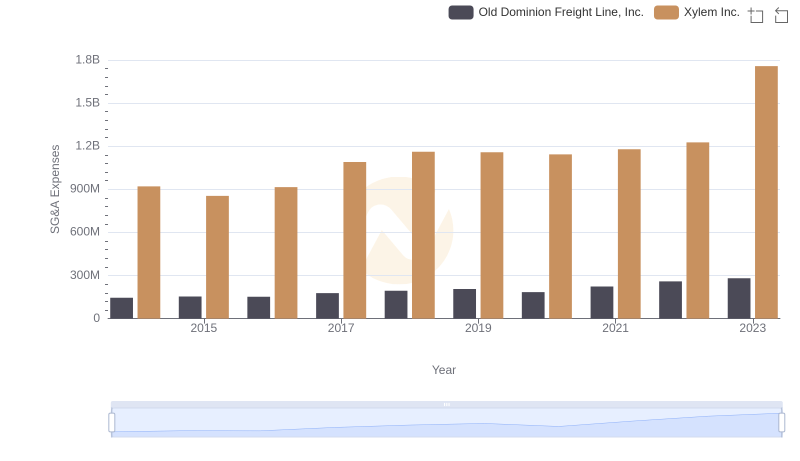

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Xylem Inc.

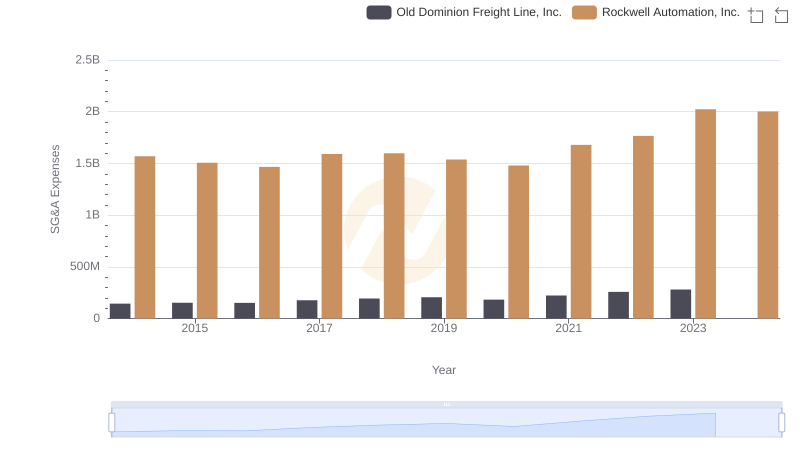

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Rockwell Automation, Inc.

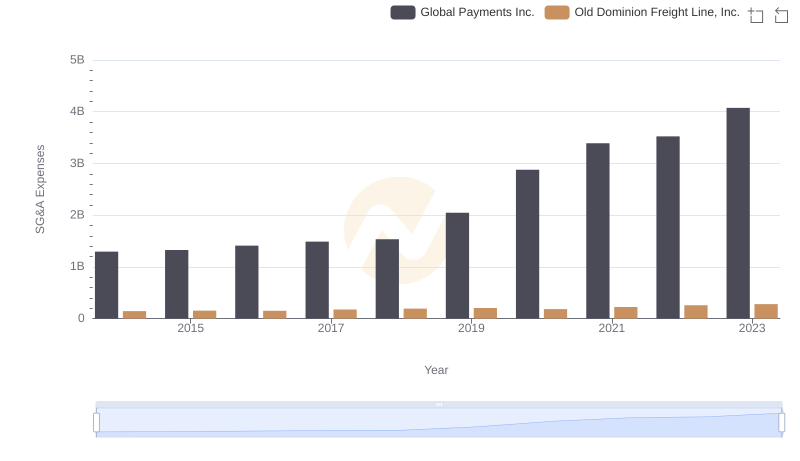

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights